Category: Weekly Detail

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

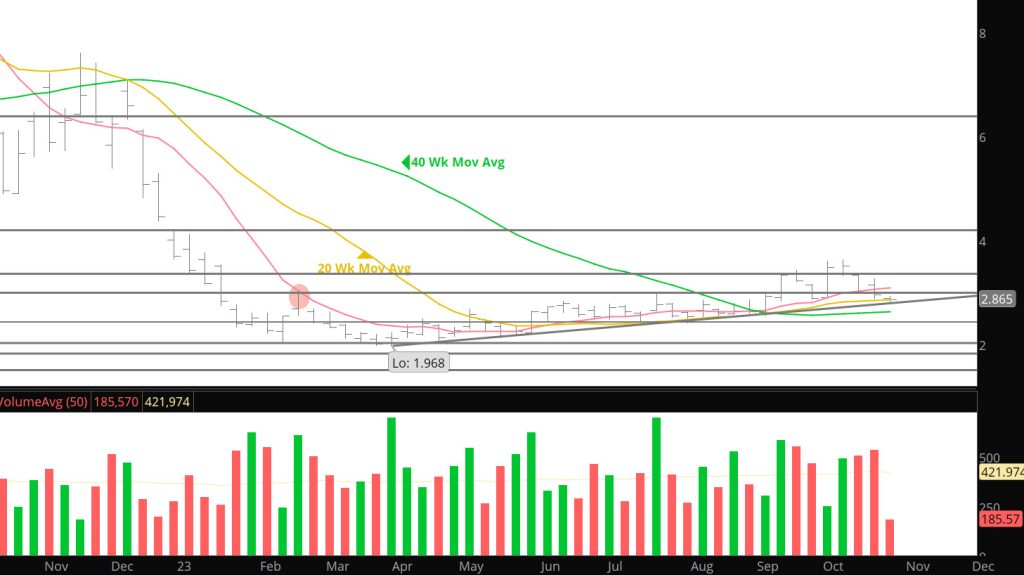

Catch a Falling Knife??

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

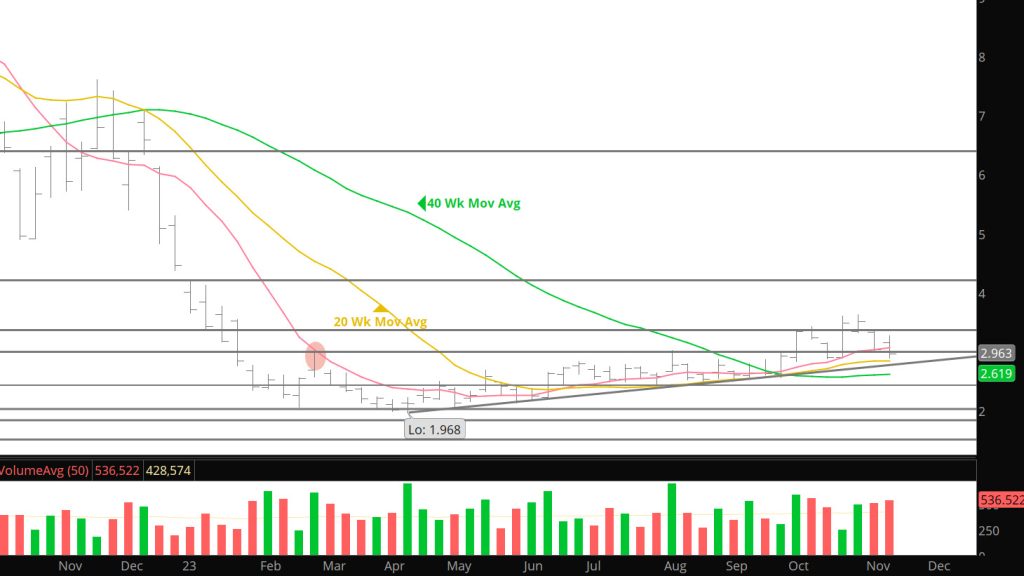

Continued Bearish Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Pushing Toward Major Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Down– But Out???

