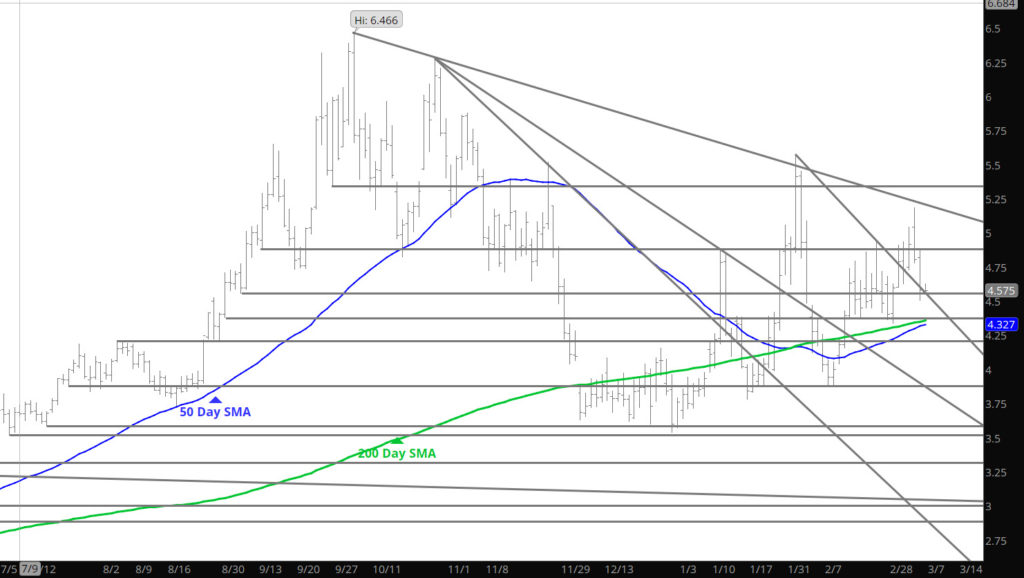

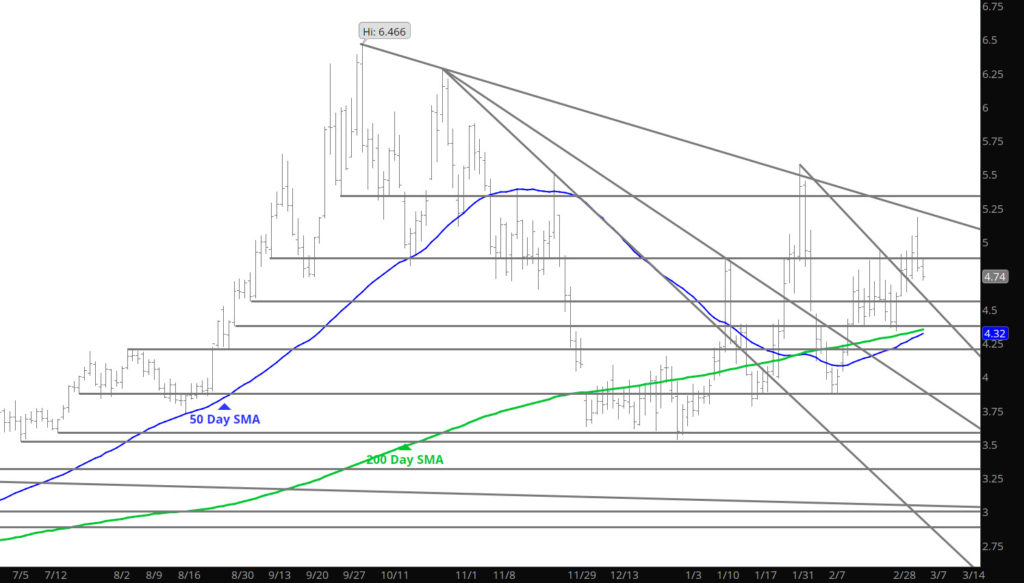

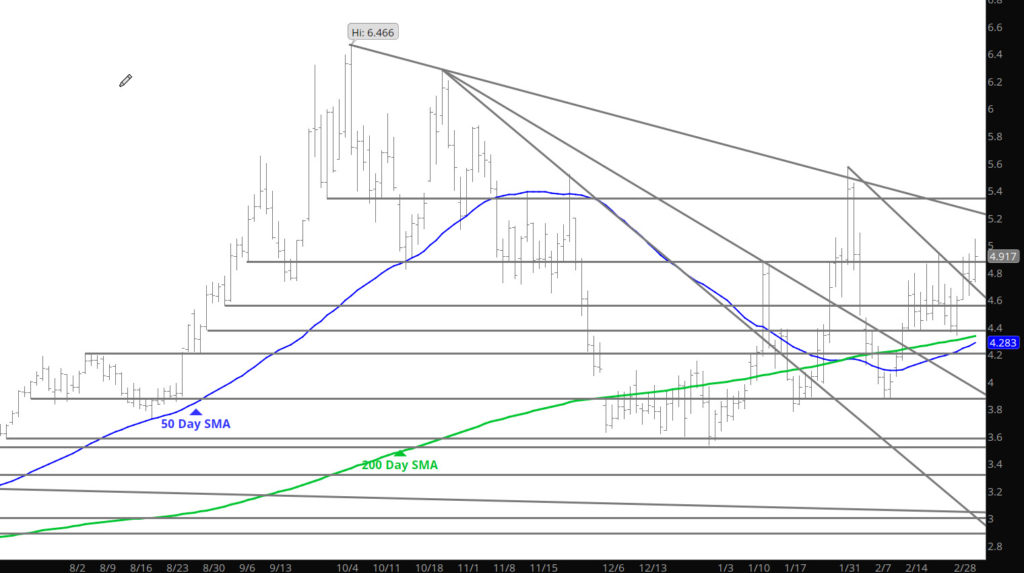

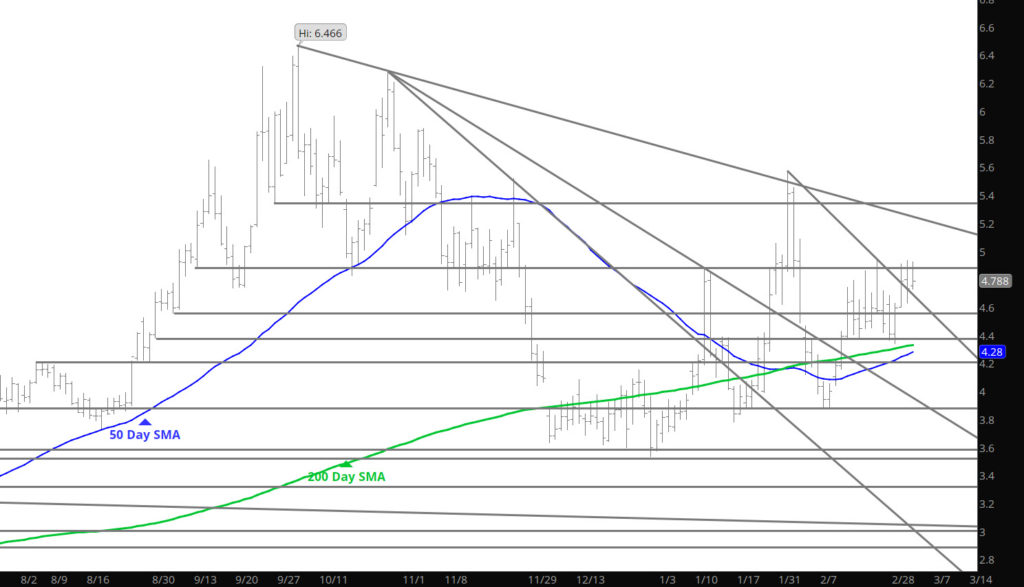

