Category: Daily Call

Consolidation Off of Declines

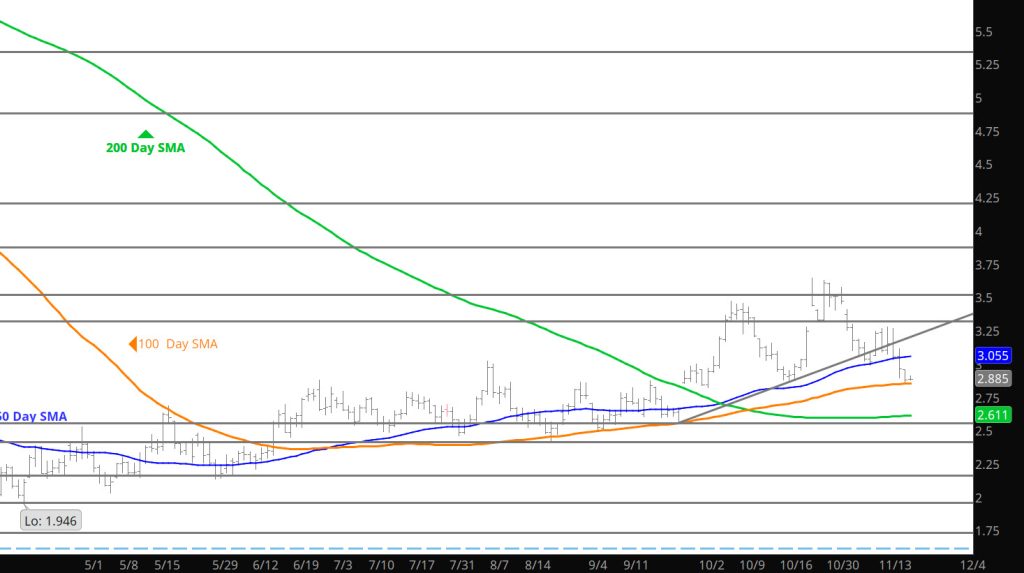

Jan Spot Extremely Over Sold

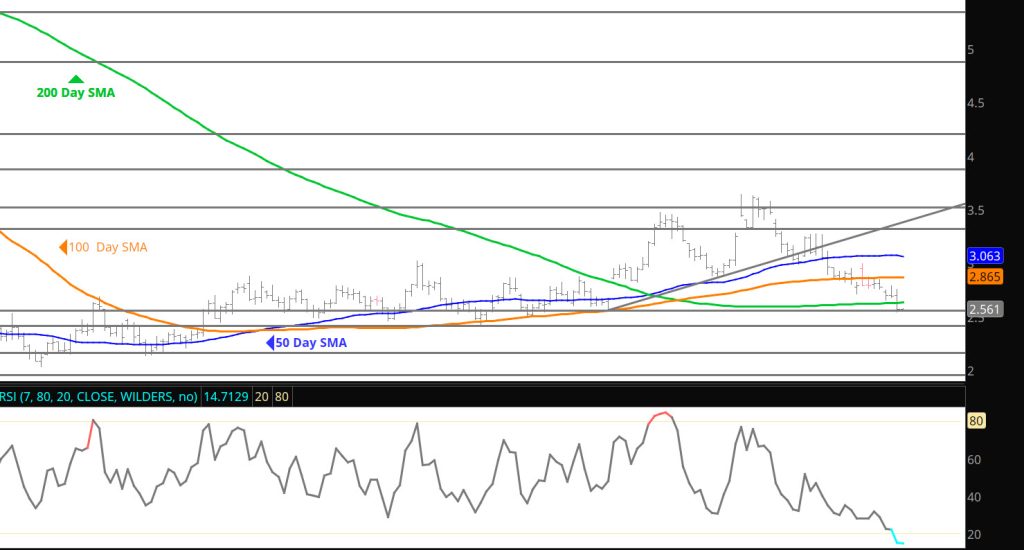

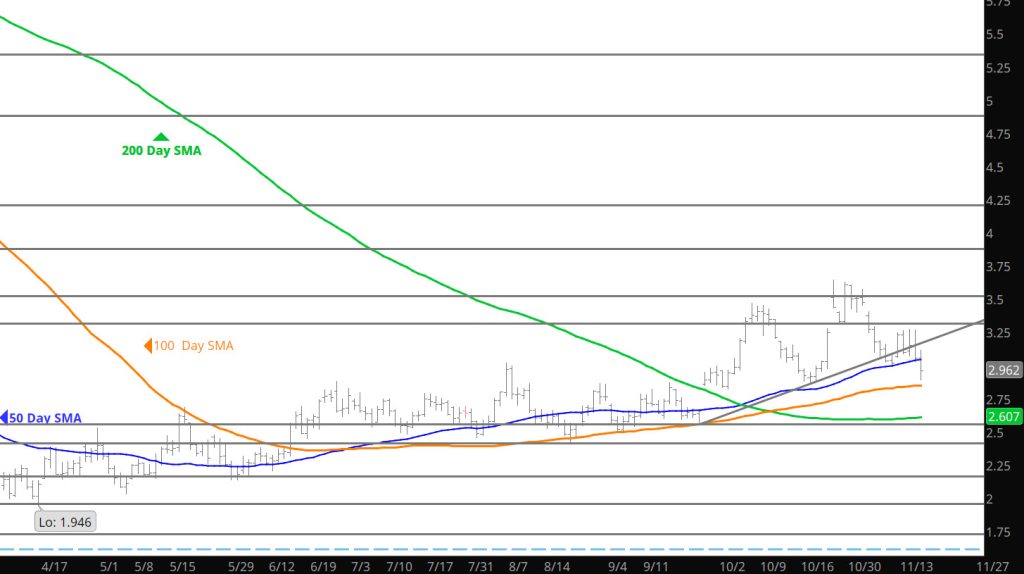

Daily Continuous with RSI

Had some questions yesterday when the market gaped lower on the open when it was over sold. Please remember that technical indications are usually based upon mathematics and one of the common indicators we use is the Relative Strength Indicator (RSI). As you will notice in the chart above — the RSI is approaching the lower level of 20 which indicates over sold. This does not mean it can’t go lower but notice on chart — it doesn’t stay there for long. Look at the chart below which is the Spot January chart which is well below 20 and is considered extremely over sold.

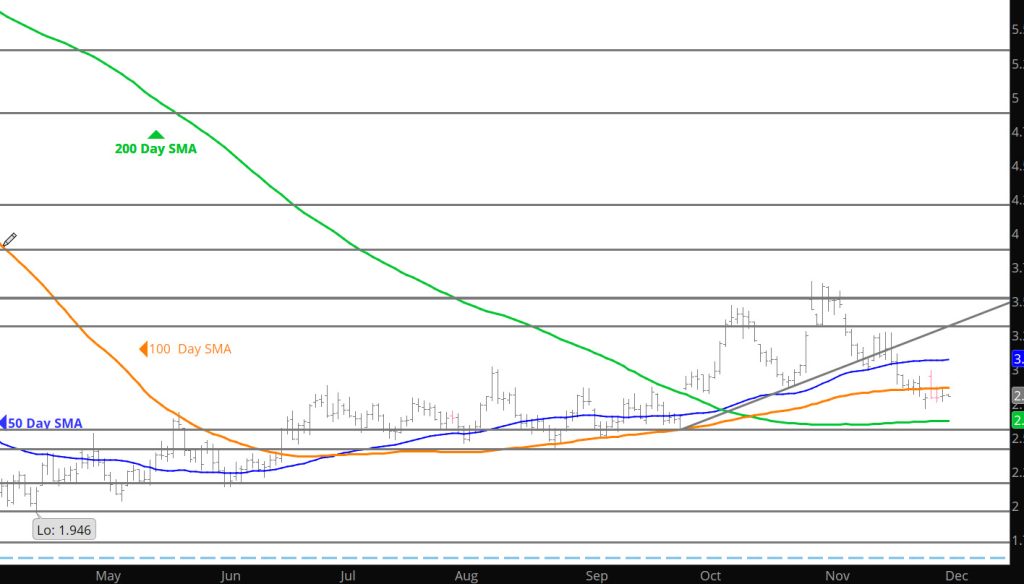

Daily Spot January Contract

Even though the technical indicator is under 20 — does not mean that it can’t go lower but how long it stays there is another question. When markets are extended to extreme levels — they are subject reversals that punish the late momentum players.

Am feeling a little better today and will work on the Weekly tomorrow.

Major Support:$2.74, $2.608, $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $2.68, $2.38-$2.26, $2.17

