Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Reverse Off New July Low

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Market May Be Showing Signs of Bias Change

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Slight Declines Continue

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Run To May Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expect Some Further Weakness But???

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

June Expiration Follows History

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

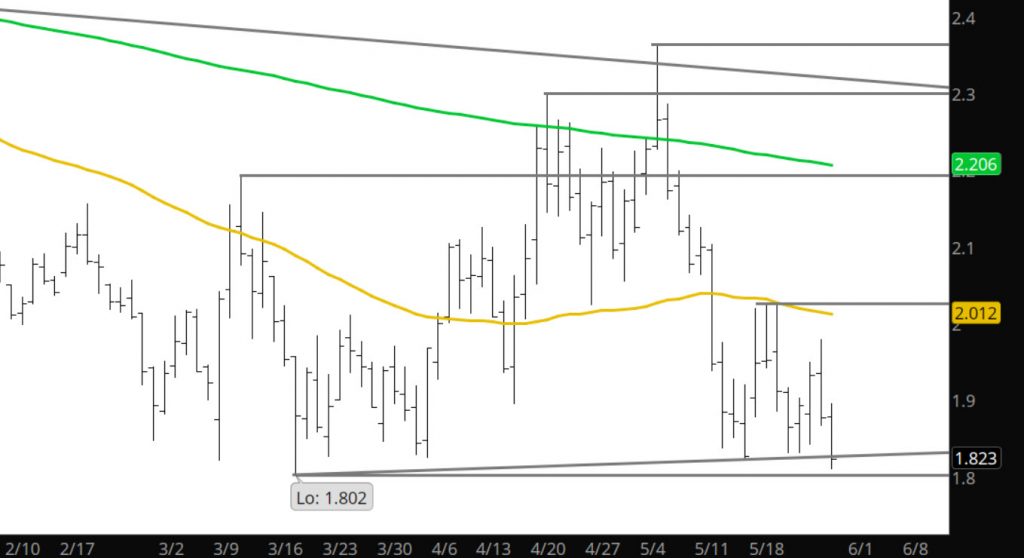

Memorial Day Weakness Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

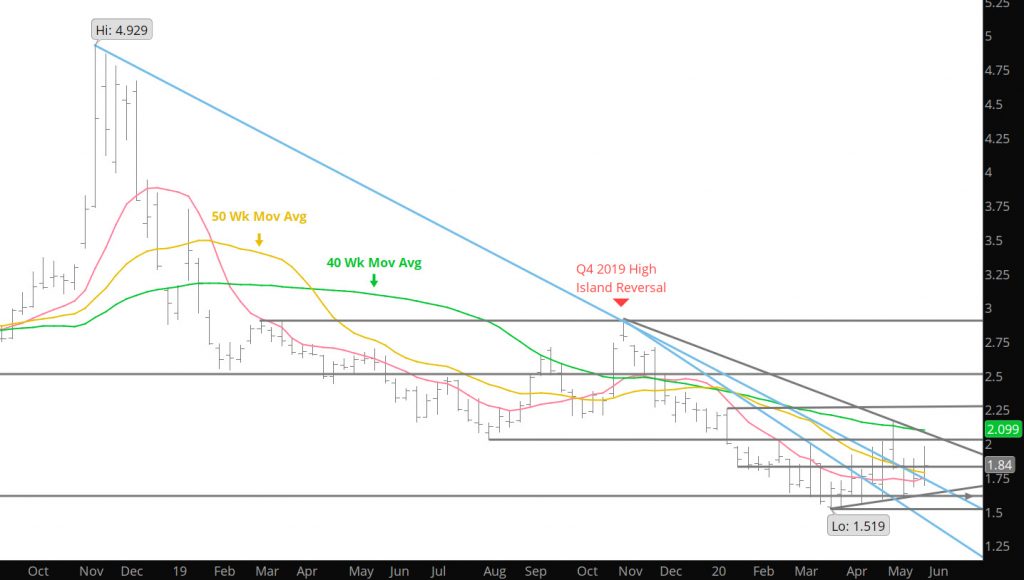

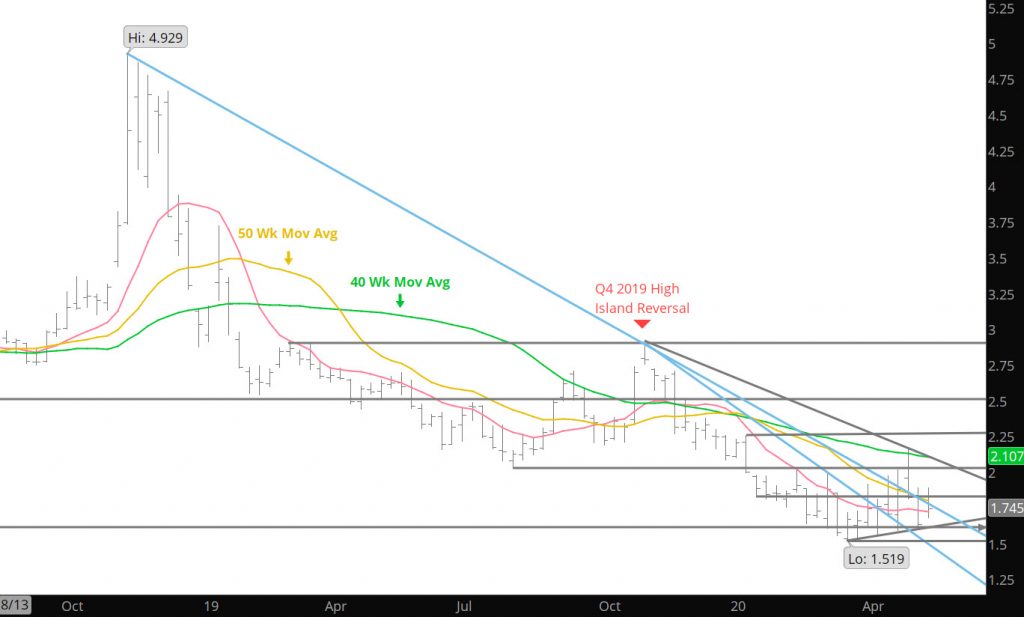

Weakness Into Bearish Report —- Again

