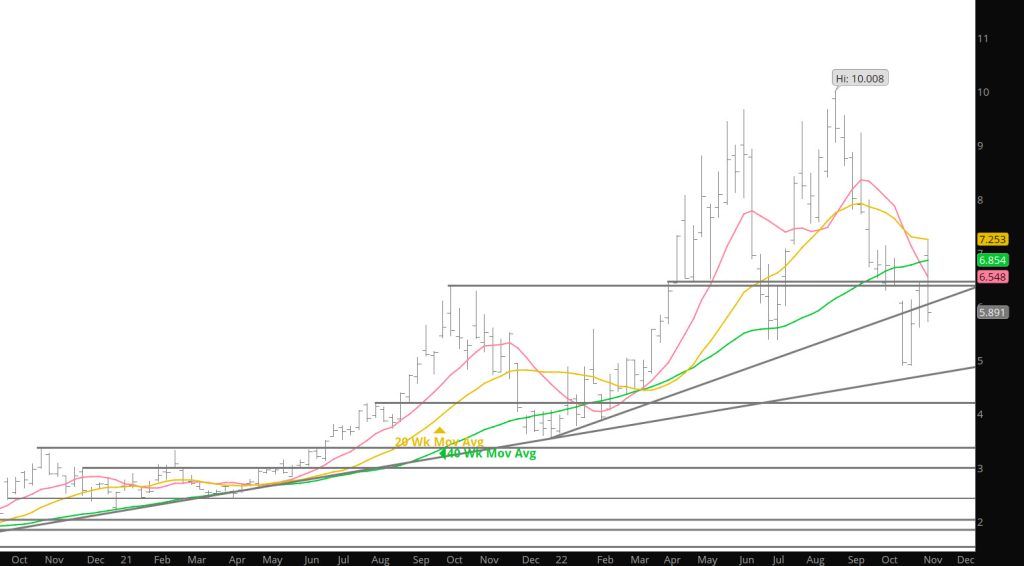

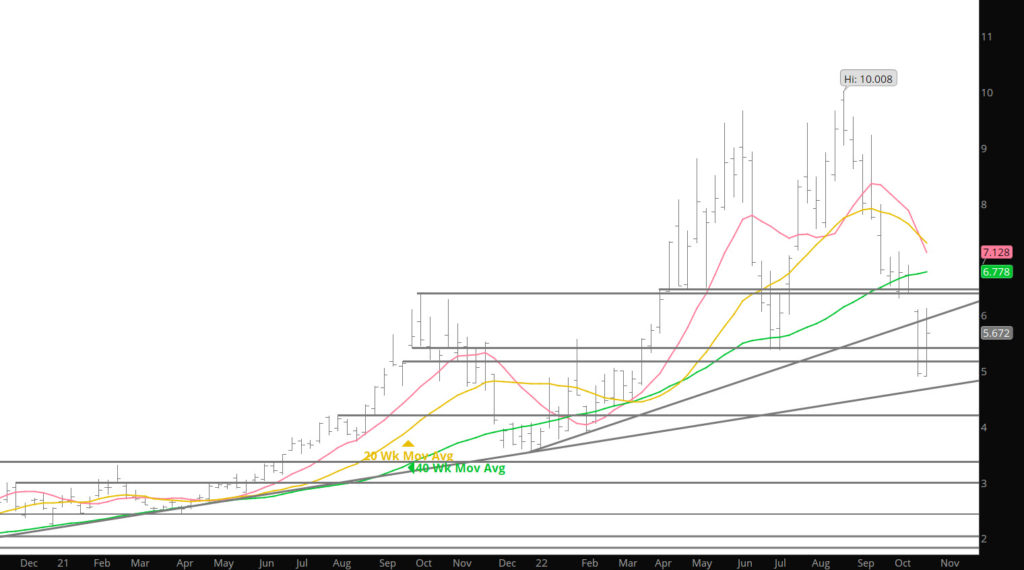

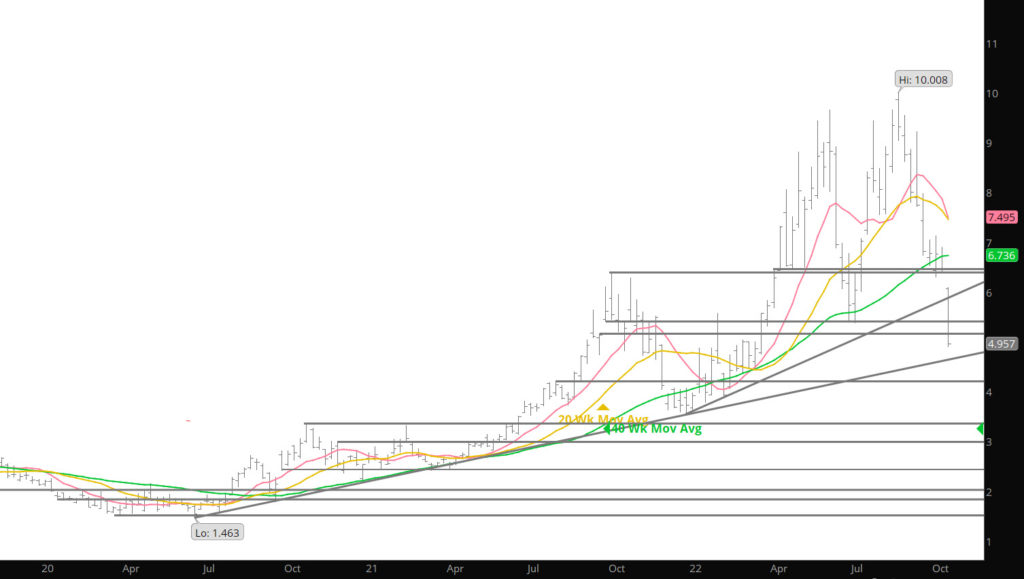

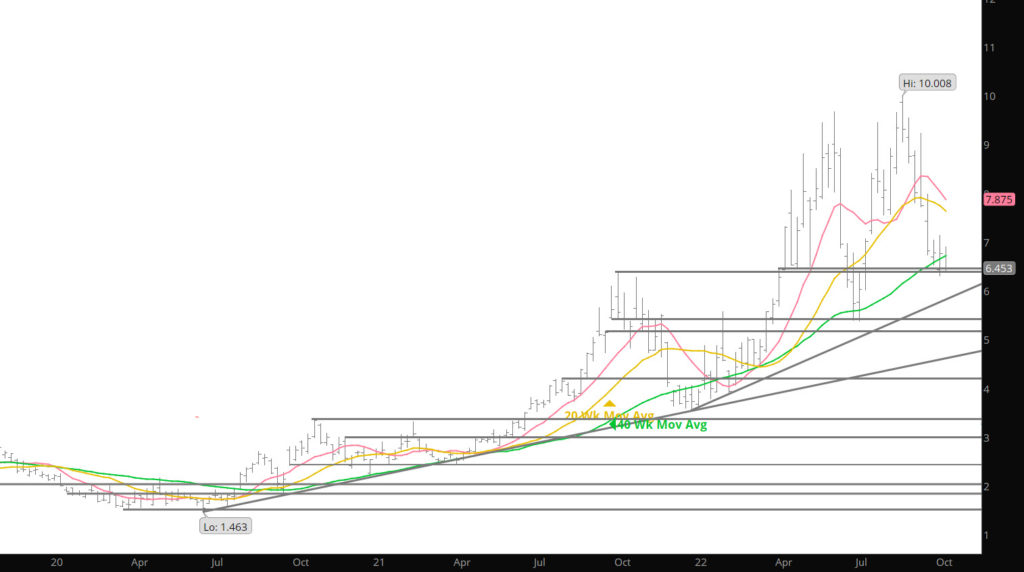

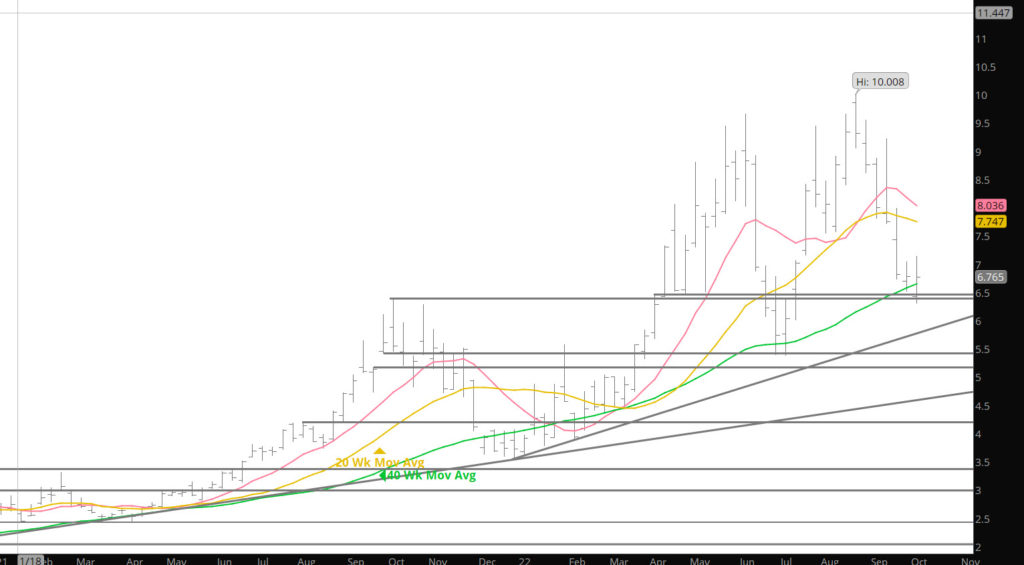

Category: Weekly Detail

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bias Switch

