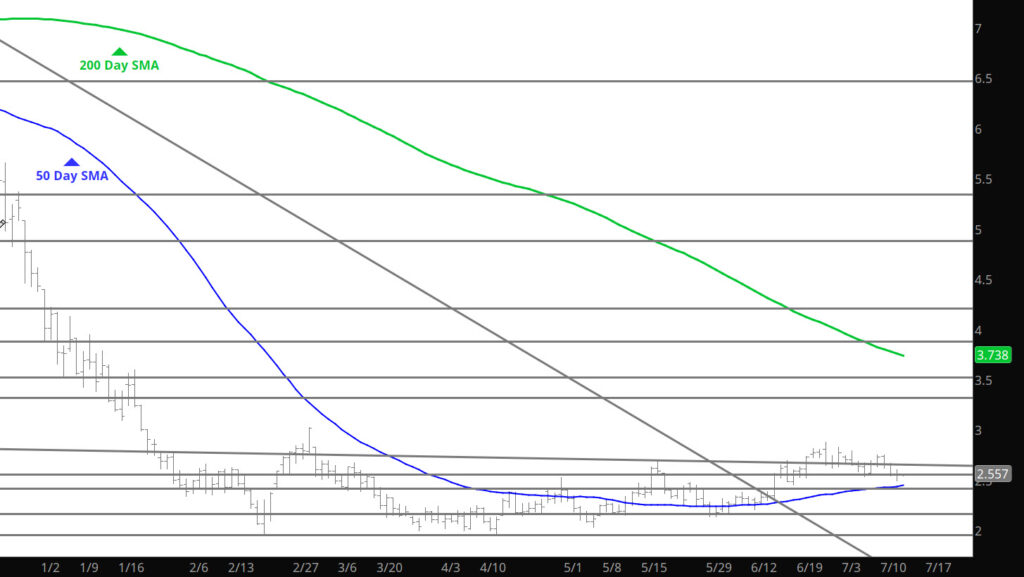

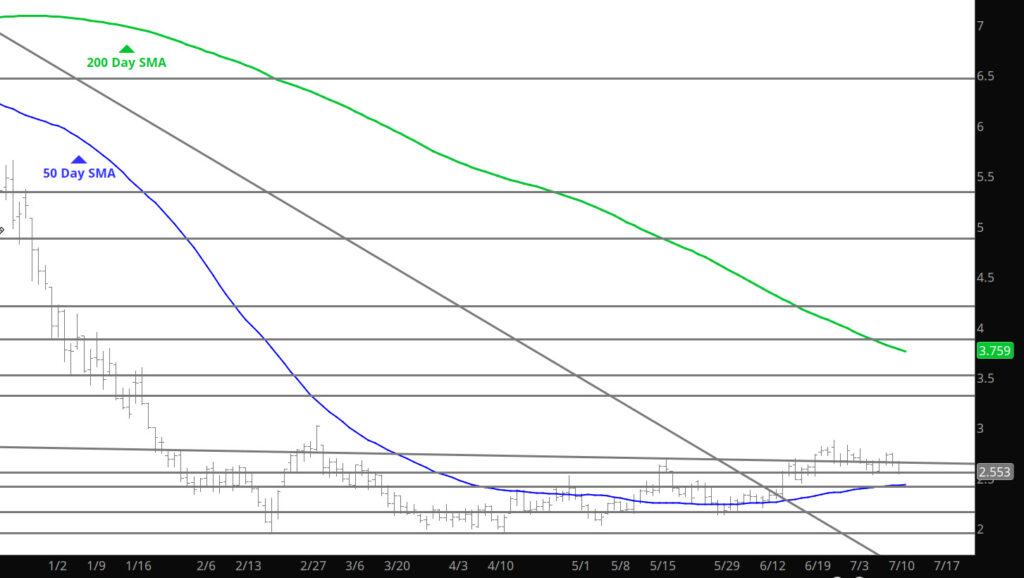

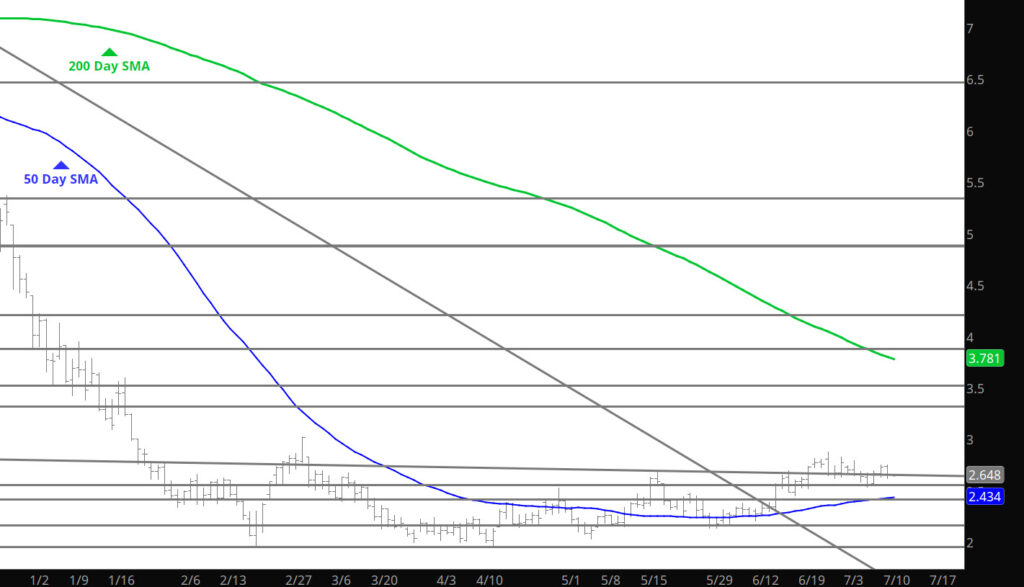

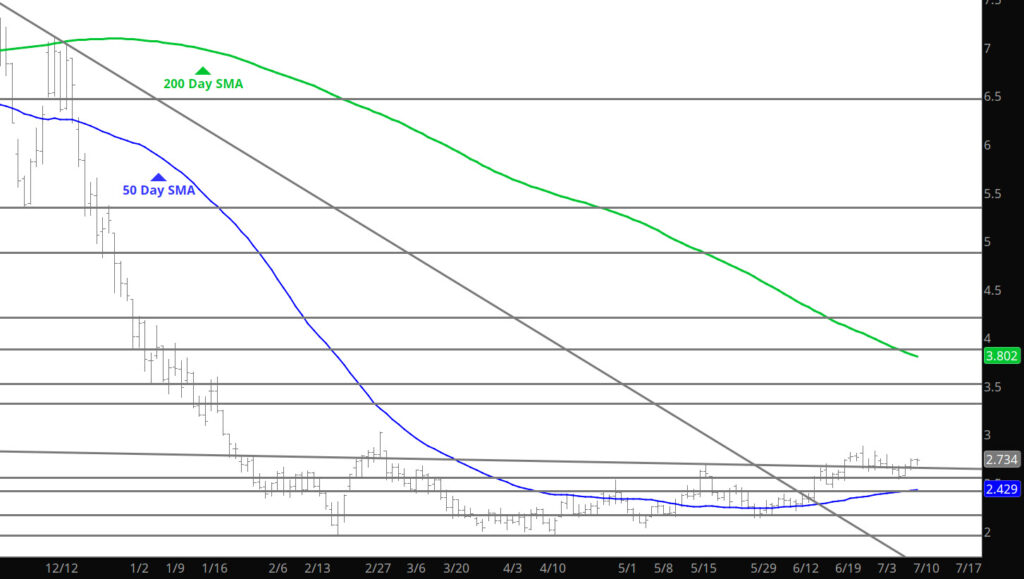

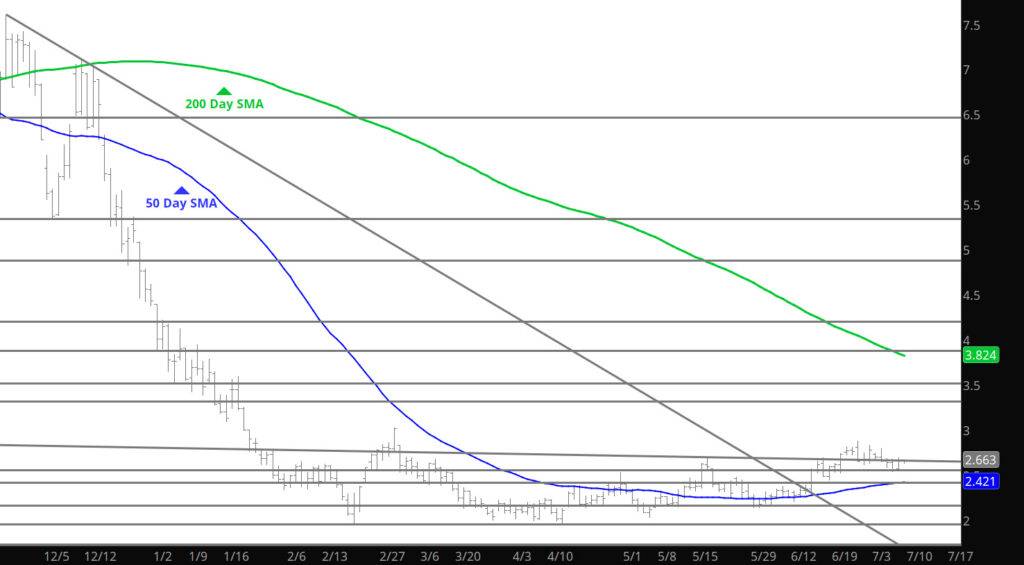

