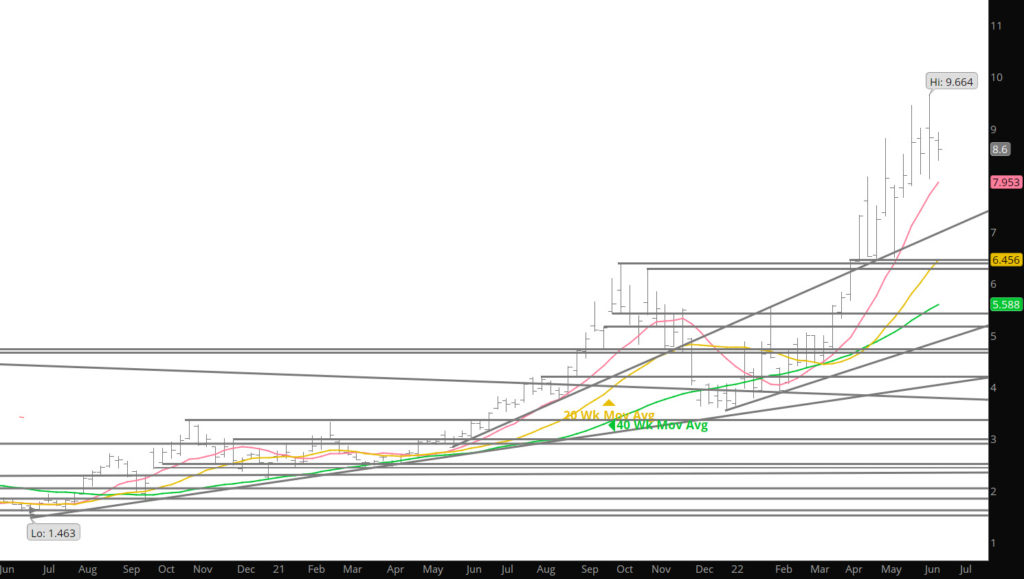

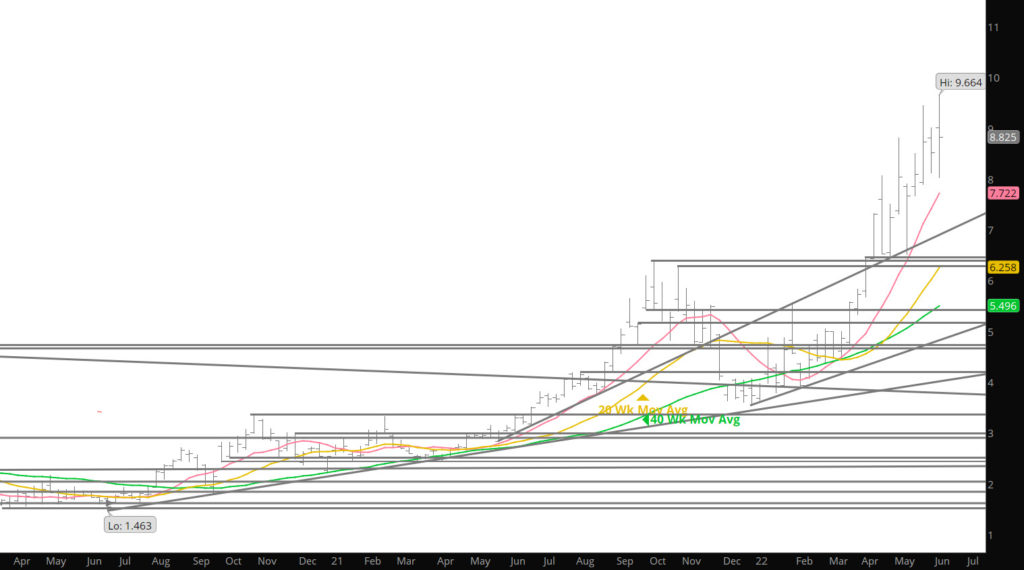

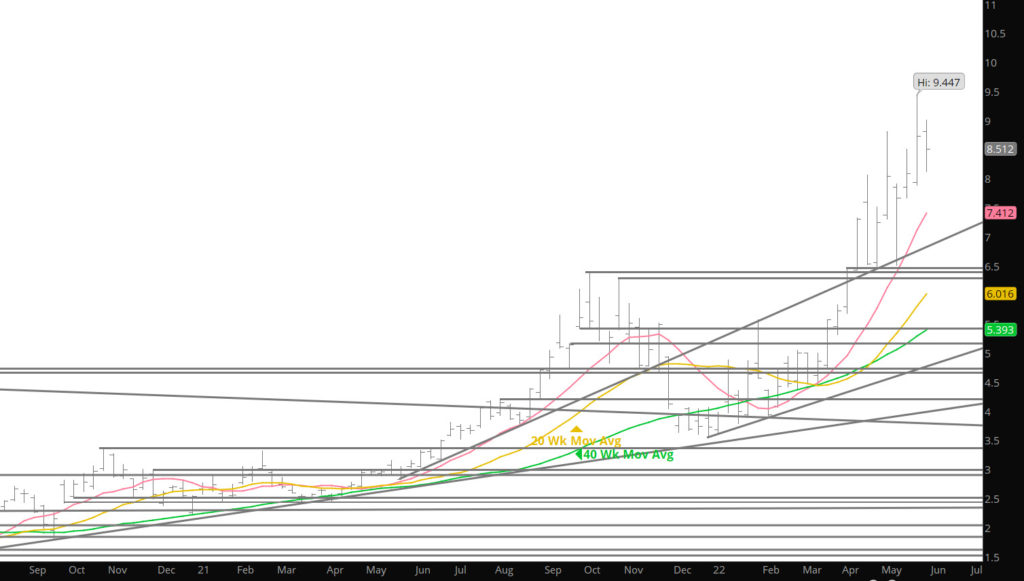

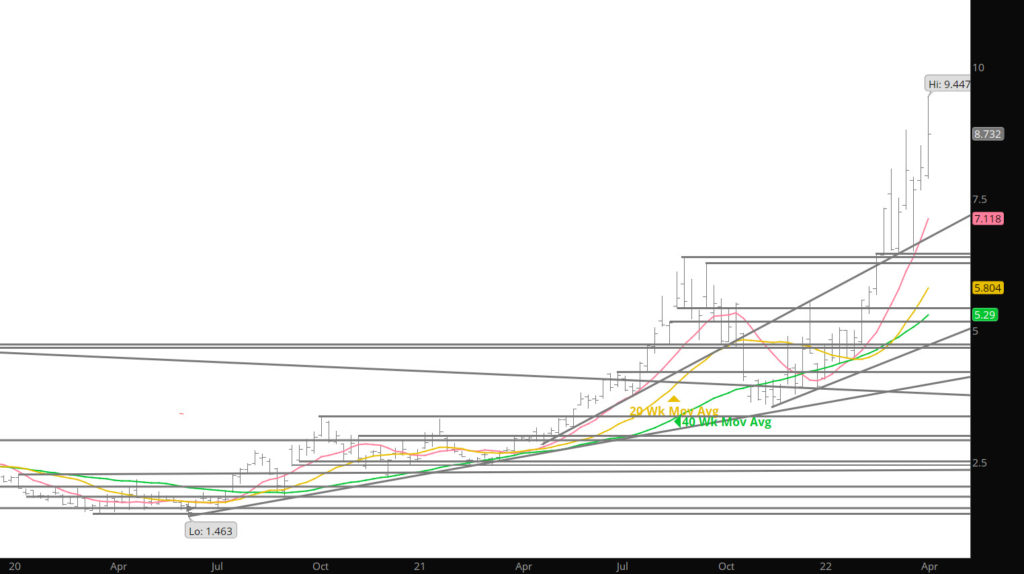

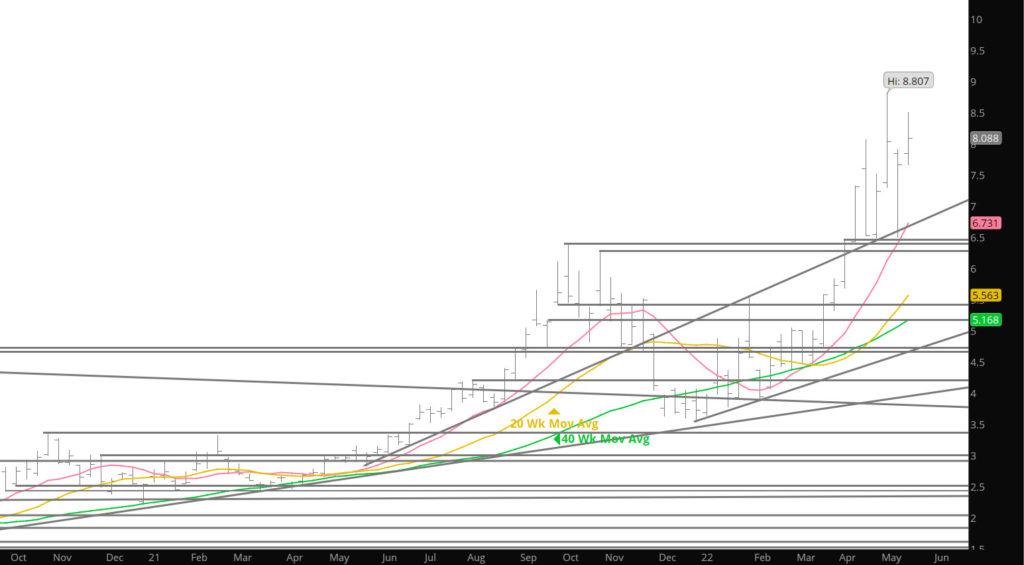

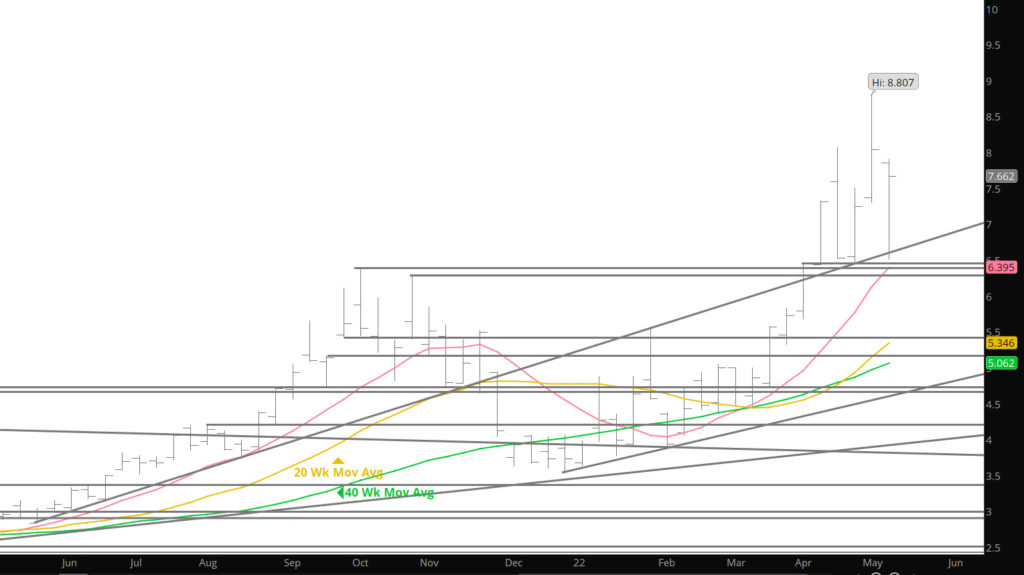

