Category: Weekly Detail

Collapse Take Prices Down to April Lows

Nine for Nine

Critical Support Holds Again

Breakdown Week in Trade

Prices Test Support a Higher Low

Expect Volatility to Continue

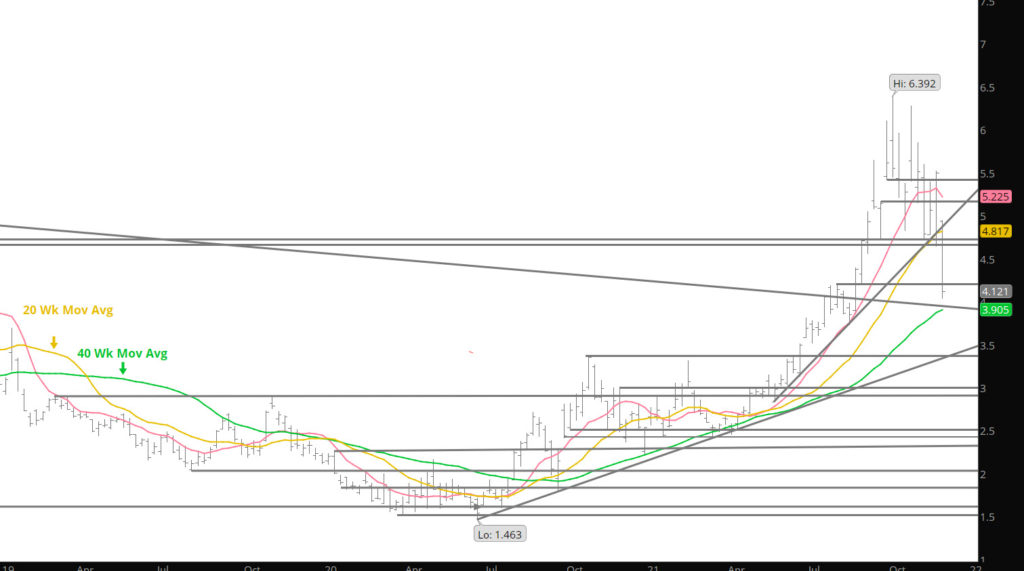

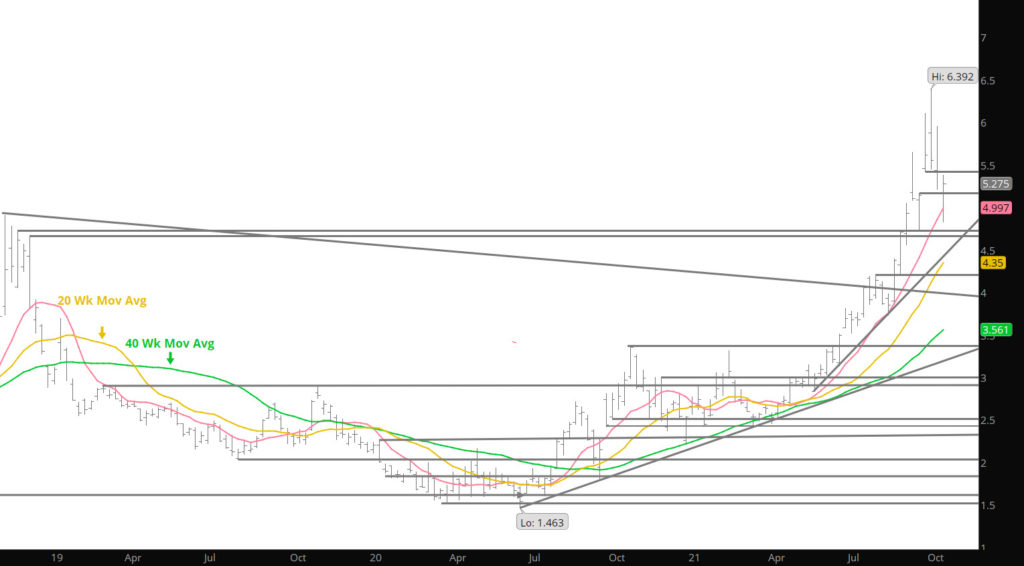

The Nov contract traded through the September high marking the fourth straight year that the Nov contract has done that (see last week’s conversation about Q4 runs and sarcasm), further into the resistance area between the January ’09 and January ’14 highs (6.240 – 6.493) before reversing lower. The reverse sent prompt gas and the coming winter strip closed lower for the first time in seven weeks. However the Q2 ’22 months, summer ’22, as well as the further months strips were higher. Volume and open interest were lower as price failed at a higher high and November closed slightly lower than it had opened when trading resumed on Sunday, suggesting the lack of an appetite for prompt gas above $6.

The elevated level of volatility, the reversals traded this week and previous weeks as prices traded over $6, the near weekly doji (prompt gas closed at 5.556 after opening at 5.628 and traded a new high in between) may be suggesting that Nov contract is vulnerable to a more significant retracement. Like a broken clock, I have been suggesting that the rally is overextended and due for a correction for the last month or so.

Major Support:$5.416, $5.341, $5.17, $4.88, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92, $3.821,

Minor Support: $5.62-$5.633, $4.728-$4.70, $4.66

Major Resistance: $5.876, $6.24-$6.493