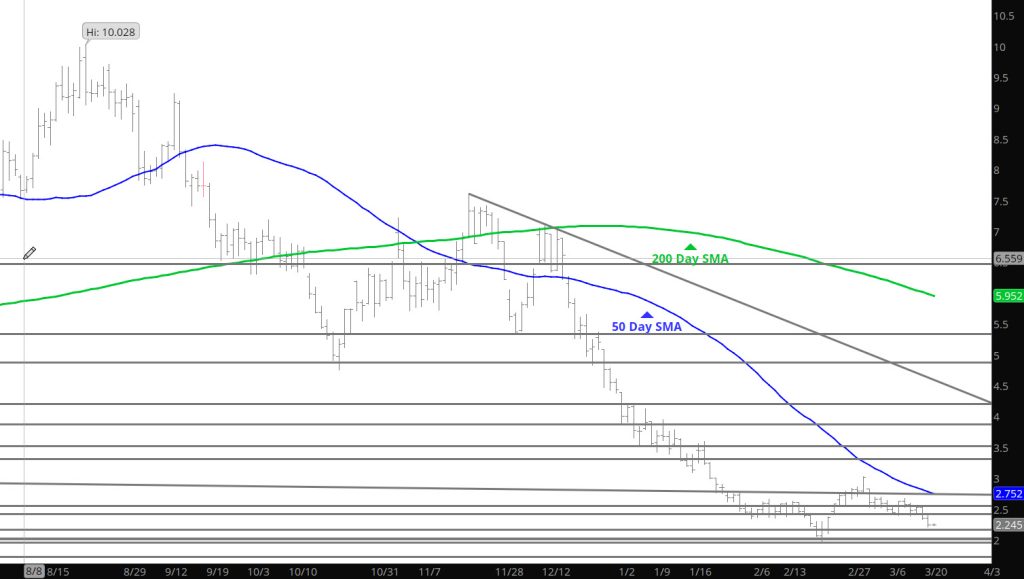

Prices dropped below $2.00 and suggested closing below that important area but found some minimal support. A close below that level sill suggest additional declines will be coming. Today will provide some important indications for the May contract and bias objectives going into the historically strong summer (power demand) season. We shall see. For me still in the range and at the low end.

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support:

Major Resistance $2.12-$2.184, $2.836, $3.00, $3.536, 3.595