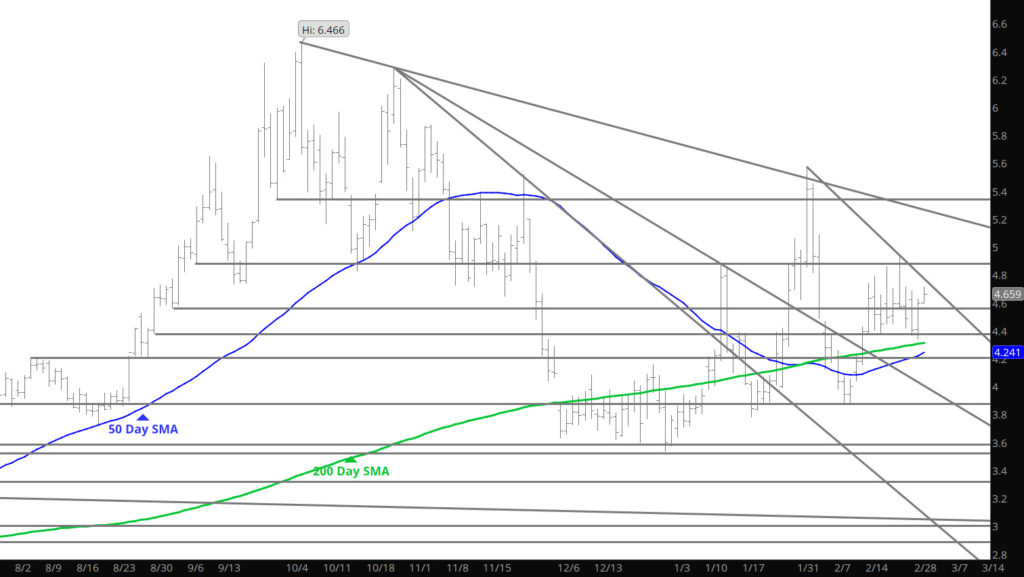

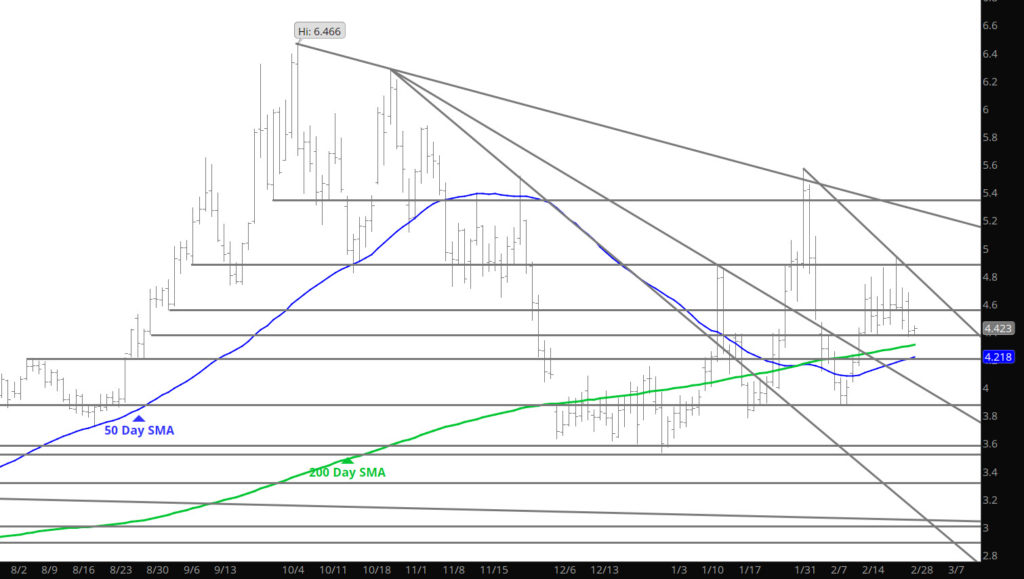

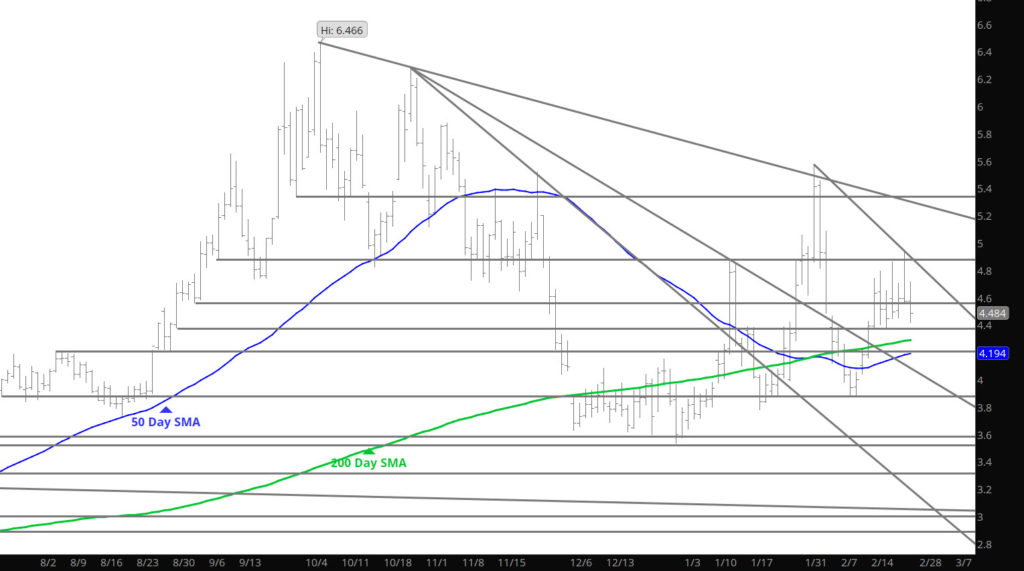

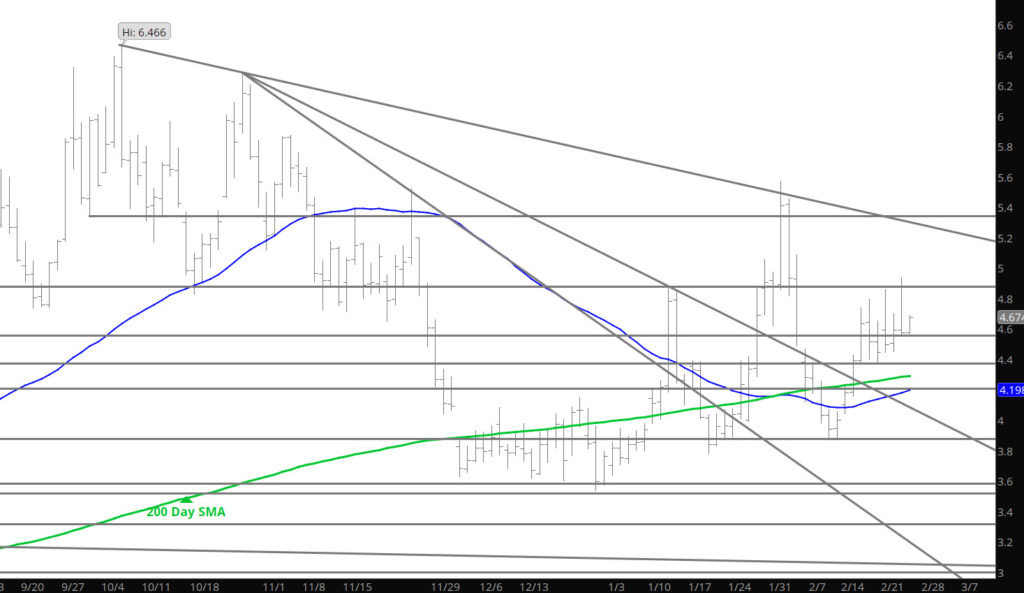

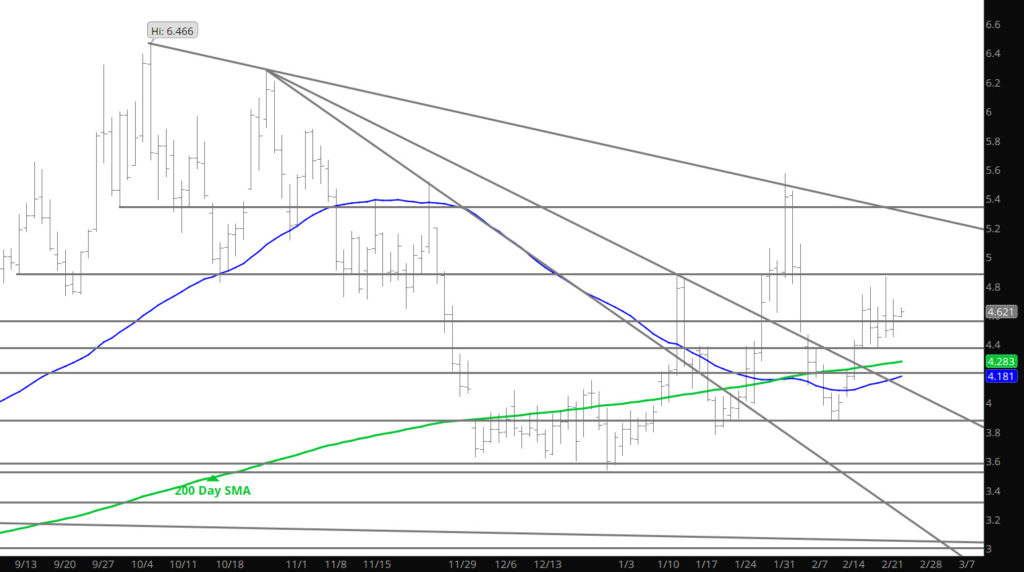

