Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

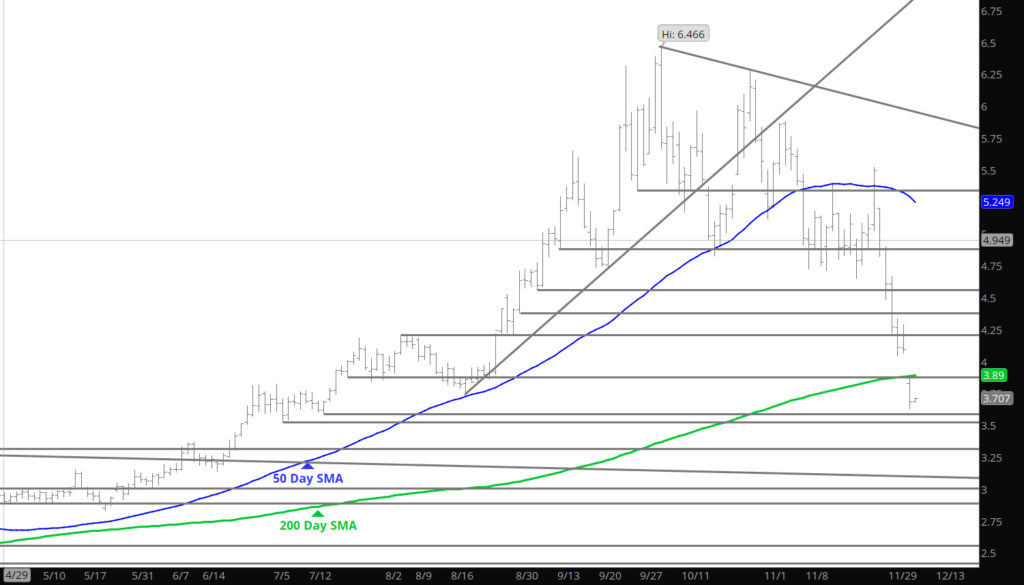

Declines Late Friday Suggest Test April Lows

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

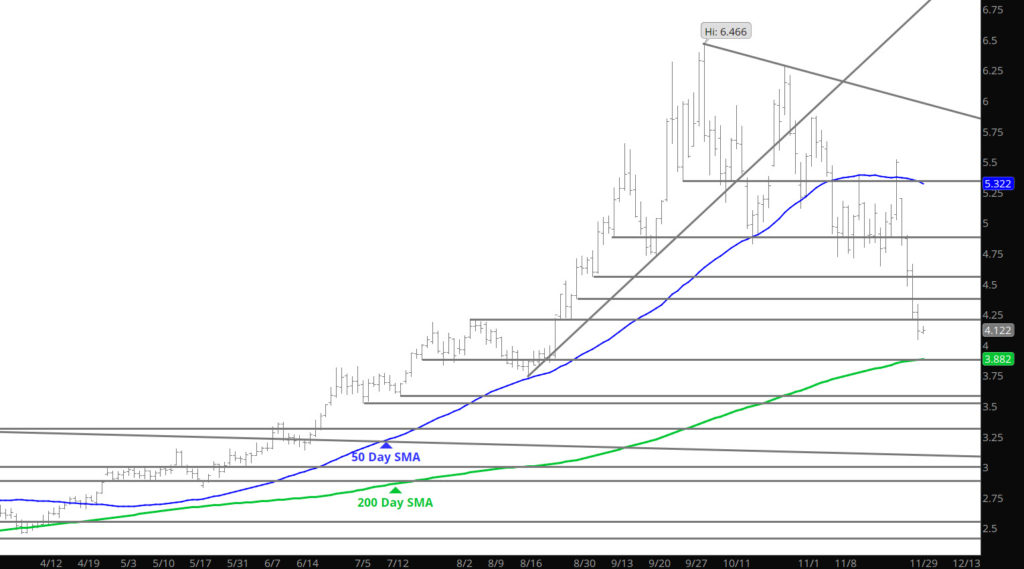

Next Stop?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

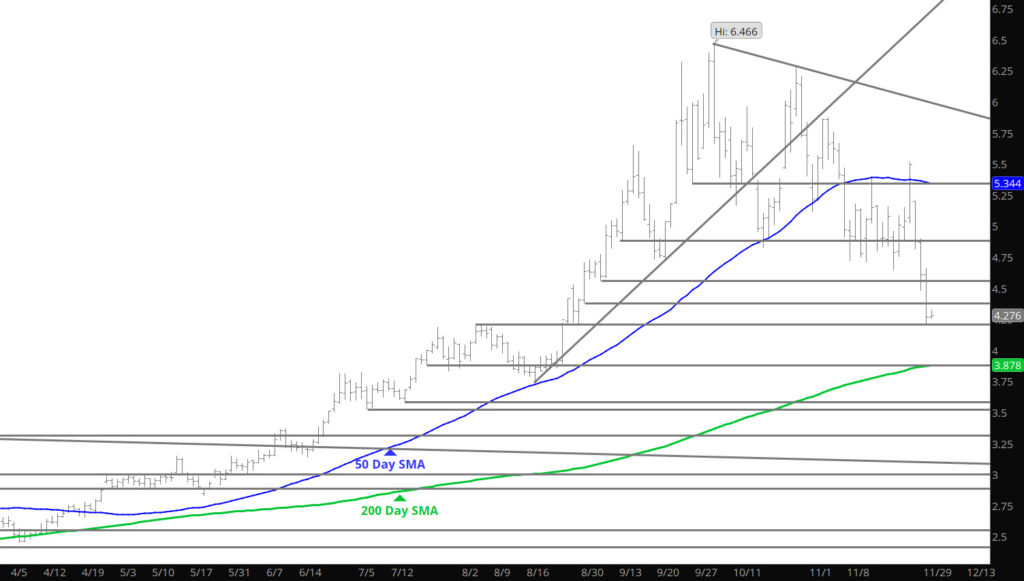

Gains From Last August — Gone

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Break Long Held Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Collapse