Category: Weekly Detail

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quiet Week

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Post Destructive Expiration – Prices Find Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

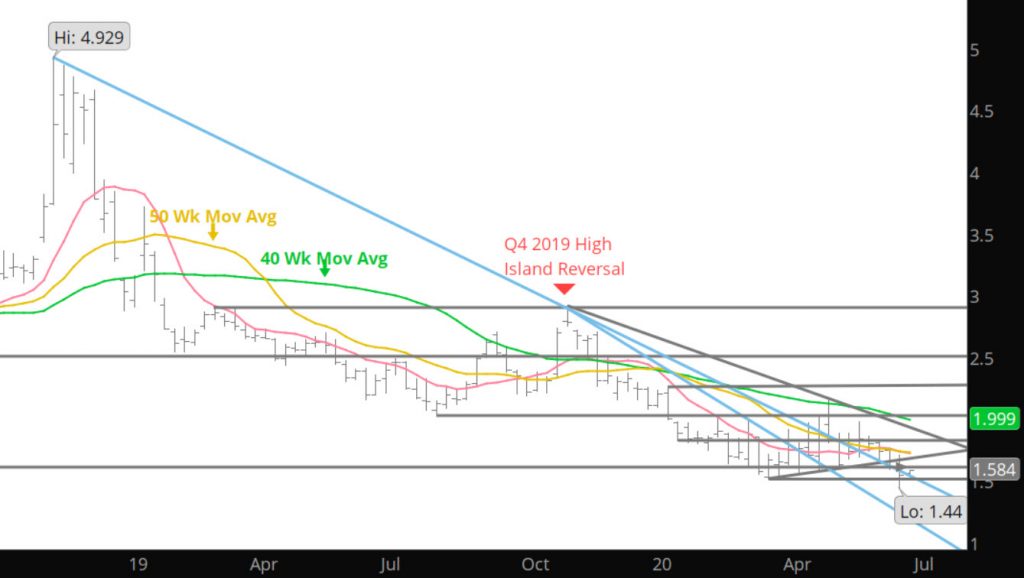

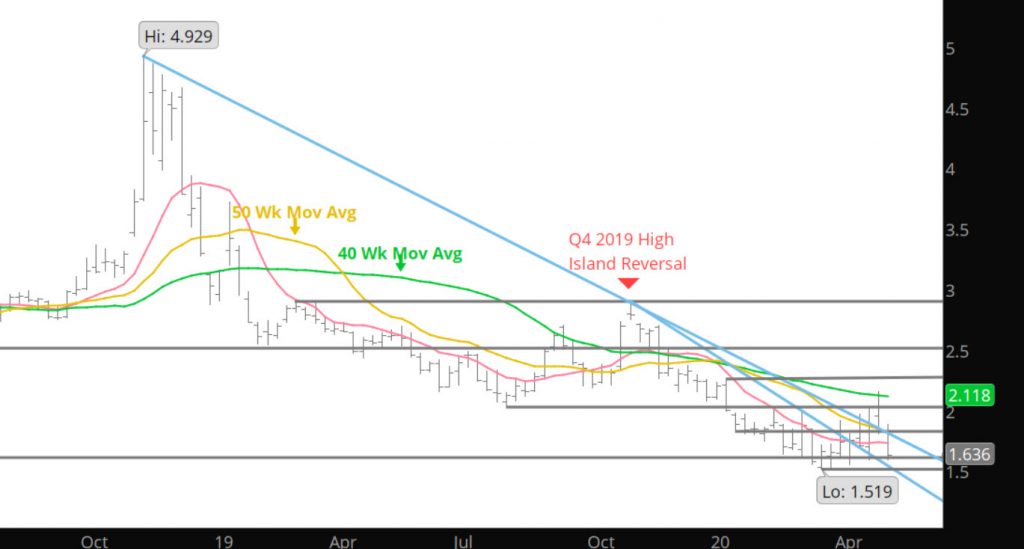

Can It Look More Bearish?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Weakness Continues with July Prompt

