Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Is Support Building For a Break

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Oh Look — Consolidation Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Spring Trade Action Similar to 2020 and Last Year

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Tired of Reading About Range Trade?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Resistance is “Resistance”

Daily Continuous

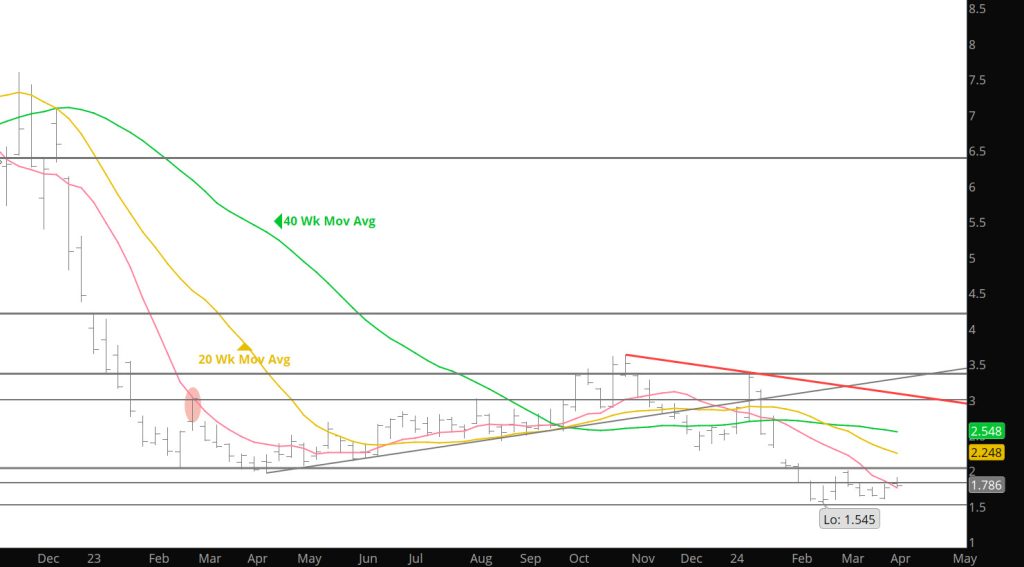

That is why they call it resistance as prices trade between the 50 Day SMA and the 10 Week SMA but does not close above them both on a daily basis. The trader has to believe resistance breaks or holds — your guess is as good as mine.

Major Support:, $1.595, $1.52-$1.519, $1.432, $1.312

Minor Support :

Major Resistance: $1.87, $1.94-$1.967, $2.00, $3.00, $3.16, $3.48, $3.536, 3.59,

Rerun Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Similar to Last Month – Firm to Start

Daily Continuous

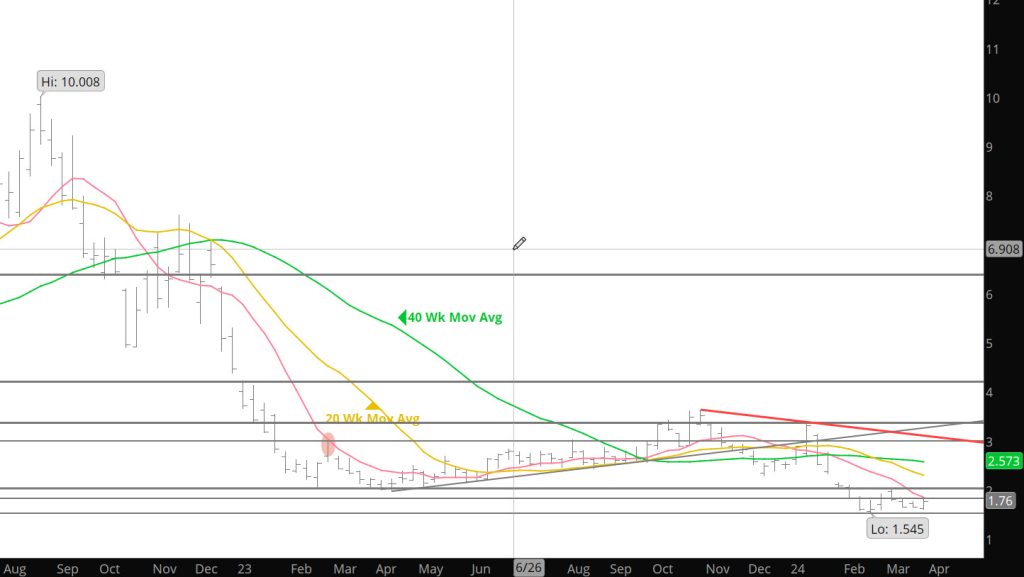

Seen this movie before — lets see if the plot thickens on this month as prices start the month off with strength only to fall back after the first week.

Major Support:, $1.595, $1.52-$1.519, $1.432, $1.312

Minor Support :

Major Resistance: $1.863, $1.94-$1.967, $2.00, $3.00, $3.16, $3.48, $3.536, 3.59,

Strong Daily Close to May

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

No New Bias Definition

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.