Category: Weekly Detail

Further Evaluation

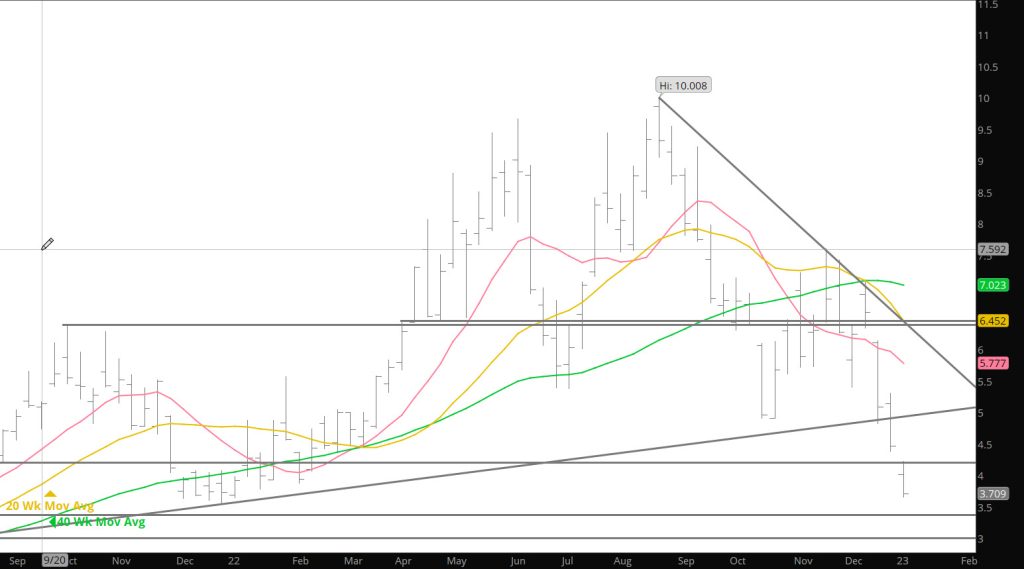

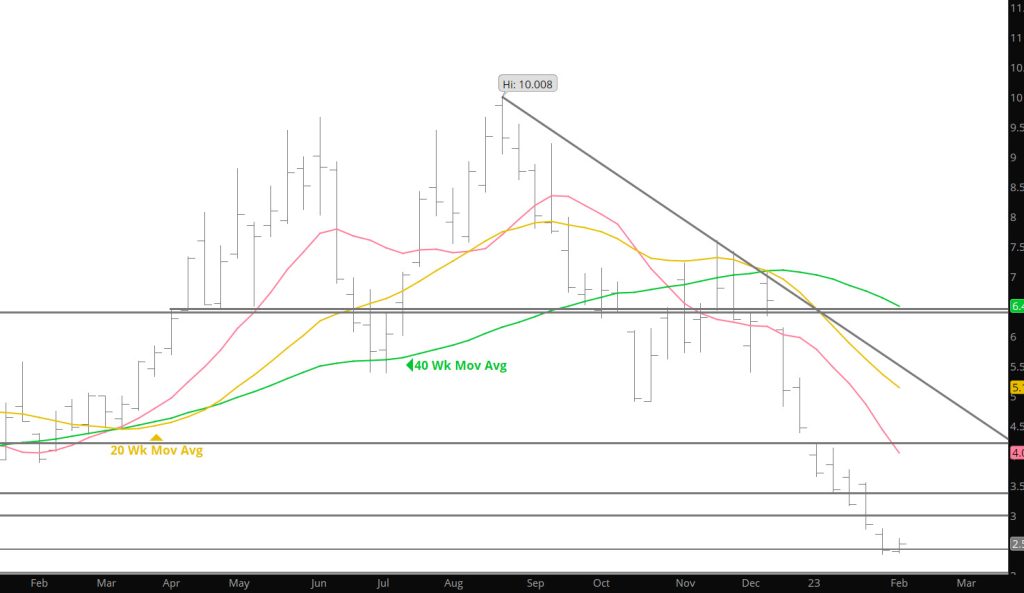

Feeling better and capable of bringing thoughts together I offer this Weekly updated for this week’s action. It may be that the “inside” week (concluding last week) is just a pause for an astronomic oversold gas market, but I beginning to think that the downside momentum developed since those bearish momentum divergences way back in August is finally exhausted or getting extremely close to it.

