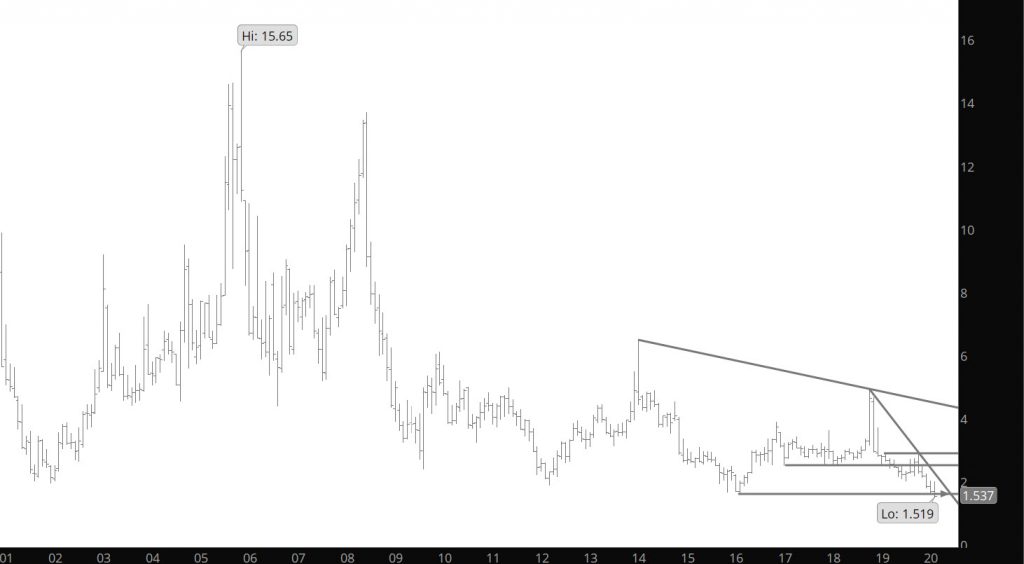

Category: Weekly Detail

Higher Lows — Constructive

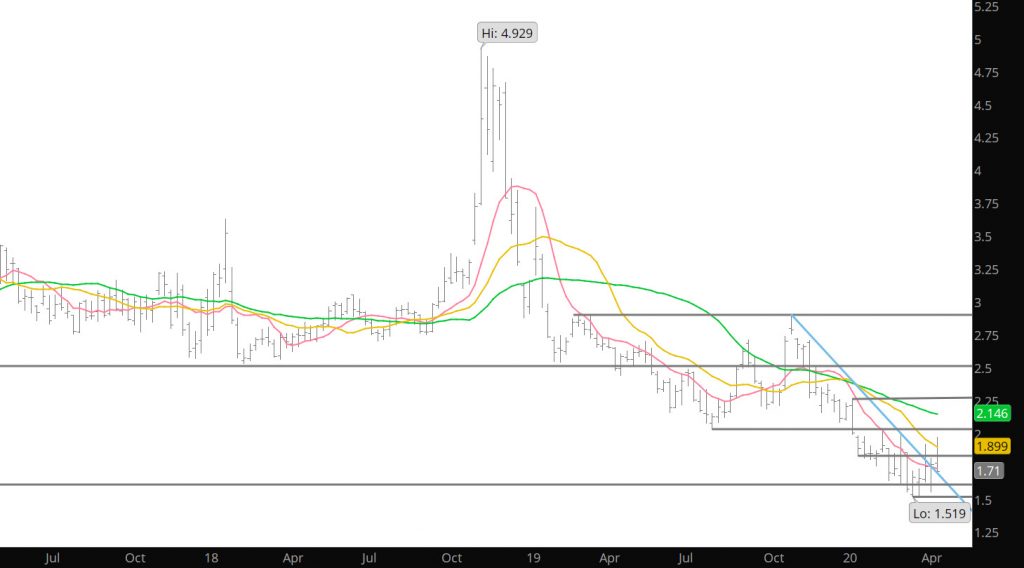

Last week continued the process of developing a consolidation process that will either lead the market to a break out (above the $2.029) area or a failure and a break below the key support area that has held prices for two months and four tests. An interesting note on trading, for the last three months, failure at the key resistance ($2.029) or near it resulted in an immediate test of support (within two weeks) as traders were content in working the range. Last week, prices could only manage a slight decline to $1.59 in the light trade around May expiration, before making another run at resistance. This action has now set the constructive behavior of higher weekly lows and another higher weekly close. Some of this behavior is clearly linked to the $.10 premium that June was awarded on expiration.

