Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Most of Monday Declines Stay

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Light Trade Extends Declines

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Substantive Declines Modify Short Term Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Juneteenth Celebration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Kinda A Range Day

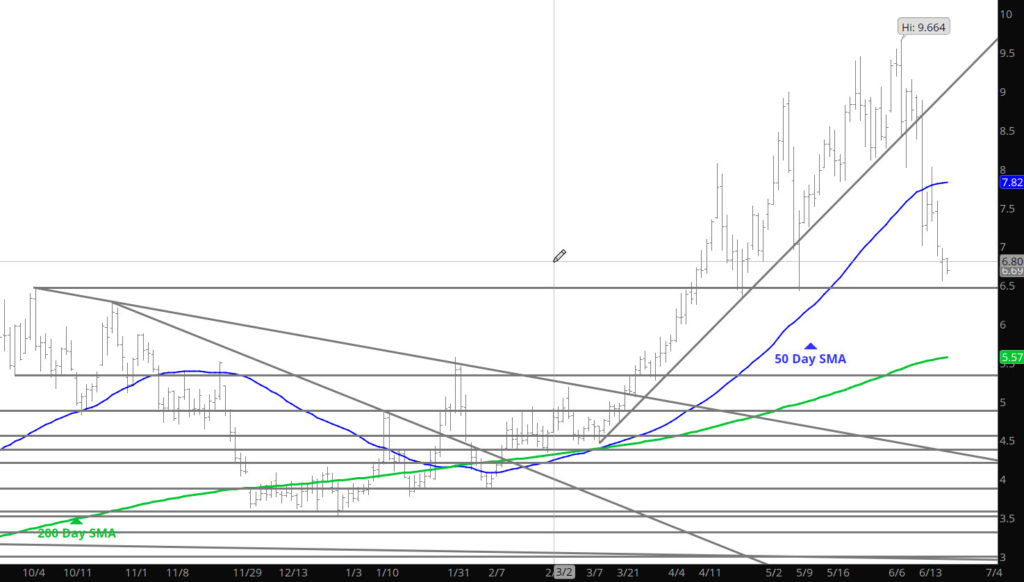

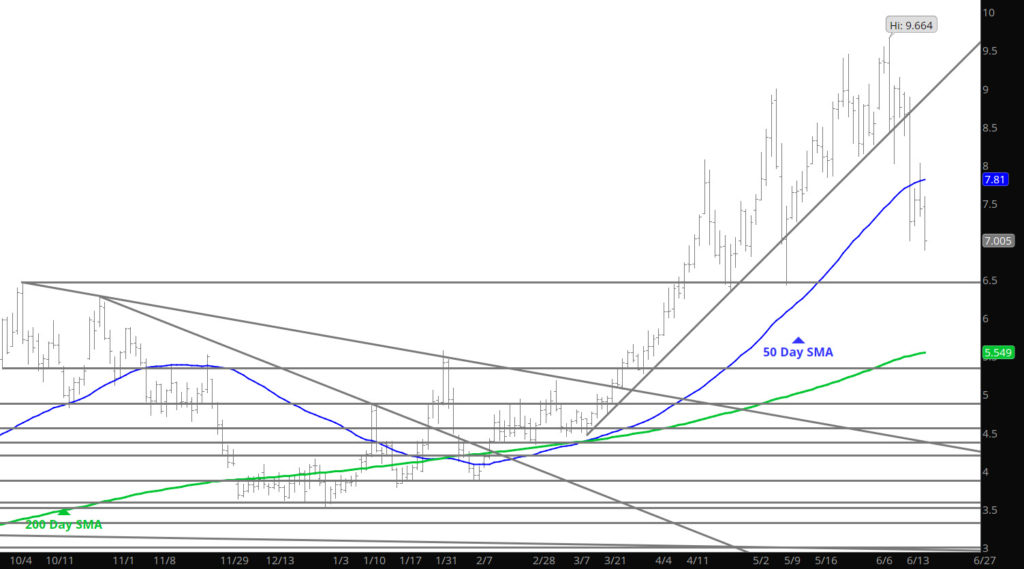