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Out Through Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

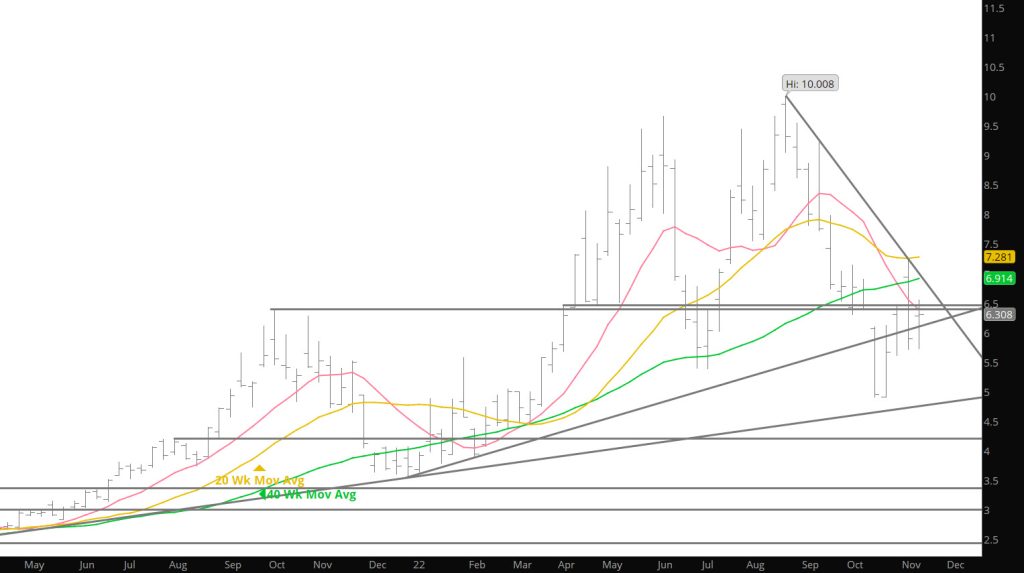

Consolidating For a Run or Break Lower

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Reversal Week

