Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

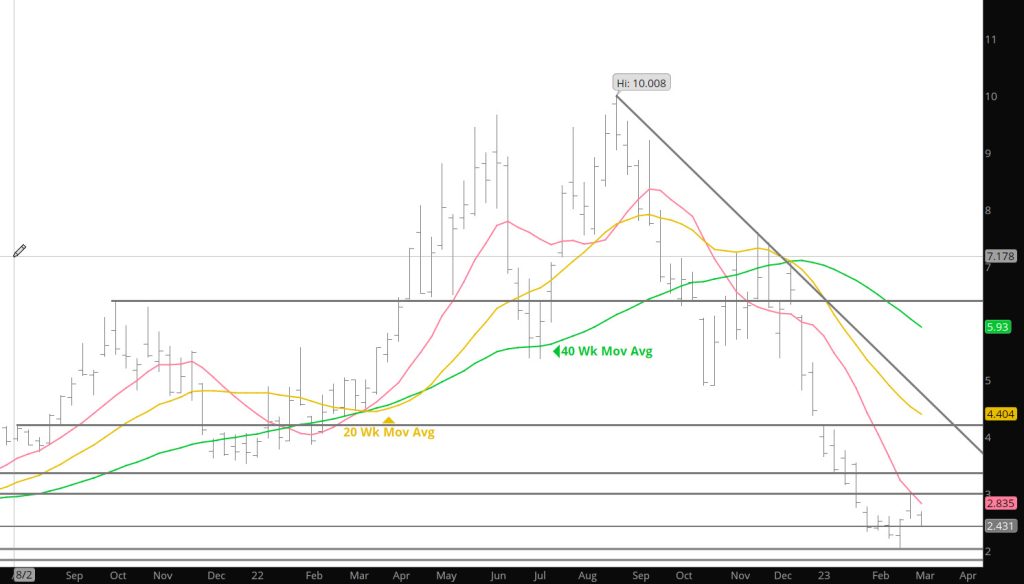

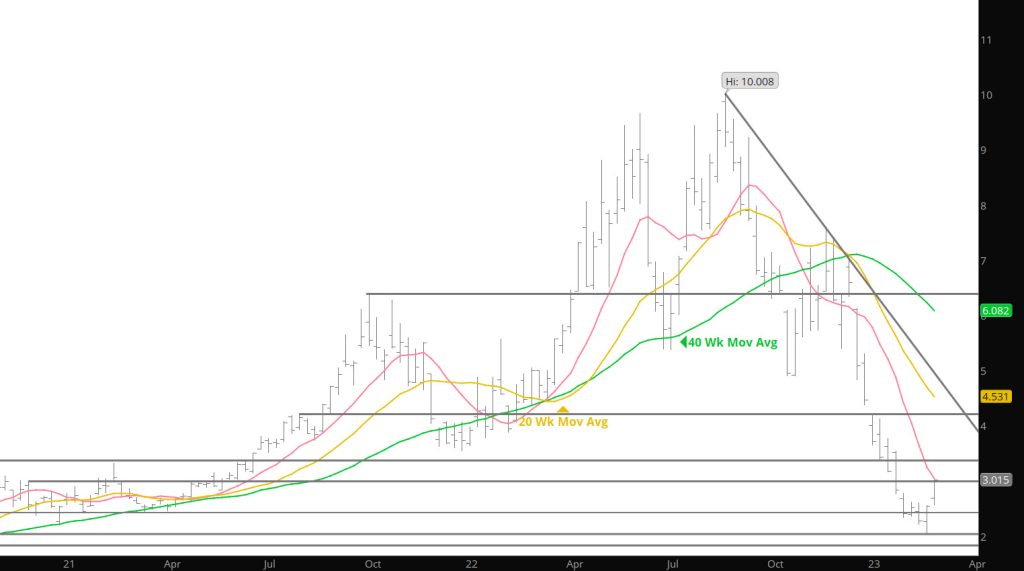

Rebound Off Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Test Strong Support Zones

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Seem to Test Key Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Testing Support Zones Hoped For

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quiet Day

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Natural Gas Wastes Little Time

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bullish Move But Caution

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bullish Weekly Close

Detail the bullish break that occurred last week in the Weekly section, but for the Daily I can only submit that the bullish close and the higher close and the technical damage would support higher prices this week but the initial phase Sunday night has prices lower by $.27– granted on thin trade. The market has declined from just below $2.00 and has rallied 50% in just over a week of trade (8 trading days)– so it is likely there will be an additional consolidation process coming this week. Look for a decline to the area that was resistance around $2.53.

Major Support: $2.00, $1.795-$1.766

Minor Support: $2.53, $2.41- $2.34

Major Resistance$2.836, $3.00, $3.536, 3.595

Price Consolidation ?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.