Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

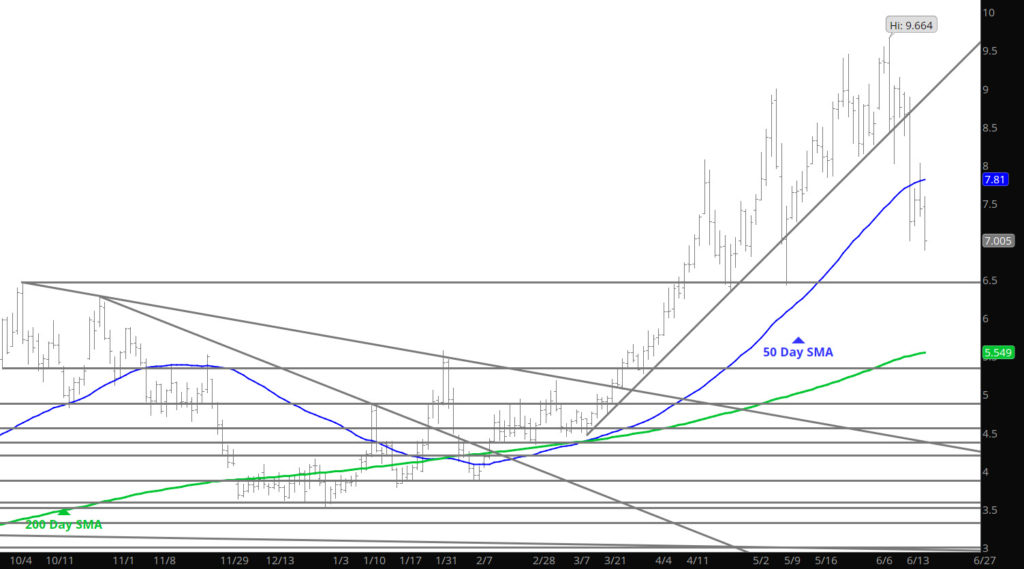

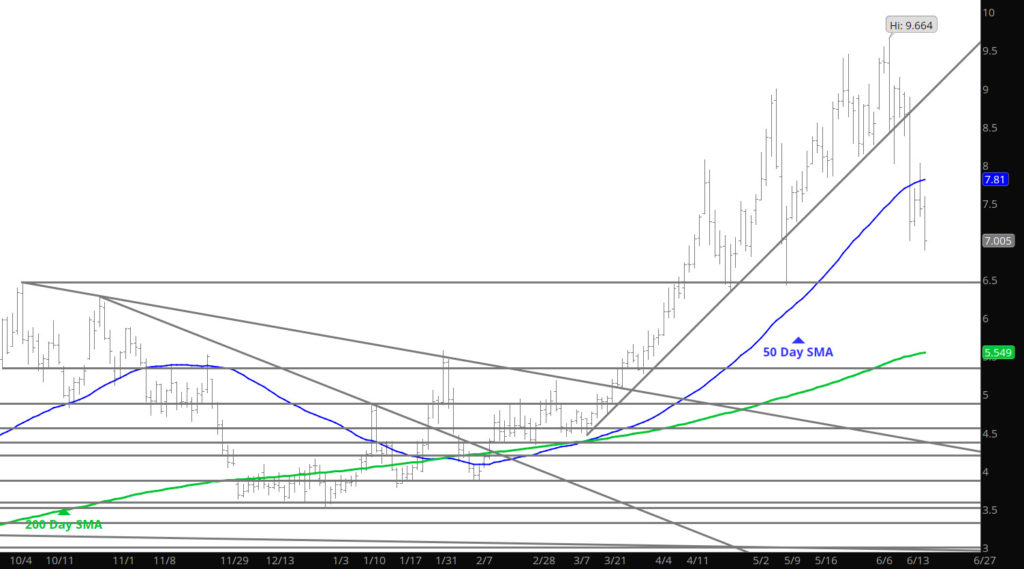

Quiet (Compared to Recent) Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

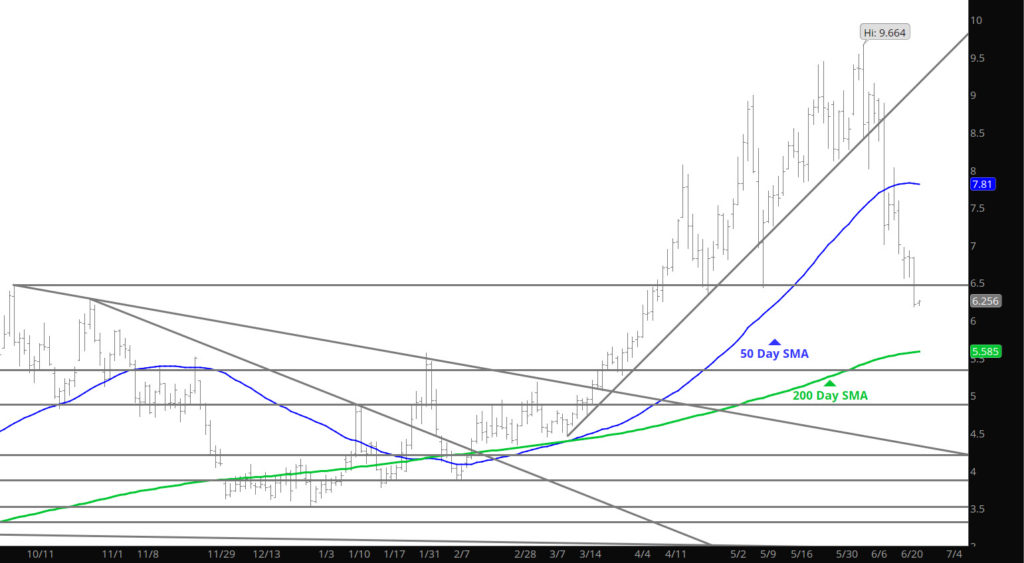

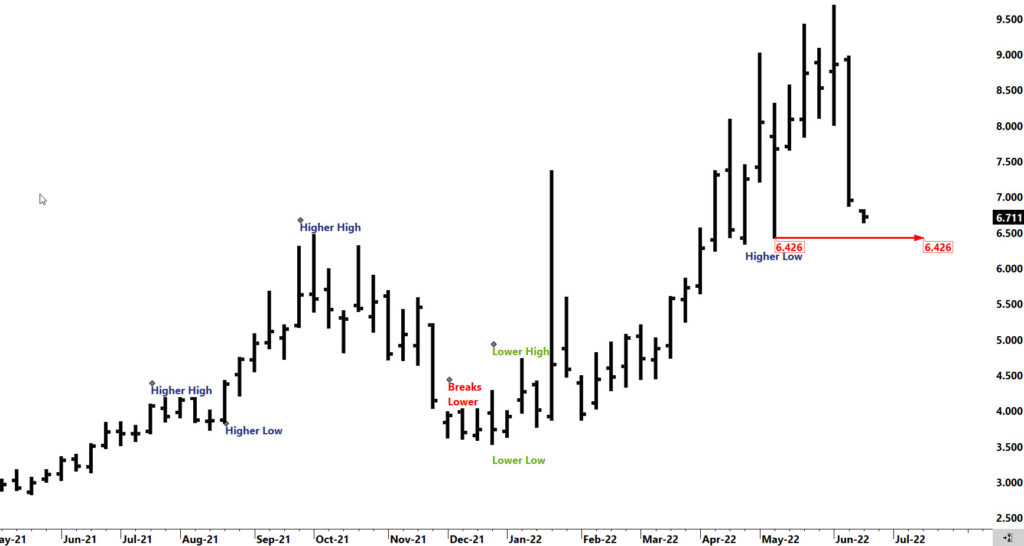

