Category: Daily Call

Volatility Returns To the Upside

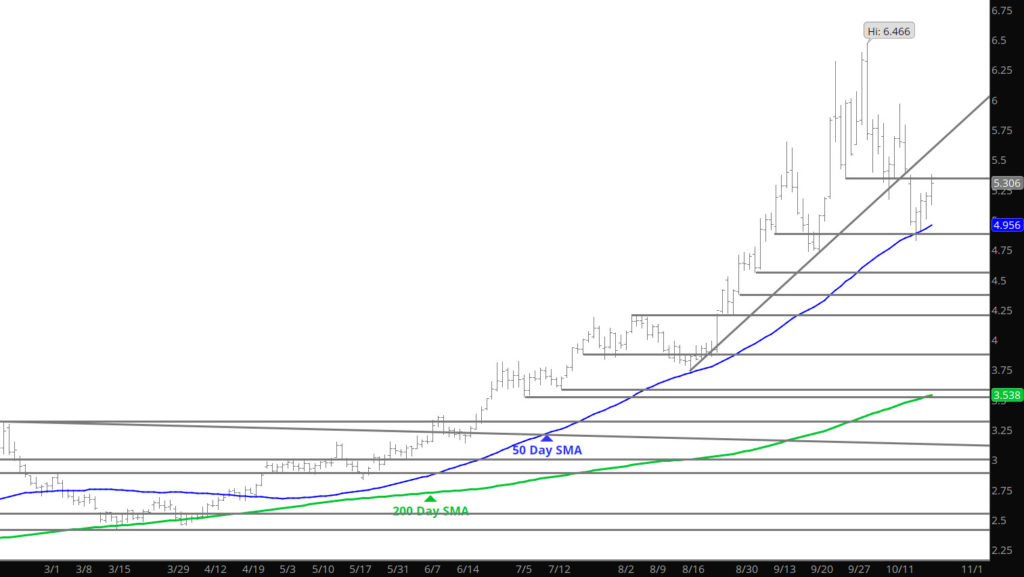

Continuous Range Remains

Commonly Watched Support Holds

Sunday Night Closes Gap

December Breaks Lower Tests Nov Support

What Goes Up May Come Down

Nothing New — Prices Strong Through Expiration

That is a Bullish Confirmation

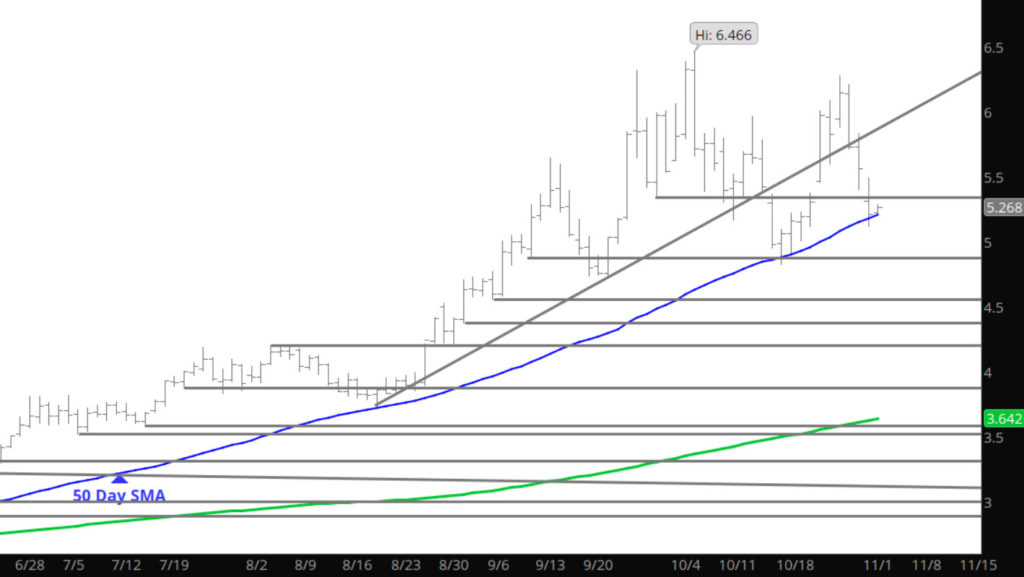

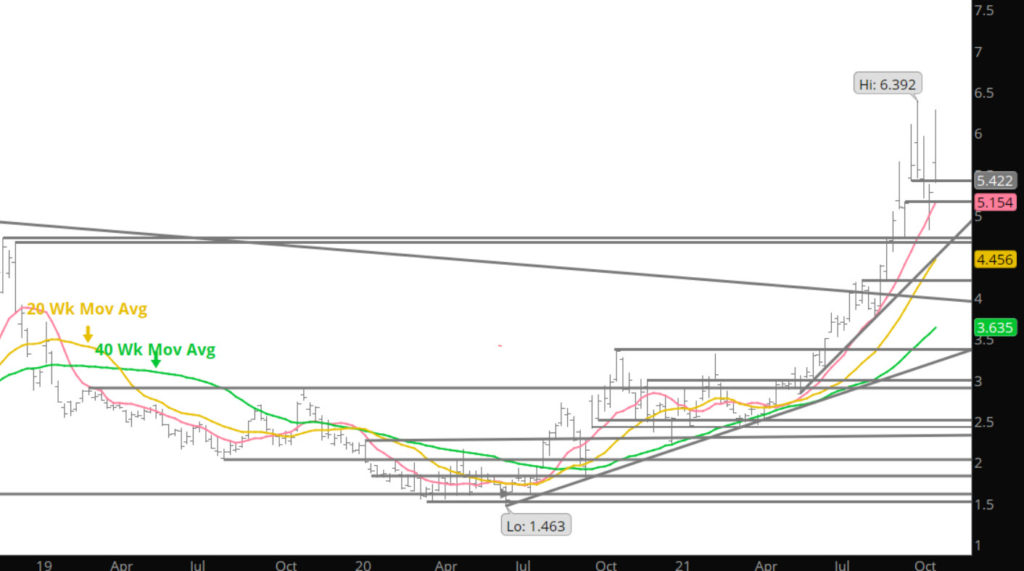

Prices rocketed over 10% higher on some sort of news. I heard from some of you that the forecasts had added some total degree days to their for forecasts– but come on. I sarcastically mentioned last month in a Daily about the weather had not even been priced in (got a couple of readers to say I was on drugs) but yesterday is a perfect example of my sarcasm (not funny if you are short gas)– just a minor change in the weather forecast had a 10% impact on price– REALLY. All I had mentioned is that my guesses didn’t include any forecast. This market is so fragile on the supply / demand balance that a minor forecast change either in the U.S. or Europe could have a dramatic impact on price.

