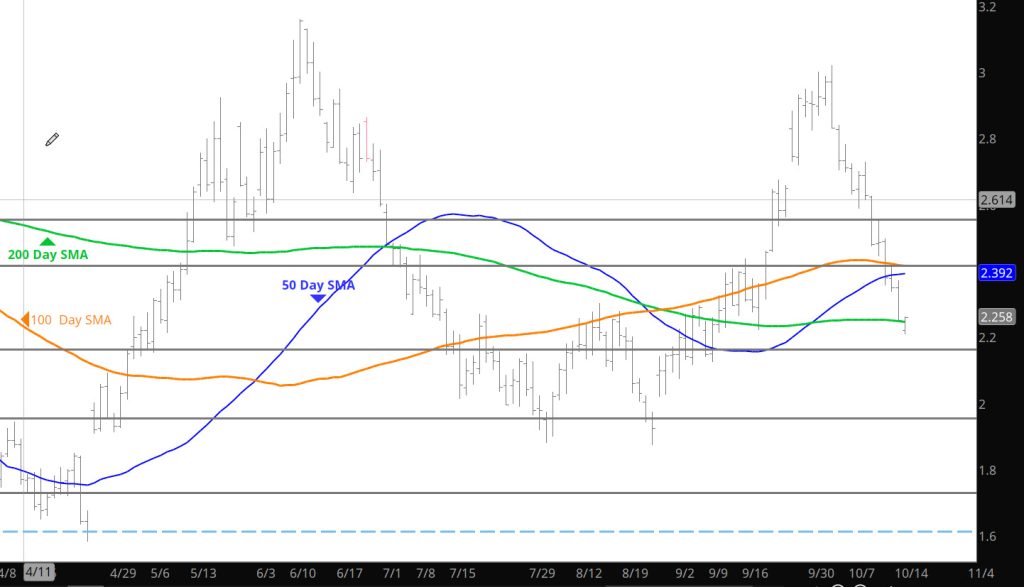

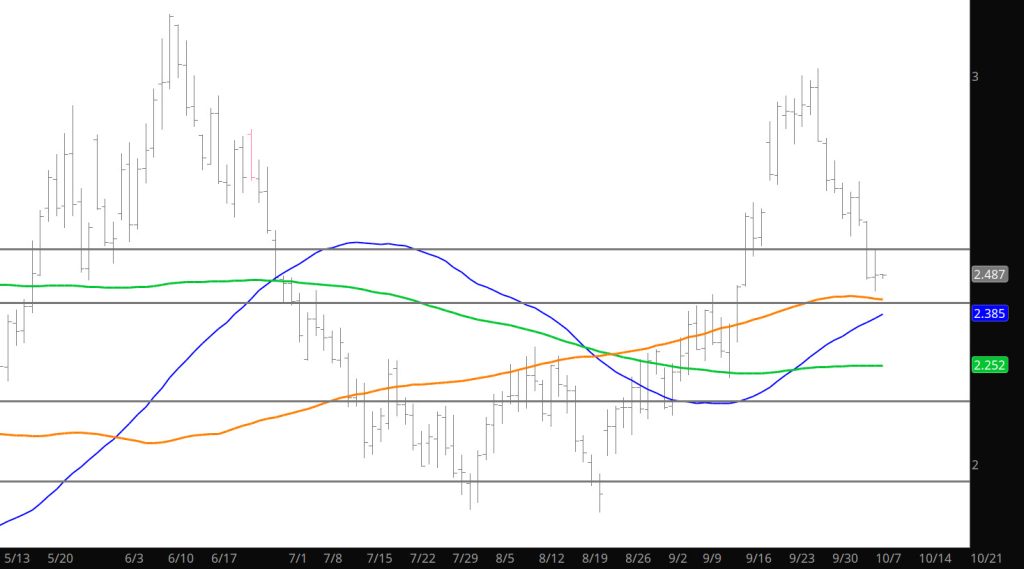

Category: Daily Call

Running Out of Stimulus

Consolidation Continues

Daily Continuous

Not much more to add from yesterday–that said if the market is going to be range bound for the near future then the concept of selling premium at the lows or the rallies come into focus.