It you are bullish one of the concerns for you to overcome is the lack of volume last week. Markets successful in making a bias change usually occur with a volume break out in the direction of the upcoming bias shift. The continued strength in the differed contracts offsets this concerning issue and suggests the bullish argument more of “when” rather than “if”.

Calendar April ended as an “inside month” which is the first time that the trade range in April has remained inside he extremes provided during March since 1996. The high for the week was early on Friday morning, May 1st. Technical theory has suggests that and “inside” trade with falling volume (discussed above) and closing the month near the highs of previous period ($.03 shy of March high) is constructive for the intermediate term. Think of it as the sponsorship need to drive prices though the previous month’s extreme was lacking but closing near the highs — the balance of power was shifting.

Major Support: $1.611, $1.555-$1.519

Minor Support: $1.794, $1.78-$1.765

Major Resistance: $1.993-$2.025, $2.062,$2.08-$2.102

Minor Resistance: $1.968

Going Forward

A series of close weekly closing prices have occurred during the May contract as prompt. Closing prices have been within a range of $.02 over the last three weeks ($1.733, $1.753 and $1.746). The two previous weeks were at $1.634 and $1.621. This type of price behavior usually precedes a significant price move as it has a tendency to bring attention to traders (yes we look at these elements in trade). In natural gas the last time this type of tight weekly closings was in December when there were four weekly closings ($2.281-$2.334) before prices before prices broke down and added to the recent Q1 declines. The previous tight weekly closes occurred last summer when prices constructed a tight weekly range between $2.119 and $2.169 over three weeks (July and August). This set up the rally to the September high ($2.71) and the eventual Q4 high of $2.905. I will be getting into the expectations of the June contract, as prompt, during this week with the final outlook next Sunday.

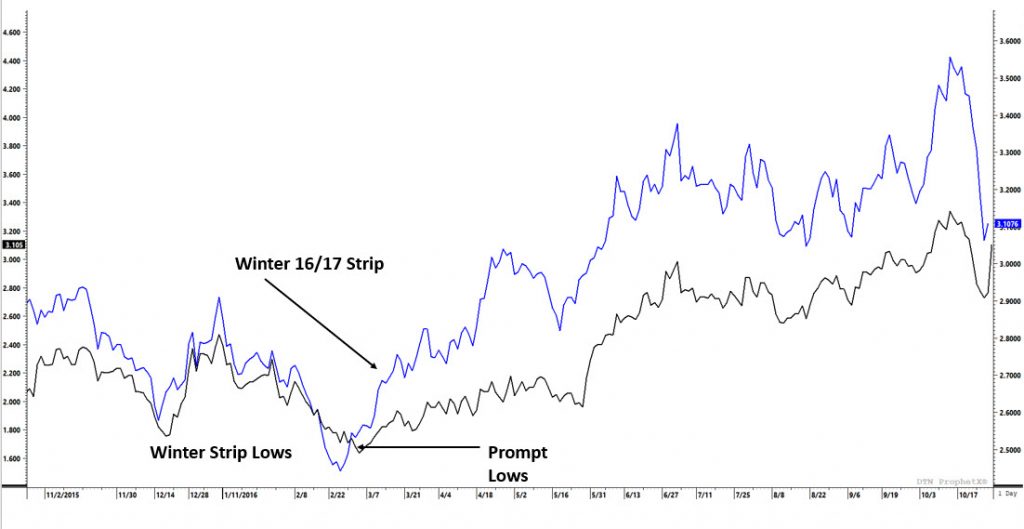

Comparing to 2016 (part 2)

I wanted to bring to your attention the similarities to trade back in 2016 (last long term low) and this year. The two charts are clearly not identical, but often with natural gas, the trade action rhymes over time. In 2016 the market was coming off of a warm summer and the expectation of production overwhelming demand was evident in the price action. Do not want to go into the weeds about fundamental issues, I am more interested in highlighting the technical side of the trade and how history may be rhyming. In 2016 the low of the winter strip for winter 2016/17 traded in late February early March. Once that low had traded prices rallied from $2.45 and established an interim high of $3.04 in early May. This represents a 24% run in just 8 weeks. After a brief consolidation, prices extended the gains into Q2 (historically bullish period) and set the Q2 high for the winter strip at $3.37 in July (37.5% gain).