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Doesn’t Get More Bearish

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

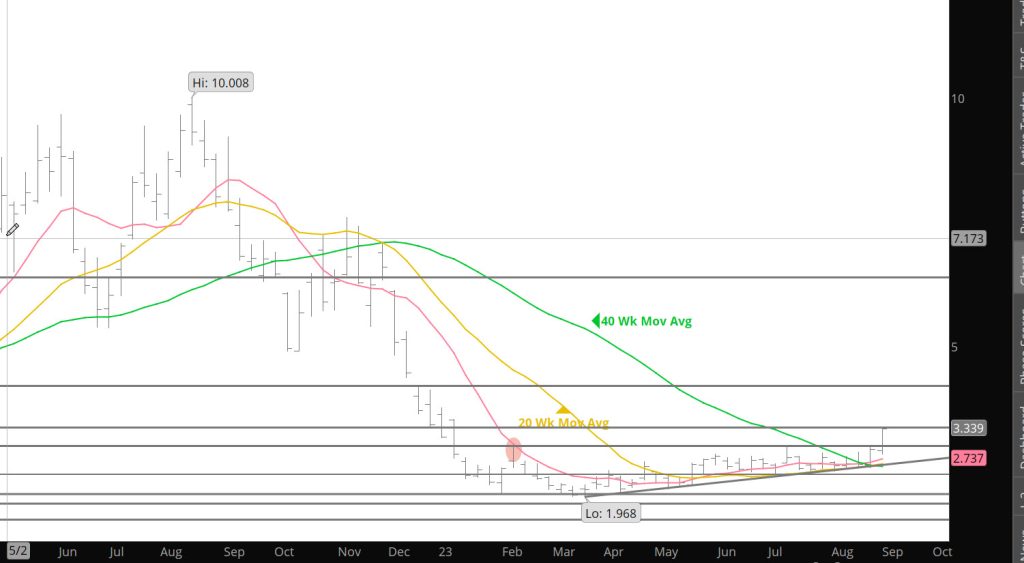

Prices Retain Most of the Premium

