Category: Daily Call

The Premium For August Diminishes

Expiration Trend Continues

No Such Weakness — Yet

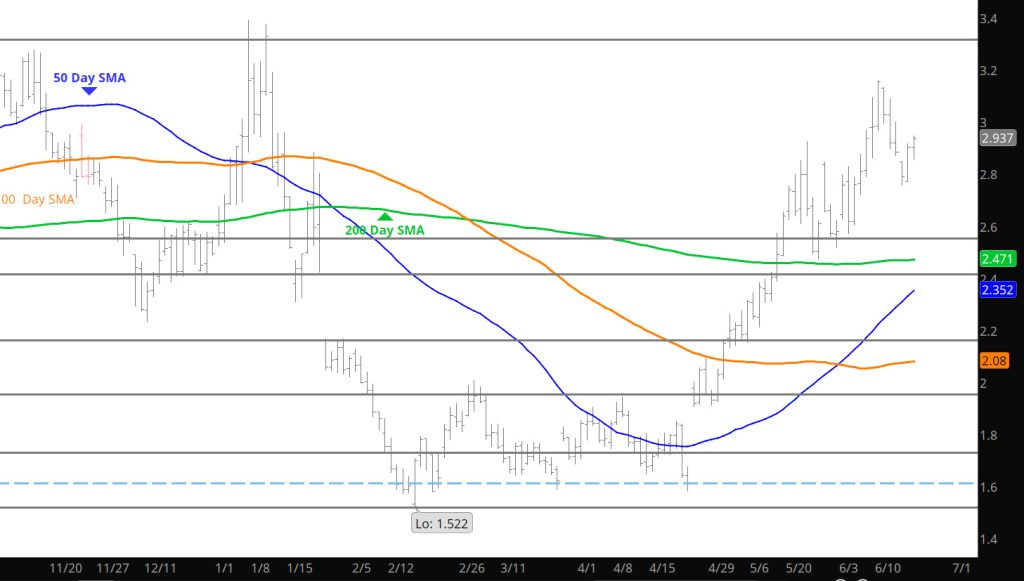

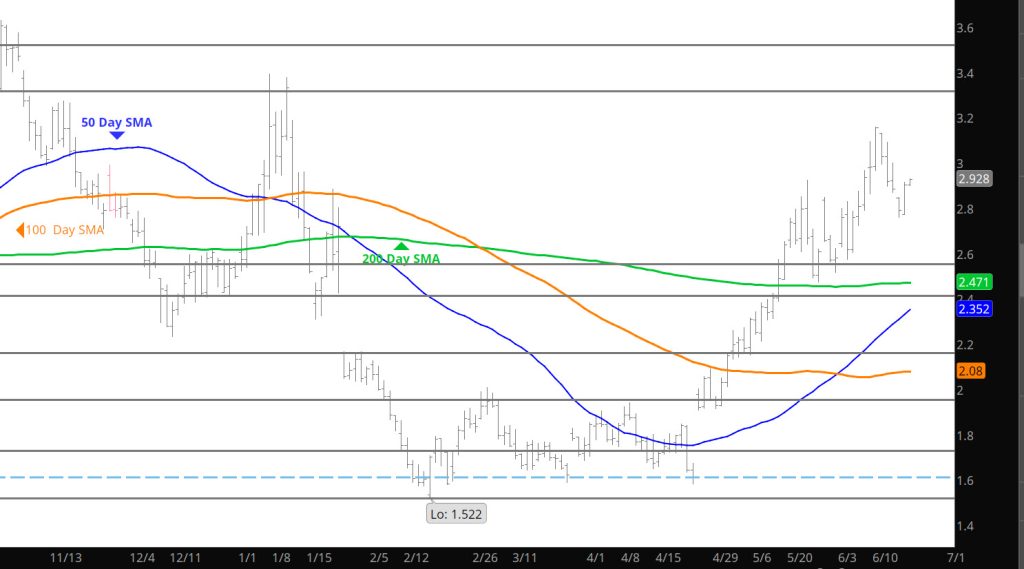

Daily Continuous

Little weakness yesterday as prices firmed after a Sunday night decline. Posting a gain it will be interesting to see if the strength continues through the full expiration process. Discussed the historical aspect of the recent expiration’s in the Weekly section so how the market behaves will provide some insight as to the future of natural gas prices.