While the winter strip was behaving with this type of rally the prompt rallies into the summer were much stronger as prices ran from the lows of $1.61 to $2.17 (35% gain) in early May and then continued on to the Q2 high of $2.99 (86% gain) by July.

Look at the current chart comparing the winter 2020/21 to prompt. It looks like the lows were established last month at $2.35 and have been on a solid run since (similar to 2016). The winter now trades at $2.76 (a 17% gain) and should the trade equal the rally in 2016 it would take prices to $3.23 for the strip. While the prompt has not confirmed a low, there are indications that the selling is loosing steam (discussed here last week).

While no year copies a previous years price behavior, the similarities between this spring and 2016 are eye opening. 1) similar fundamental conditions, 2) similar price levels (lows at $1.61 in 2016 and $1.51 in 2020), 3) similar prices in the winter strips ($2.35 this year versus $2.45 in 2016), 4) winter 20/21 strip has started its run. I bring this information on history to your attention and hope it was insightful for your trading strategy.

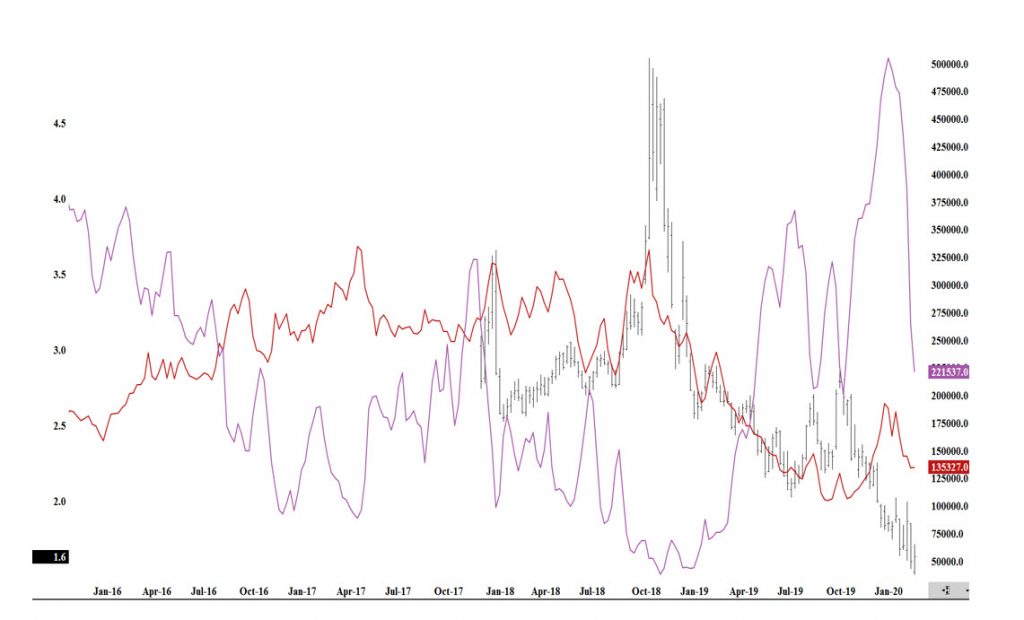

Market Lacks Bias Definition

While managing to gain and close higher than the previous week’s high, there are considerable divergences showing up. Recently trade has had increased volume on up days and reduced volume on down days. While not getting the CFTC data on Friday, total open interest has declined significantly (over 320,000 contracts) since early February, with a large portion of those declines coming from the speculative Managed Money short position (discussed on this website several time last month). All of these events have occurred yet prompt prices have largely staying between $1.73 and $1.88. Lower lows since February have not been confirmed with RSI levels (weekly) creating yet another potential divergence.

All of this seems to be confirming that the market is in a consolidation phase for the summer contracts. The same cannot be said for the winter 20/21 strip. These contracts continue to show sufficient sponsorship (see Chart above) to close above the 200 day Moving Average for the last seven trade days. This behavior to me suggests the market is slowly coming to the realization that the prevailing downtrend bias that has gripped the front end of the curve may not be around much longer. Look at the premium that June and July carry to the May prompt ($.13 and $.20 respectively), it is also showing a divergence developing in the trade. The period around May expiration will give us a clue for prices near term- as any premium afforded to the next contract has been quickly eroded post expiration.

