Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bias Switch

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

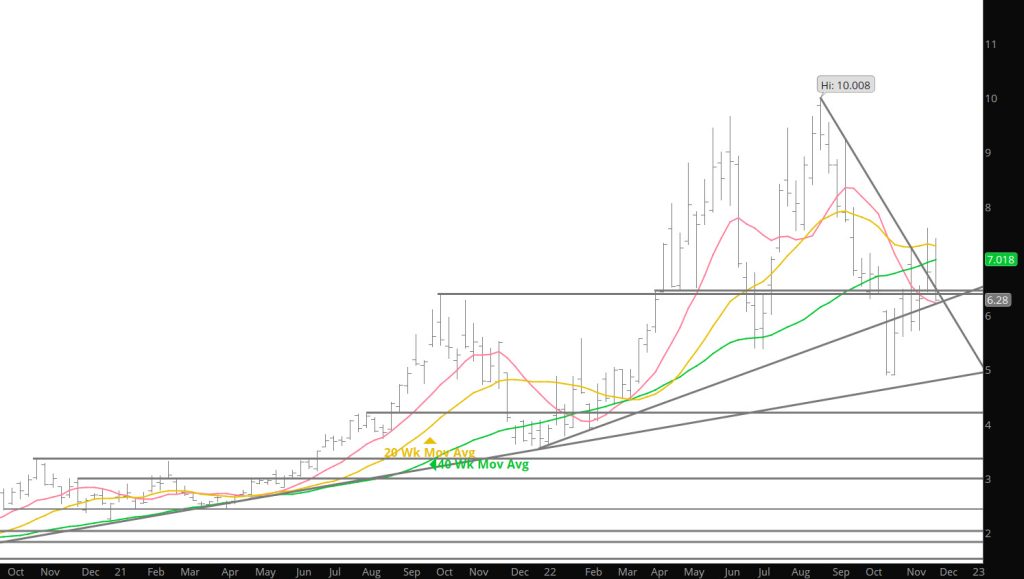

Don’t Look Now — But Back in the Old Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