Is the Bull Run Over?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

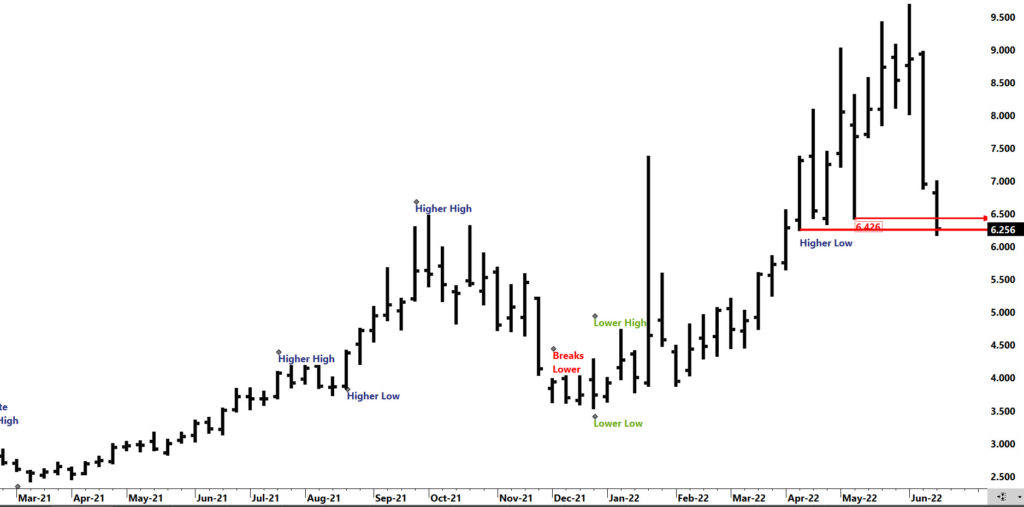

Collapse Takes Prices to a Lower Low

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Declines Break Support and Challenge Bull Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

