Author: Willis Bennett

Going Where?

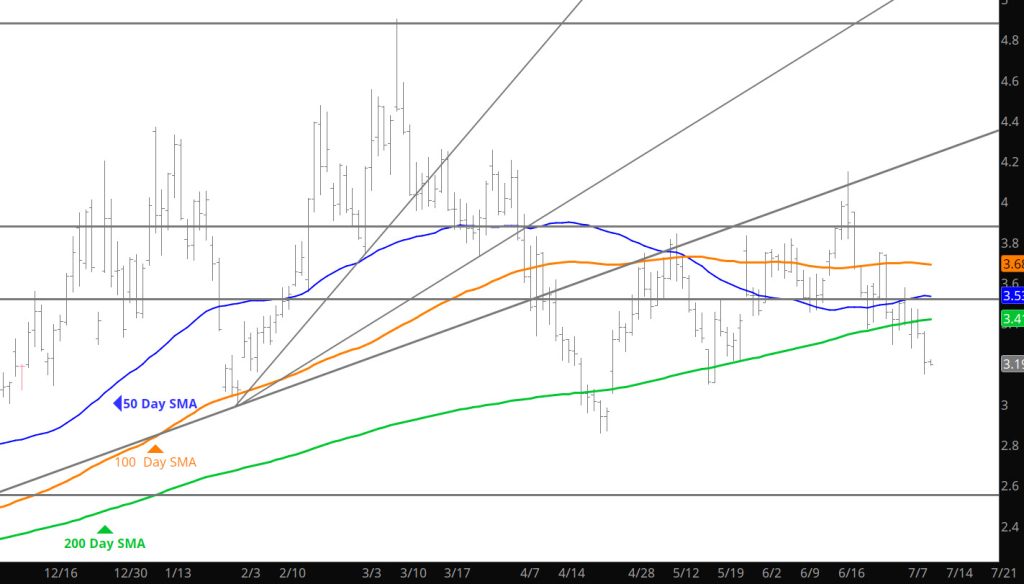

Daily Continuous

Didn’t post last Friday as the market is just continuing the range aspect of trade (please see the Weekly section for more information). My comments may have additional breaks in publishing if the prices remain within the tight ranges.

Major Support: $3.25-$3.16, $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.62, $3.46, $3.30-$3.26

Major Resistance:$4.168, $4.461, $4.501

Testing Continues

Still Searching

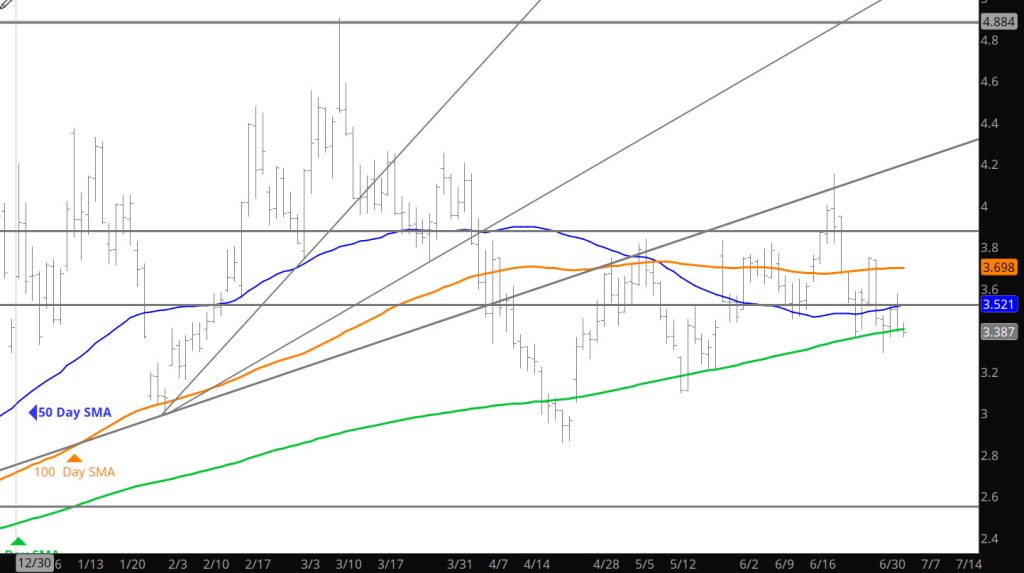

Daily Continuous

As mentioned yesterday — prices are seeking to define the low end of the range which may hold the August contract as prompt. Be patient during this lull in trading.

