Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Suggested Rally Commenced

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation Type Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

An Extension Though Slight

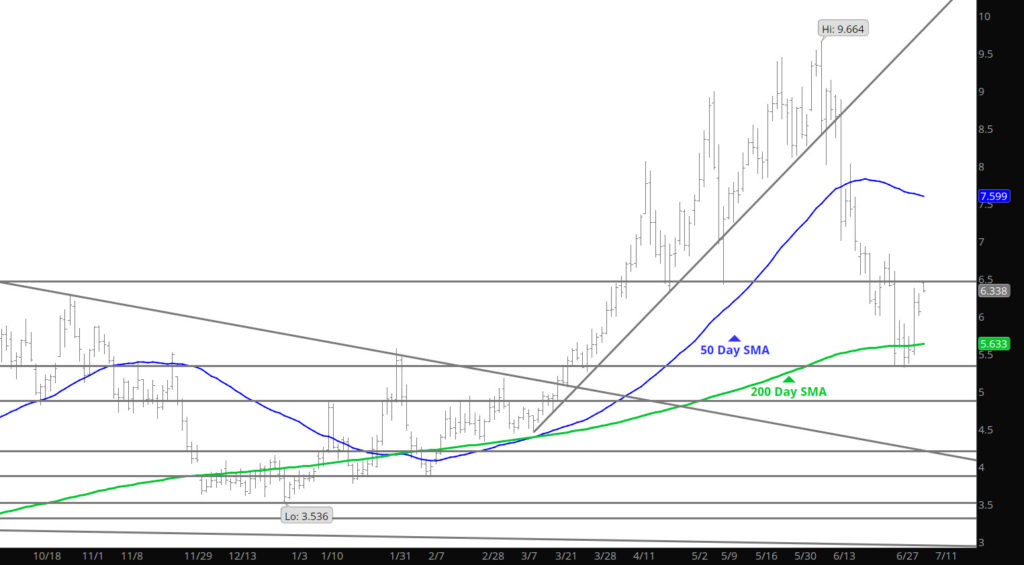

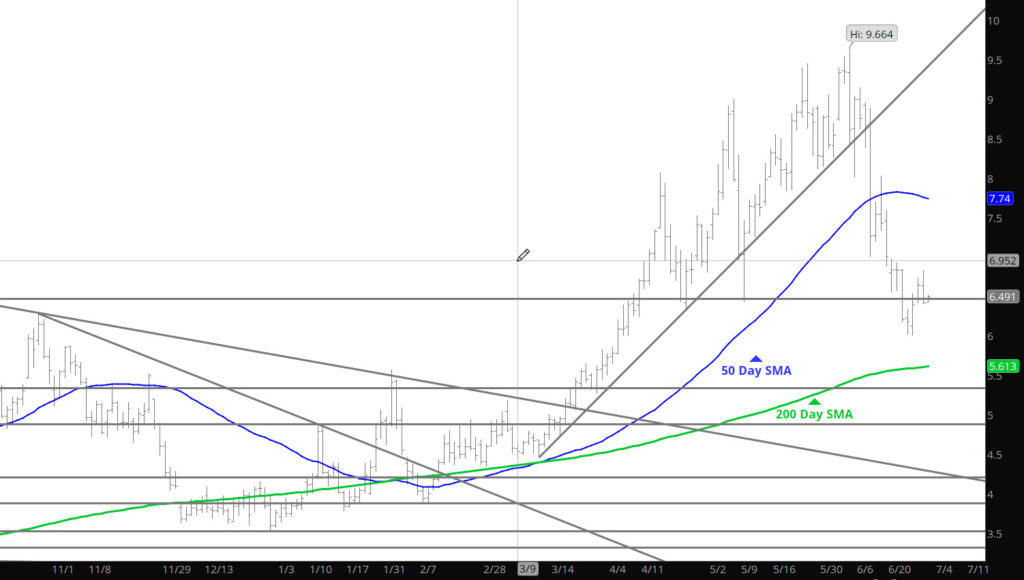

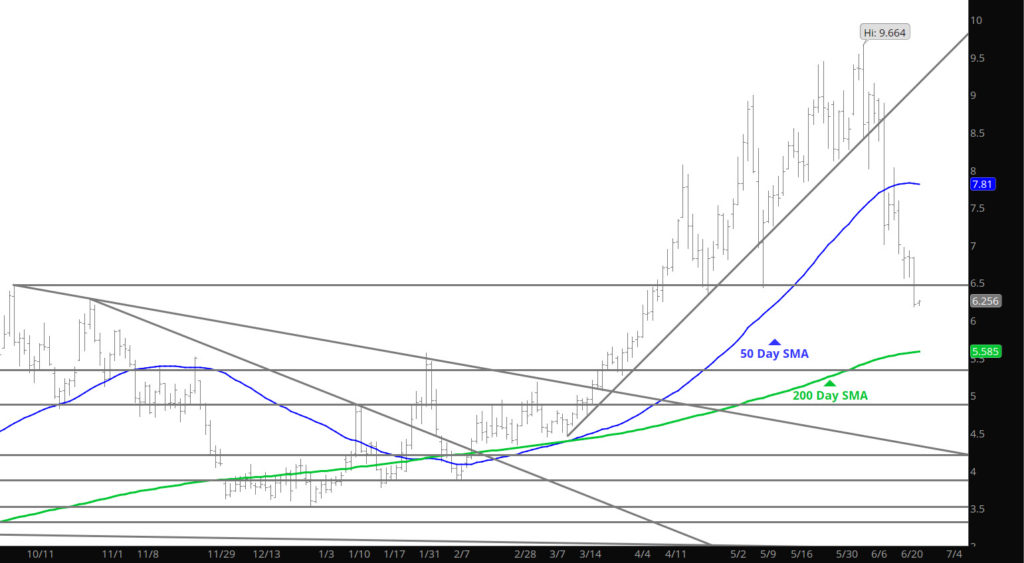

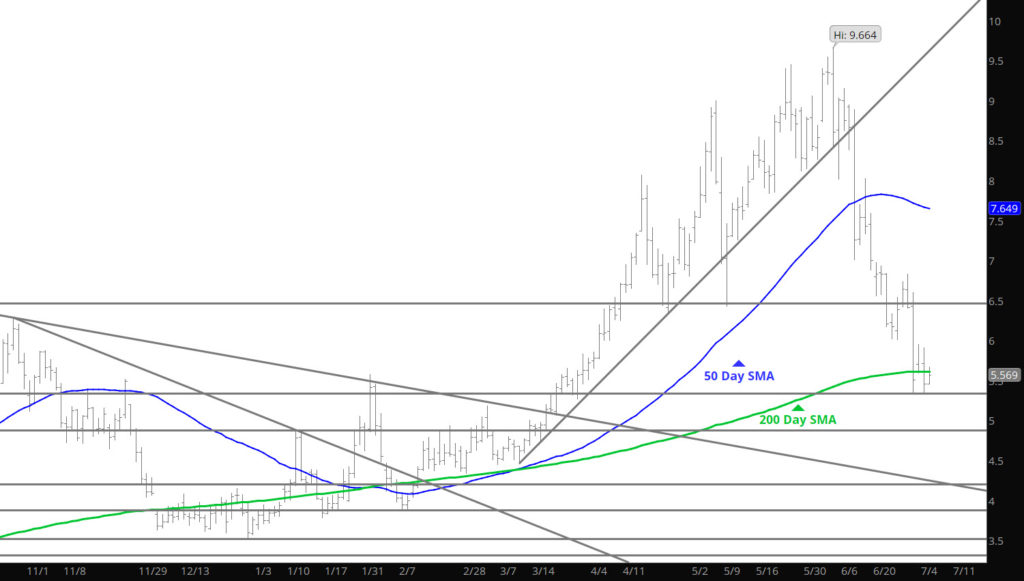

Price challenged the support from last week — just below the 200 day SMA but similar to last week, prices found support and bounced slightly upward. This is a near term support area and would not advise large buying. The market is over sold on numerous technical stand points (mostly daily in focus) and will eventually allow for a significant rally—- eventually. In the meantime it looks to be a sell any rally focus.