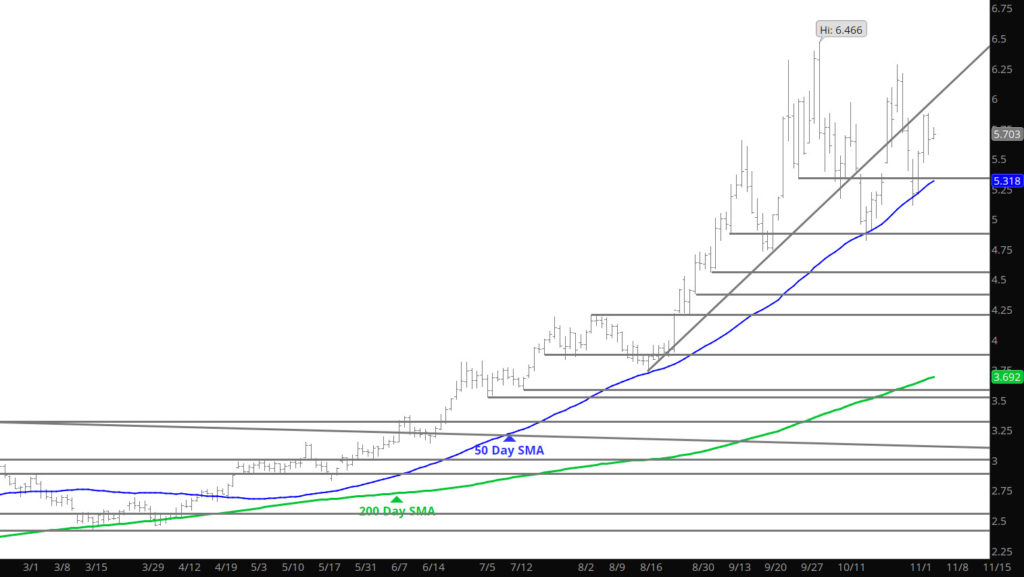

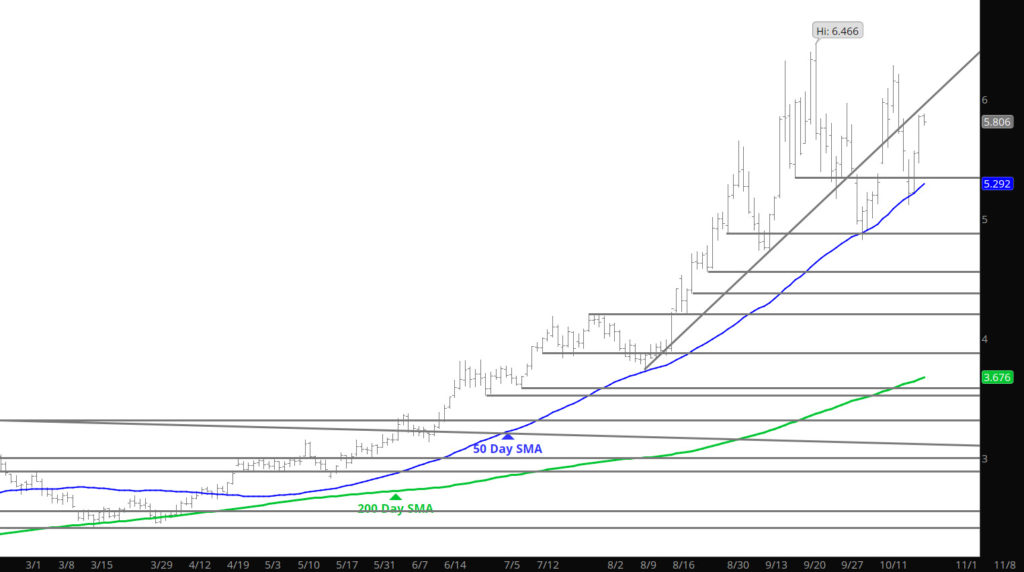

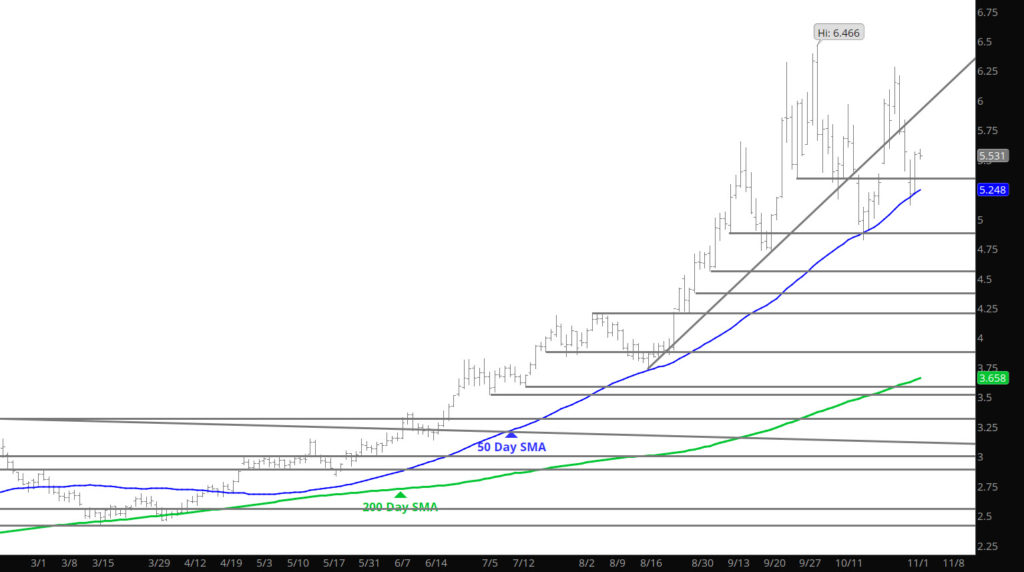

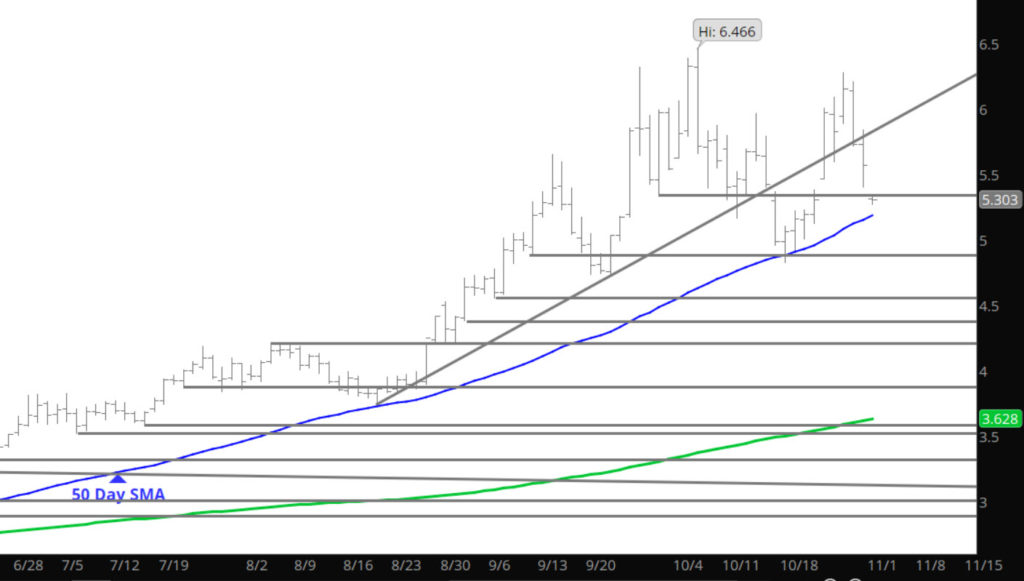

Major Support:$5.655, $5.275, $5.17, $4.88-$4.825, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92

Minor Support: $5.489, $4.728-$4.70, $4.66

Major Resistance:$5.822, $5.964, $6.24-$6.493, $6.28,$6.466