Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

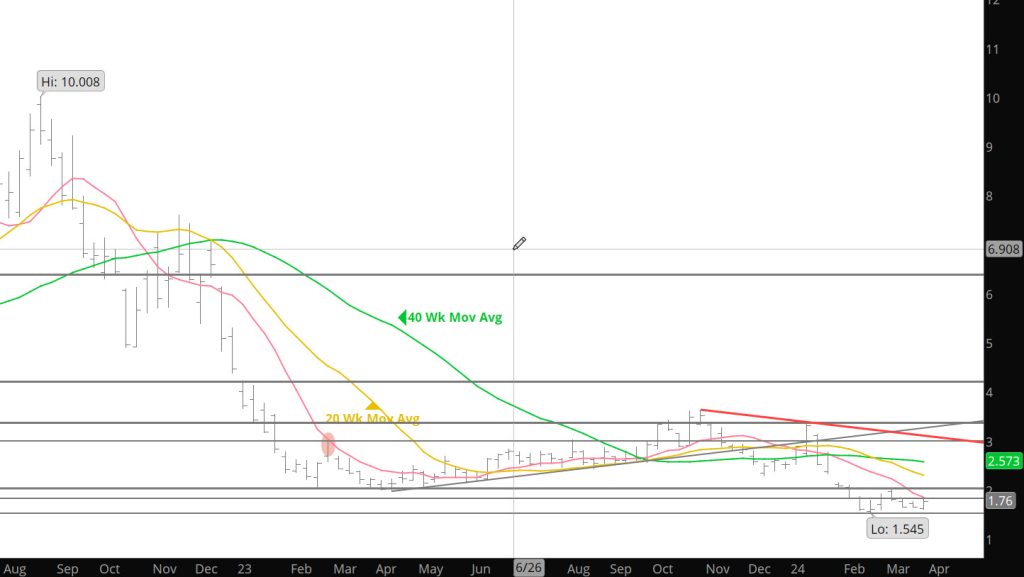

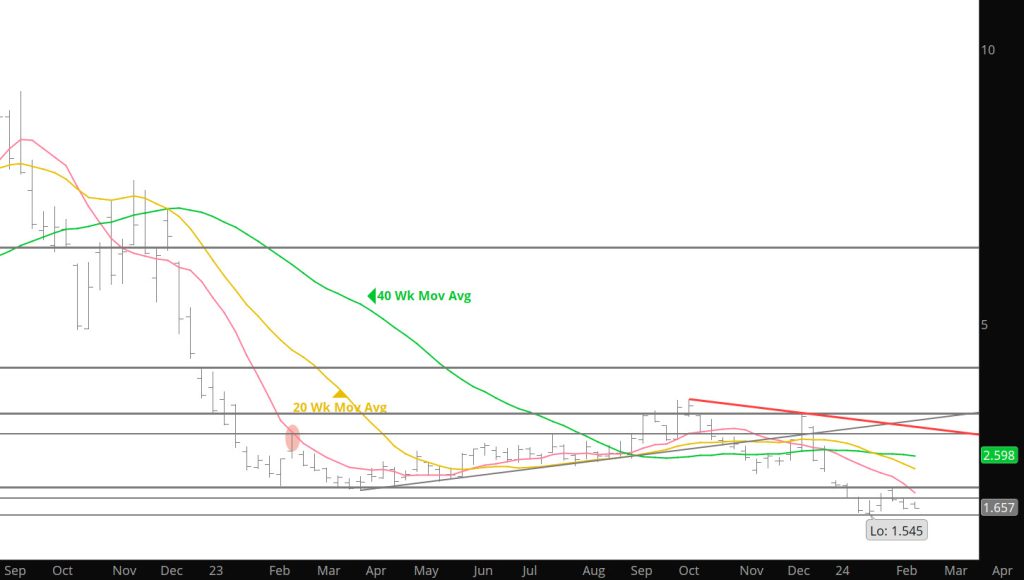

Similar to Last Month – Firm to Start

Daily Continuous

Seen this movie before — lets see if the plot thickens on this month as prices start the month off with strength only to fall back after the first week.

Major Support:, $1.595, $1.52-$1.519, $1.432, $1.312

Minor Support :

Major Resistance: $1.863, $1.94-$1.967, $2.00, $3.00, $3.16, $3.48, $3.536, 3.59,

Strong Daily Close to May

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

No New Bias Definition

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Options Today Contract Tomorrow

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Average Trade Range Narrows — Expiration Coming

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consequences For the Declining Range Trade

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

More Of the Same

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Another Storage Release

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Short Term Base May Be Forming

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.