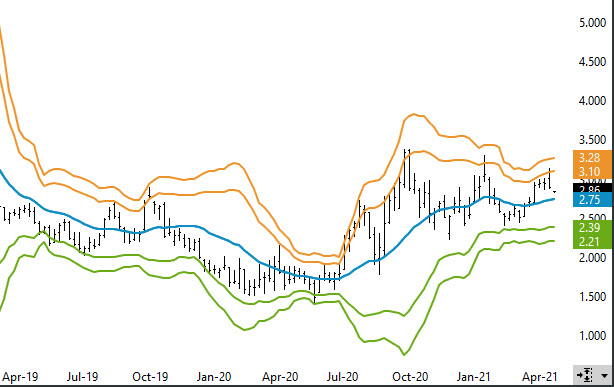

Category: Weekly Detail

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

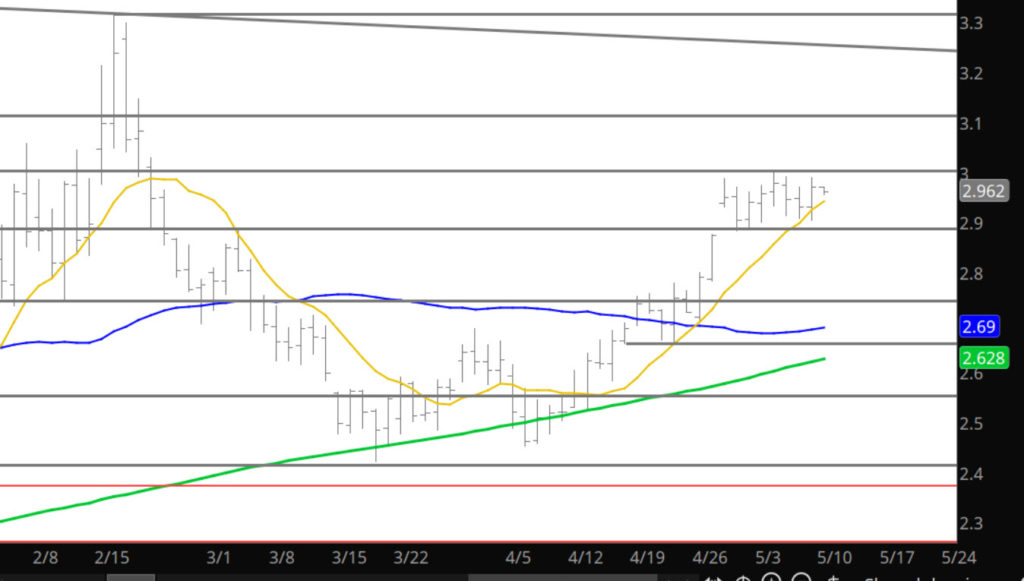

Prices Firm Above $3.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

July Takes Over

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Failure At Near Term Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Short Term Break Above

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Rally Maintains Strength

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Higher Weekly Close

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expiration and Unknowns

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Why Not Gas?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation Brings Volatility Weakness

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.