Major Support:, $2.35, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $1.856,$1.89-$1.856

Major Resistance: $2.63, $3.00, $3.16

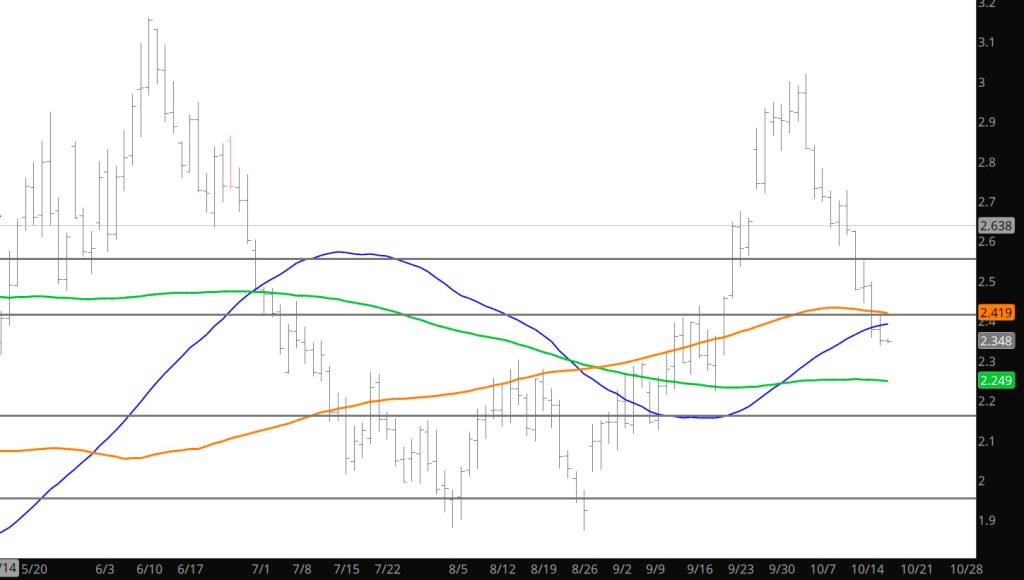

Now Consolidation at the Lows

Daily Consolidation

Just as the market consolidated the gains around $2.90 for a few says — the market is likely to consolidate the losses not between $2.40 and $2.55. All part of a range trade discussed in the Weekly.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance: $3.00, $3.16