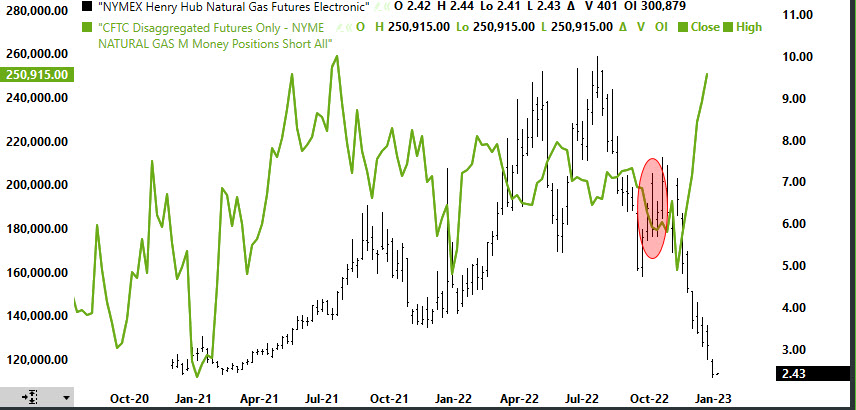

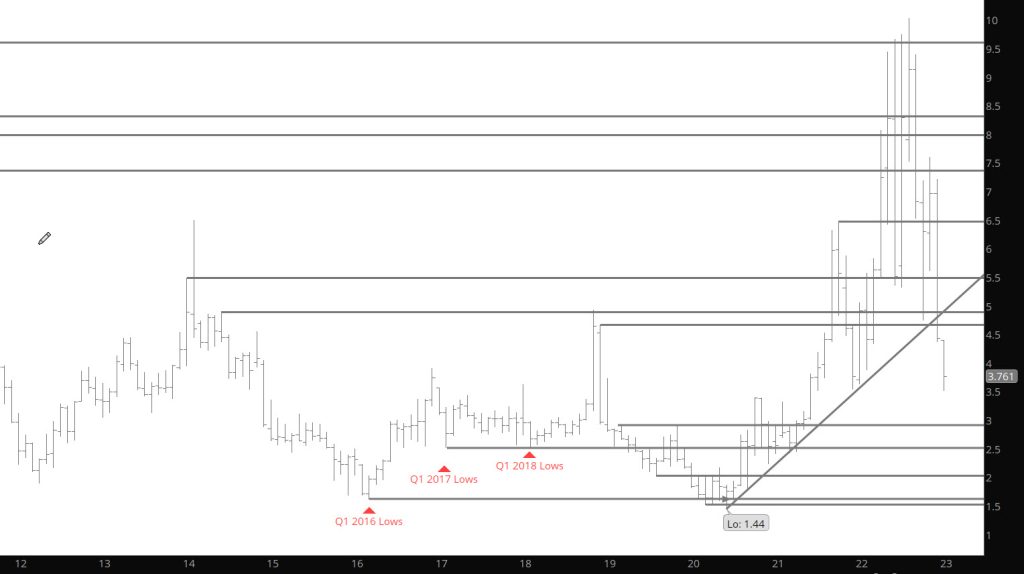

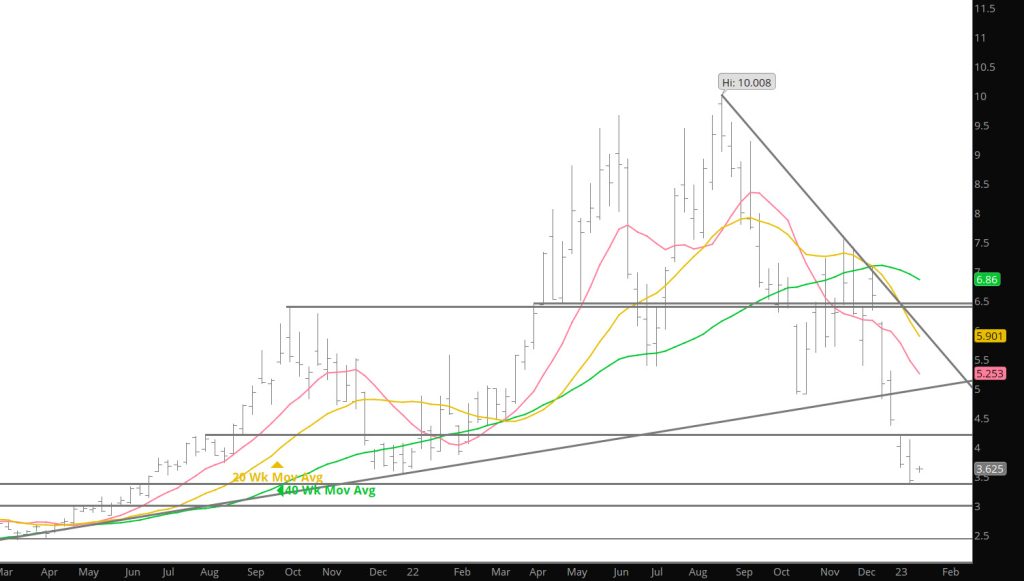

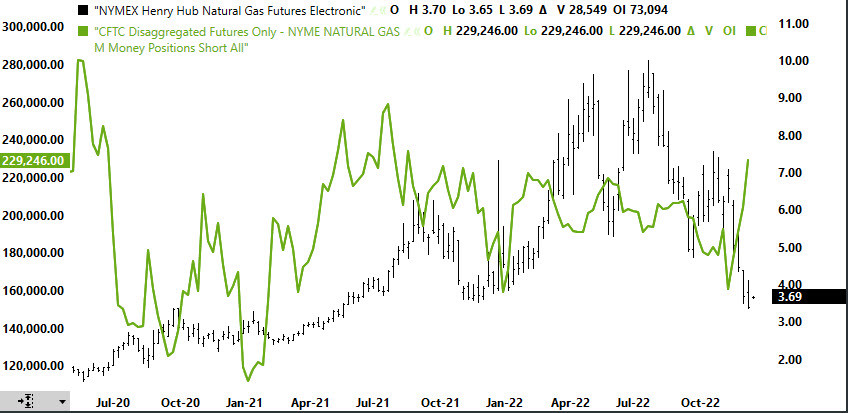

The gas market fueled by speculative fervor (previously discussed Managed Money position short gains) characteristically take trends further than what is sustainable.. Prices did that in June ’20 when there were projections of a prompt price under a dollar then it did that back in last August when prompt September fleetingly visited the rarefied air over $10 for the first time since the hedge fund inspired run in the spring and summer of ’08. Last summer’s correction was quick and efficient.