Should Test Intermediate Major Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Sunday Opens with Collapse

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

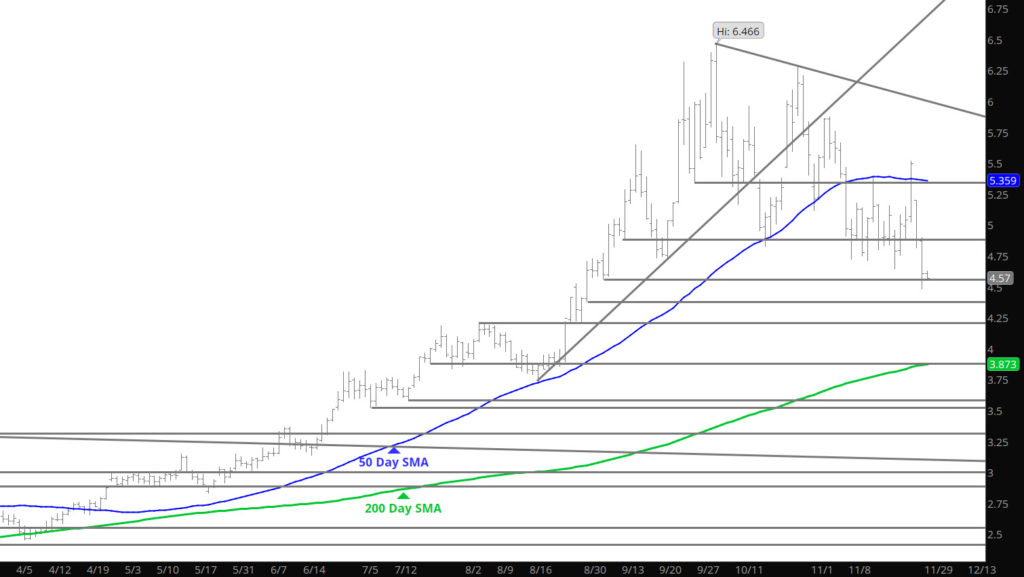

The Rebound Off of Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Support Breaks at the Open

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Strong Close to the Week — Weakness on Sunday

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.