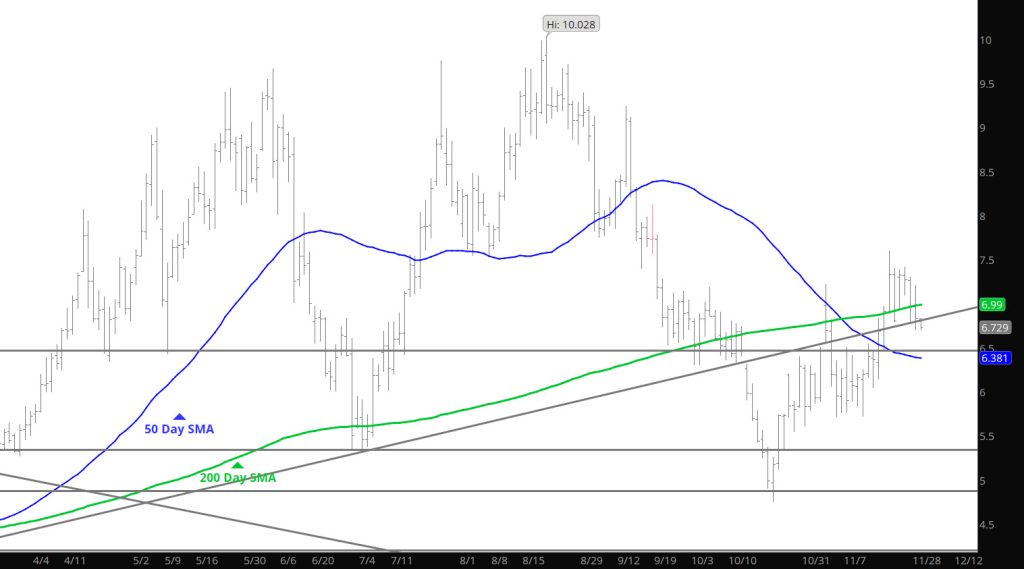

Declines Continue Below Trend Line

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

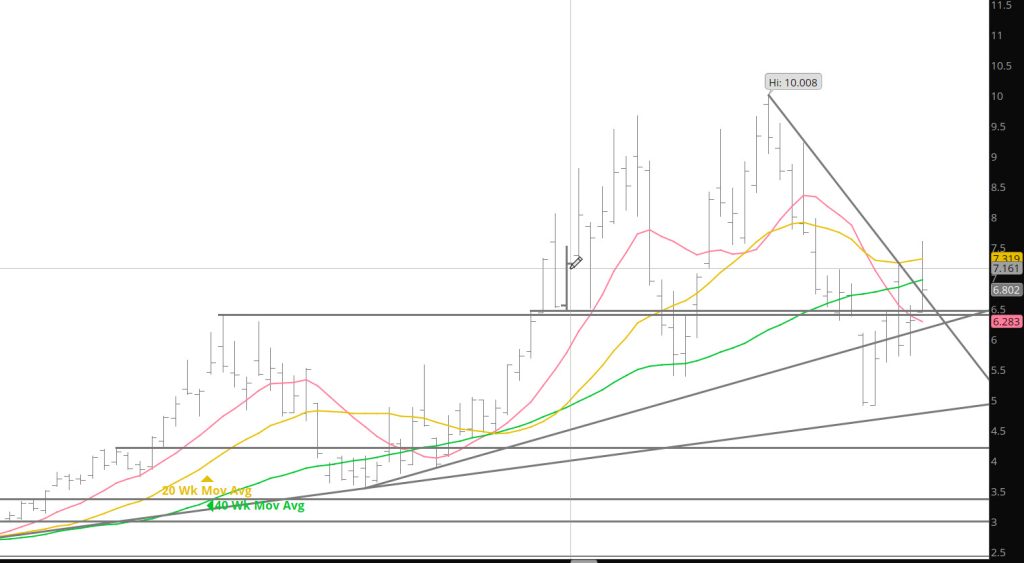

Solid Test of Support Trend Line

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

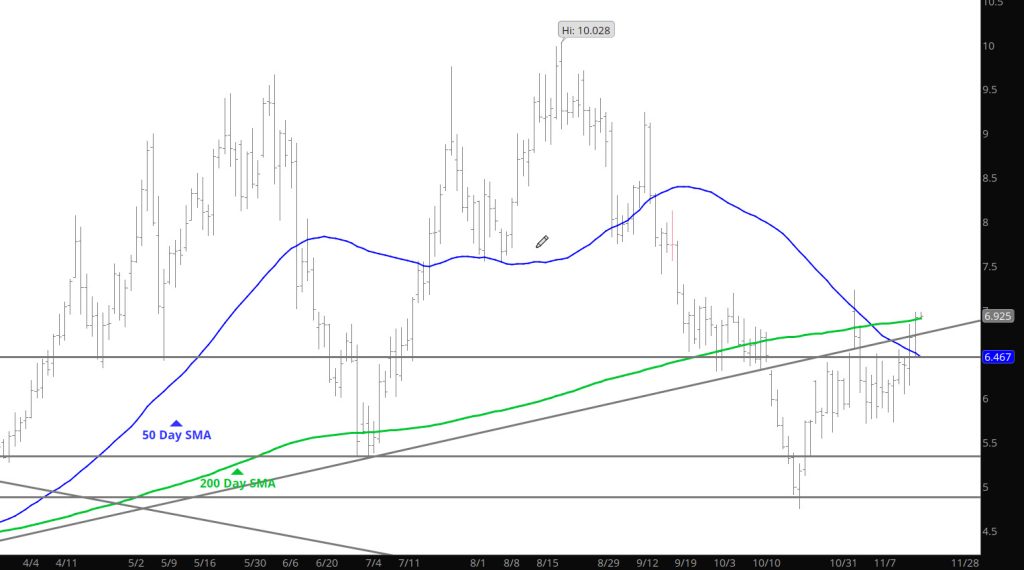

Historical Weakness in Early Dec Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

January Takes Over

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Out Through Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Expiration With Limited Comments

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

As Expected — Retrace to New Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.