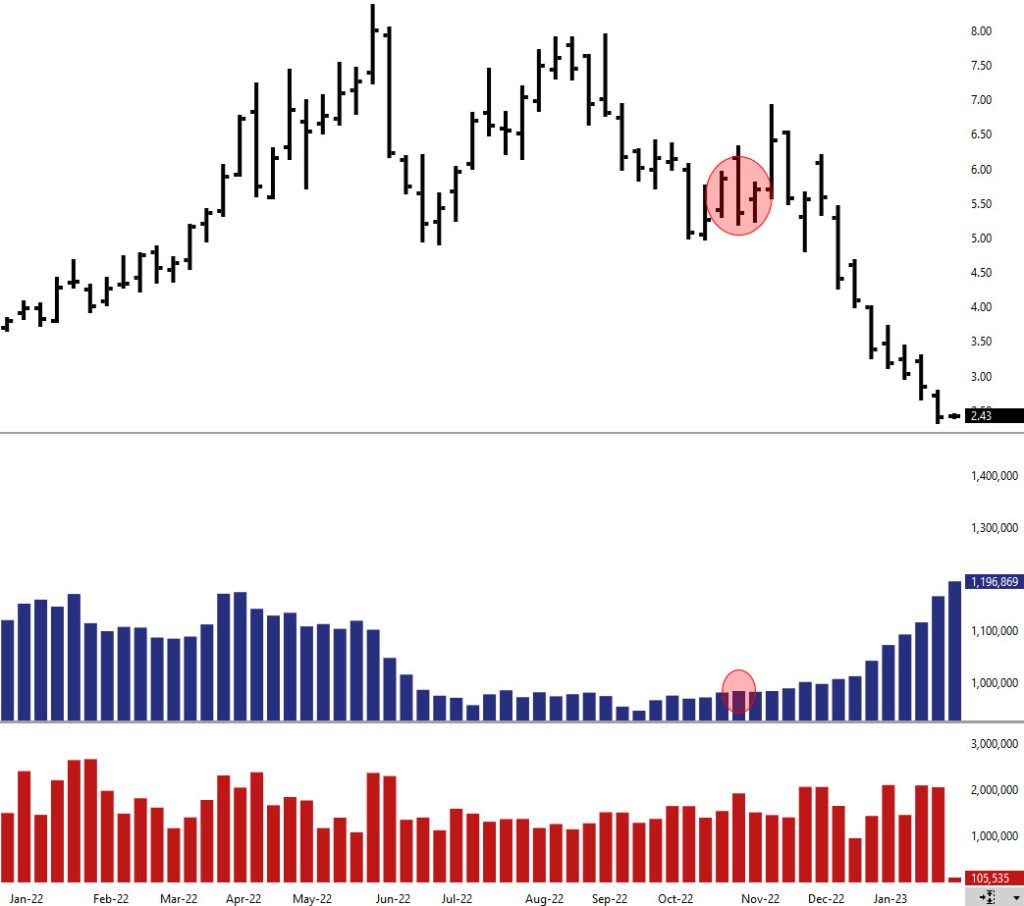

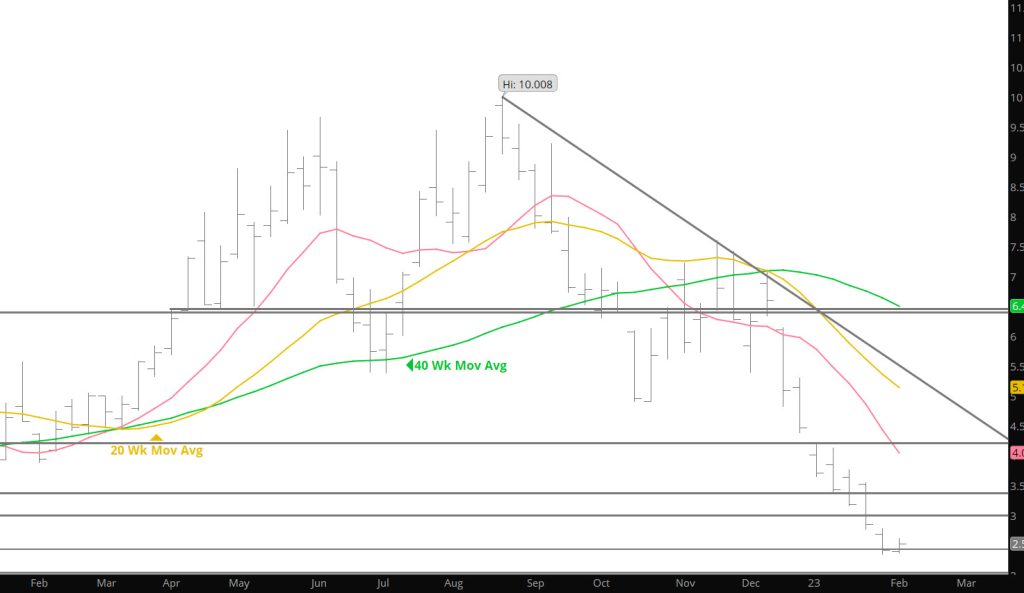

My view is that the gas market has just begun the basing process and its early, only one week removed from trading a lower low, but most technical objectives have been met and then some. While the consensus of technical indicators is still solidly negative, the extreme state brought by the most recent phase of the decline (from the November/December highs) moderated a bit. The weekly RSI are still extreme and the RSI has ended in its EXTREME zone for the last six weeks…it has not done that since the decline from the ’08 high. Being extremely oversold does not mean that an indicator can’t get more oversold (witnessed that over the last few weeks), but that’s not the history of the purely mathematical indicators. More interesting is something of a change in the market’s internal characteristics during the past week. Volume has been increasing as the market fell that’s what is supposed to happen if a trend is to continue, but last week the volume starting increasing as the market rallied. On Tuesday 619,703 contracts traded…the highest daily volume since June 14th. The range traded that day was $1.881…the range traded on 02/07 was $.192. What I expected to see the next day was that open interest had declined indicating that a bunch of shorts had covered an existing position but that did not happen. Rather, open interest increased 7,362 contracts– that could show a strong indication that more than enough new buying came into the market to offset the amount of short covering. That is the first technical positive suggestion from market internals since the fall.