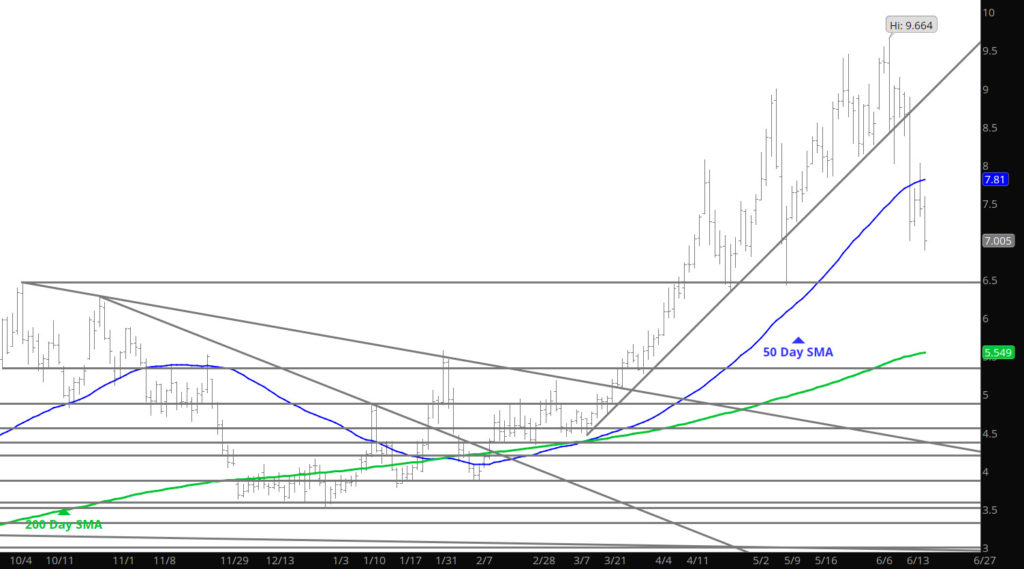

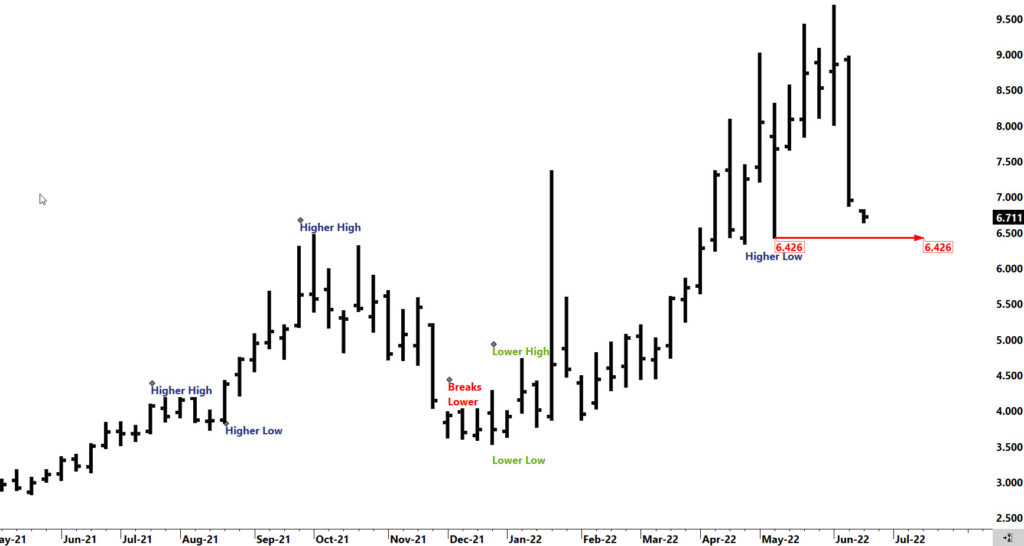

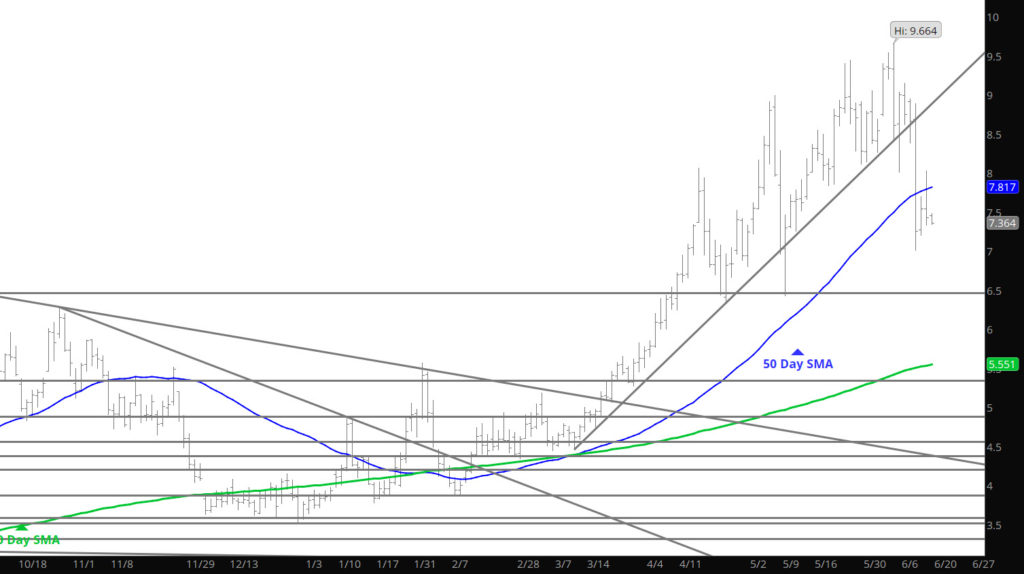

Remember, the folks that have been buying each dip have just been smoked on the accelerated declines — so if you are looking for support on each dip — tread carefully. By the same token the market has not proven that each rally will be sold– guess we need some time to establish the “mood” of the traders and there machines.

