Author: Willis Bennett

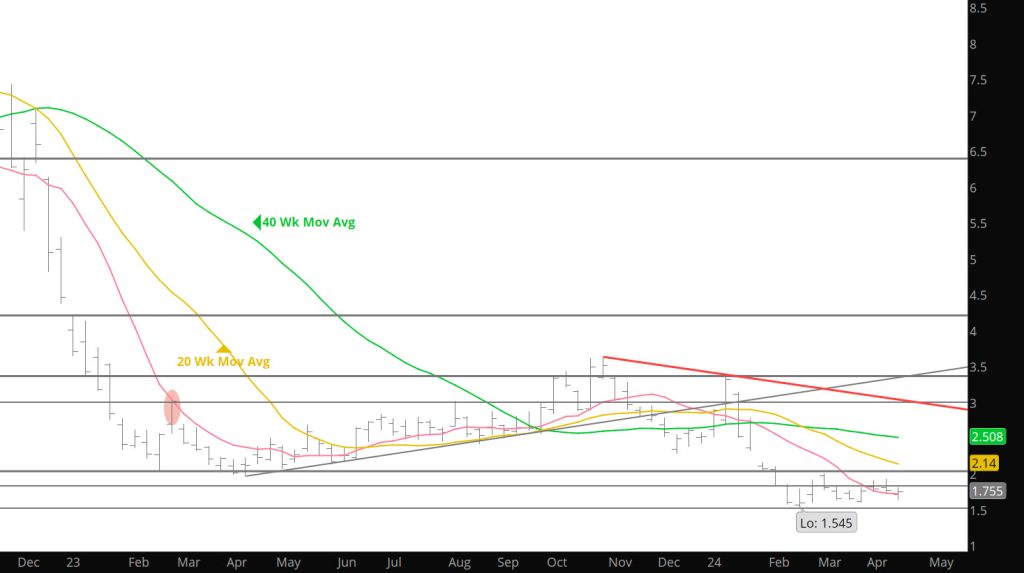

Where We Going

Expiration Day

Daily Continuous

Here we are at expiration and the variances between prompt May and the rest of the market have become pronounced. My suggestion remains the same from yesterday.

Major Support:, $1.595, $1.52-$1.511, $1.481, $1.312

Minor Support :

Major Resistance: $1.94-$1.967, $2.00, $3.00, $3.16, $3.48, $3.536, 3.59,

Expiring May Gets Crushed

Still Hanging at Resistance

Solid Run to Resistance

Range Events Create Limited Analysis Insight

Some Evidence Developing

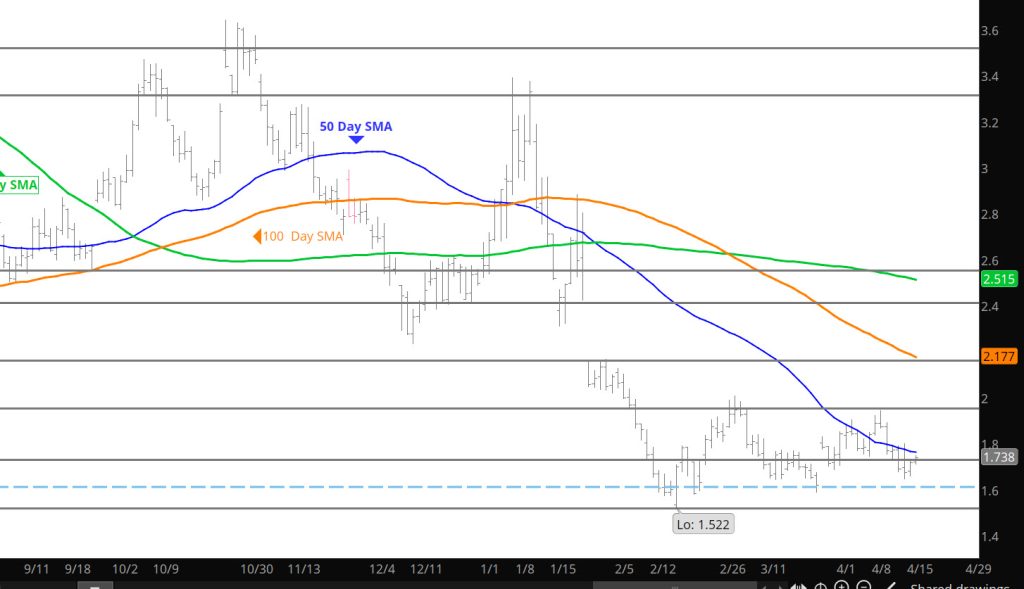

Daily Continuous

Discuss some of the elements that the market is starting to advertise as to future in the Weekly / Long term section, but most are light at this point so the likely hood of any break out is limited. May prompt has five days left and expect a complete closure of the gap from the April expiration but am not convinced of the expiration weakness that the last two expiration’s experienced. Volatility will return to the market but unlikely until power demand and expectations starts to rear it’s head.

Major Support:, $1.595, $1.52-$1.511, $1.481, $1.312

Minor Support :

Major Resistance: $1.94-$1.967, $2.00, $3.00, $3.16, $3.48, $3.536, 3.59,