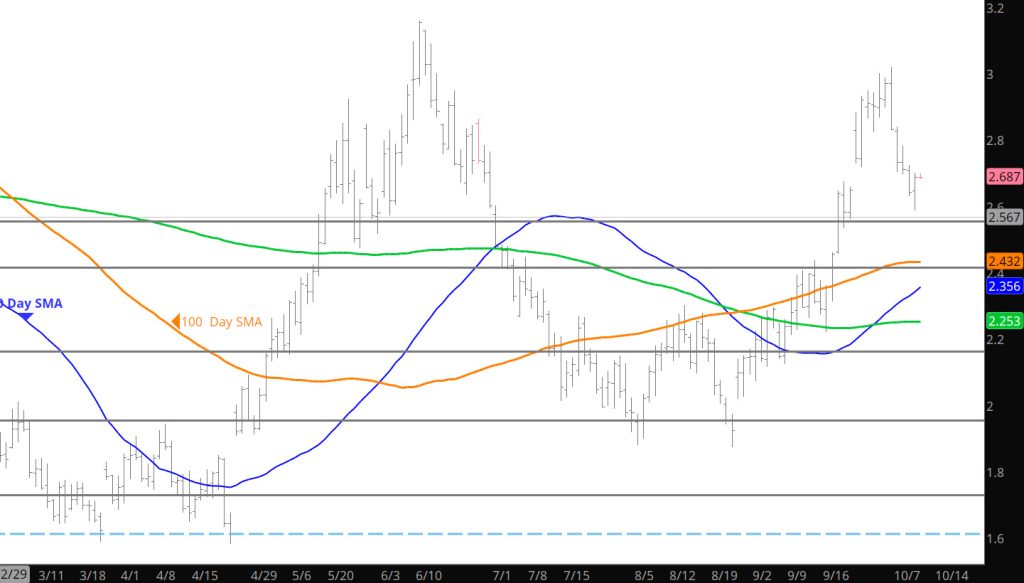

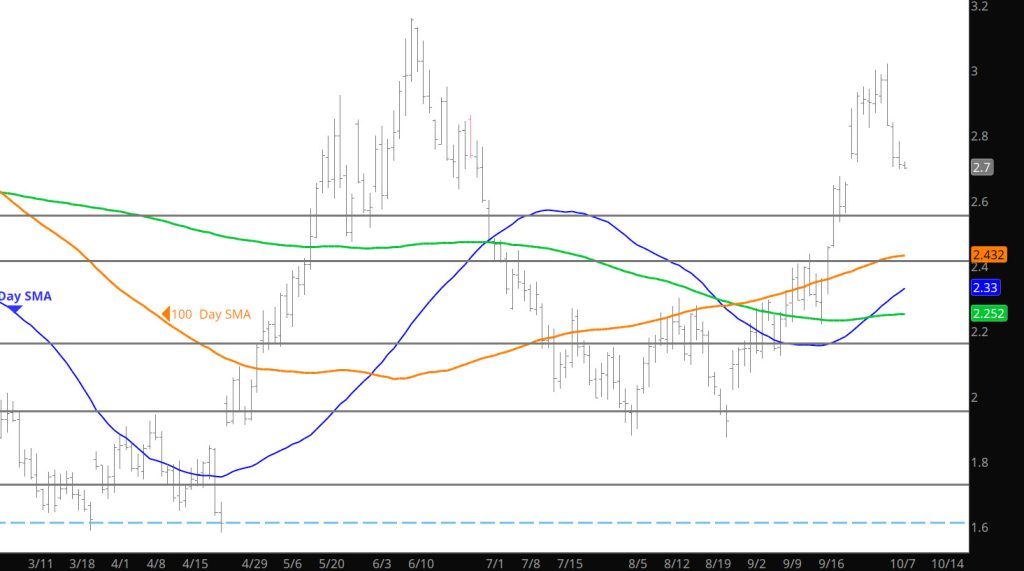

Weekly Closing at Lows

Weekly Continuous

Glad to have the Holiday, as if I would of published on Monday due to the market close from last Friday– I would have missed the additional $.13 loss that happened in the light volume trade yesterday. Prompt gas fell with increasing volume to and through the gap to support. The “bounce”, such as it was, came from support and it wasn’t much of a bounce. November failed at first resistance, the “outside” day reversal low November traded on 09/26. Reversing again from that resistance with significantly less volume left the prompt below its 50 – day SMA and likely set the stage for a test of support at a lower price level.

The failure left a fourth lower high. The first was in November ’22, which was lower than the August ’22 counter seasonal high; the second was the October ’23 Q4 high. The third was in January, the fourth last week. Unless/until prompt gas conclusively breaks from that pattern, the technical presumption is that declines and failure at the resistance zones will continue. It also is likely to effect the premium afforded to deferred/distant deferred contracts as they will dissipate as their maturity dates draw nearer

After gaining $.313 over the two weeks ending 09/27, November declined $.270 over the next ten trading days. From its close on 09/12 until Friday’s close November is exactly $.001 higher. Despite extension of the Q4 rally to the October 4th high at $3.019 that is not a characteristic of a continuing bull market. The deferred months, which all had gained modestly previously (while November ended lower) the deferred contracts gave up the lion’s share of gains from their August/September lows.

The consensus of technical indicators, which moderated somewhat last week continued to deteriorate. The continuation weekly RSI, which two weeks ago ended within its historical EXTREME zone is negative and not yet oversold. The daily RSI, which showed a confirmed bearish momentum divergence at the highs remains negative and still above its extremely oversold zone. Average daily volume increased significantly as prompt gas fell. Total open interest fell along with price, which is at least a mild technical positive. As mentioned last week, it is interesting that the total number of contracts outstanding is almost the same as at the beginning of August. My guess is that suggests that there is no real conviction on the part of longs or shorts…which is characteristic of prices remaining in a definable range.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance: $3.00, $3.16

