Category: Weekly Detail

Prices Retrace on Cue

Looking At History

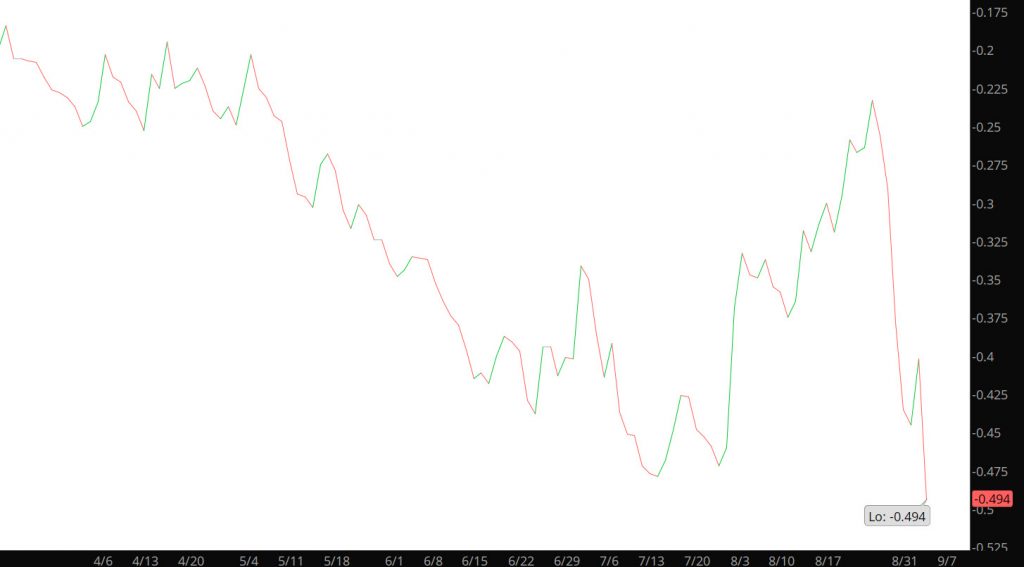

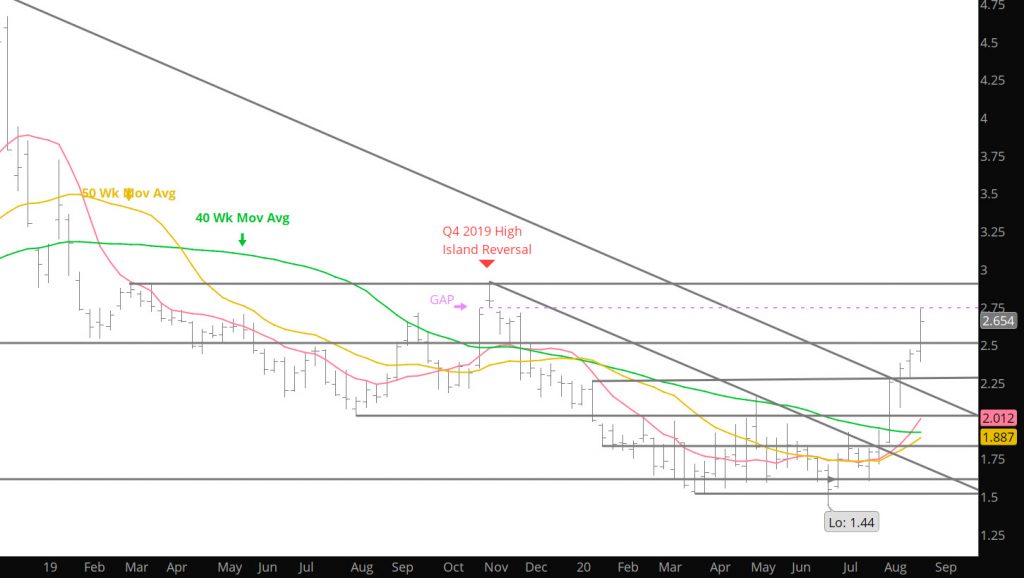

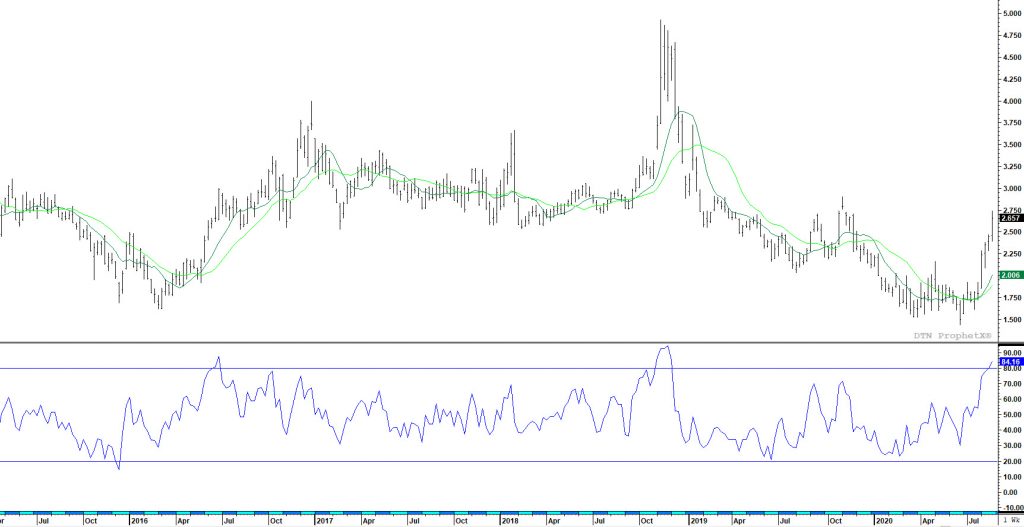

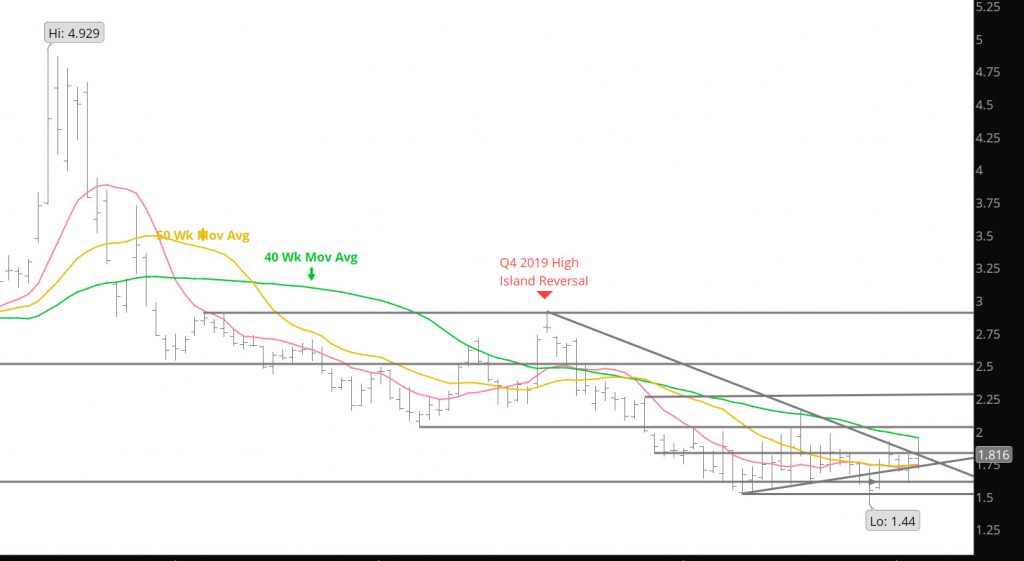

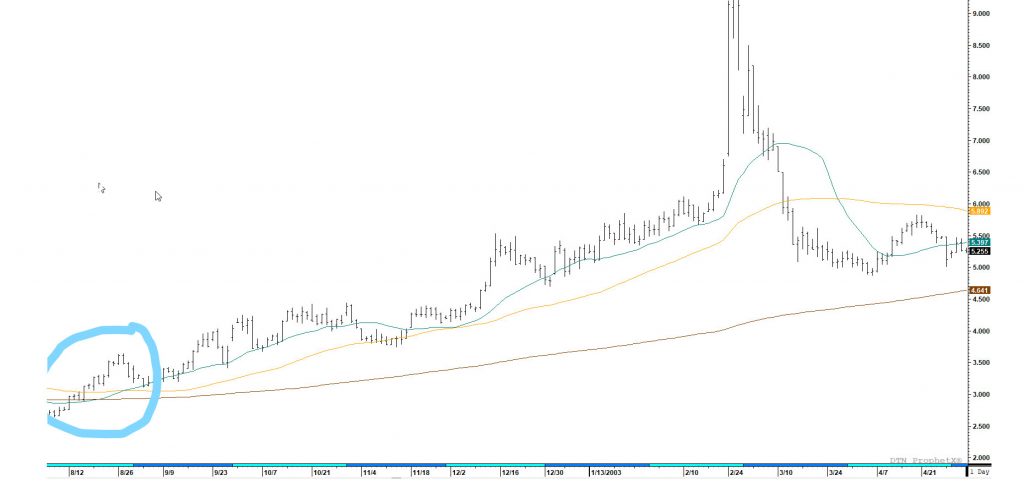

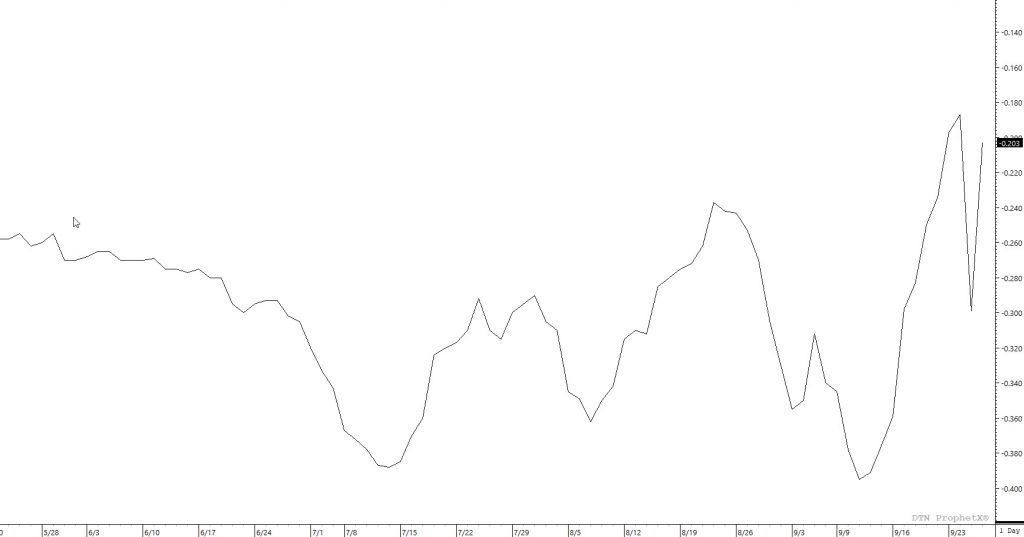

Highlighted three years that prices stayed strong during August, but I wanted to focus on 2002, as the spread between October and November expanded to over $.40 in early September, which is similar to this year.

Notice that the solid gains during the August month in 2002 (blue circle), prices then retracted 14.6%, before extending on a long term rally that didn’t conclude until February ’03. While that started, the spread between Oct and Nov contracts expanded to $.40 (premium Nov) during early Sept. Similar to the current year, prices held firm all during the August trade and currently trade $.45 differential to the November contract. The recent declines from the highs at $2.743 have corrected 14.7% at the lows yesterday. In 2002, the market did not correct until Feb 2003 as prices skyrocketed. Not sure if this occurs in 2020 but wanted to bring history to your attention.