Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

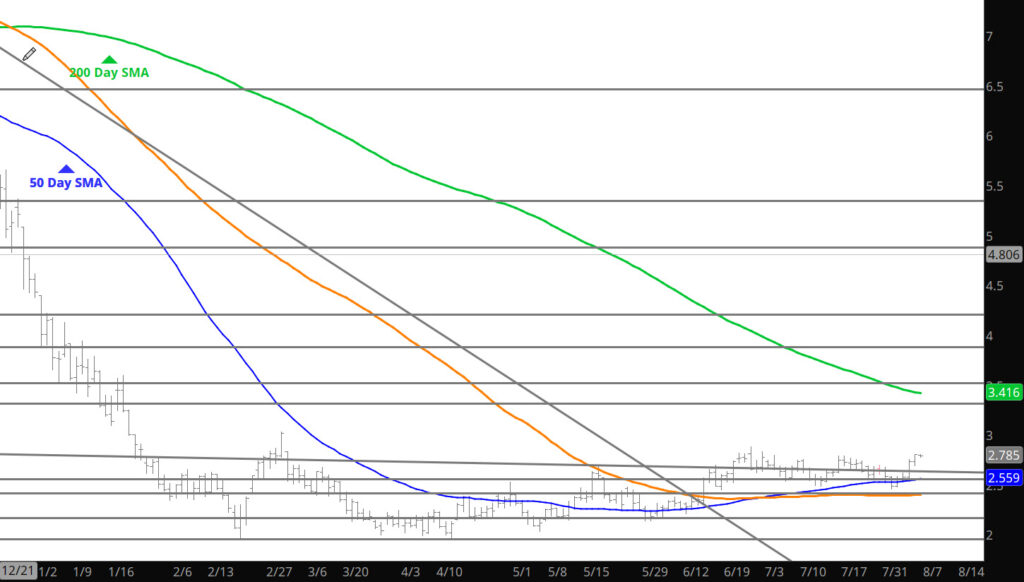

Price Action Decides to Challenge Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