Major Support: $1.611, $1.555–$1.519, $1.481

Major Resistance:$1.883, $1.993, $2.029, $2.08-$2.10, $2.34, $2.437,

Minor Resistance: $1.767-$1.78, $1.833

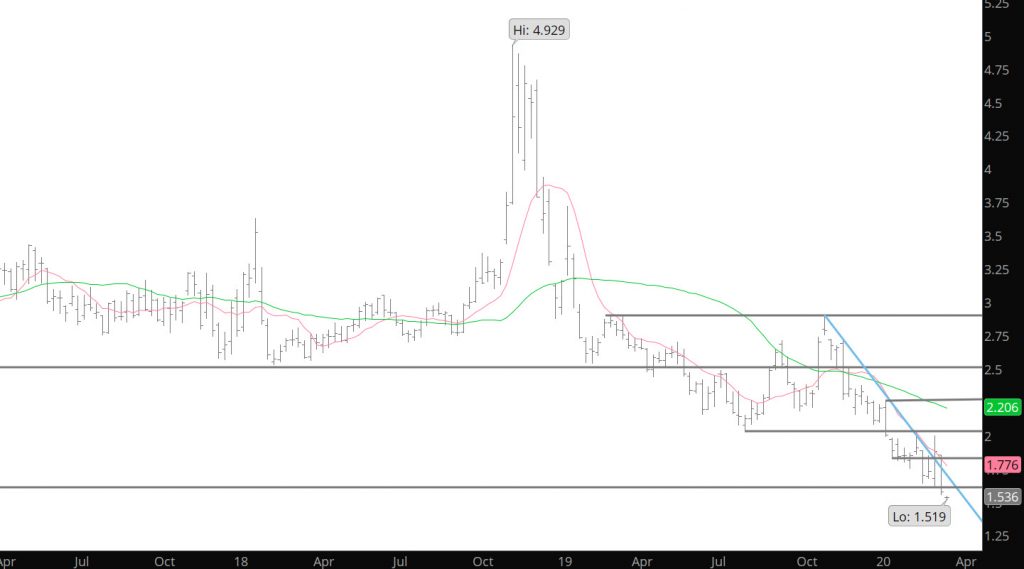

Subtle Expiration Near the Lows

The lower low last week ($1.519) on the open of the trade on Sunday night was quickly replaced by subtle strength. The impacts from the virus may have short term expectations of demand destruction ( though not being a fundamental trader- I don’t care) are now being offset with serious implications of production issues from the declining crude price. Looking at the chart above – some folks supported the April contract into expiration which is contrary to the fundamental trade. It is likely that prices will decline to close the small differential from last weeks contract expiration (the lowest since Sept ’95) and the close of the May contract- from there the market will be fun to watch. Also, watch the nominations and flow data early in the month as any hedges from the winter are gone and if folks hedged they may not choose to show up with their gas in this price environment. The three month range remains the trade game.

I remain on the sideline for the fundamental arguments of whether prices are headed up due to oil price issues impact and the virus blues. All I can see in the technical data is that the price continues to have problems at major support and the fact prices are trending into 25 year lows suggests to me that things will change. Unfortunately for nat gas traders, those changes can be violent. Longer term, the weakness in the summer strip was met with strength in the winter strip — while speculative shorts declined. The market may be sending a strong signal for the upcoming summer.