Major Support: $5.623, $5.59-5.572

Minor Support: $5.548, $5.40-$5.45

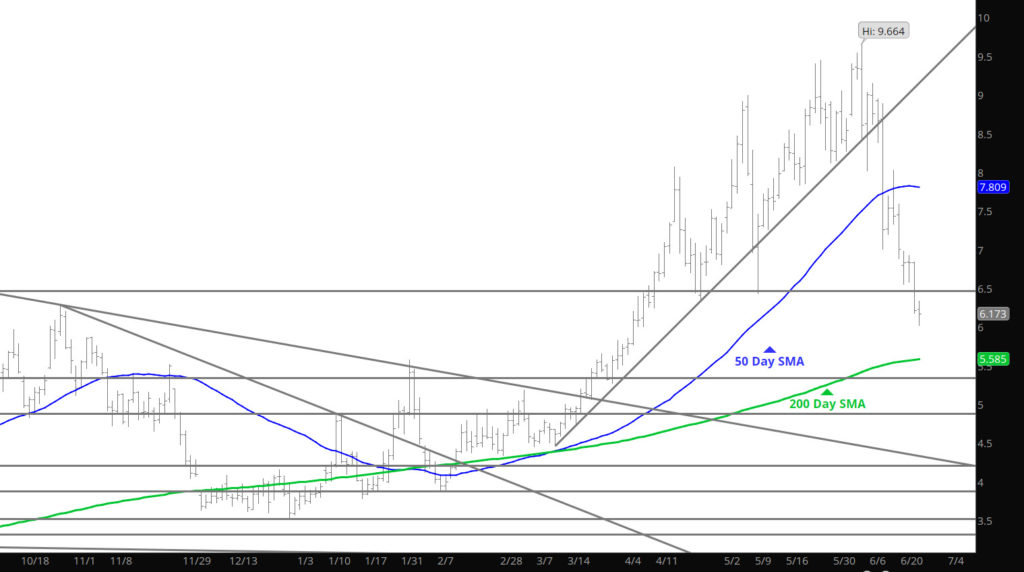

Major Resistance:$6.021, $6.34-$6.43, $6.587, $6.638

Definite Technical Damage

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Silent Trade Day

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Quiet (Compared to Recent) Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Is the Bull Run Over?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Collapse Takes Prices to a Lower Low

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Break Support and Challenge Bull Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.