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Above Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Dec Takes Over as Prompt Giving Up Some of Differential

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

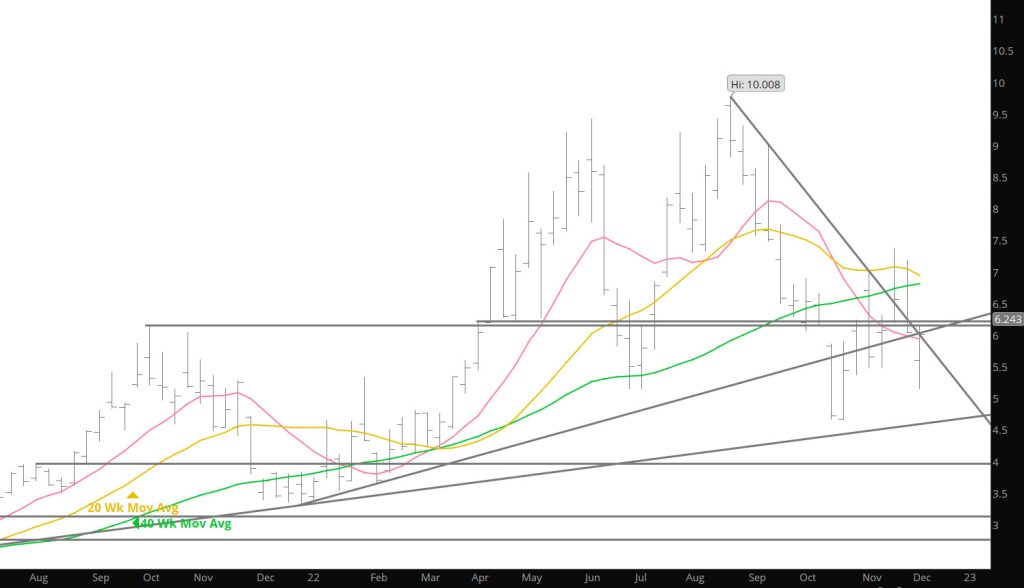

Technical Destruction of 2022 Bull Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