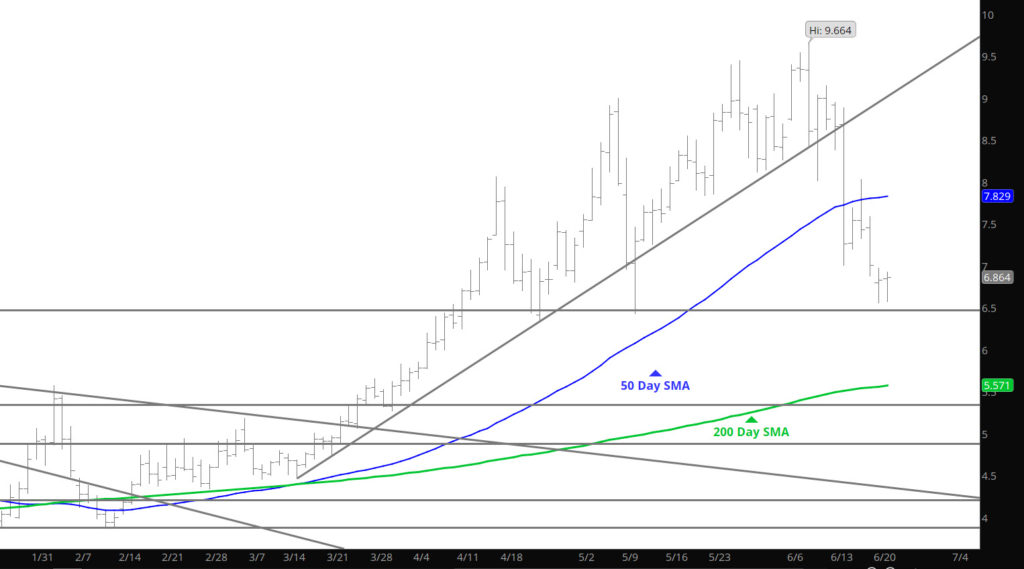

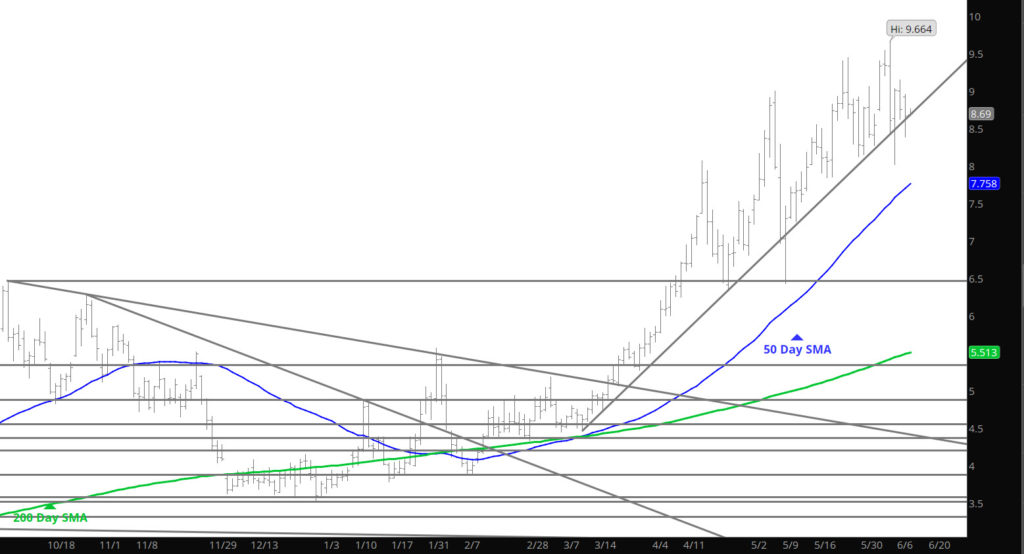

Major Support:$7.36, $7.21, $6.60

Minor Support: $$6.60, $6.245,

Major Resistance:$7.66, $7.725, $7.816, $7.955

Similar to May, Prices Find Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Now That Is a Decline

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Wild Volatility

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Close Right On Trend Line Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.