Major Support: $1.611, $1.555, $1.481

Major Resistance: $1.99, $2.029, $2.08-$2.10, $2.34, $2.437, $2.48-$2.52,

Minor Resistance: $1.883,

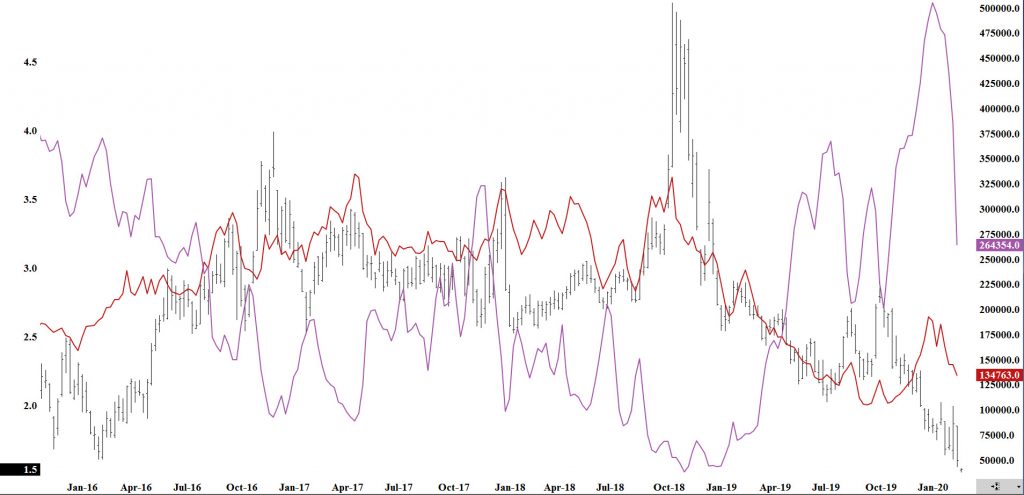

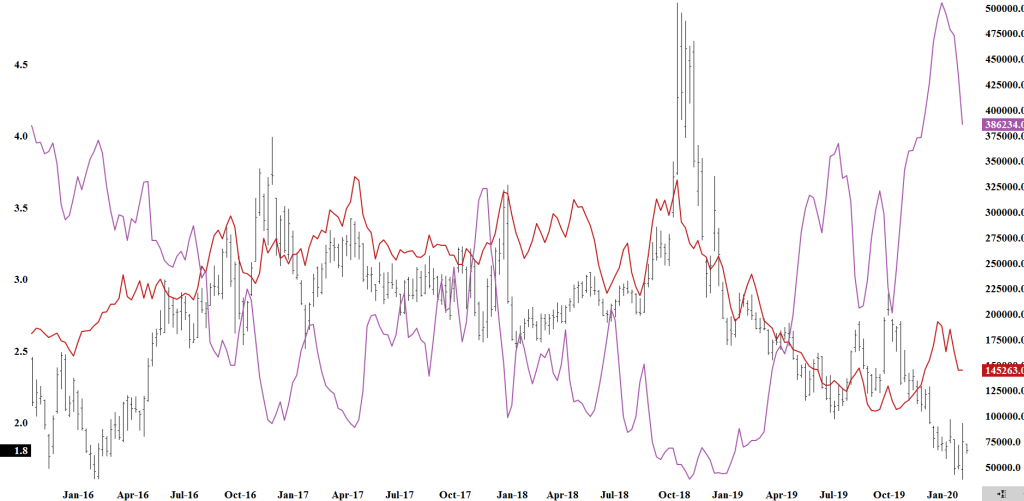

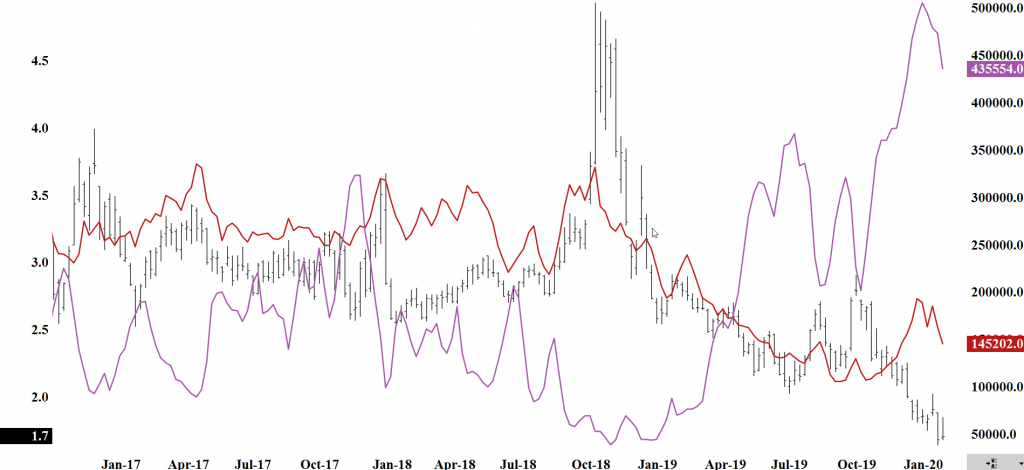

Commodity Futures Trading Commission

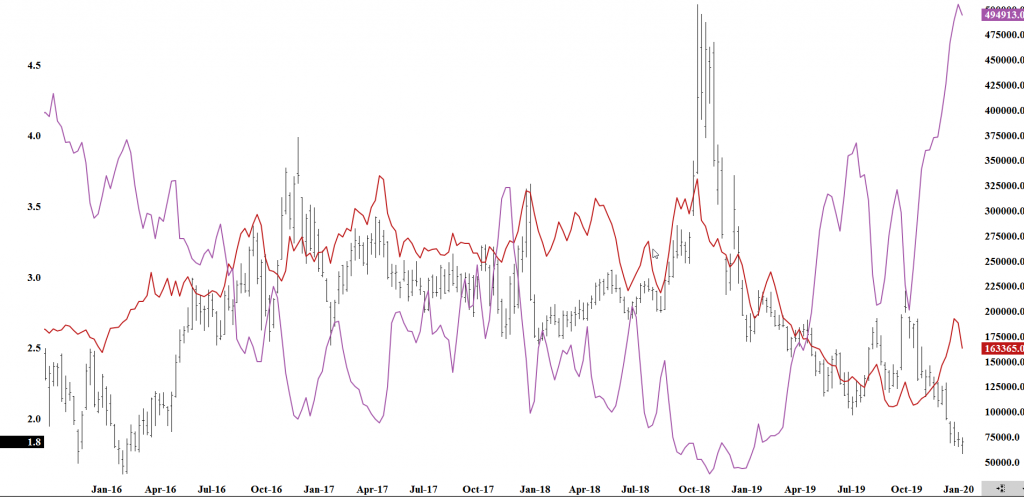

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

Additional short covering occurred last week but what was of interest to me, was the gains in the winter strip while the summer strip found just minimal support. The market is showing a slight change in long term bias with this action. Time will only tell, but it is beginning to look like the bears are becoming a little spooked and loosing impact.

New Multi Year Lows

The trade last week left serious implications for future prices as the close near or below the long held (10+ year lows) will have longer impacts both up and down. The weakness is related (so I hear) to the effects of the virus and with the additional declines in crude oil prices. That tells me that declines due to the illness, there is less gas is used to keep homeowners warm than buildings which, not occupied, still need heat (avoiding frozen pipes) and therefore demand goes down. Seriously, you fundamental guys are twisted. Not sure where this goes down to but it will continue until this irrational perspective is concluded.

All fundamental noise to me, as I look at the markets, is the interpretation of the virus and the oil war that has commenced. The price action does not blend with the potential of the producer cutting production in the upcoming weeks and the effects of the coming summer that will start occurring. Technically, there is no support down to lows from the mid to early 1990’s so good luck picking those bottoms.

Major Support: $1.611, $1.555

Major Resistance: $1.99, $2.029, $2.08-$2.10, $2.34, $2.437, $2.48-$2.52,

Minor Resistance: $1.883,

Commodity Futures Trading Commission

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

