Category: Daily Call

Where Do We Go — Nowhere

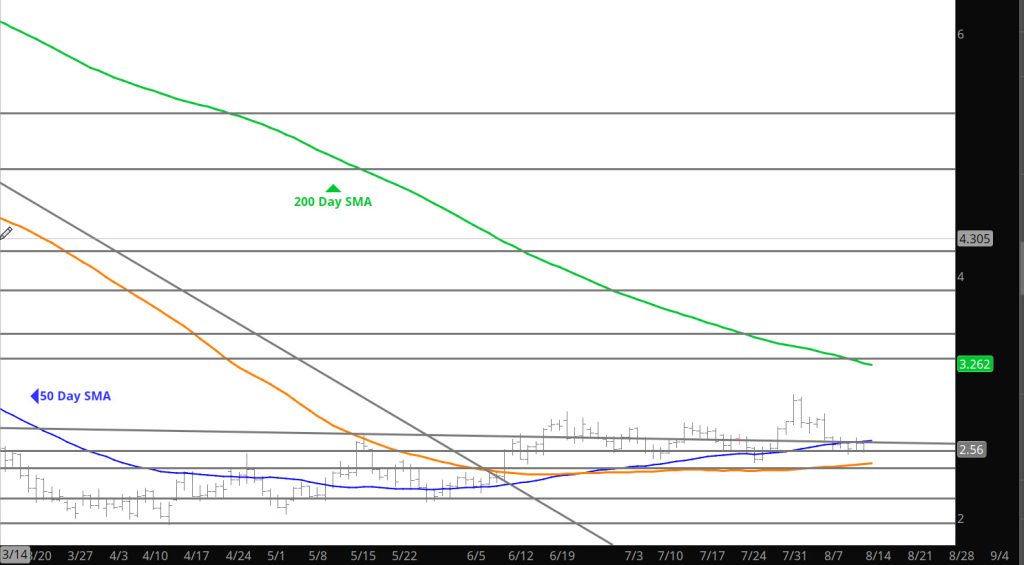

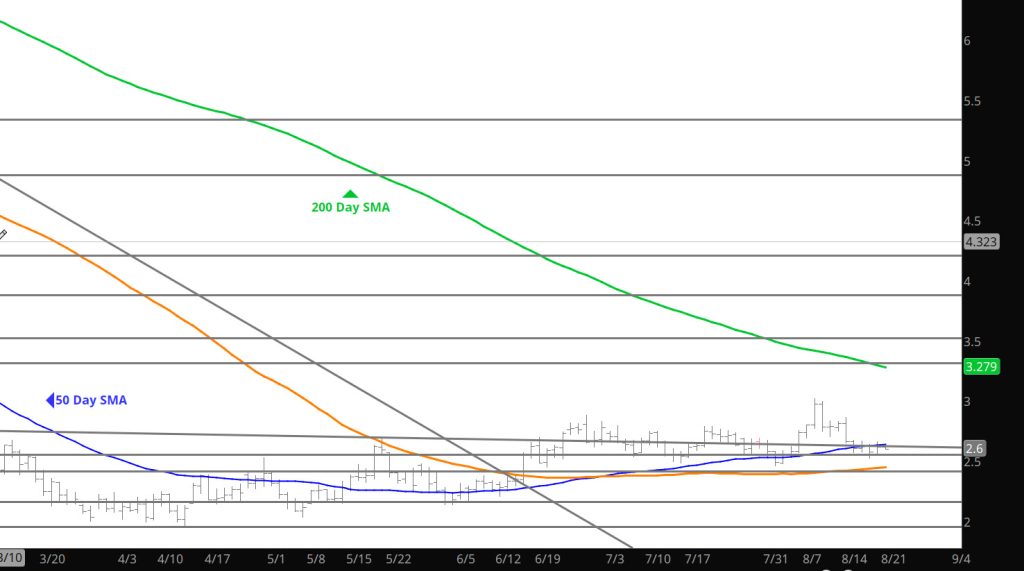

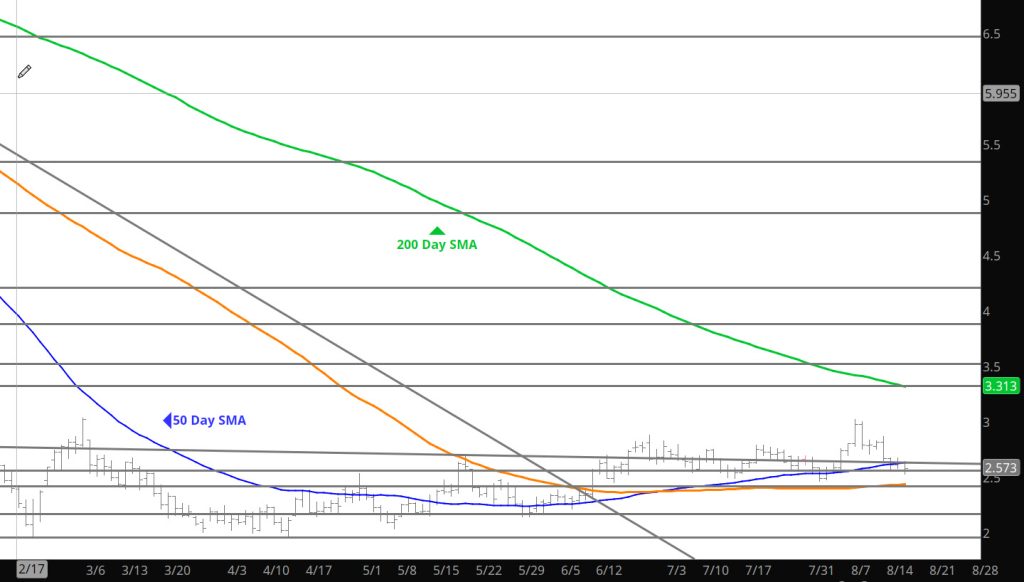

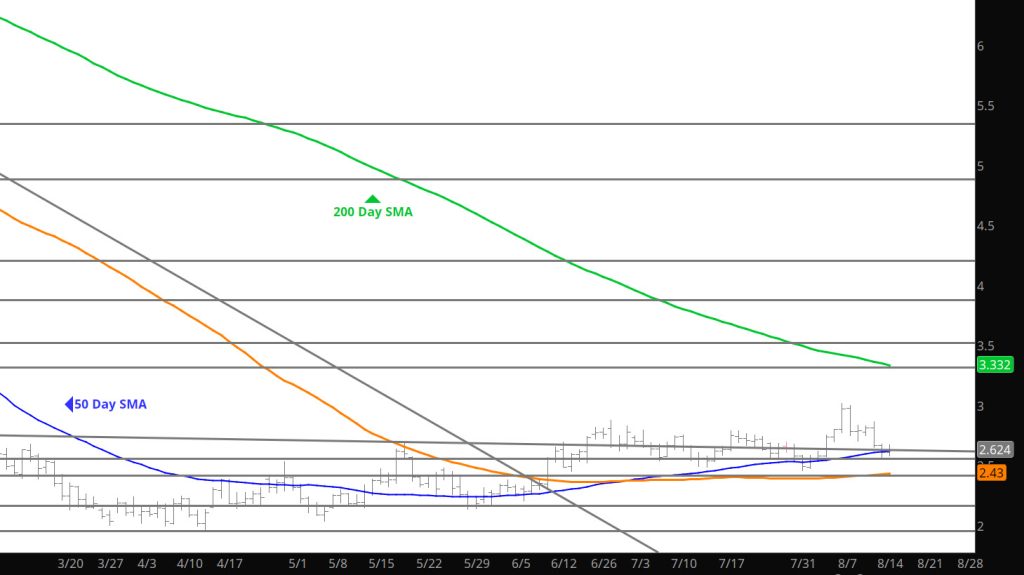

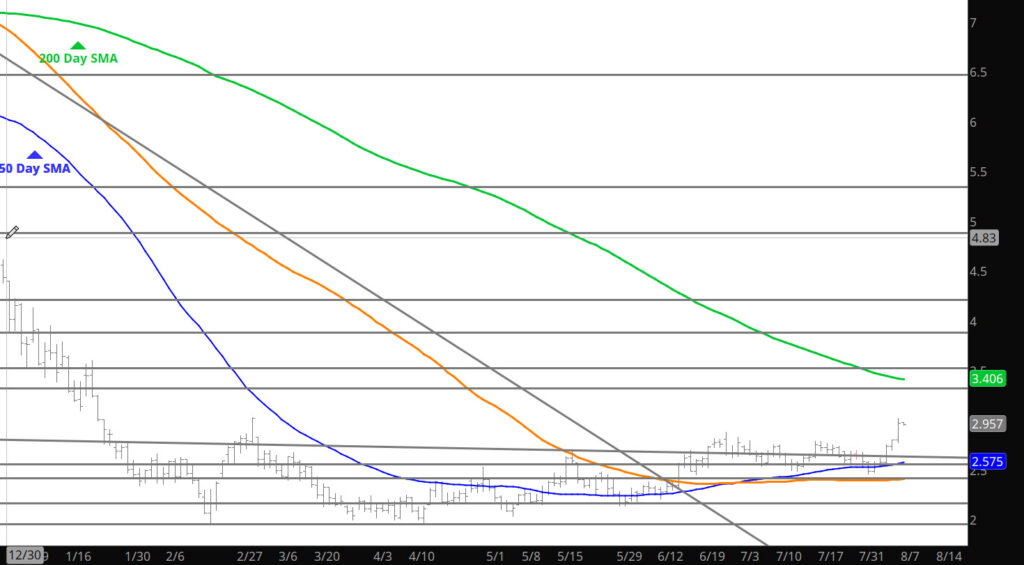

Price Action Declines to Support

Consolidation With In the Range

Declines Extend

