Author: Willis Bennett

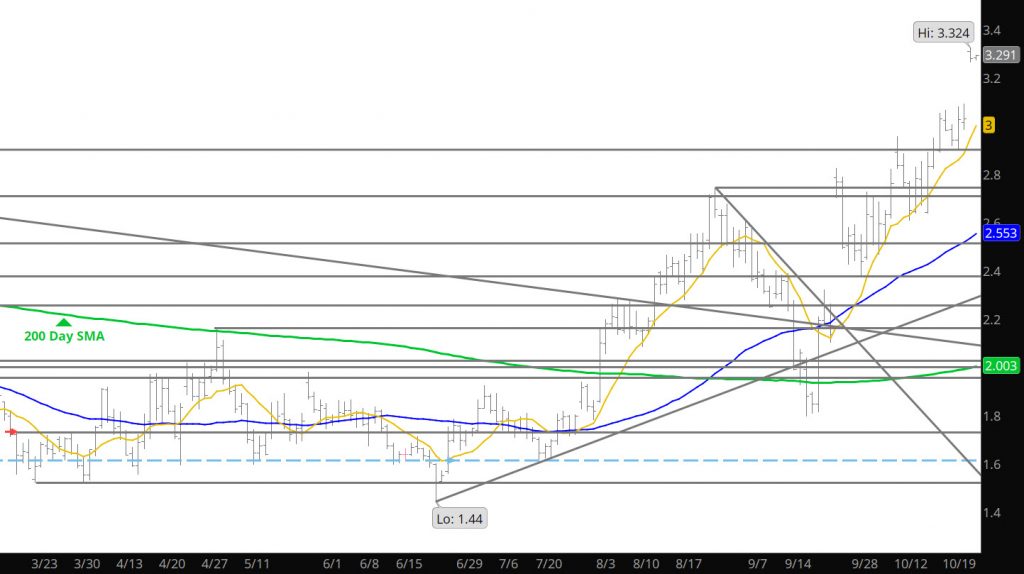

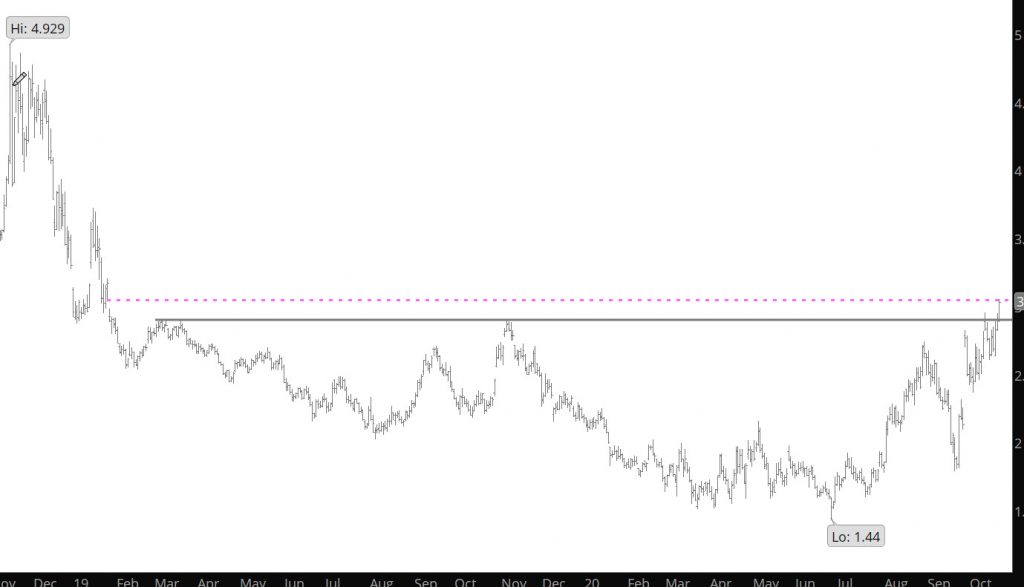

Again, Failure at Resistance

Third Time Not the Charm

Another Attempt

A Reversal Towards the End of the Week

Expectations Being Met

Now What Happens

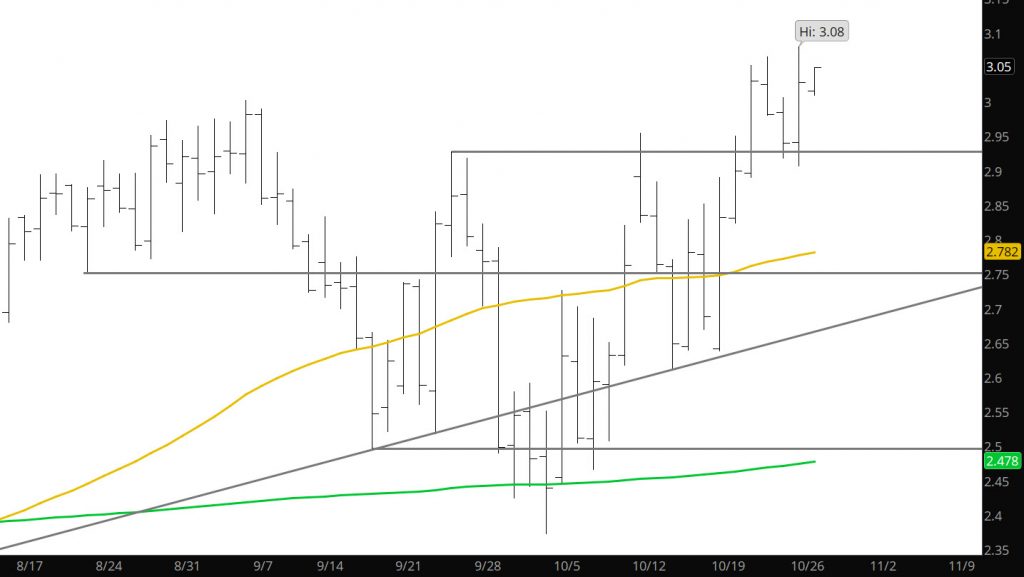

Gap in Daily Closes – Meaning

Gap is Closed in Early Trade – Not Confirmed at Close

Prices Remain Firm

First off, I want to thank those that responded to my email yesterday. I know you are all busy but I wanted to get a sense of the technical knowledge of how important the gap, discussed yesterday, is to the NYMEX price for the next few weeks. Due to the responses, I will go into it’s importance in more detail on the weekend with the Weekly report. Until then, that gap remains significant resistance. Noticed that the gains were not met by the differed contracts as Dec came close to a new high, but fell short, while the spread between the prompt contract and differed narrowed. Trade the range but keep the stops close on selling this rally. Not sure if this rally has enough support to close the gap, but the varied participants participating in this commodity trade, give me pause.

Major Support: $2.476-$2.446, $2.392,$2.258-$2.253, $2.219

Minor Support:$2.79, $2.618, $2.508, $2.339

Major Resistance: $2.908-$2.928,$2.973-$3.00, $3.047