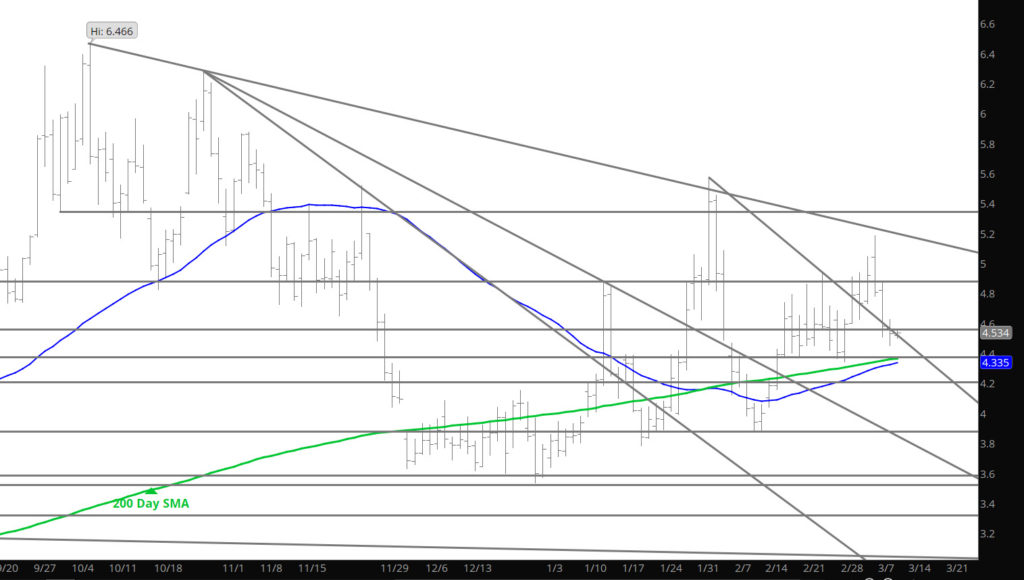

Price action slowed yesterday and while declines extended, the end of the trade day was met with more of a consolidation theme. Continue to expect a decline to test last week’s low at $4.34 (early morning light trade) but I am more interested in the $4.36-$4.40 area as that zone has held support and finding buyers for the last month.

Major Support:$4.38-$4.26, $4.187, $3.972, $3.734, $3.63, $3.584-$3.522

Minor Support: $4.60-$4.557

Major Resistance: $4.82-$4.88, $5.08