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

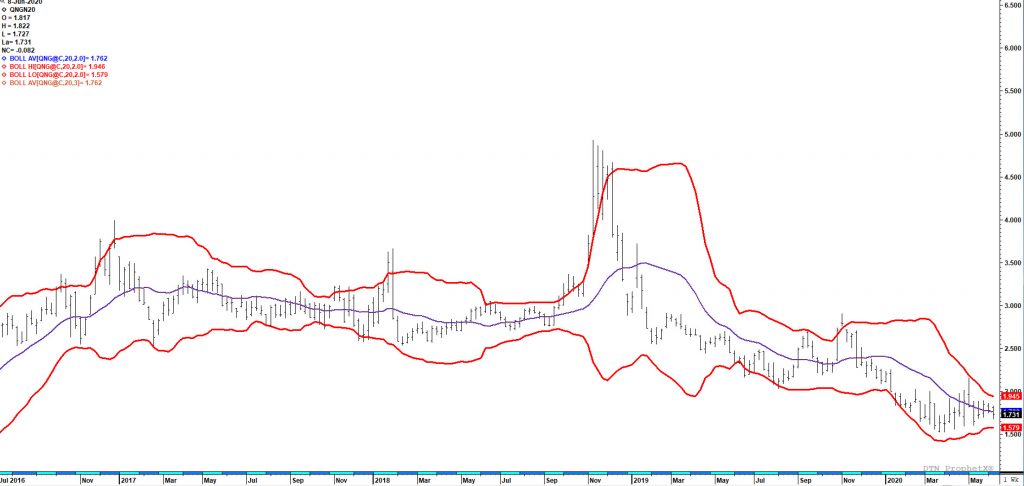

Another Weak Weekly Close

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

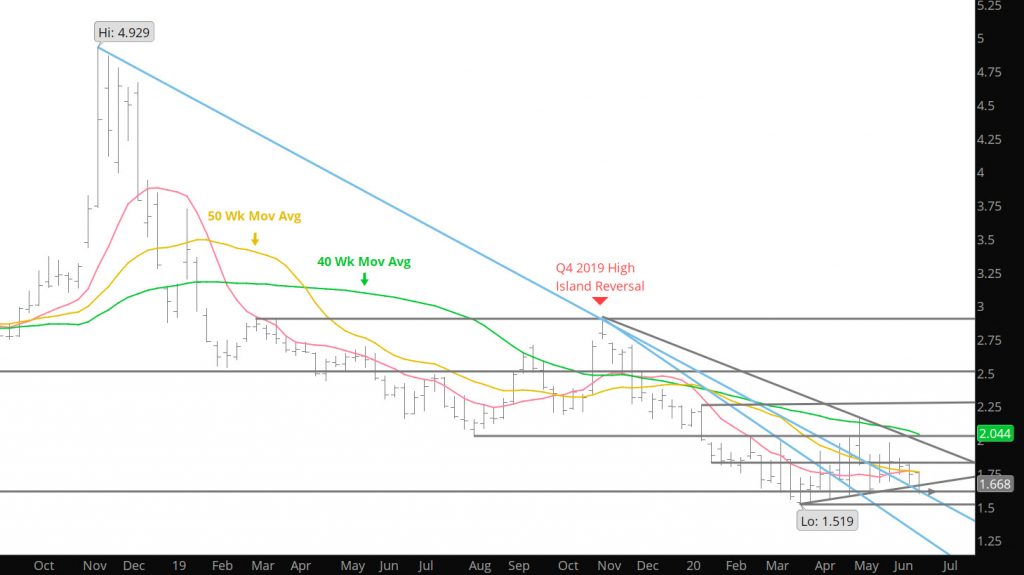

Prompt July Breaks Down

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Market May Be Showing Signs of Bias Change

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

June Expiration Follows History

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

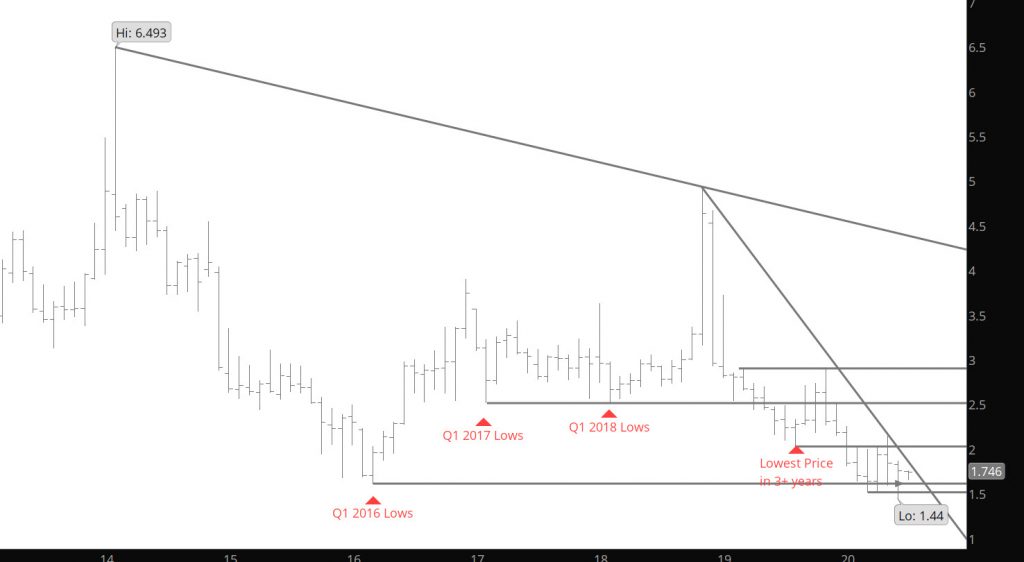

Trend Line Destruction Takes Prices to Test Major Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.