Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Support Continues to Hold

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Rally –Support at Breakout Holds

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Failure At Resistance — Failure Near Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

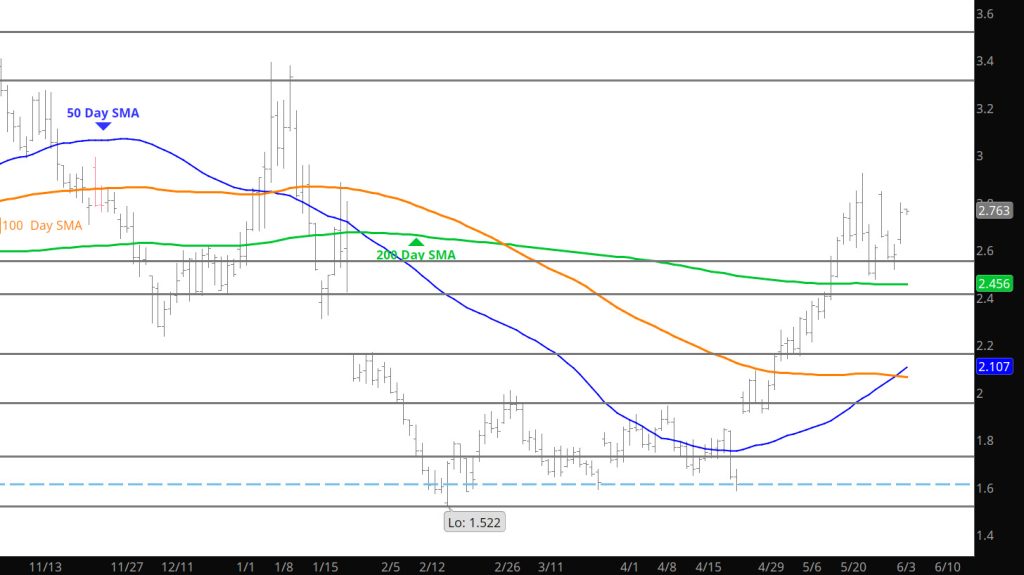

Challenging Levels Not Seen For Months

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Storage Release Creates Decline — Only to Reverse

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Gains Return

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

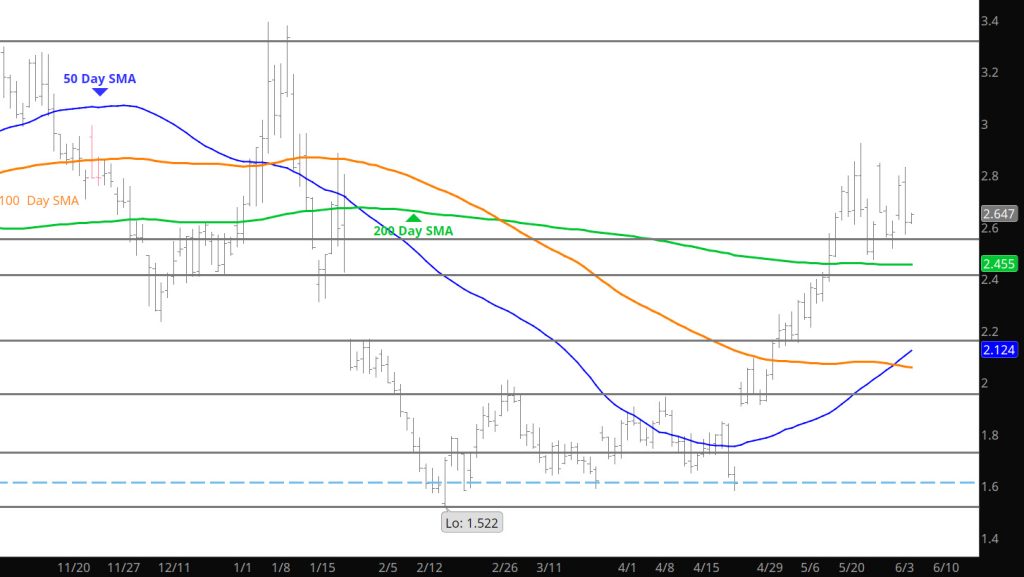

July May Be Setting Up a Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

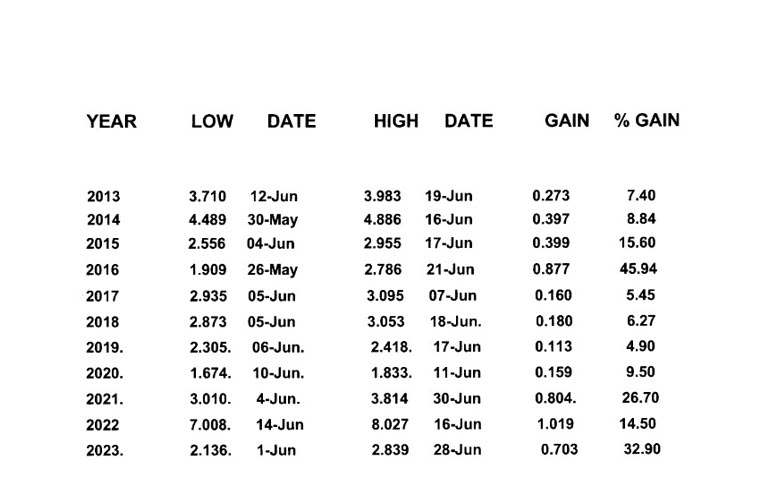

Seasonal Trend Rhymes

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

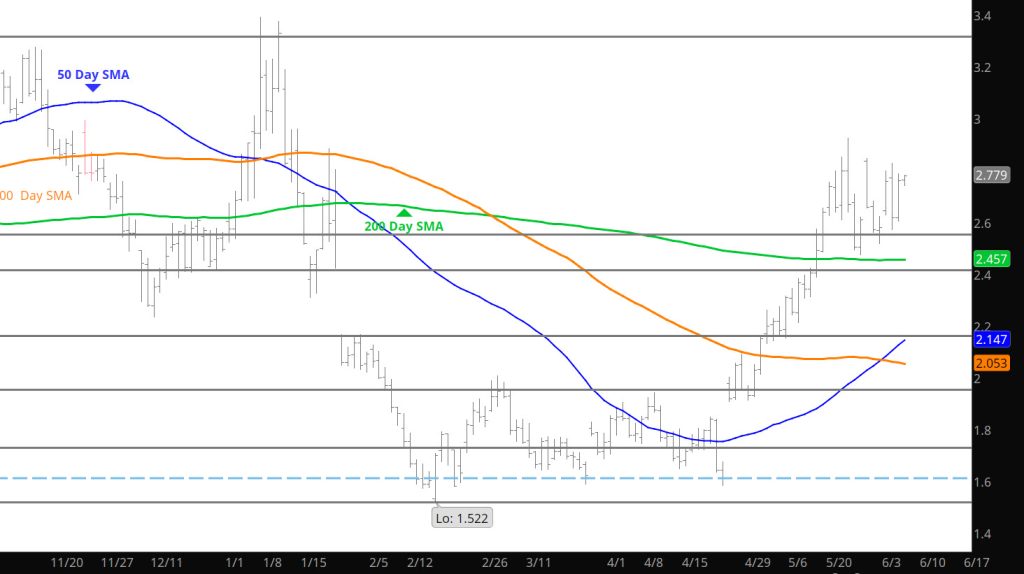

Does History Rhyme

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.