Major Support:, $1.595, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.64, $2.448, $2.168, $2.12, $2.00, $1.967- $1.94

Major Resistance: $3.00, $3.16

Expiration Should Bring Weakness

Oops — Got Caught

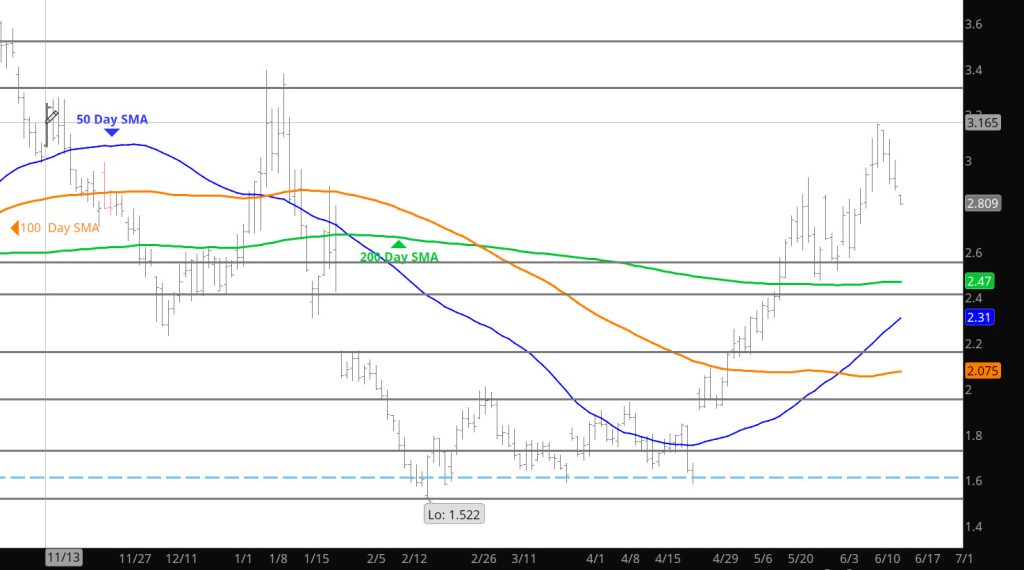

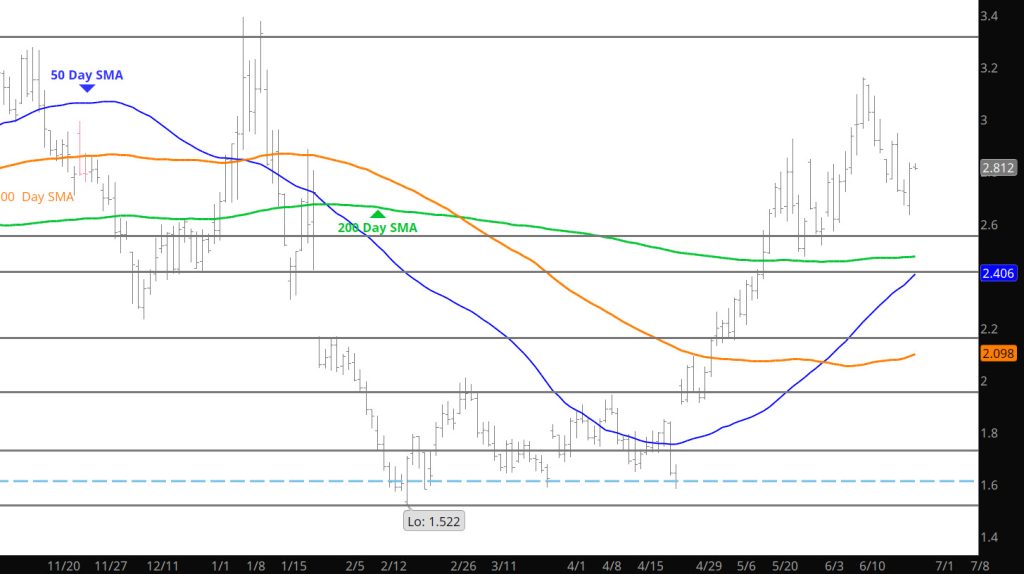

Daily Continuous

Ok, I confess, wrote yesterday’s Daily thinking I would roll it over to today’s — little did I know that prices were going to drop into the low end of the range. — Was not going to update (limited internet sources) but have decided to use my mobile hot spot on the phone. Nothing has changed except that prices declined to the low end of the range regardless of Storage.

Storage release should give us one of two options — if it is bullish to expectations, prices are likely to test the double top of the July contract seen below:

Daily Prompt July Contract

On the other side of the expectation potential will be a bearish report sending price back to the low of the July trading range (down to $2.70-$2.50).

Major Support:, $1.595, $1.52-$1.511, $1.481, $1.312

Minor Support : $2.944, $2.64, $2.448, $2.168, $2.12, $2.00, $1.967- $1.94

Major Resistance: $3.00, $3.16