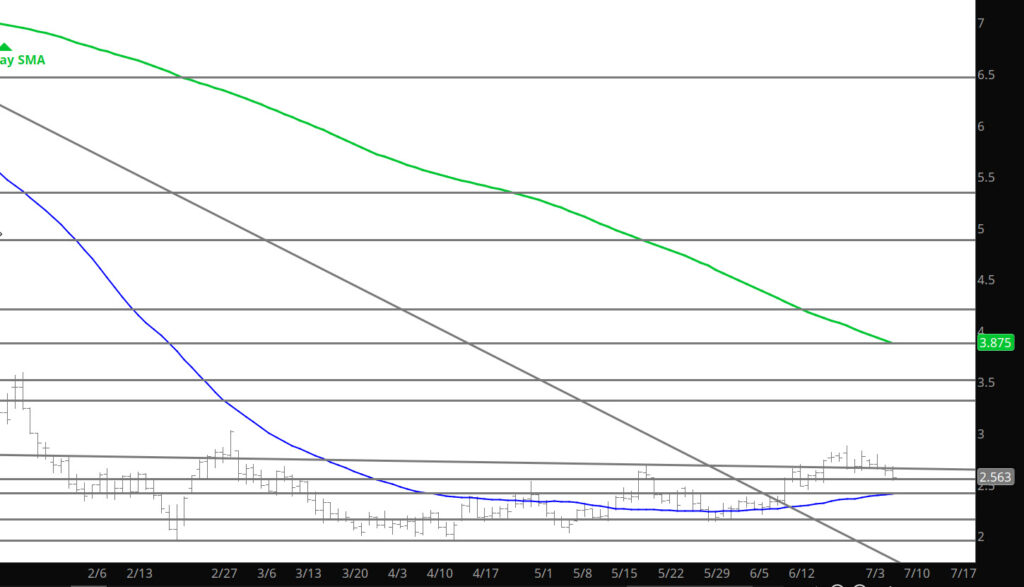

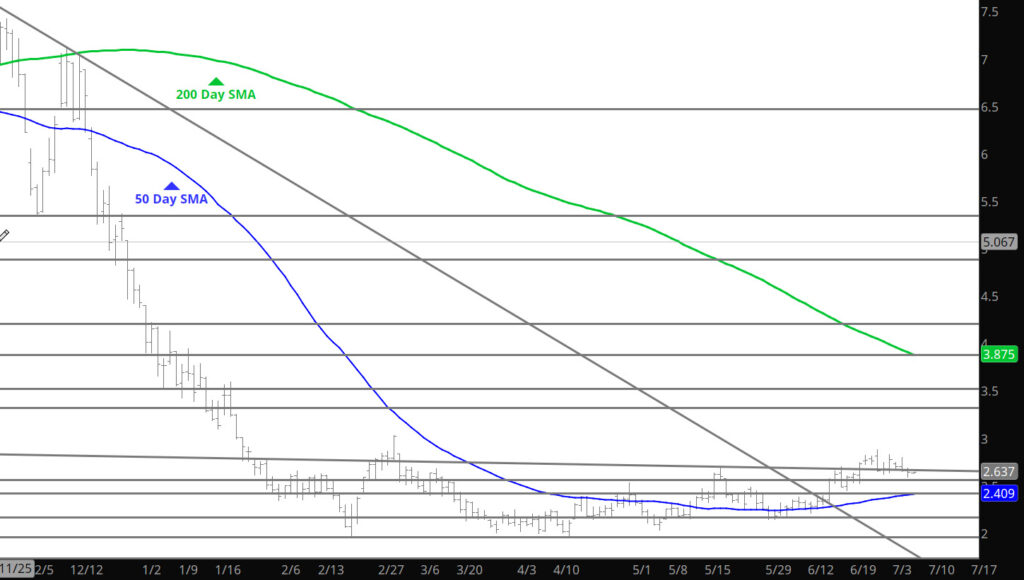

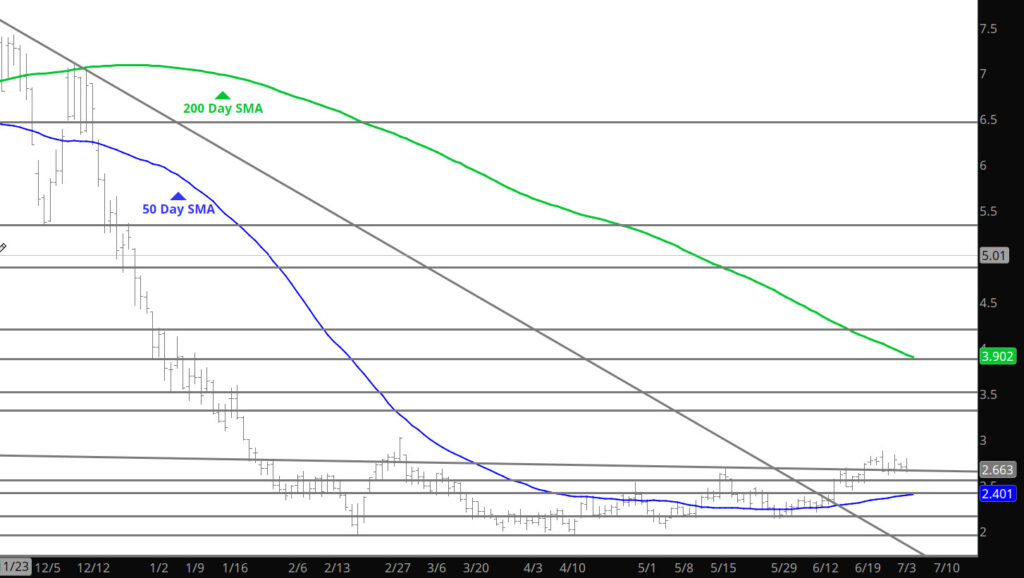

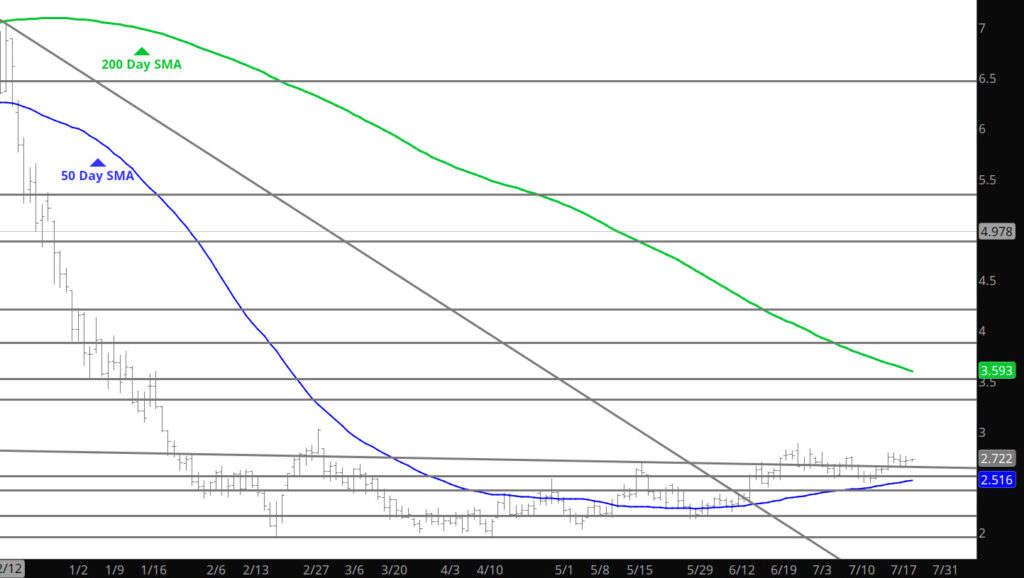

Daily Continuation

Haven’t been able to communicate with you folks for a couple of days, but the market has gone nowhere for the last few days. As we enter expiration, would not be expecting anything different as to the price behavior. Continue with the range trade of the last three weeks.

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support:$2.52-$2.47, $2.38-$2.26, $2.17

Major Resistance $2.816-$2.836, $3.00, $3.536, 3.59