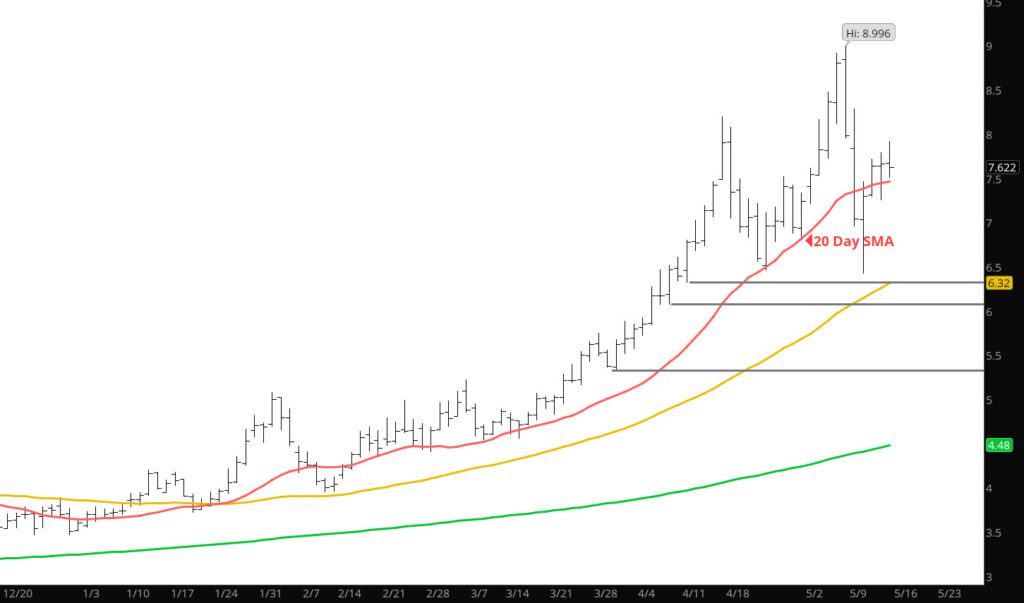

Category: Weekly Detail

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

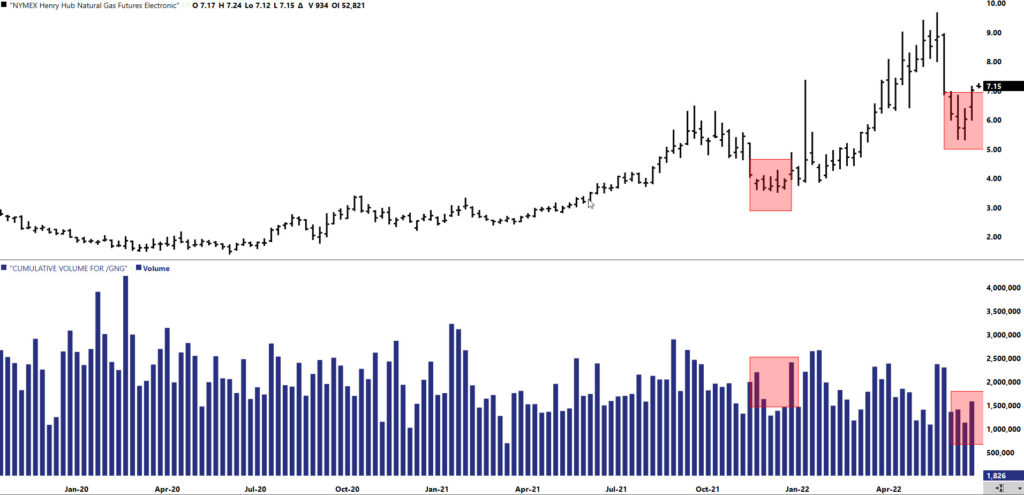

Definite Technical Damage

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