A serious reduction of the short position from the speculative crowd occurred from March 10th to the 17th and is reflective of the chart above. It should not be construed as the potential for a short covering rally being abated but rather the short speculative sector is reaching the conclusion that significant additional declines is now limited.

Prices Send a Signal

The two charts above are provided to show the damage to the bearish market last week. Natural gas has a history of announcing a change in directional trade with a weekly reversal, accompanied with large volume. That is what happened last week as prices traded a lower low than the previous week and tested the lows from previous years (mentioned in previous postings) at $1.61. From there prices reversed in a large way on Monday and Tuesday (importance of Monday and Tuesday below in CFTC analysis) and traded to a higher high than the previous week on extraordinary volume. Prices closed the week at a higher close than the previous week which confirms a bullish outside week reversal. This is teh second strong signal that prices are in the process of completing a bottom to the trade and long term technical support.

Major Support: $1.611

Major Resistance: $1.99, $2.029, $2.08-$2.10, $2.34, $2.437, $2.48-$2.52,

Minor Resistance: $1.883,

As explained last week –Prices have retraced precisely to support in the Monthly chart above. The average gain from Q1 lows to Q2 highs is nearly 40% over the last ten years. Last year’s run was well below the average, with just a paltry 8% gain. These 2nd quarter gains in price have occurred in various stages of fundamental supply and demand imbalance levels – highlighting the supply situation of this winter may provide a muted impact this year, though the short interest by the speculators may keep this year’s rally well within the historical averages. The potential break-out areas for any rally will be the area of failure last months and the lows from August ’19 which held support from August to January. The lows tested last week at many annual lows seems to confirm long term support.

