Daily Call

Storage Report Brought Volatility

Daily Continuous

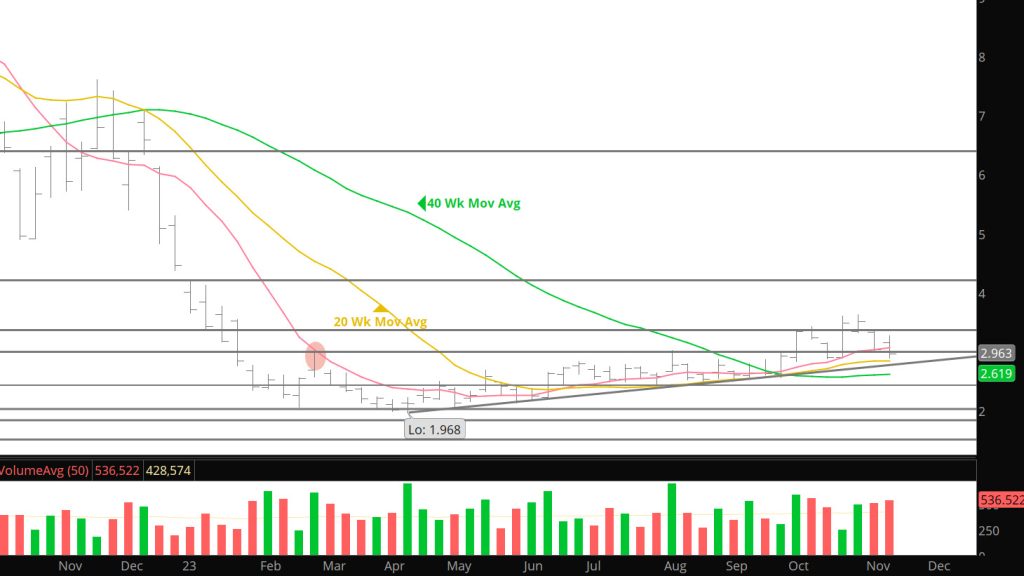

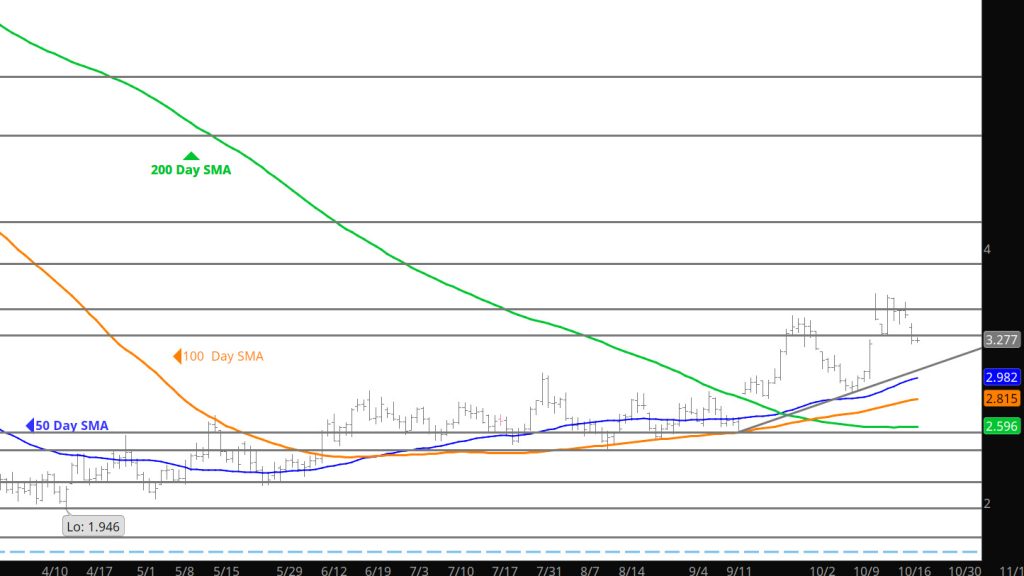

Expected the potential for volatility but a $.238 range yesterday seemed a little over done. Regardless, prices now have to deal with the key $3.00 area that was rebuked last week at the 50 day SMA. So here we sit — if you a bullish bias trader, then buying on this decline with a stop just below the key support zoned makes for a low risk trade. If you are a bearish bias the you need to see a close below the key area to add to positions.