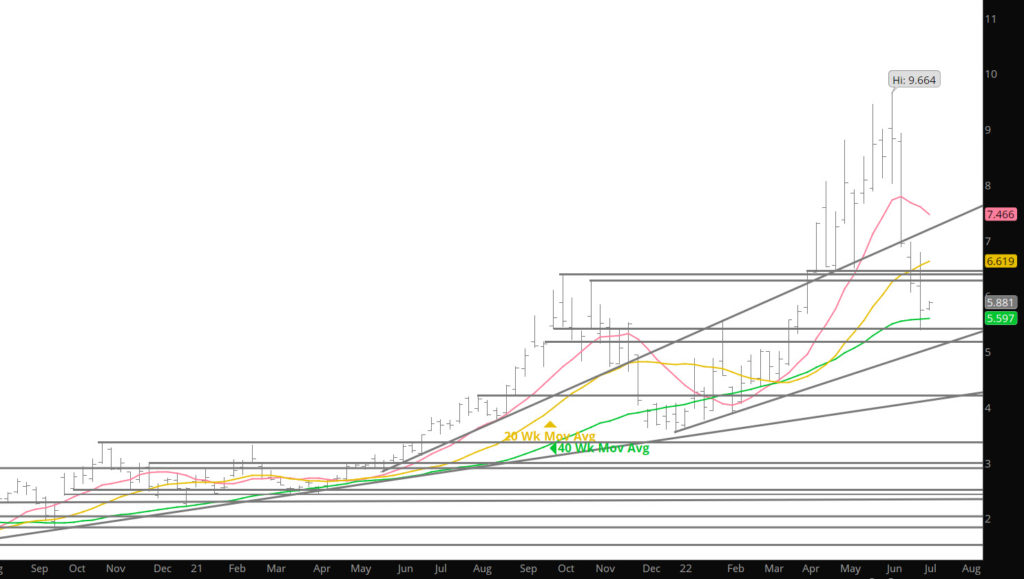

Is the Bull Run Over?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Substantive Declines Modify Short Term Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Wild Volatility

