Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

New April Closing Low

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

A Break Below $4.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Testing Low End of Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Rally to Run Out of Buyers

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Slight Reversal of Fortune

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Storage Release Provides Bounce

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

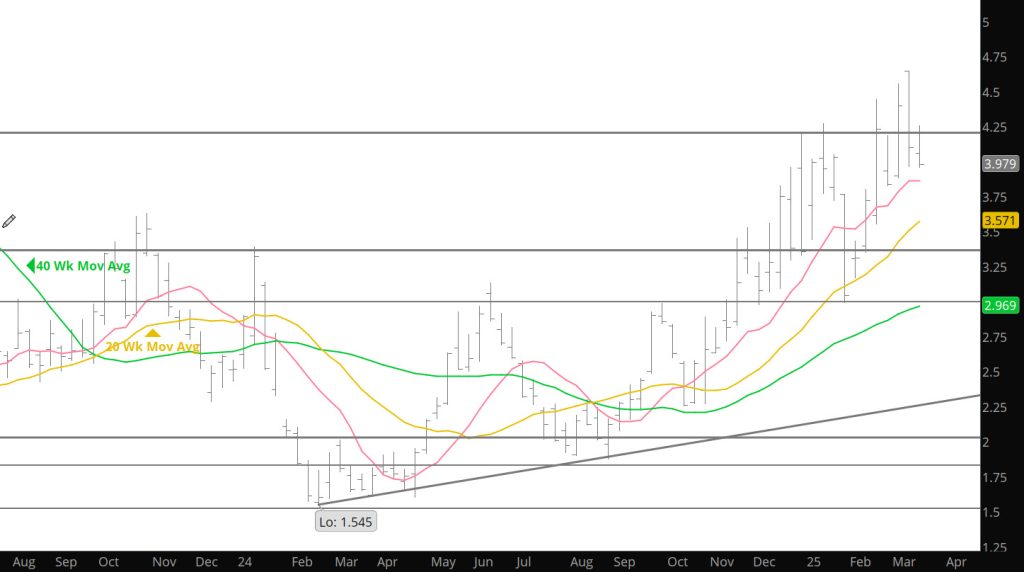

Starting To Like a Potential Weekly Reversal

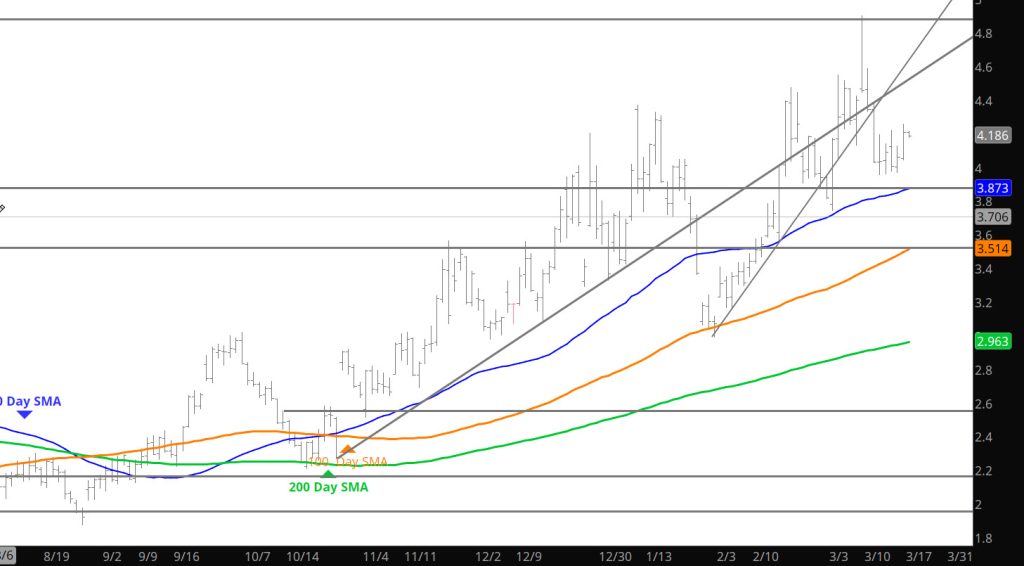

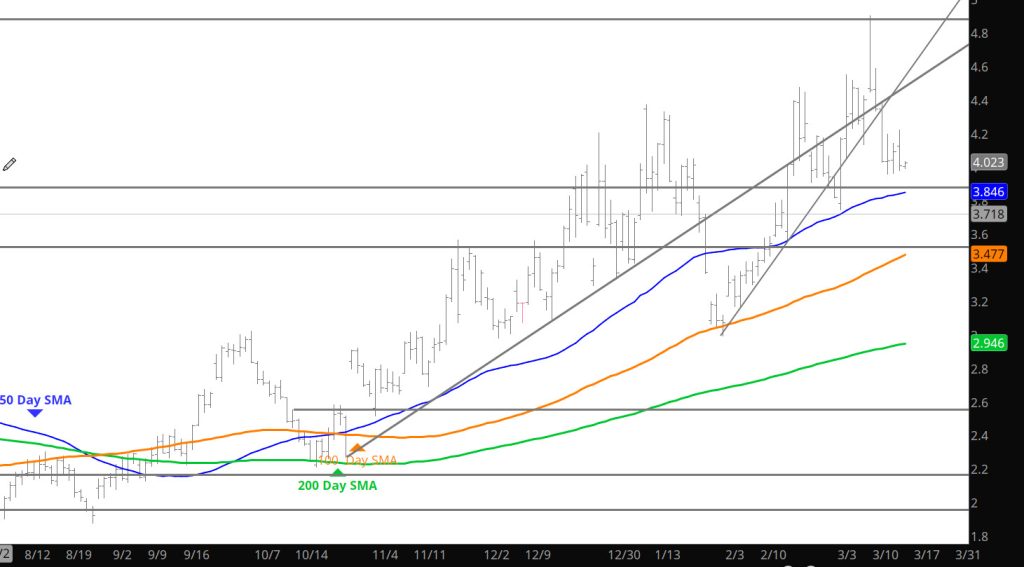