Major Support: $3.25-$3.16, $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.62, $3.46, $3.30-$3.26

Major Resistance:$4.168, $4.461, $4.501

Defining Low End of August Range

Daily Continuation

Declines tested support before finding a bid. These range tests may continue this week and from a technical standpoint, it will be interesting to see how far they go.

Major Support: $3.25-$3.16, $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.62, $3.46, $3.30-$3.26

Major Resistance:$4.168, $4.461, $4.501

Seasonal Declines Per History

Everything on Historical Plan

Declines Challenge Initial Support

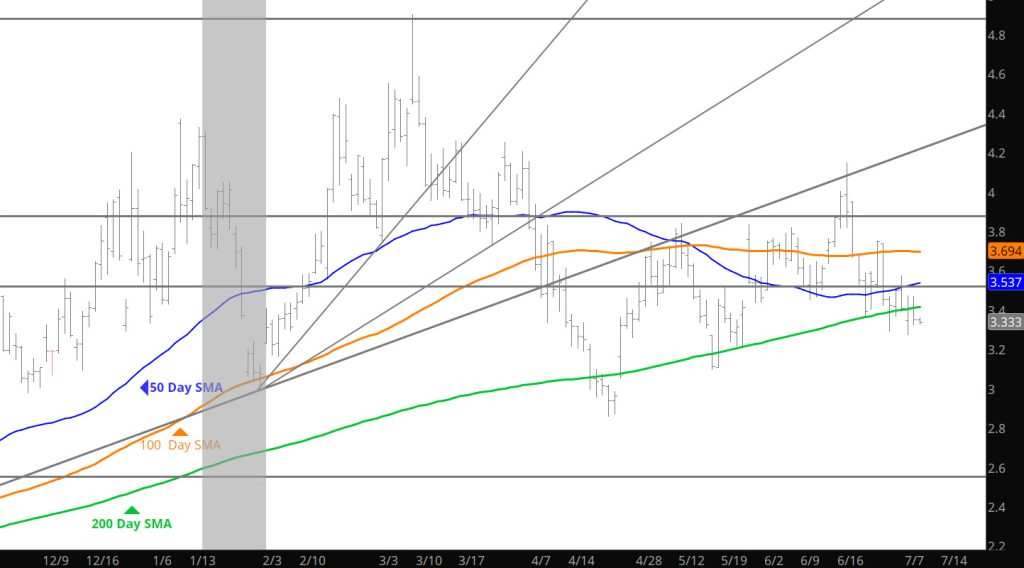

Daily Continuous

Declines took price to the high side of the support range ($3.25 topside), failed and then rallied slightly. Trade seems light going into the Holiday so look for anomalies that the thin trade may provide. Doubt the trade will provide any kind of major move but the slow declines may provide opportunities for selling some premium.

Major Support: $3.25-$3.16, $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.62, $3.46, $3.30-$3.26

Major Resistance:$4.168, $4.461, $4.501

Strong Close May Suggest Early Strength

Daily Continuous

The strong close to last week may be suggesting early strength today but the Sunday night market is showing weakness. Discuss the seasonal patterns and historical averages (declines) around the Independence Day in the Weekly section — give it a read. Will be in and out of access this holiday week– but I should be scheduling the Daily tomorrow and Wednesday. Should the declines initiated on Sunday hold — the market will likely be establishing the initial low end of the range for August contract.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :$3.62, $3.46, $3.30-$3.26

Major Resistance:$4.168, $4.461, $4.501