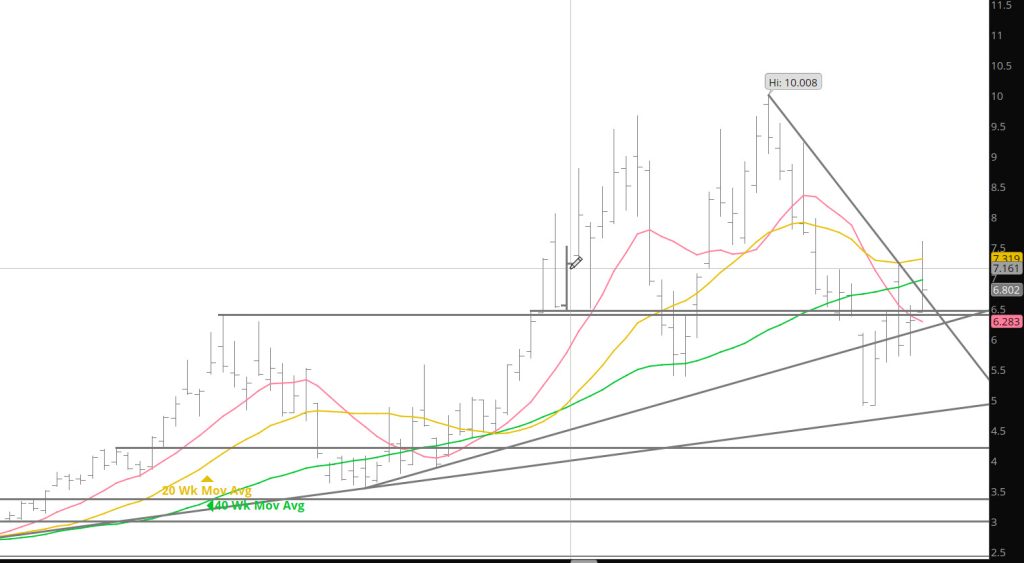

Consolidation — Range Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

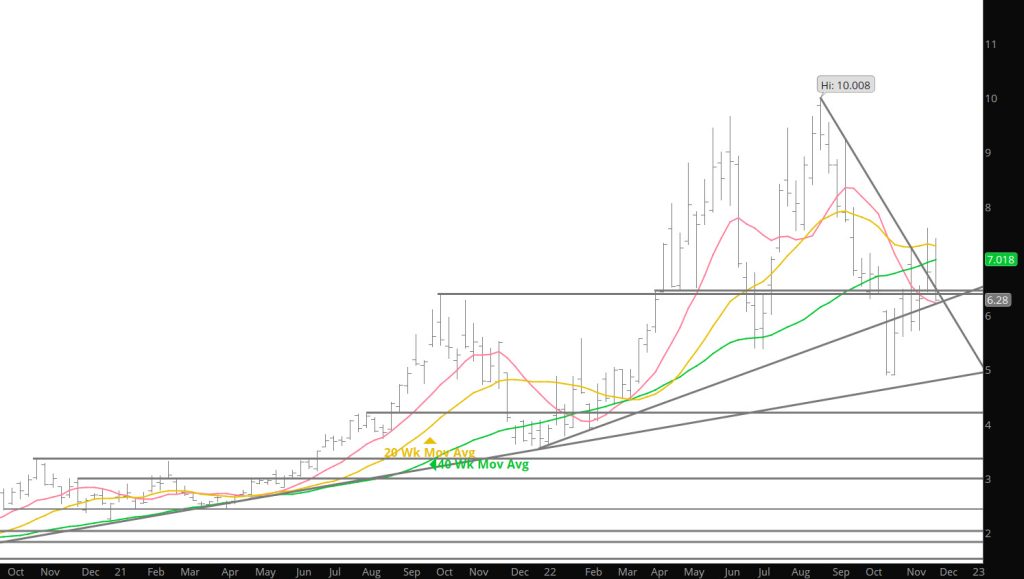

Counter Trade Rally Ends Just Over $7.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.