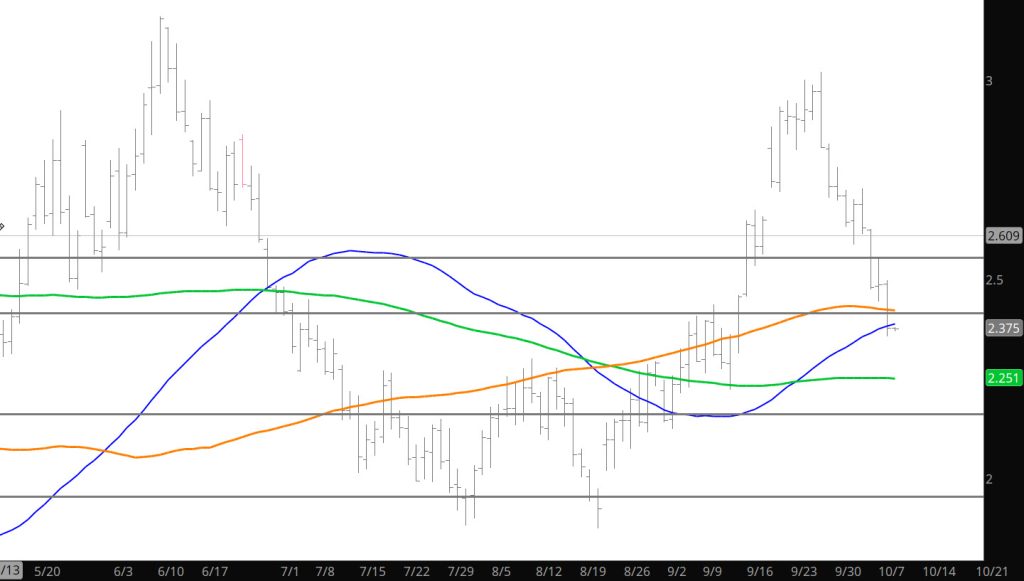

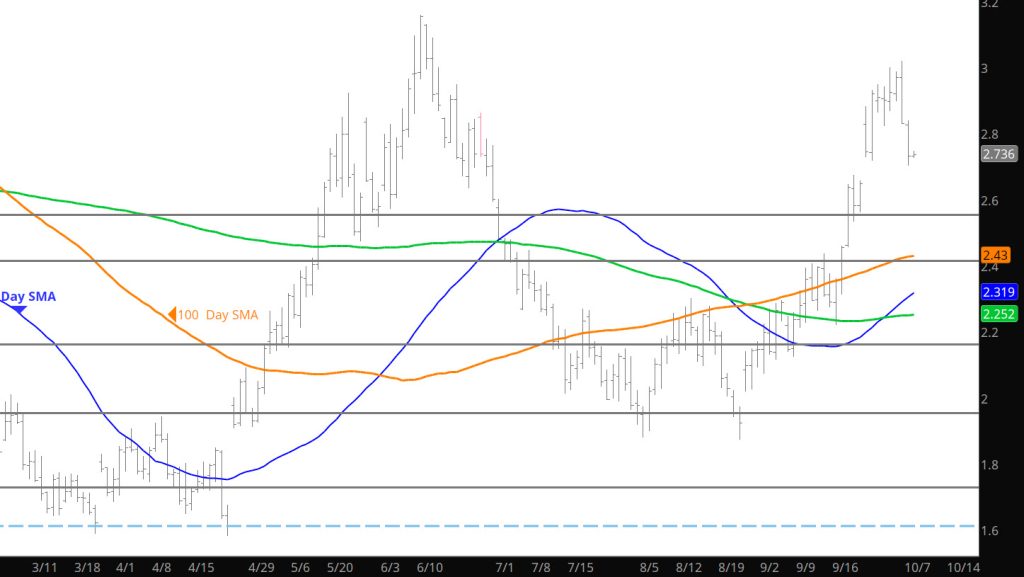

Light Holiday Sends Prices Testing Major Support

Daily Continuous

Was going to send out a Daily yesterday before I remembered it was a Holiday– glad I didn’t as I would of missed the additional $.14 decline that sent price down to a key medium support zones: the September low of November gas, $2.439; 38.2% retracement of the rally from the August low and 50% retracement of the rally from the April low, $2.432 –$2.438; the continuation 20 – week SMA, $2.418. That will provide significant support for prices in the near term. The upside remains $2.68-$3.00.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance: $3.00, $3.16

Intra-Day Whip

Expiration Differential Closed

Daily Continuous

Not shocking that the declines extended to close the expiration gap left from Oct’s expiration — but now how committed is the selling to test further areas of support. Not surprised to see the declines occur when the storage release comes out as it should give some the ability to cover (volume) or profit (volume). Lasting effects will have to wait until the open on Tuesday.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.62, $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance: $3.00, $3.16

Very Slight Expansion to the Downside

Daily Continuous

Prices tried to expand the low side of the recent range but did not challenge the major support starting at $2.64. Suggest the same range as last week.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.62, $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance: $3.00, $3.16

Still Lookin’ Outside the Range

Daily Continuous

The market failed at resistance and now wants to challenge the support side of the recent range between $2.58-$2.64 we shall see how much the market adds to the positions in the coming days. Keep and eye on daily volume levels over the next couple of days — lets see how many folks want to sell into Nov prices this early in the month.

Major Support:, $2.112, $2.026-2.00, $1.991, $1.93 ,$1.642, $1.605

Minor Support : $2.62, $2.507-$2.44, $1.856,$1.89-$1.856

Major Resistance: $3.00, $3.16