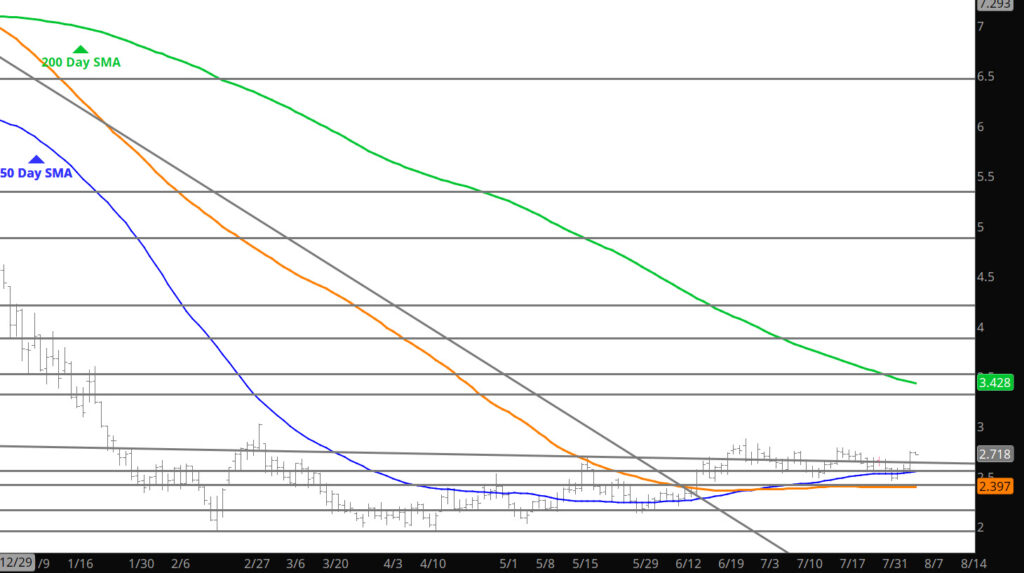

Range Continues to Hold

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Trader Heaven

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

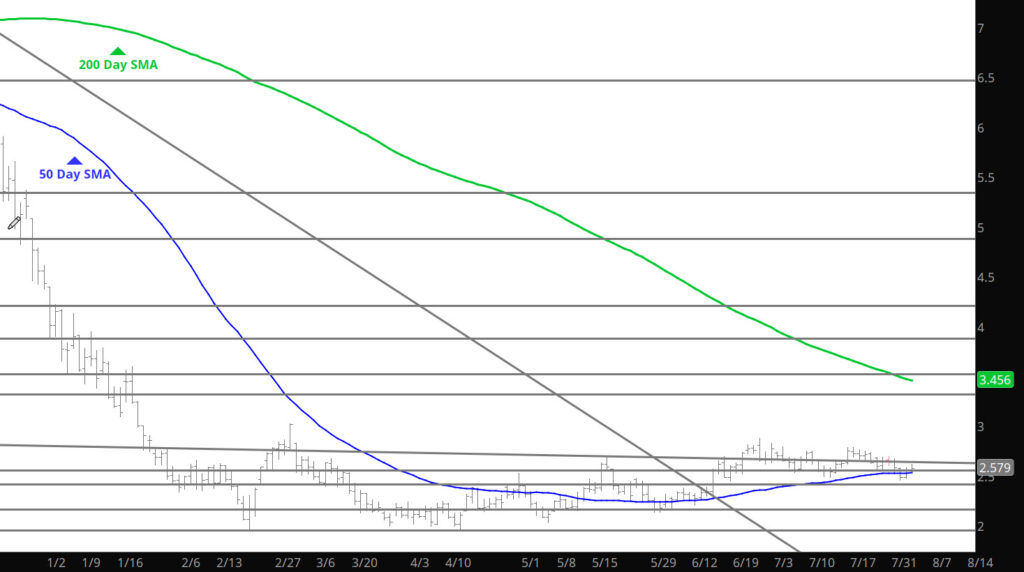

Tests and Closes the Day at Mid Term Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Exciting — Isn’t it