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

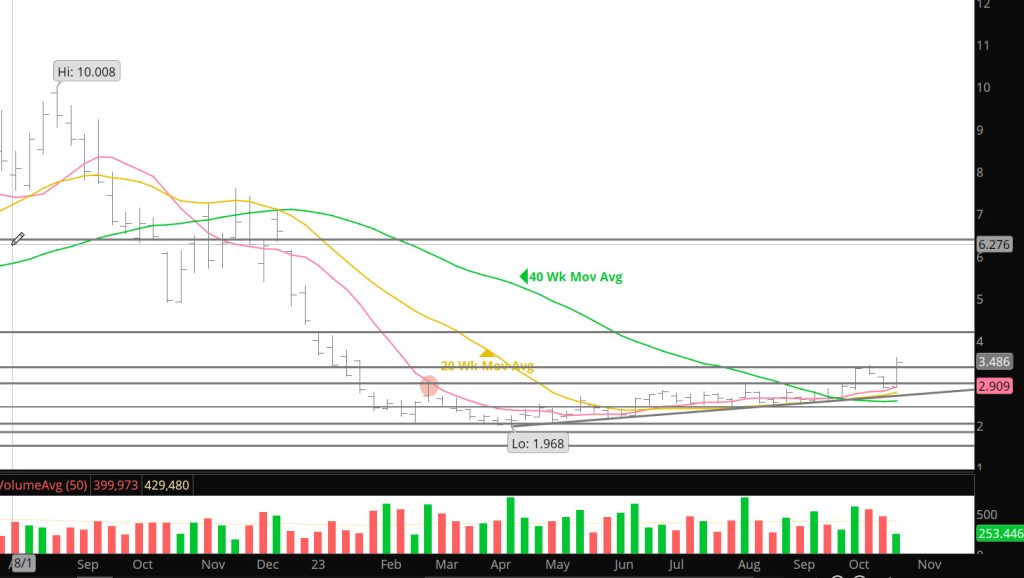

Nov Well Bid Into Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

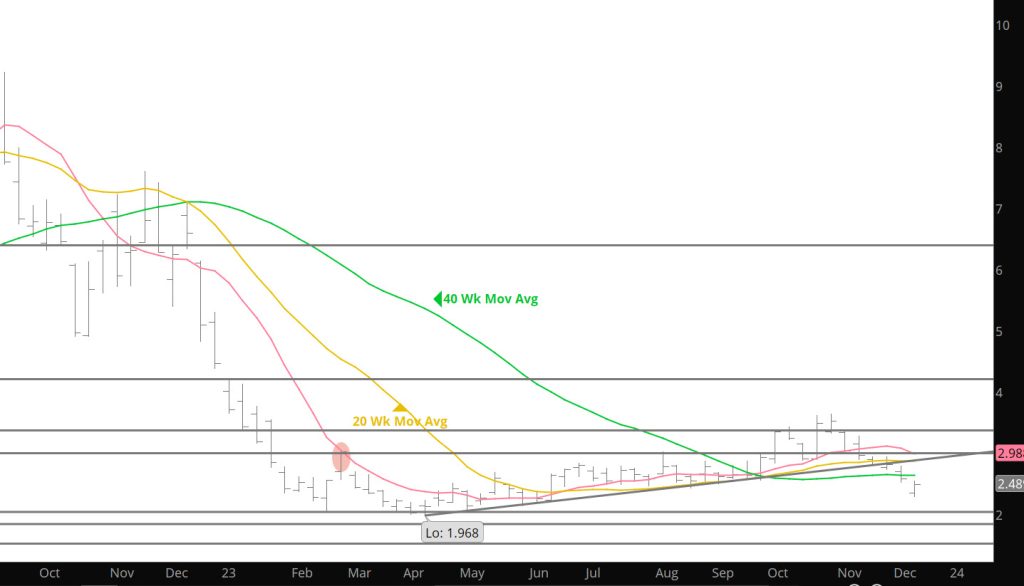

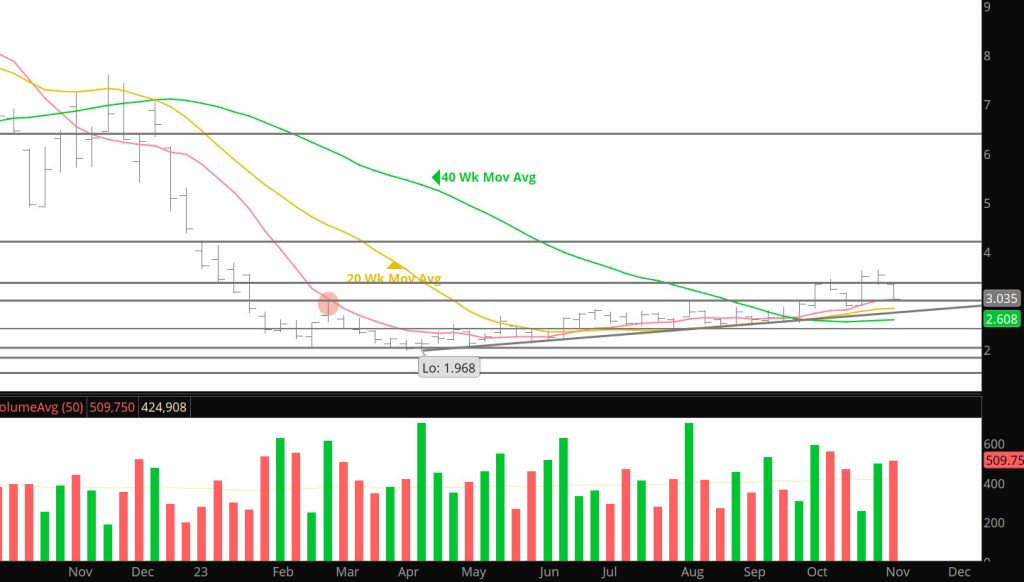

