Category: Weekly Detail

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

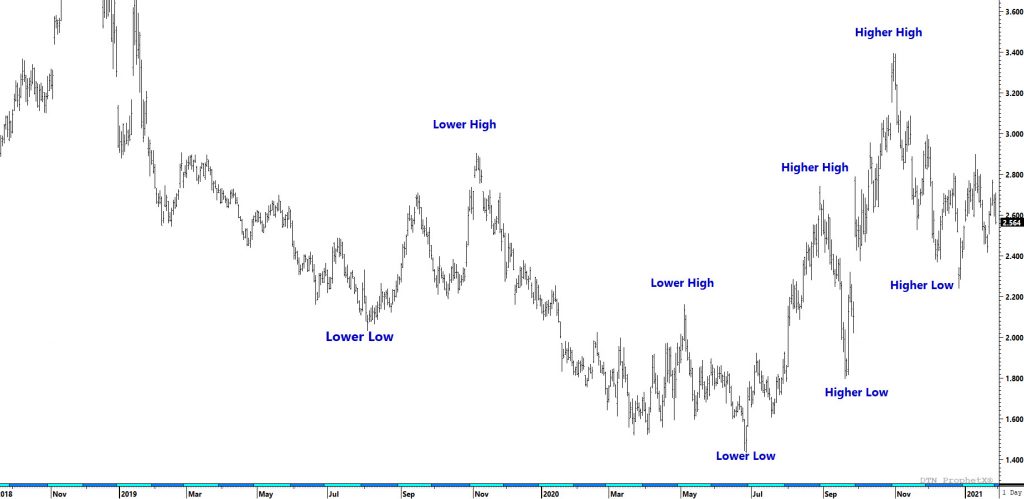

Higher High — Quiet Week

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

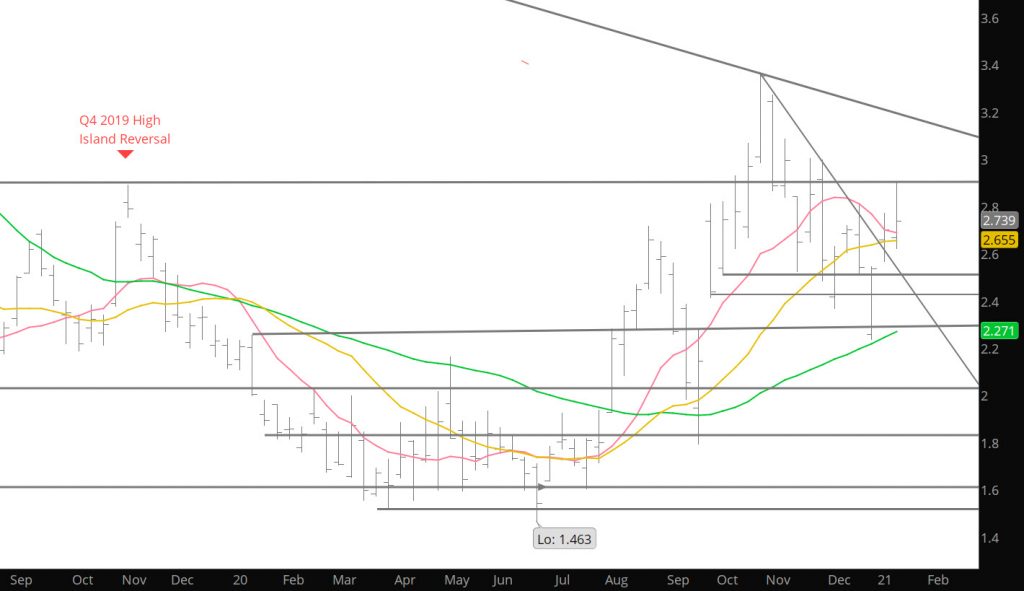

2021 Commences With Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

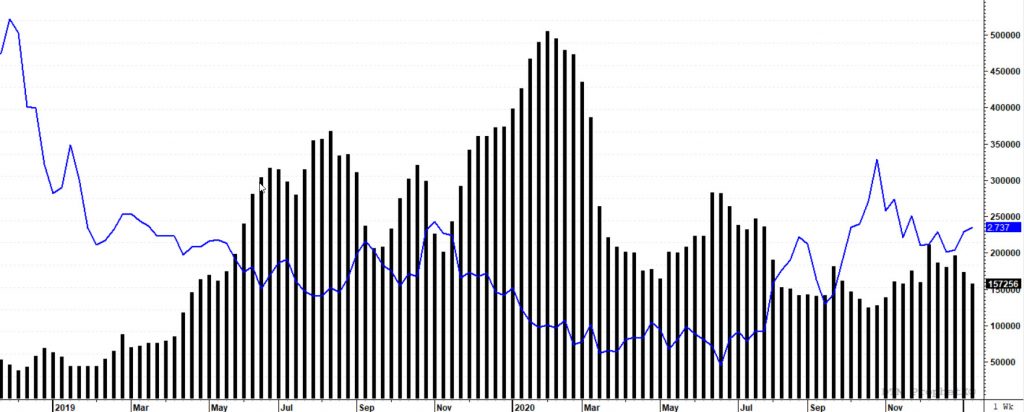

Early January Trade Has History

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Likely to Test Support Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Where Does It End