Pardon my sarcasm but for the last few weeks the Wednesday trade has been weak on low volume to set up for the storage report (which I hear, is going to be bearish — again). The question remains, do folks sell into the report only to run out of sellers? From a technical trade perspective continue to trade the range and sell the rallies (prices in the high $1.80’s and above), OH and buy the dips (low $1.60’s and below). History suggests weakness into, or just after, the holiday while the higher daily volume following the gaining price days.

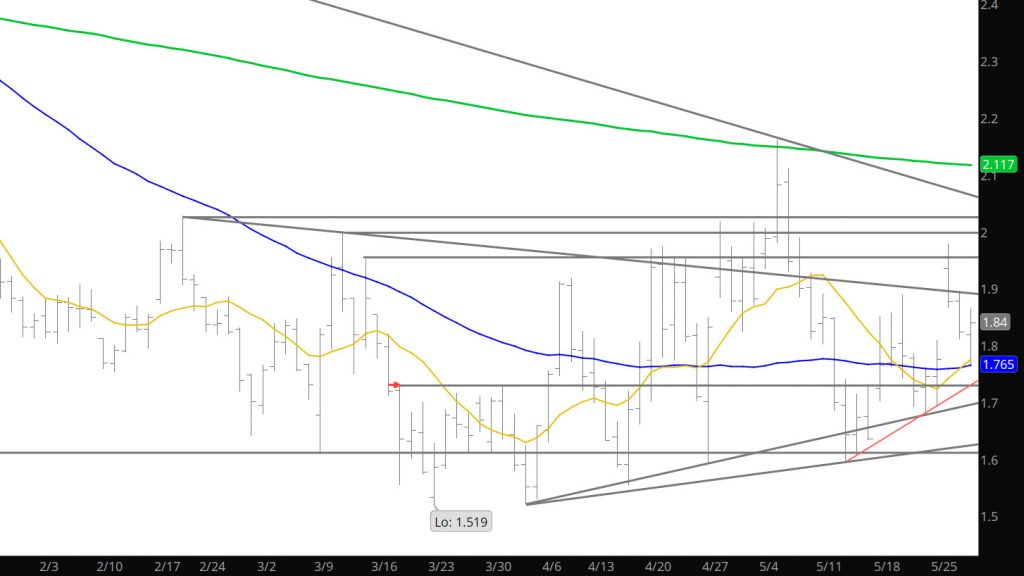

Major Support: $1.611-$1.59, $1.555-$1.519

Minor Support: $1.649

Major Resistance: $1.82-$1.849, $1.873, $1.90

Minor Resistance: $2.029

Trade Consolidates Monday’s Gaines

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.