Author: Willis Bennett

Chop In the 60’s

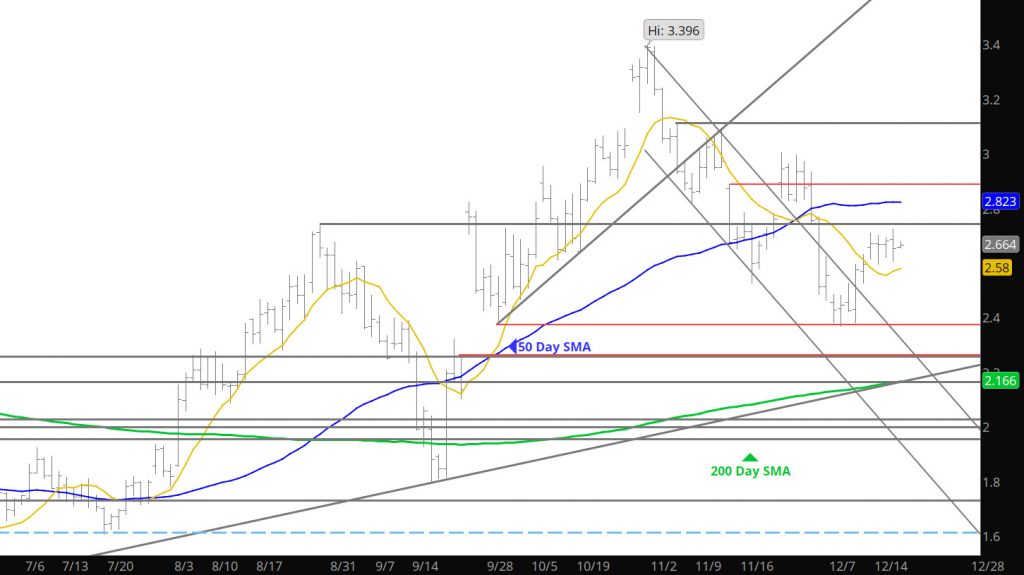

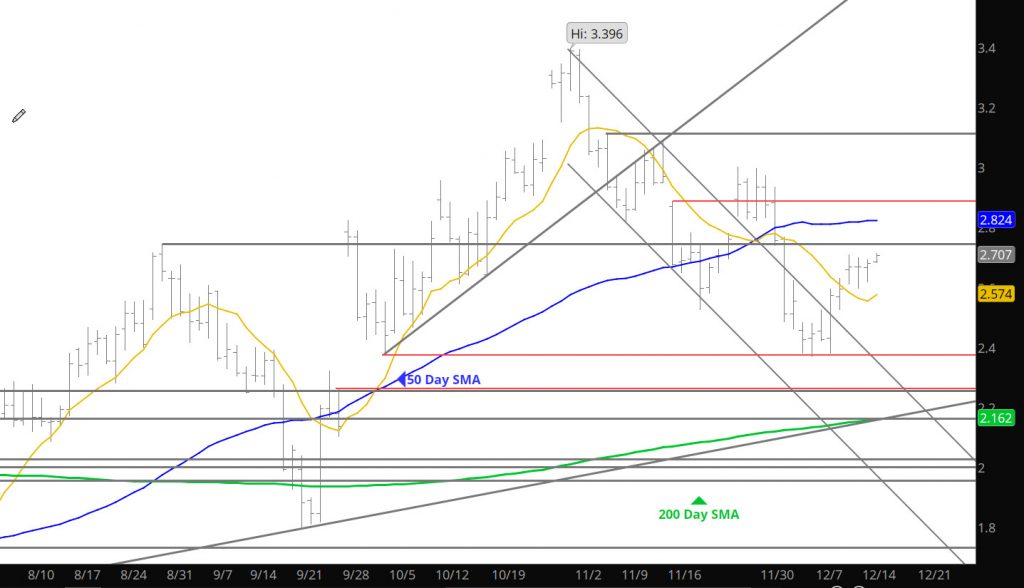

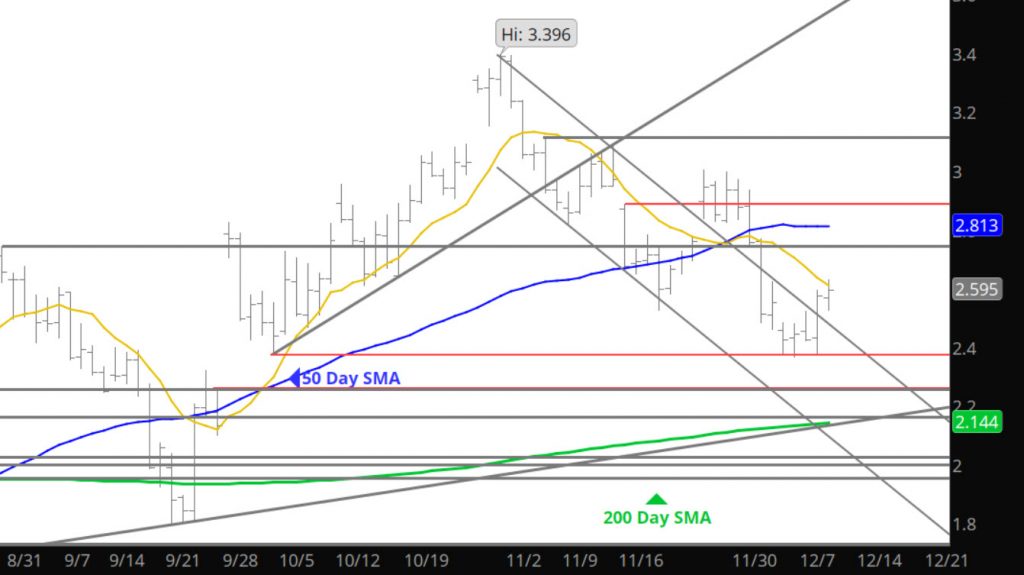

Not much to say except that prices are chopping around between $2.60 and $2.70. Is this a consolidation pattern that will lead to a break out or break down? You tell me! Last week had big volume on the declines and rebound with open interest loosing ground– I am as confused as the market is. Two weeks ago I wrote about all the comments I hear about the winter being “over” and the seasonal high is in– OK — why is it so stubborn to give up the ghost and land below $2.50? If you are long keep the stops in place (the 20 Week or last weeks close) if you are short your key is this week’s high.