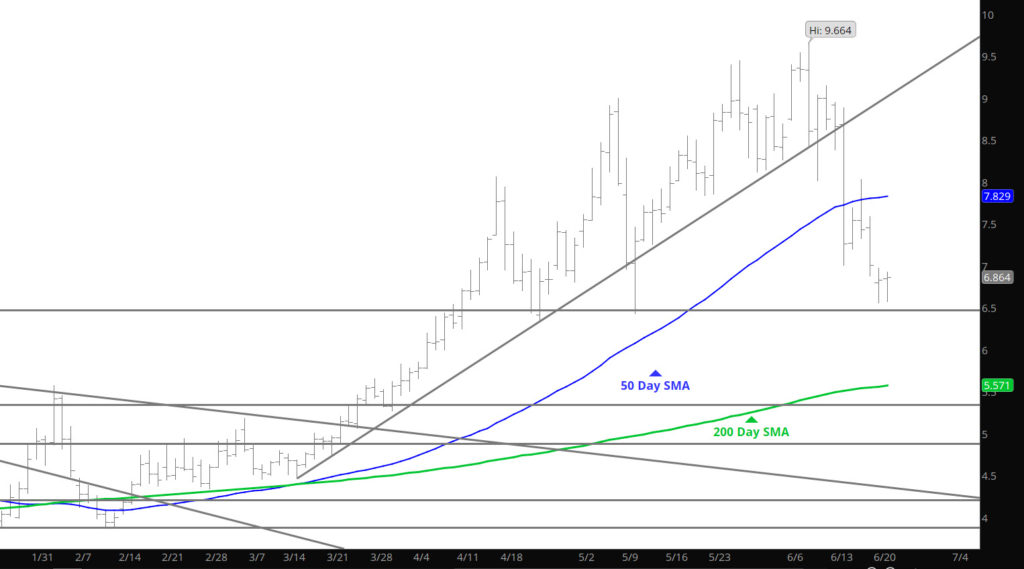

Never a Serious Test

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Most of Monday Declines Stay

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

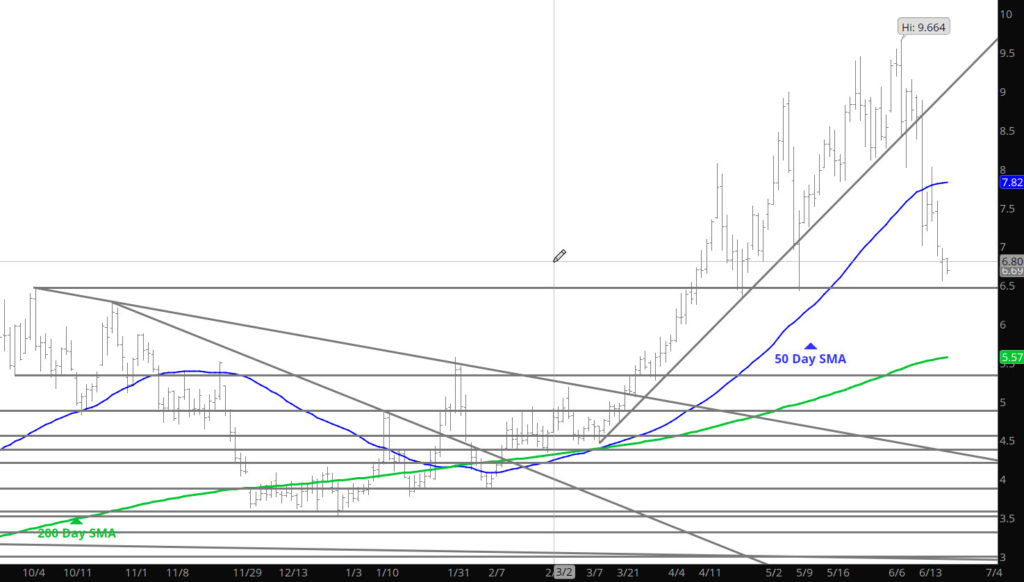

Light Trade Extends Declines

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Substantive Declines Modify Short Term Bias

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Juneteenth Celebration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.