Major Resistance $3.00, $3.16, $3.48, $3.536, 3.59, $3.65

Down and Down Further

Close But No Cigar Yet

Bearish Extends Closing Jan Premium Expected

Expiration Gap Closed

Bearish

Press Lower

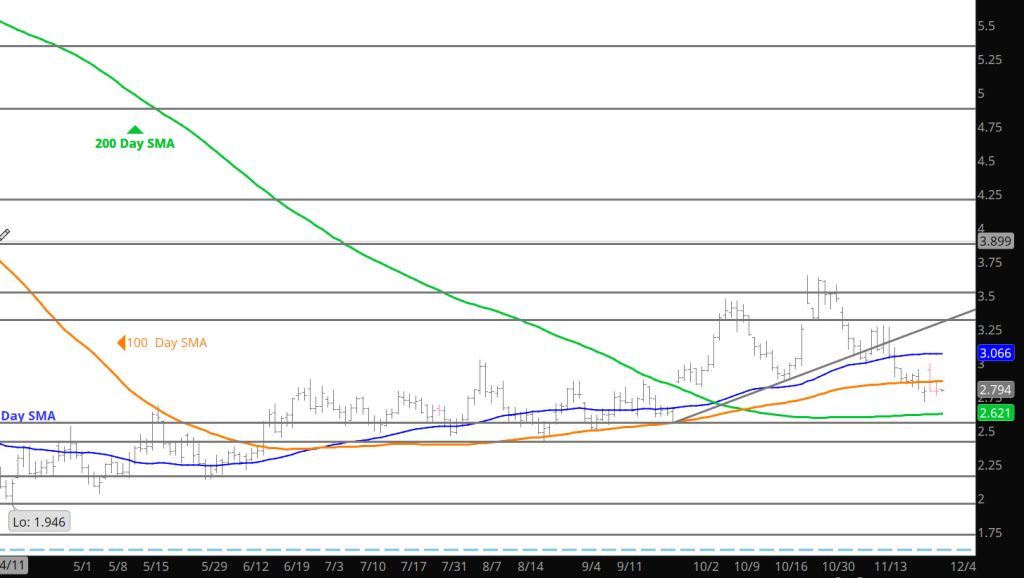

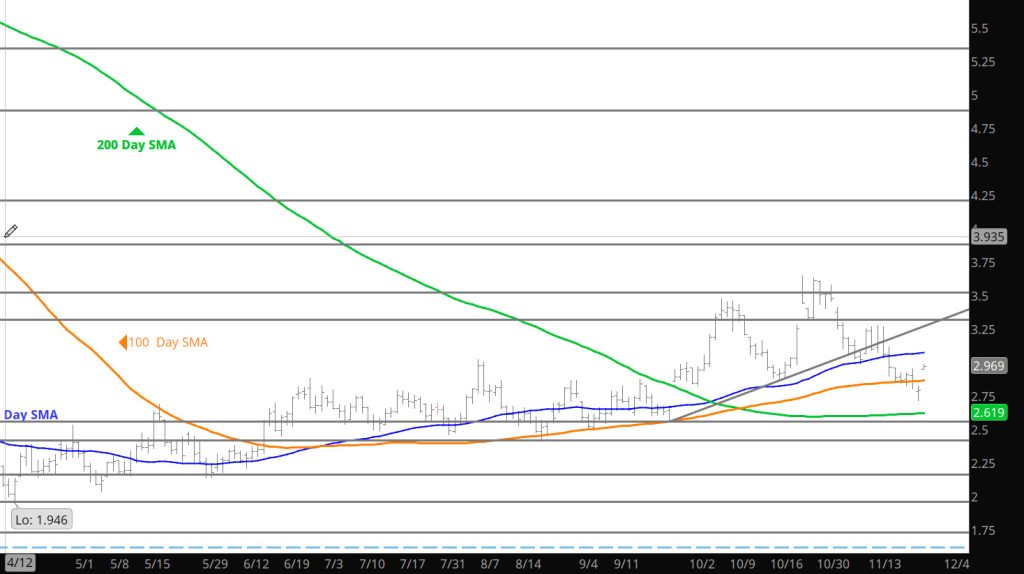

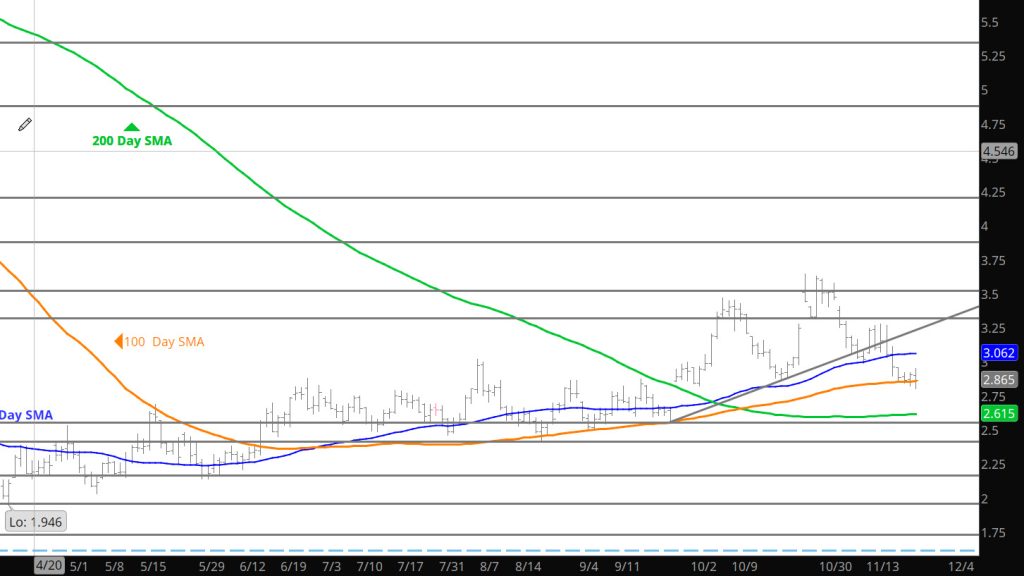

Daily Continuous

As suggested in the Weekly yesterday, prices pressed lower and are now starting to attract the major support areas from the summer (what was resistance is now support). This will be interesting as volume during the holiday week is historically weak and may make the extending the declines easier.

Major Support: $2.98-$3.03, $2.82-$2.78, $2.74, $2.608, $2.47, $2.00, $1.991-$1.96, $1.795-$1.766

Minor Support $3.16, $2.84, $2.38-$2.26, $2.17

Major Resistance $3.48, $3.536, 3.59, $3.65