Support: $2.425,$2.373, $2.255-$2.176

Minor Support: $2.596, $2.162

Major Resistance: $$2.74-$2.789, $2.98-$3.05,

Minor Resistance: $2.649, $2.798

Small Breakout Above Initial Resistance

Range Looking for the Next Bias

Gains on the Open

Support Challenged — Declines Failed

Weekly Closes Firm

Slight Break Above Resistance

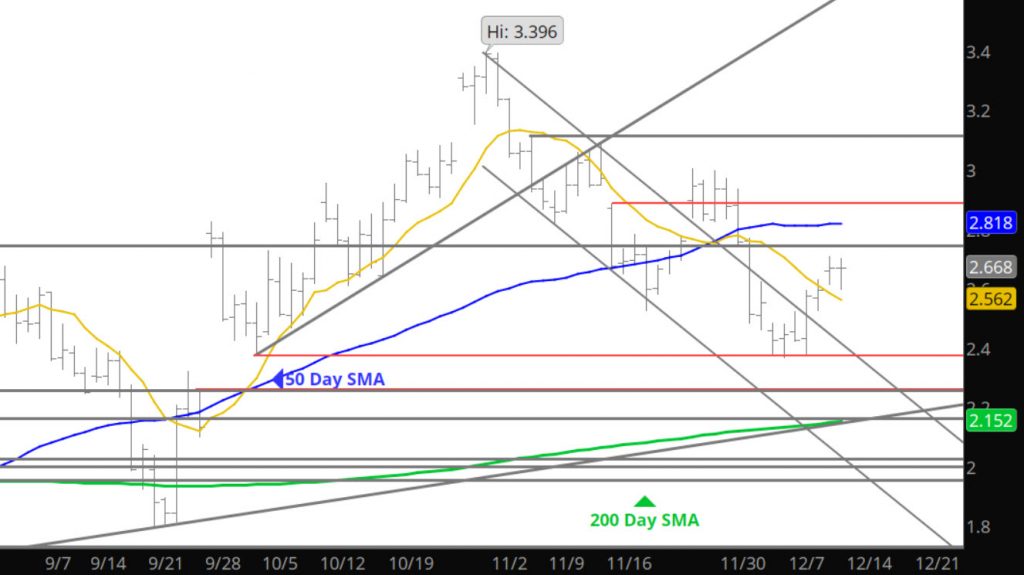

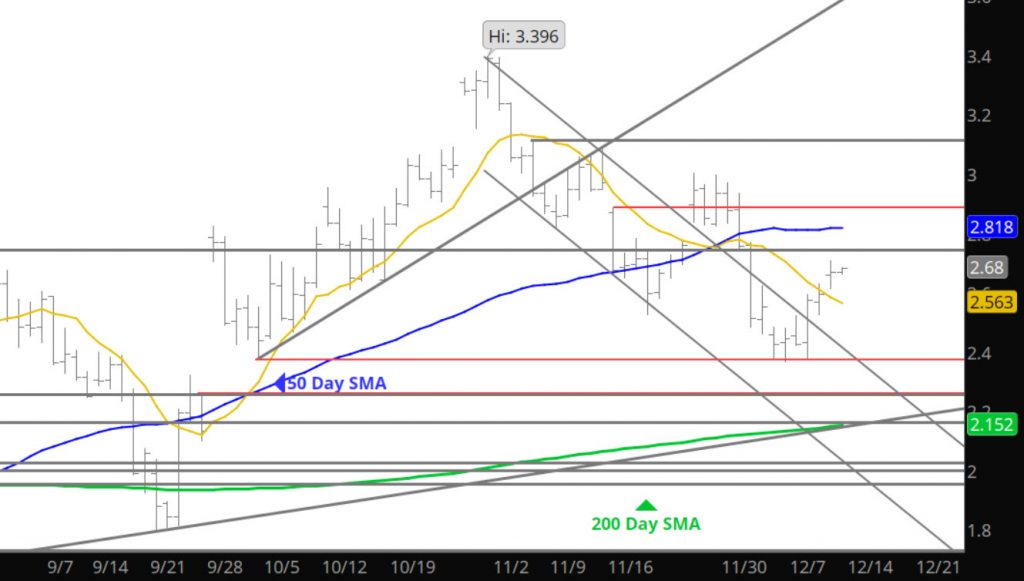

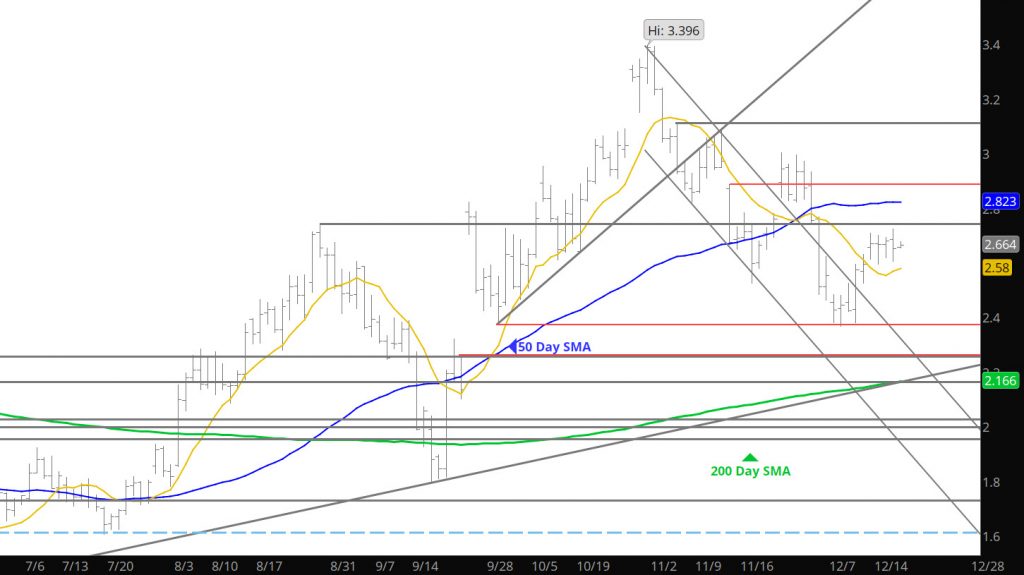

The storage report came in above expectations (I guess) as prices took off after the publication. From my perspective the counter rally was to be