Break Out Confirmed — So Far

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

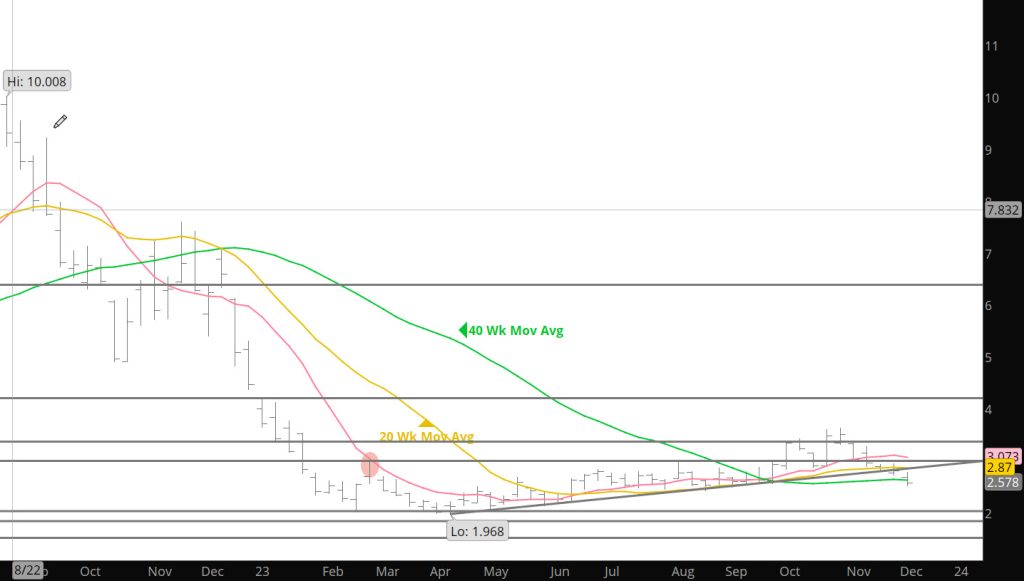

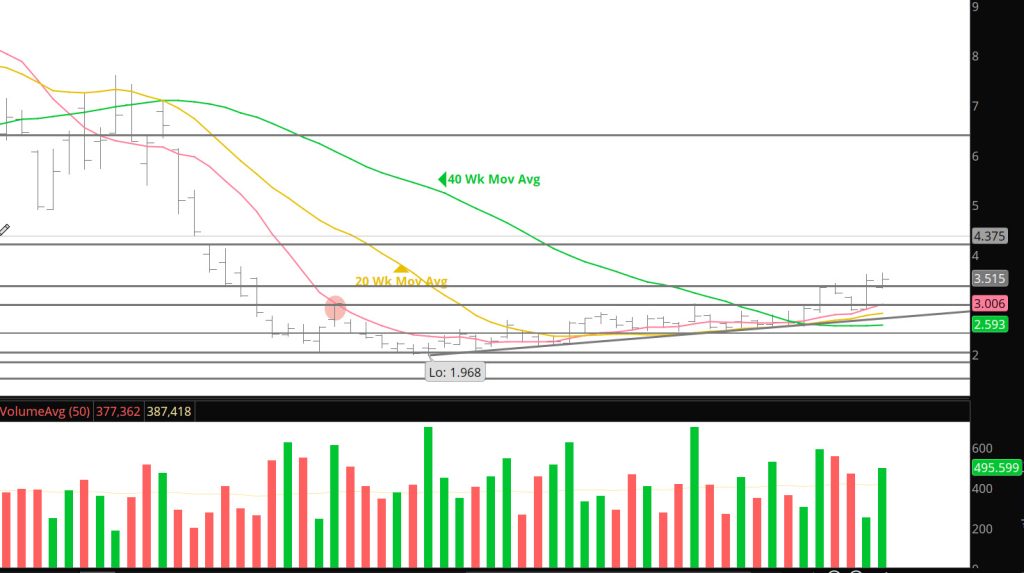

Headed For The Q4 Rally

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.