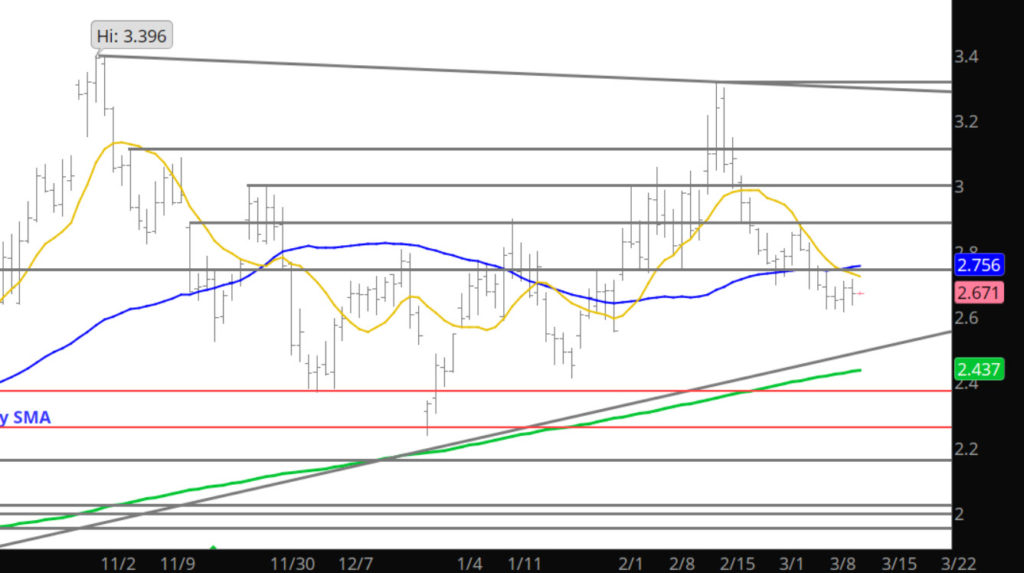

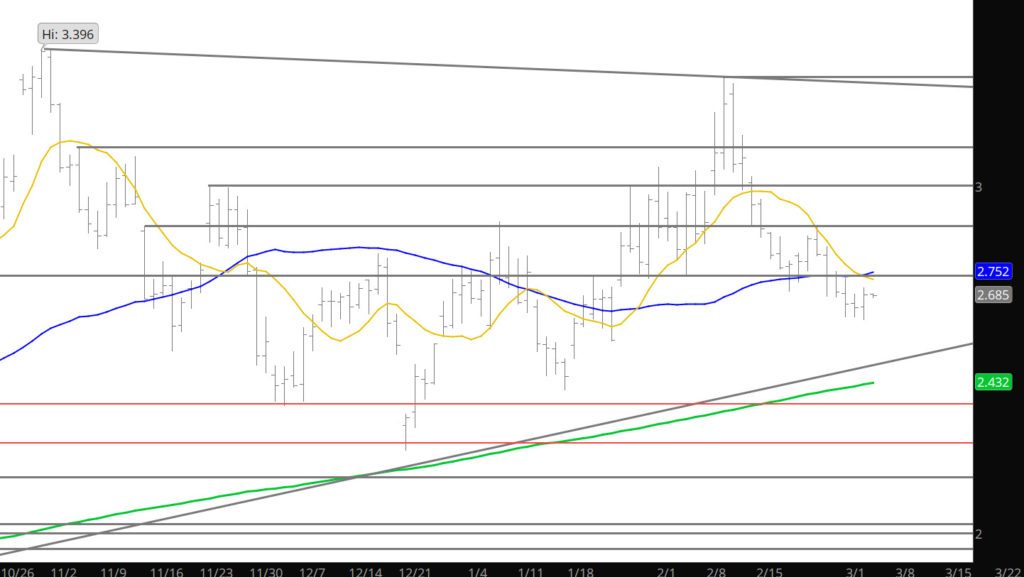

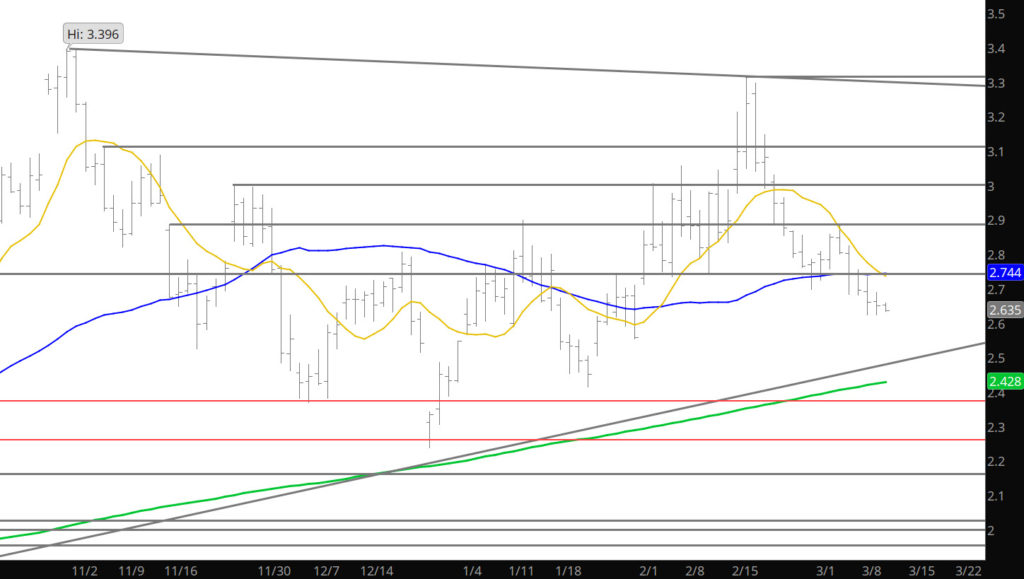

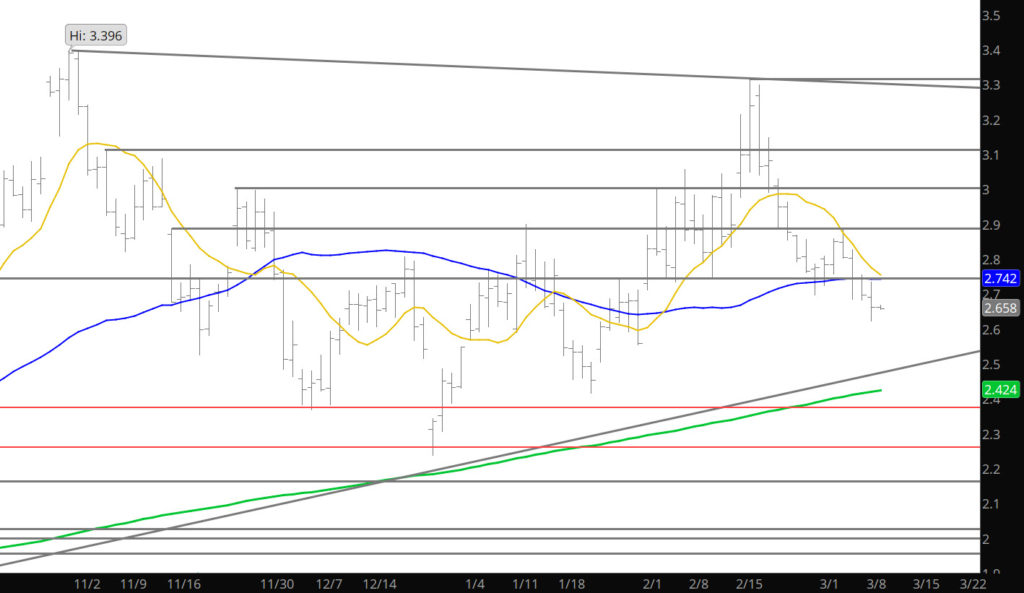

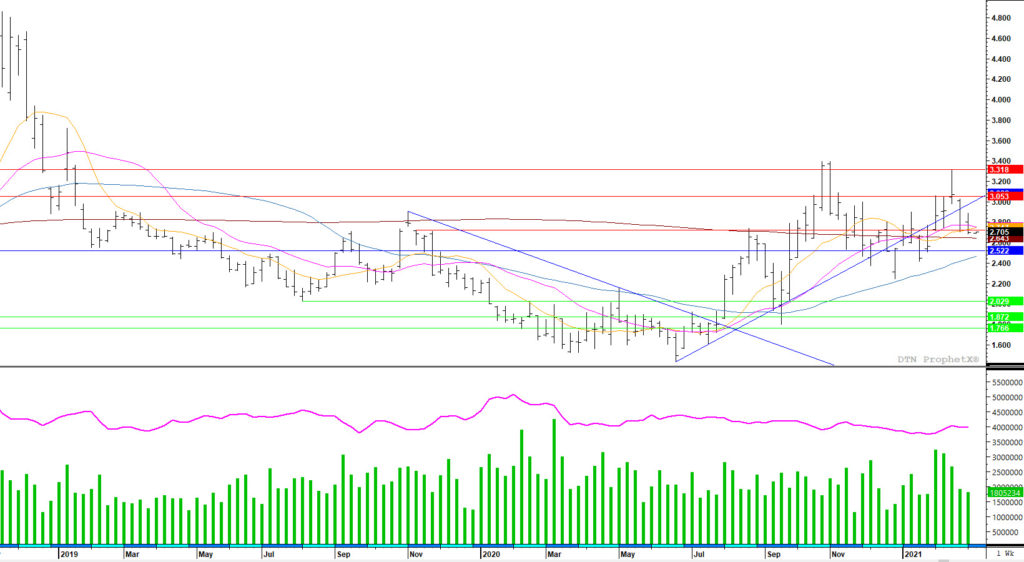

Well yesterday proved inconclusive to direction but today is a storage release may give the market the volatility to break out or extend the breakdown. If the gap ($2.566-$2.584) closes, from the first of the week, and prices get into the $2.60’s there are not a lot of resistance areas for a dime higher. To the downside there are areas of support around $2.44 down to $2.37.

Support: $2.422-$2.414, $2.373–$2.356,$2.255-$2.176

Minor Support: $2.483, $2.162

Major Resistance: $2.74-$2.789, $2.89, $2.98-$3.05,

Minor Resistance:$2.806