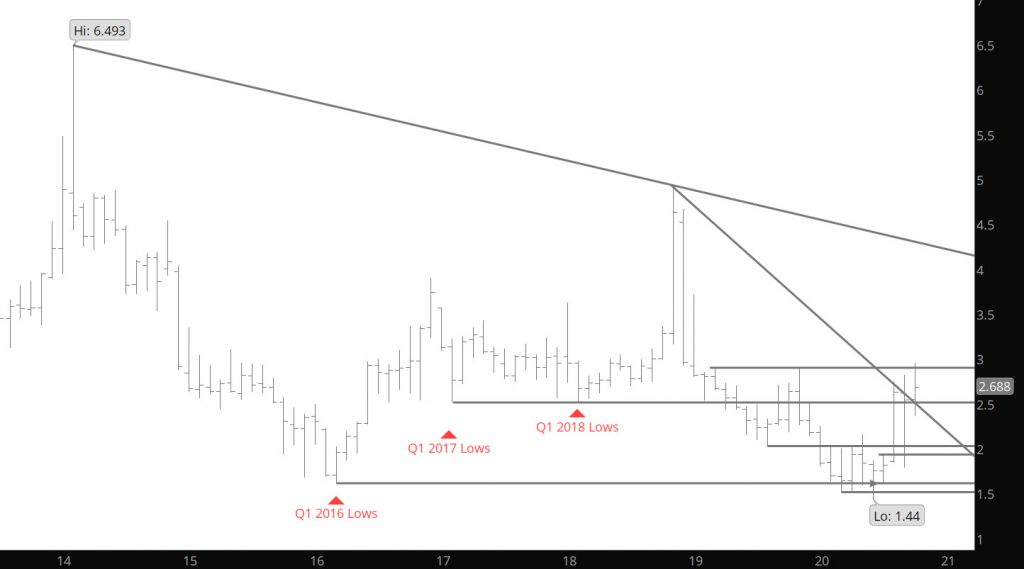

The high for November gas printed just over $3.00 in early September and while last week provided a marginal attempt to get back to that level, the rally failed reversing and closing near the lows (in fact after the regular session was finished the late afternoon traded much lower). The late declines took prices to close just about on the 10 week SMA. The week’s action occurred on lighter volume and declining open interest (highest volume on the declines).

Since prior to the beginning of November’s tenure as prompt it has presented a volatile trading range (basically +/-$2.40 – $2.90). Trade gave up the a significant portion of the substantial premium awarded at October expiration. Action then had November trading through its September low (and its 200 – day SMA) before regaining that SMA, and significantly more, when it traded to a higher continuation high at $2.955. This failure at both of the extremes suggests that the volatile range will continue through the remainder of the November contract. This price behavior will mimic other years when there has been such a significant premium.

While the Nov contract has traded in a volatile range ($+.55) this month the differed contracts have not provided the same level of volatility. December traded within a +$.35 range since the expiration of the Oct contract and similar narrower ranges occurred in the other winter differed contracts. I will be going into the open interest and volume of the differed contracts during the week so be sure to check.

Major Support: $2.476-$2.446, $2.392,$2.258-$2.253, $2.219

Minor Support: $2.618, $2.508, $2.339

Major Resistance: $2.789-$2.801,$2.908-$2.928,$2.973-$3.00