expected at some point as prices have had quite a negative correction of late. While yesterday’s action contained some short covering based upon the storage data– now the question is how much more short covering will occur if prices continue to rally. On the downside the $2.38 area has proven itself quite powerful.

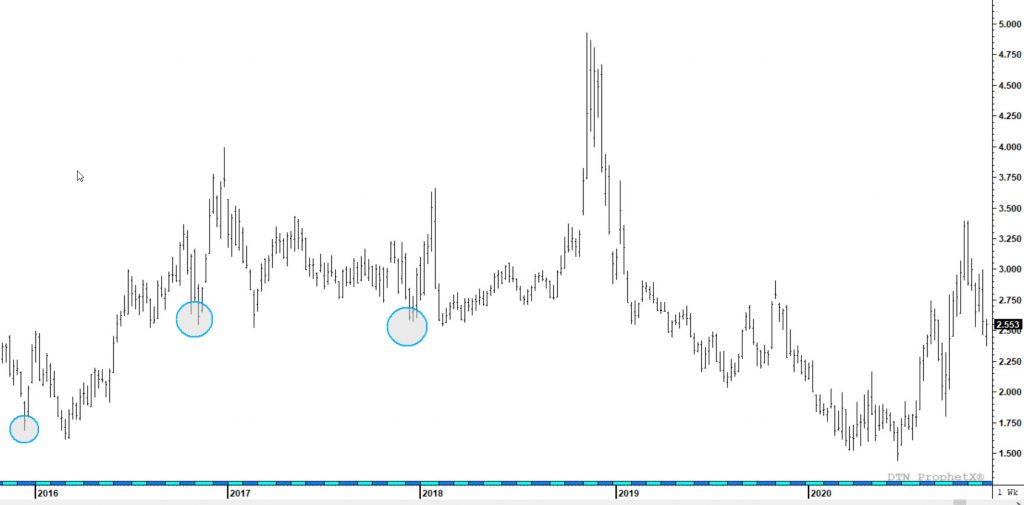

Finished the analysis on the winter price history over the last 5 years on the long term section.

Support: $2.425,$2.373, $2.255-$2.176

Minor Support: $2.162

Major Resistance: $$2.74-$2.789, $2.98-$3.05,

Minor Resistance: $2.55, $2.649, $2.798