Major Support: $2.98-$3.03, $2.82-$2.78, $2.74, $2.608, $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $3.16, $2.84, $2.38-$2.26, $2.17

Major Resistance $3.48, $3.536, 3.59, $3.65

Storage Report Brings Implications

Daily Continuous

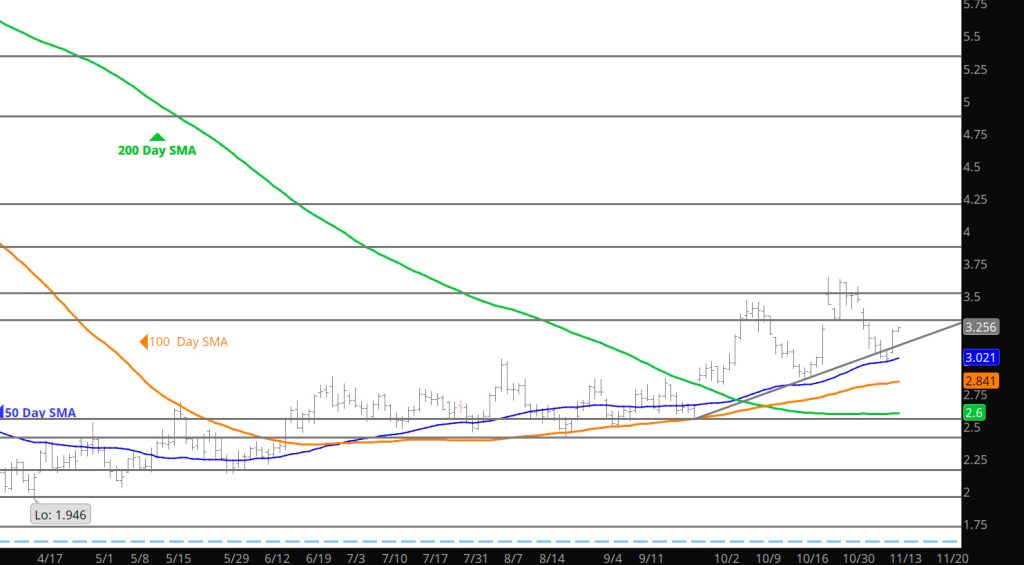

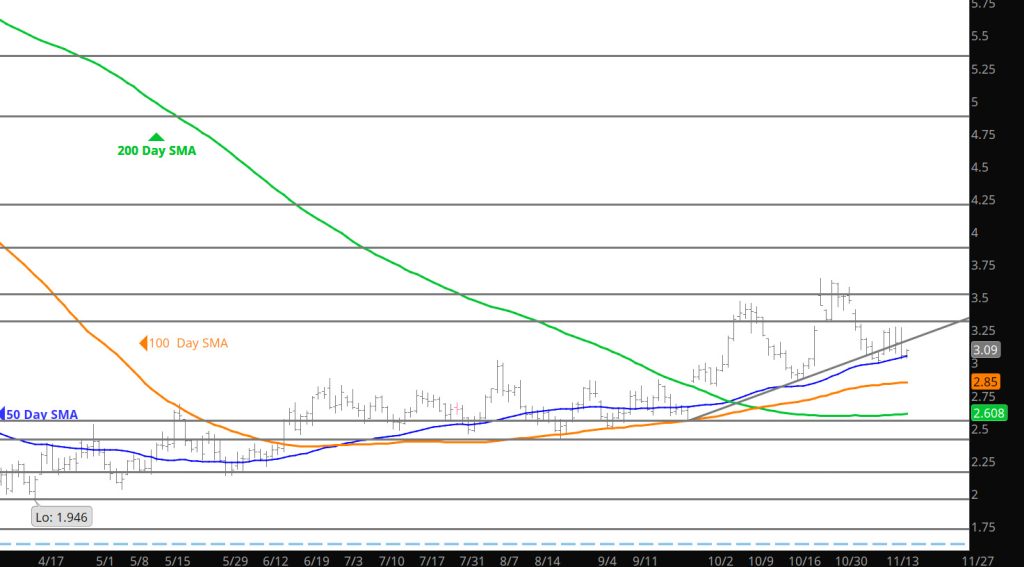

Not sure what the release will show but taking into the fact that it reflects two weeks of activity — the potential for volatility is high. The market, though, continues to reflect a consolidation phase type of behavior. If the previous months are any indication the range developing will have $3.00 as the low end and the highs of $3.64 finding sellers. Plan accordingly.