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Action Consolidates Above Key Moving Average

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Support Challenged — Declines Failed

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

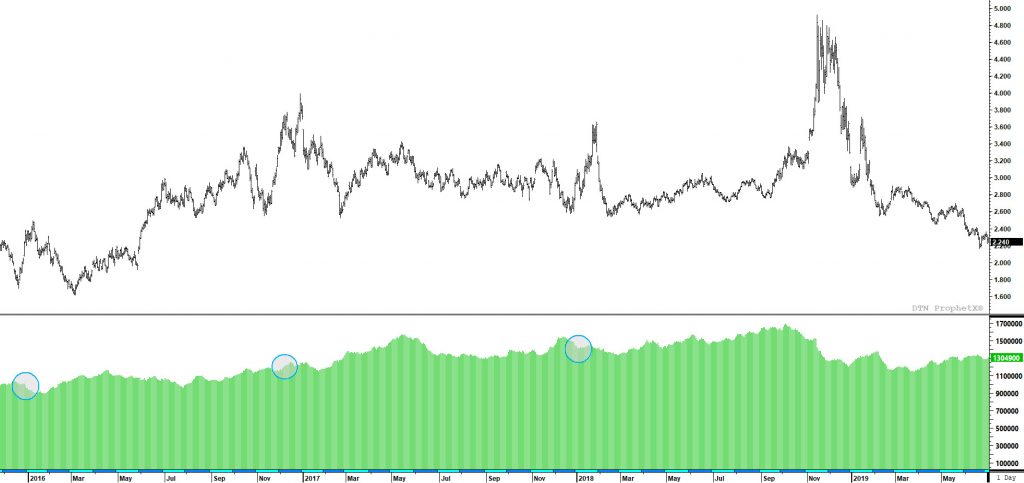

Those Early Winter Calls for the “End of Winter”

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

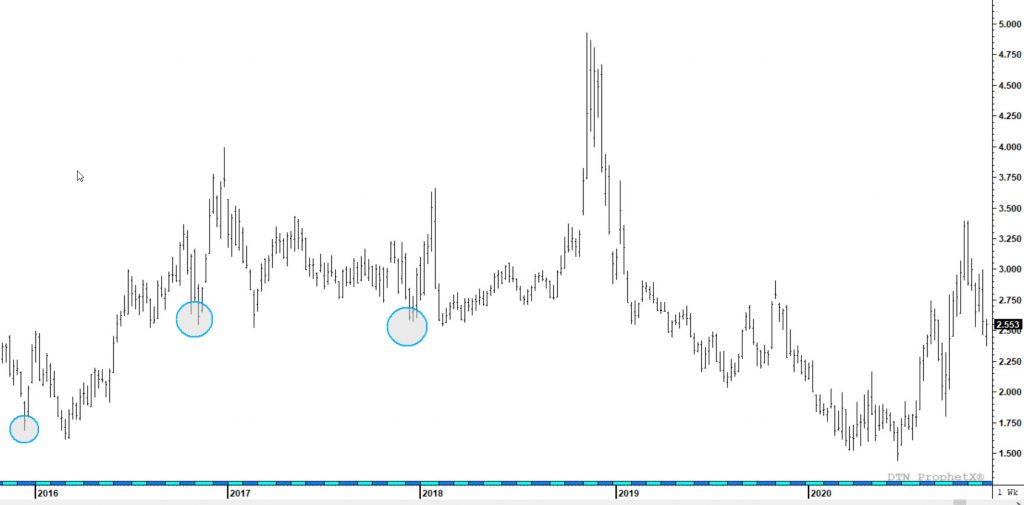

Break Down Tests the ’18 and ’17 Q1 Lows

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.