Major Support: $2.533, $2.422, $2.238

Minor Support:

Major Resistance$3.536, 3.595, $3.63, $3.789, $4.128, $4.22-$4.39, $4.75-$4.825, $4.948

Important Change May Be Starting

Fell victim to a serious sinus bug late last week and with the headaches — will not try put the market in perspective. Will try tomorrow or Tues

Bull’s Stand Aside-Humor Will Come

Bearish Technical Indicators Continue

Another Lower Weekly Trade

Holiday Prices Bounce Off Support

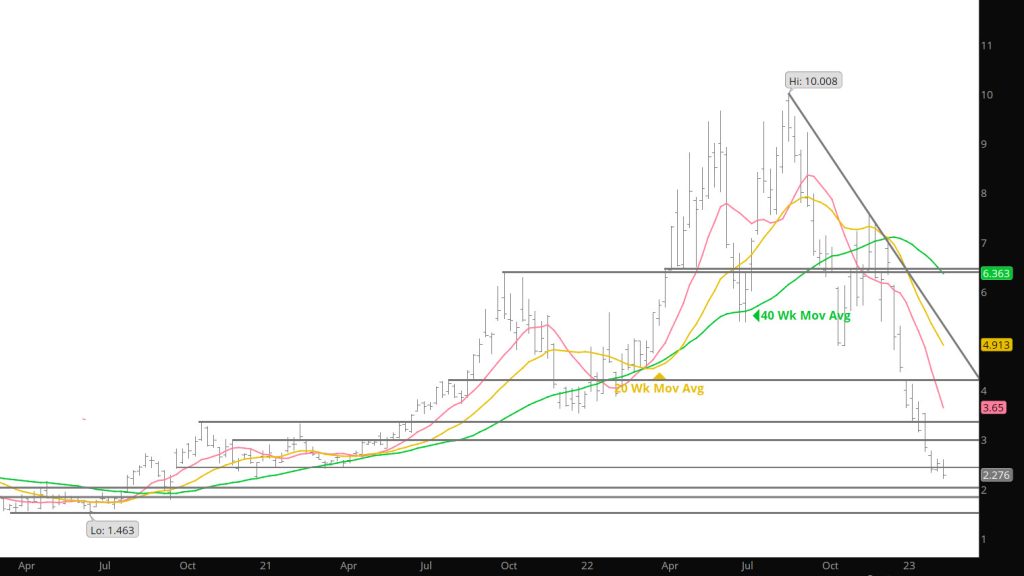

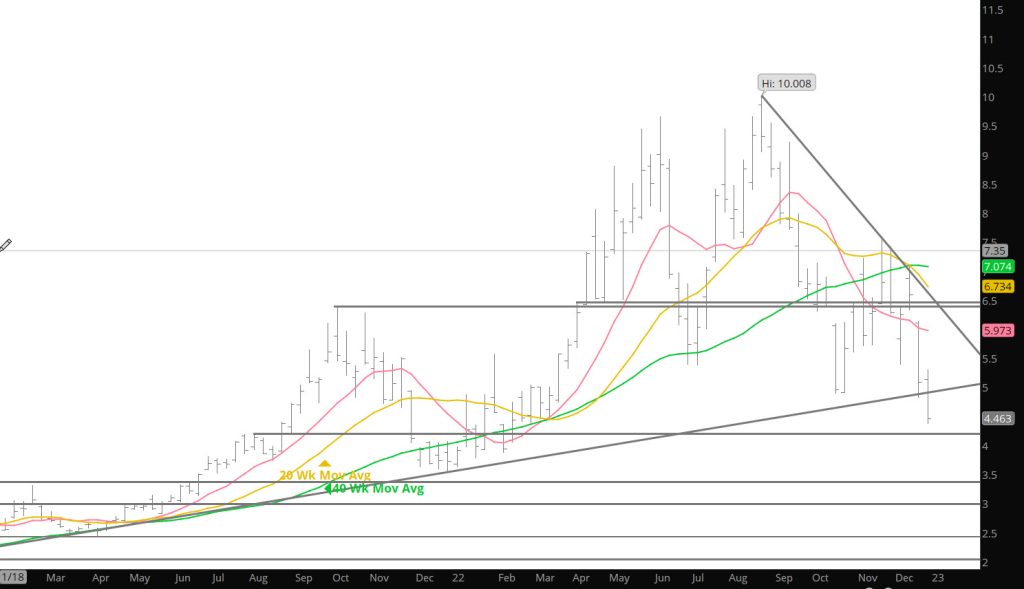

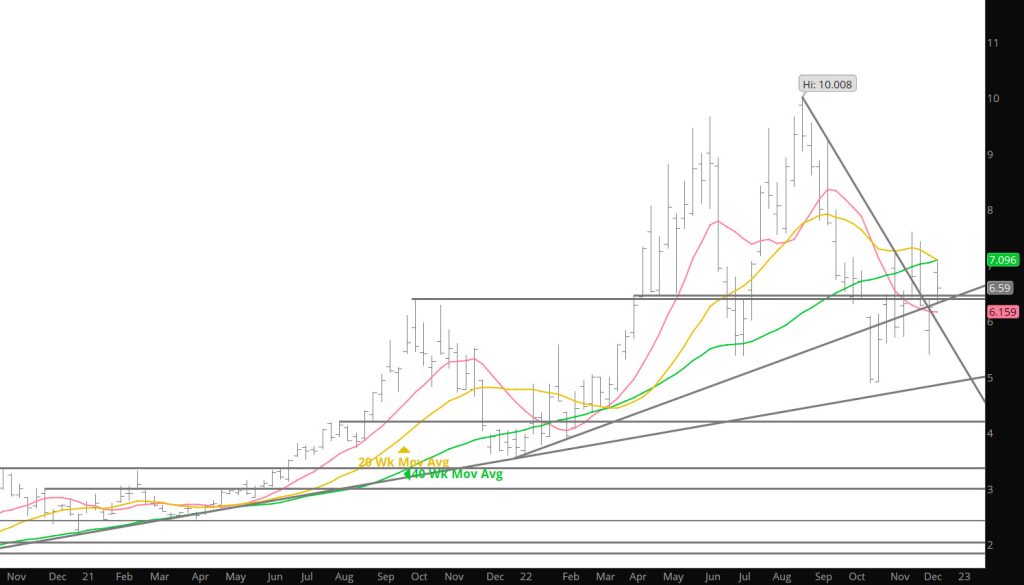

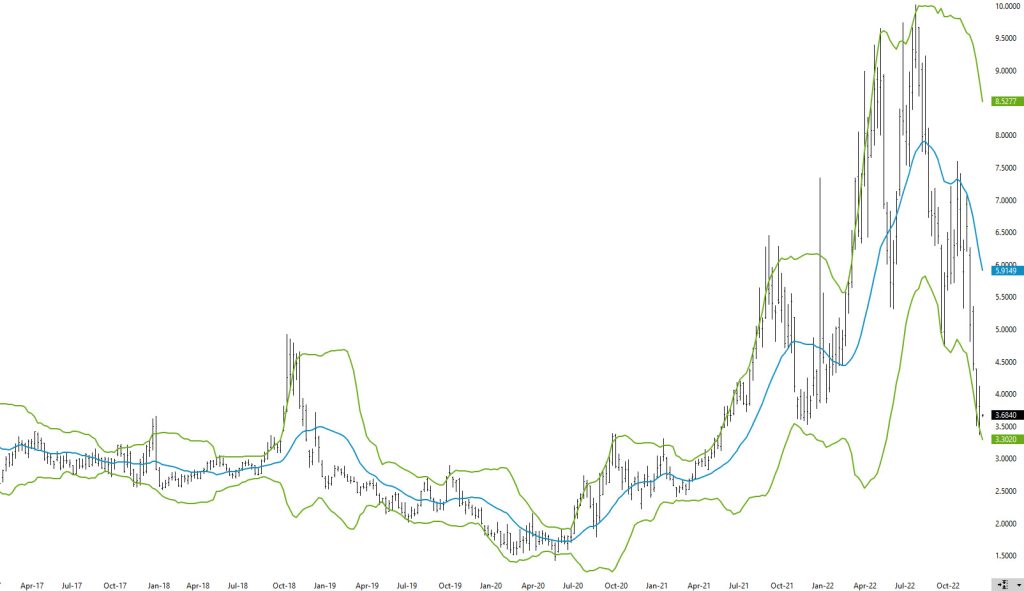

The current natural gas market is dissimilar to last year (from a technical standpoint) as prices are now developing over-sold conditions from declines that commenced last September. As the weekly chart (with Bollinger Bands) shows below, the market is now trading at 2 standard deviations below its 20 week moving average (last week’s close) —a level that historically does not maintain the market for very long and usually presages a rally or series of rallies.

It is also concerning, that the declines of late have caught the interests of the speculators. The latest Commitment of Traders Report has the Managed Money Short positions increasing their short commitments with the expectations of further declines.

The increased attention from the speculators to the price action suggests that there will likely be upcoming volatility in the market. When this group comes into a market aggressively—it sets the market up for violent short covering rallies when the prices find support. Exposure to these rallies should be minimized by a hedging strategy.

Expect rallies off of support and should these rallies break some key resistance areas — forcing the shorts to cover some positions– the rally may become violent.

Major Support: $3.638-$3.536

Minor Support:

Major Resistance$4.22-$4.39, $4.75-$4.825, $4.948, $5.056