Major Support: $2.98-$3.03, $2.82-$2.78, $2.74, $2.608, $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $3.16, $2.84, $2.38-$2.26, $2.17

Major Resistance $3.48, $3.536, 3.59, $3.65

Consolidation of Recent Gains and Declines

Daily Continuous

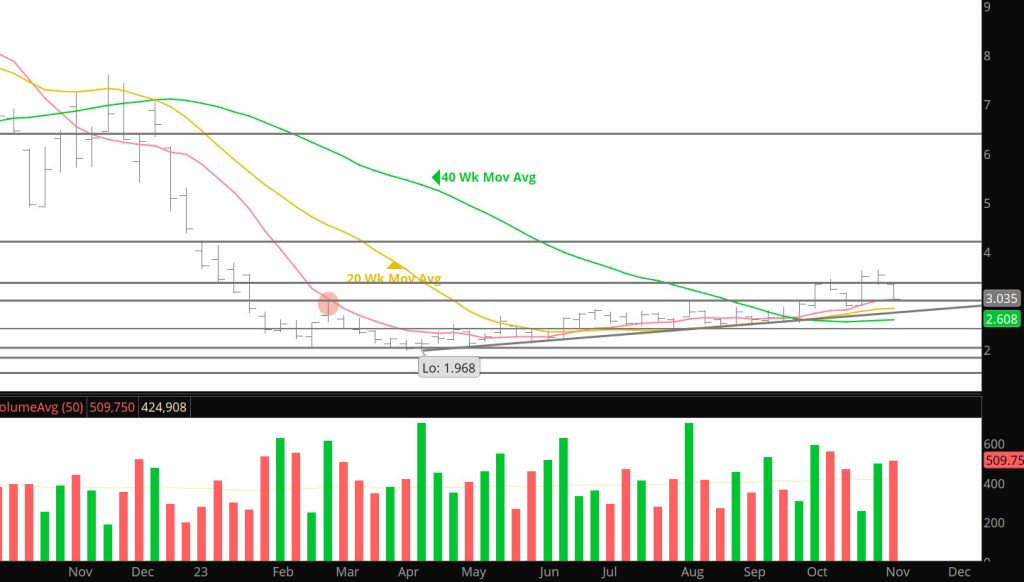

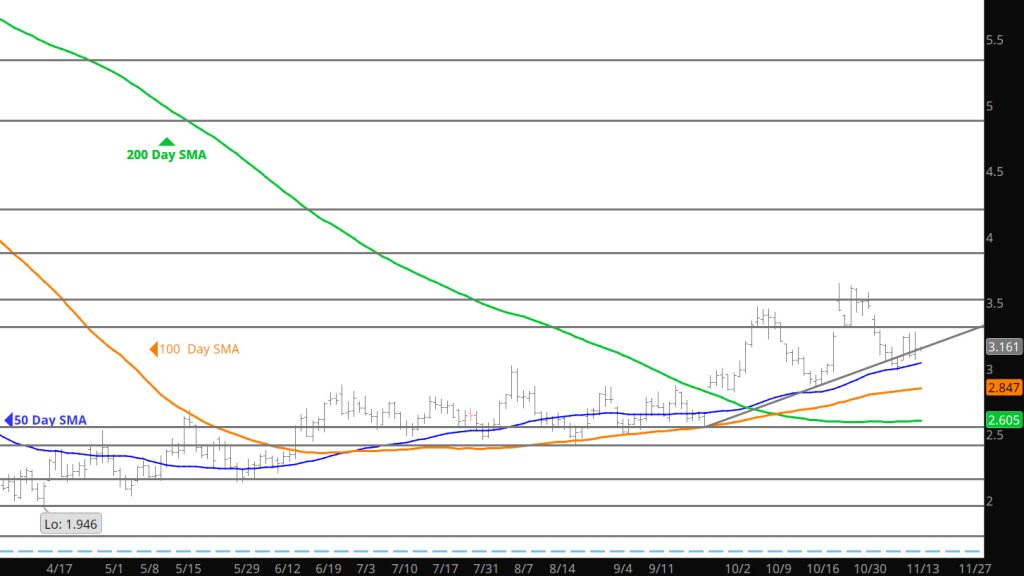

Last week’s declines met with early gains this week — its not surprising that the market is going to consolidate and figure out its next directional bias (if only for a day or two). Developing a nice trading range that could provide $.25-$40 volatility in both directions.

Major Support: $2.98-$3.03, $2.82-$2.78, $2.74, $2.608, $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $3.16, $2.84, $2.38-$2.26, $2.17

Major Resistance $3.48, $3.536, 3.59, $3.65