Commodity Futures Trading Commission

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

The chart above indicates the historical extreme short position and some of the short covering that has commenced and actions last week confirmed the volatility the short covering will provide. Mentioned above that after prices sold down to $1.61 they rebounded and rallied for the next two days. That rally reduced the speculative short position, nearly 50,000 contracts according to the CFTC report released last Friday showing positions as of Tuesday the 10th. That short covering took volume over 878,000 contracts on Monday and and additional 1,039,000 contracts on Tuesday as prices rallied up to $1.95. This represents a somewhat muted short covering rally as discussed in previous weeks– but make no mistake the karma of this market is changing and it only a matter of time until the bias cracks.

Prices Continue Range – Now Testing Support

The market remains with a bearish bias. After failing two weeks ago at resistance at $2.029, price have drifted lower as both the speculative long and short traders have been reducing positions (see CFTC data below). Have discussed the history of Nat Gas trading to a low in Q1 of the year and in four of the last ten years the low has occurred in April (slightly beyond the calendar quarter). Currently, support is holding between $1.61 and $1.76 which represents the lows from ’96, ’97, ’98, ’99, ’01, ’15 and ’16. Needless to say, this is a very strong level of support.

Prices have retraced to support in the Monthly chart above. As discussed in the Weekly above, how long this support holds (and from where) is the key for the upcoming annual second quarter run for prices. The average gain from Q1 lows to Q2 highs is nearly 40% over the last ten years. Last year’s run was well below the average, with just a paltry 8% gain. These 2nd quarter gains in price have occurred in various stages of fundamental supply and demand imbalance levels – highlighting the supply situation of this winter may provide a muted impact this year, though the short interest by the speculators may keep this year’s rally well within the historical averages. The potential break-out areas for any rally will be the area of failure last months and the lows from August ’19 which held support from August to January. Alternatively, per the Weekly above, declines will start to hit major support areas from many years.

Major Support: $1.753, $1.611

Minor Support: $1.705

Major Resistance: $1.983, $1.994, $2.029, $2.086

Minor Resistance: $2.124

Commodity Futures Trading Commission

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

The chart above indicates the historical extreme short position of the speculative component to trade. History warns the traders that such extremes will not last long, though don’t indicate an immediate reversal. Over the last two weeks the short position has been reduced and the effect of the short covering was offset by the Managed Money Long position selling into the short buying. As long as this behavior continues, the expected short covering rally may be more muted than expected. Currently, the market remains under a bearish bias meaning that the short covering rallies may continue to be slow and inconsistent.

Market Maybe Poised for a Reversal

Weekly Continuous

Taking a look at the longer term trends of the Natural Gas contract the market remains with a distinctive negative bias. This is consistent with market history as Nat Gas trades to weakness during Q1 of the calendar year. In the last 10 years, the market has traded to the low prior to the expiration of the Feb contract once. In four of the last ten the low was postponed until April (slightly beyond the end of the quarter). The other five traded to the low after the Feb contract expiration and in the last four years the low was establish between 02/15 and 03/04.

Not crazy

Monthly Continuous

Prices have started to gain limited support in the Monthly chart above. How long this support holds is the key for the upcoming annual second quarter run for prices. The average gain from Q1 lows to Q2 highs is nearly 40% over the last ten years. Last year’s run was well below the average, with just a paltry 8% gain. These gains in price have occurred in all stages of fundamental supply and demand imbalance levels – highlighting the supply situation of this winter may not have a muted impact this year. The key areas of resistance to the seasonal run will be the lows from August ’19 which held support from August to January when the support was broken. Should the run be delayed and weakness resumes – the lows from this month down to the multi-year low from March ’16.

Major Support: $1.753, $1.611

Minor Support: $1.705

Major Resistance: $1.983, $1.994, $2.029, $2.086

Minor Resistance: $2.124

Commodity Futures Trading Commission

Natural Gas Managed Money Long (red) vs Managed Money Short (purple) positions

The chart above indicates the historical extreme short position of the speculative component to trade. History warns the traders that such extremes will not last long, though don’t indicate an immediate reversal. This information should be put into the perspective of what is likely to happen at some point in time (short covering rally). How far that rally takes prices is subject to where it starts and under what circumstances. Currently, the market remains under a bearish bias meaning that the short covering rallies may be slow and inconsistent.