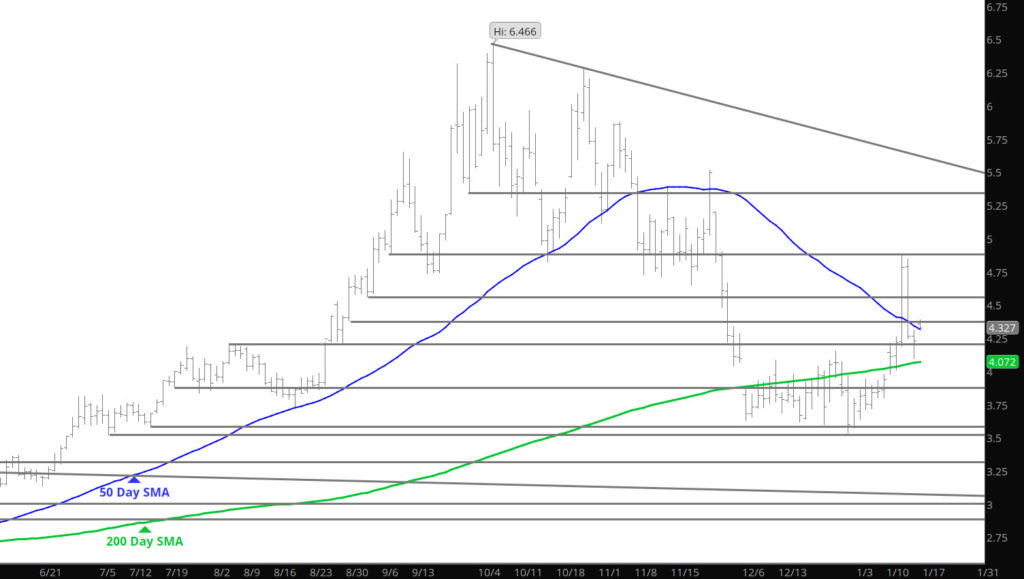

Discussed in the Weekly section, the tremendous decline in open interest since September had brought with it a potential upside vulnerability. Discussed it last week as more of a fact not a question of if. This last week, prices all along the maturity curve moved dramatically higher with both volume and open interest increasing substantially (average daily volume by an estimated 200,000 contracts and open interest by the most contracts since the week beginning June 28th) . I mentioned in Weekly section that February would remain range bound, while still expecting a range bound trade, clearly the levels of the range has changed to higher levels. Last weeks action also strongly suggests a significant intermediate term low may be in place. Expect price weakness to attract substantial interest at progressively higher levels.