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Limited Weekly Continued Bullish Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

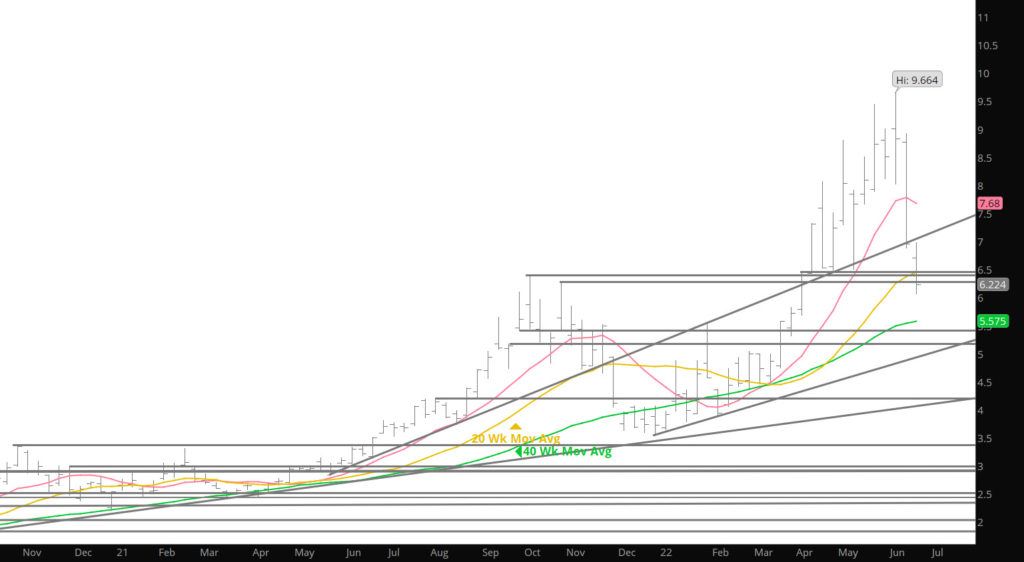

Holiday Weakness Plays Out

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

The Trend Is Your Friend — Until It Isn’t

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

EOM We All Know the History

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Divergence Developing and History

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.