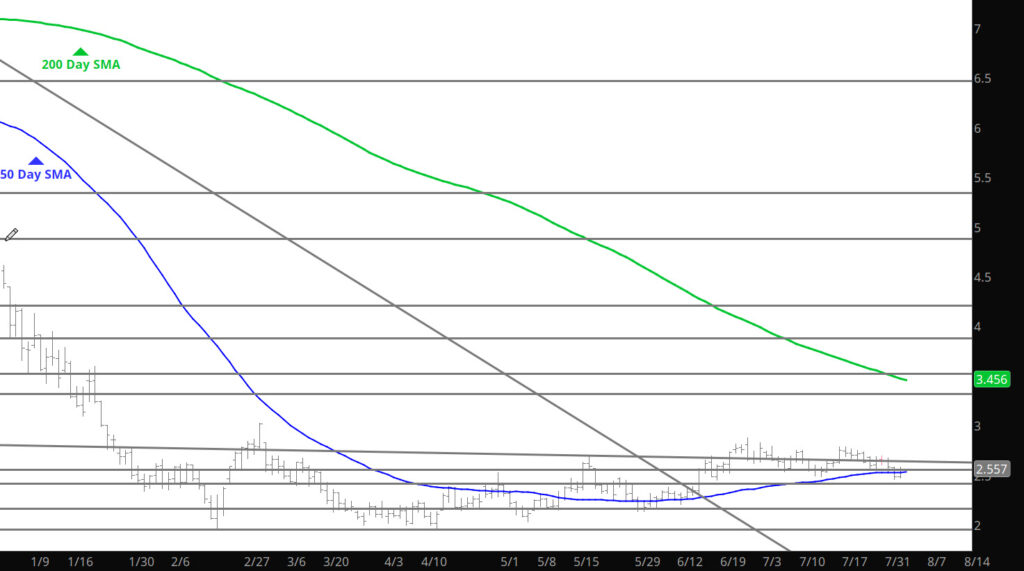

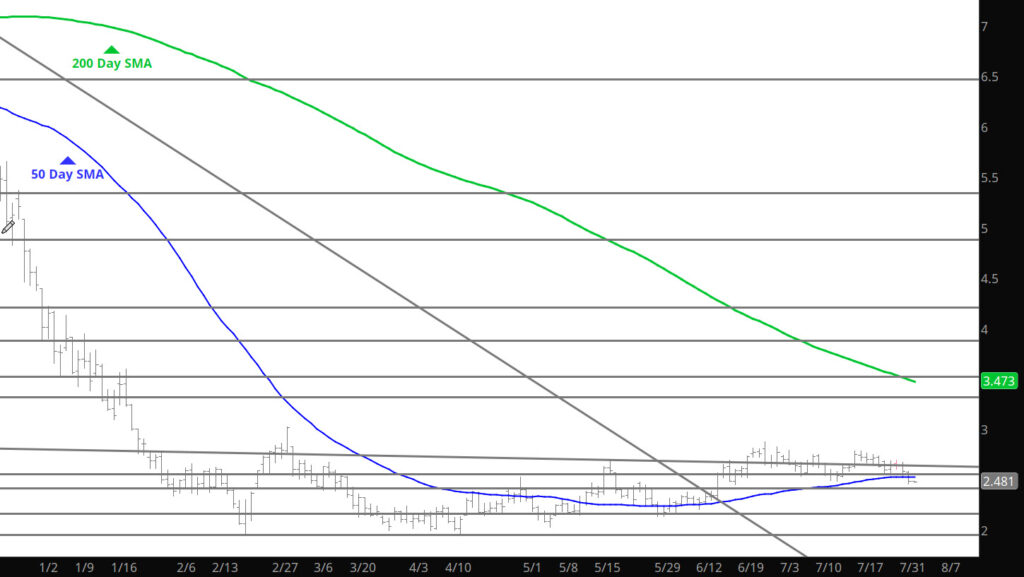

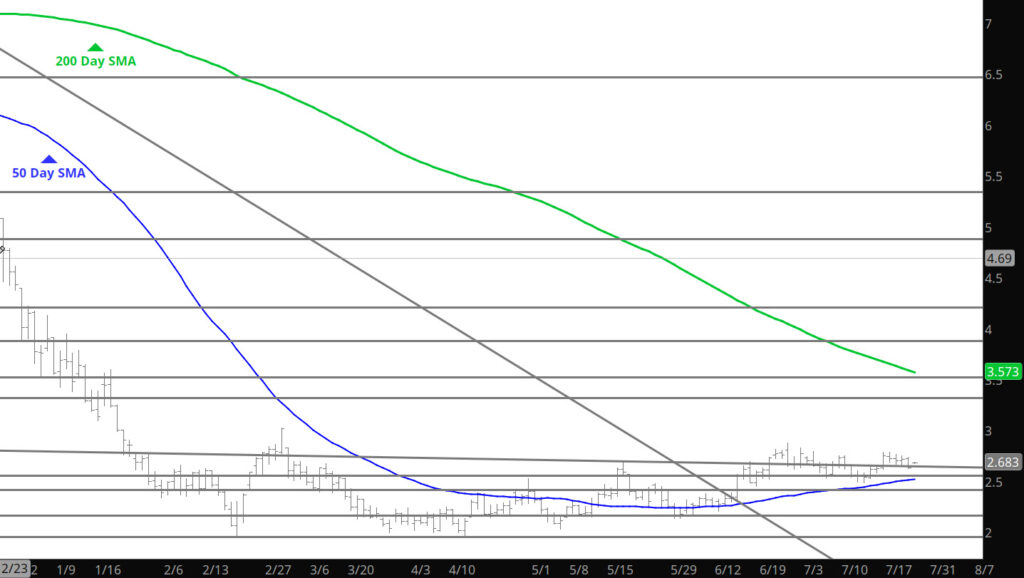

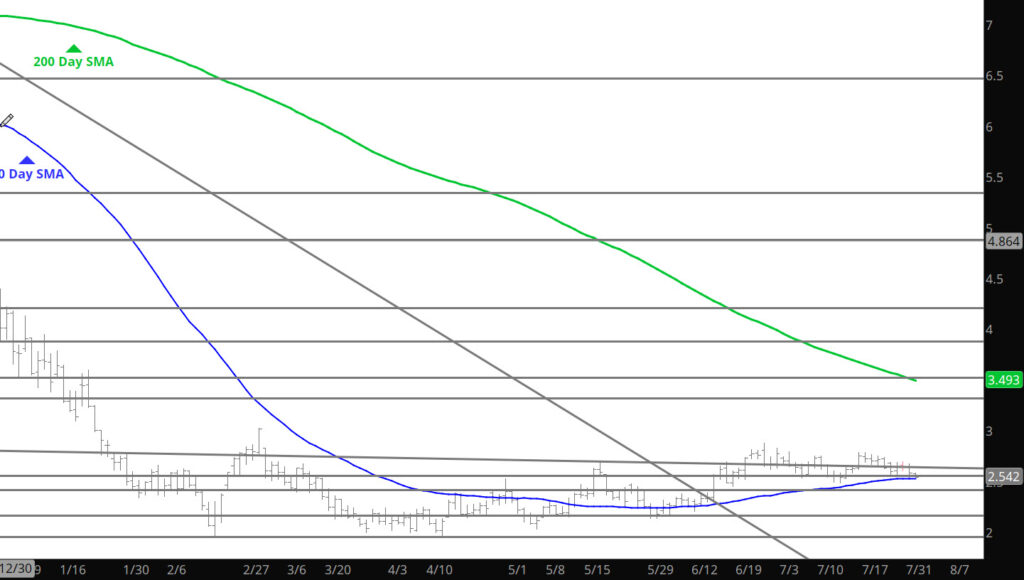

Daily Continuous

Does the concept of watching paint dry come into play here.

Major Support: $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support:$2.52-$2.47, $2.38-$2.26, $2.17

Major Resistance $2.816-$2.836, $3.00, $3.536, 3.59

Going Nowhere at a Turtle Pace

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Daily Market Hitting a Inflection Point

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Weak Expiration and Separation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Little Movement

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.