Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Range Type Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Shocking — Down Day

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Beat Goes On

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Silliness May Continue But Reckoning Coming

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Got It

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Not Yet

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Hmm — Perhaps a Blow Off

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

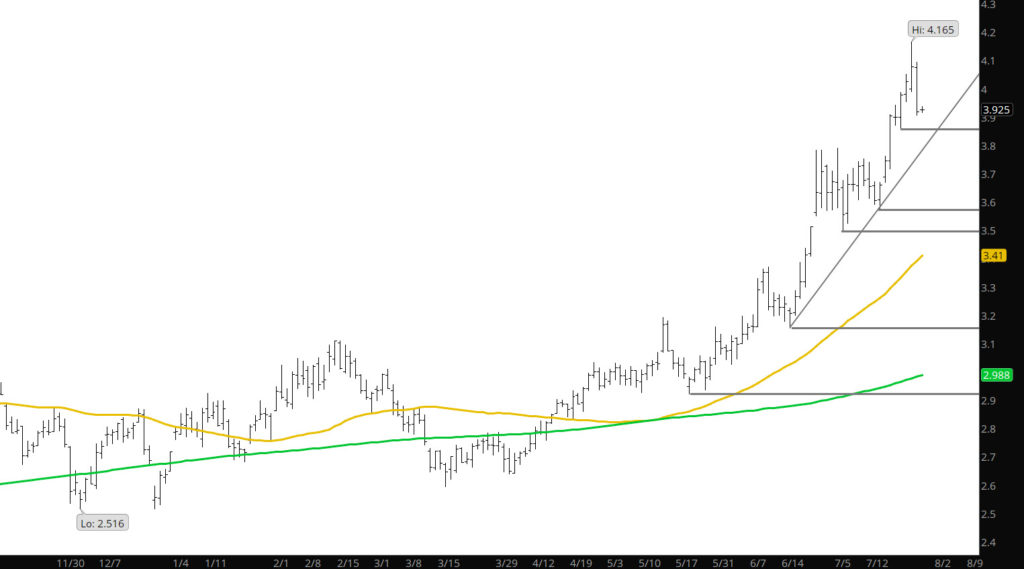

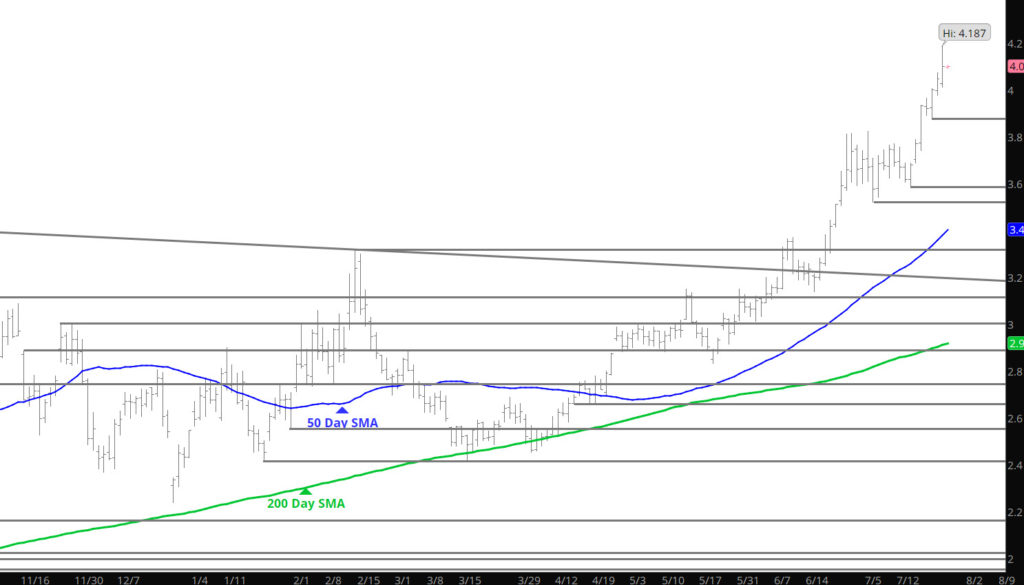

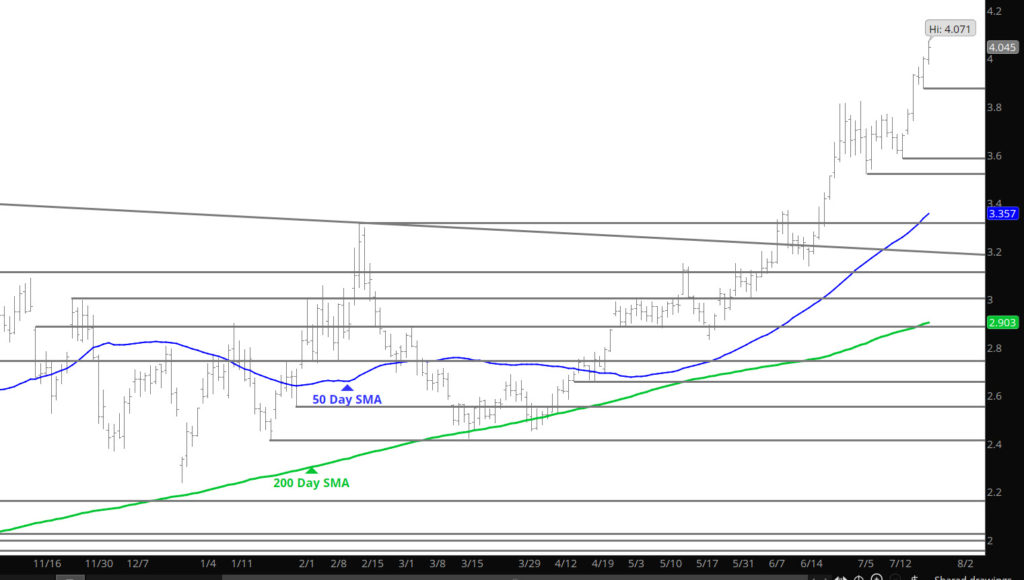

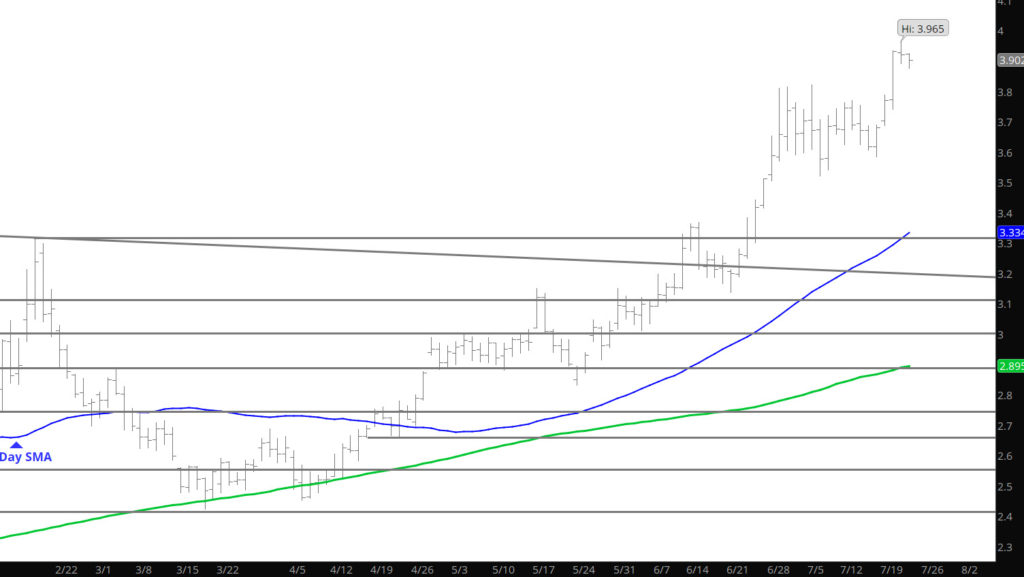

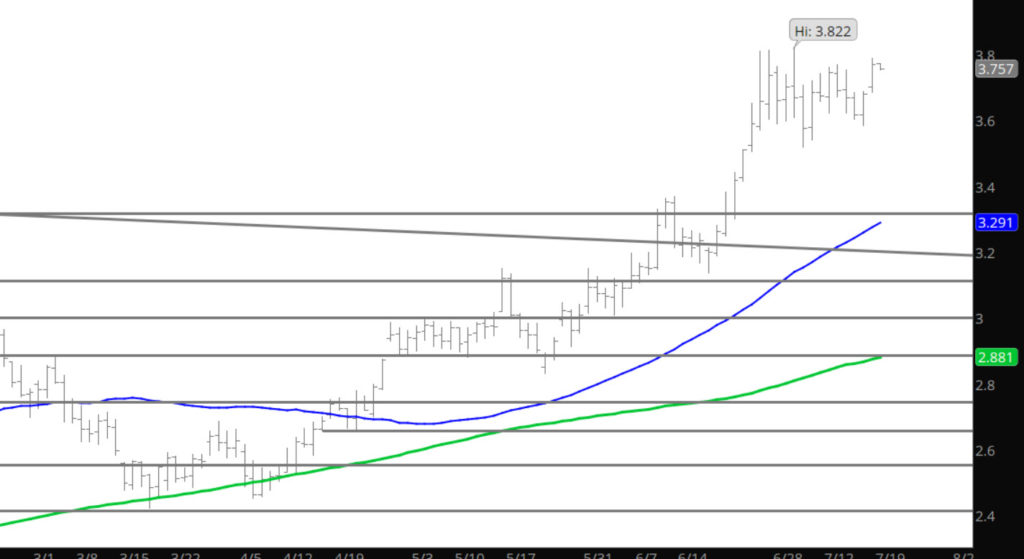

What Is With Natural Gas

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Well — That Worked Out Well

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.