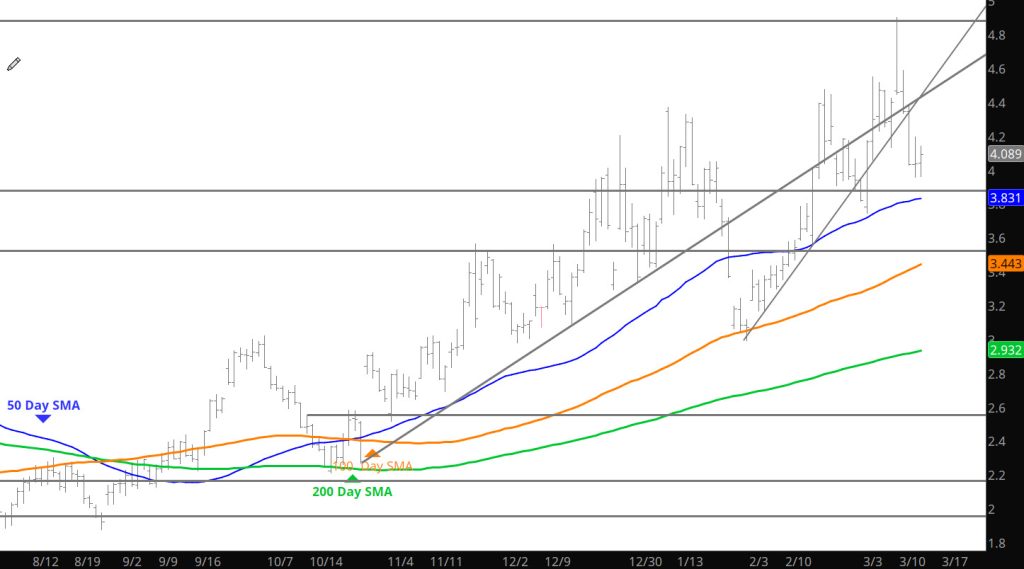

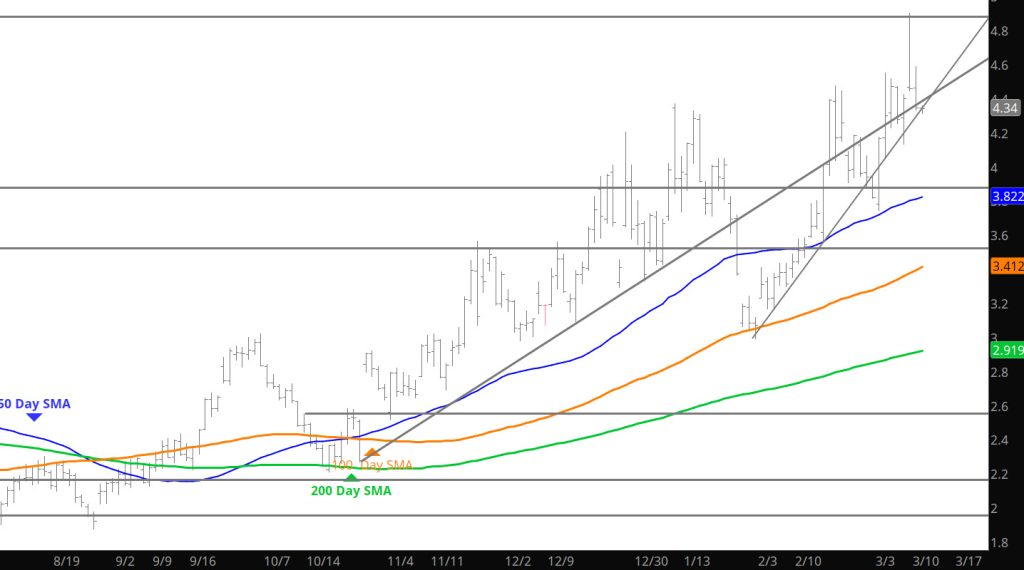

Daily Continuous

Spoke earlier in the week about the market continuing to go up until it runs out of buyers– suggesting that a daily/weekly reversal would start to suggest a lack of buyers. Recently each decline has found buyers but the trade yesterday and Tuesday clearly did not find folks buying the dips. Today is storage and will likely give further indications of the potential further actions.

Major Support: $3.16-$2.97, $2.727, $2.648,

Minor Support : $4.00, $3.827-$3.801 $3.742

Major Resistance: $4.461, $4.501, $4.551, $4.746-$4.75, $5.031

Nothing To Add

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.