OK – Support Zones Tested

Working Through the Kinks

A New Range Likely to Develop

On Cue

Breakout

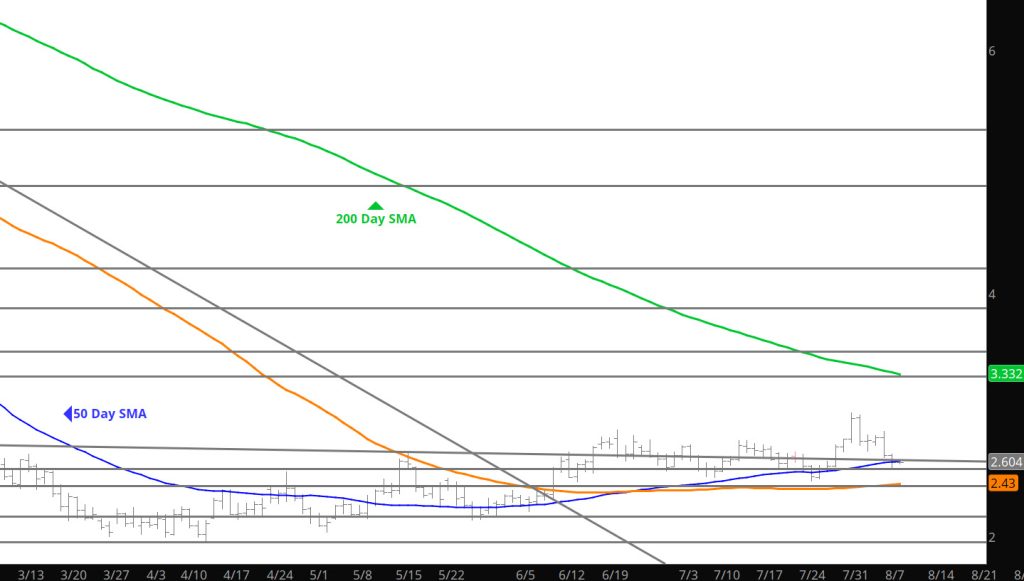

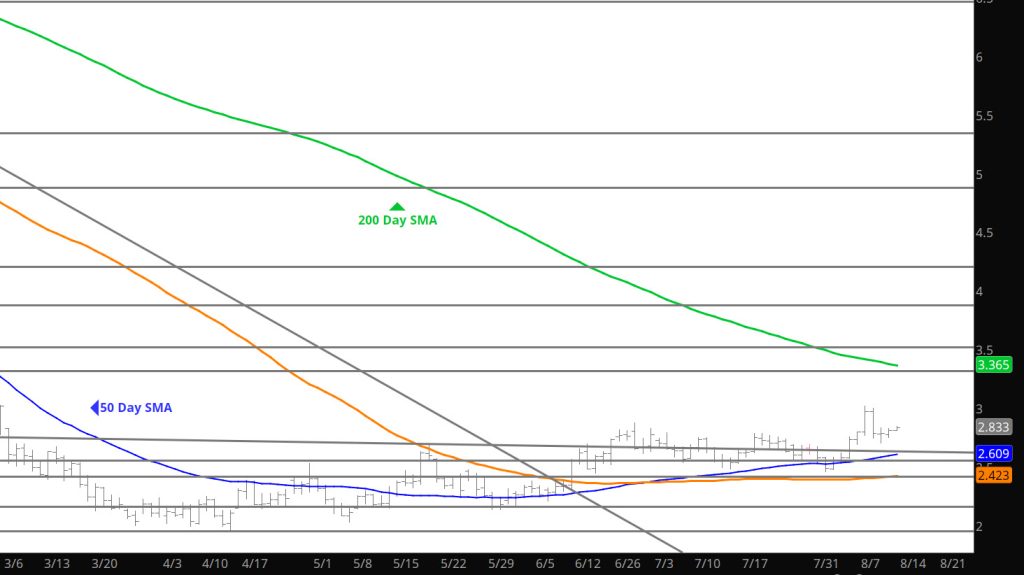

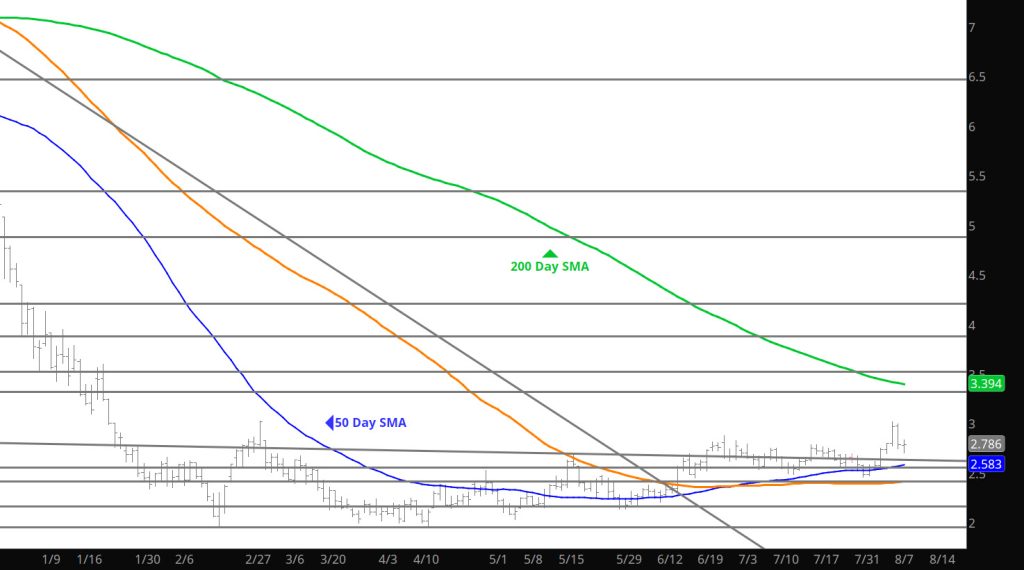

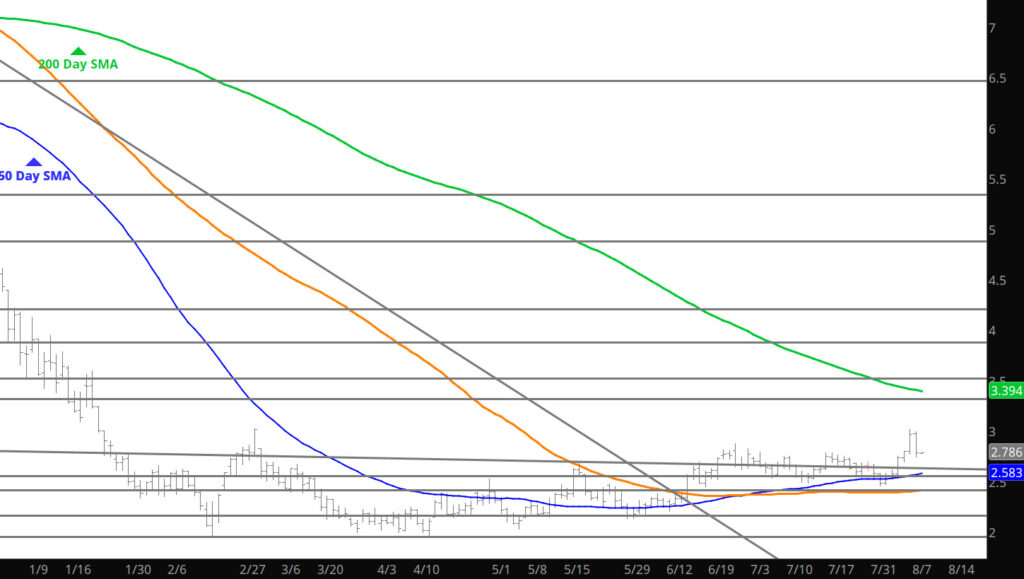

Daily Continuous

A little surprised that the break out to the highs from Feb occurred this early in the September prompt (was expecting it after Labor Day) but perhaps that timing will provide the next leg in the current run. Nevertheless, yesterday provided the proof of what has been suggested here for a couple of months – that a series of higher highs and higher lows, is signalling the gradual demise of the bear market in 2023. What is next — storage report will be interesting to watch what occurs after the gains of yesterday — but my expectation is a retracement of the gains during the trade and a test of support provided by the old range.

Major Support: $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.836-$2.81, $2.38-$2.26, $2.17

Major Resistance $3.00, $3.536, 3.59