First things first– just a reminder that the Daily will continue free until May 1, 2020 at which time you will need to be a subscriber– please see the website for details.

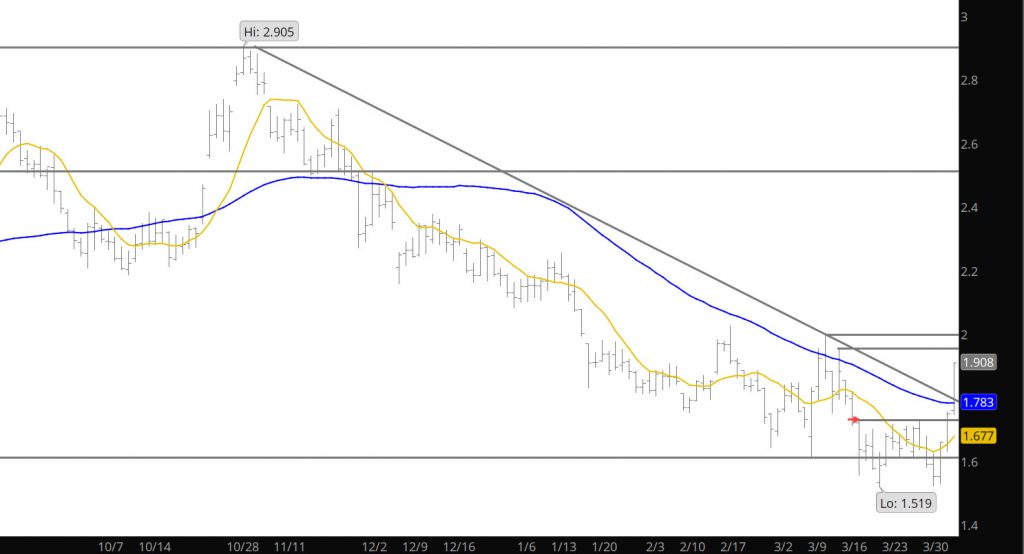

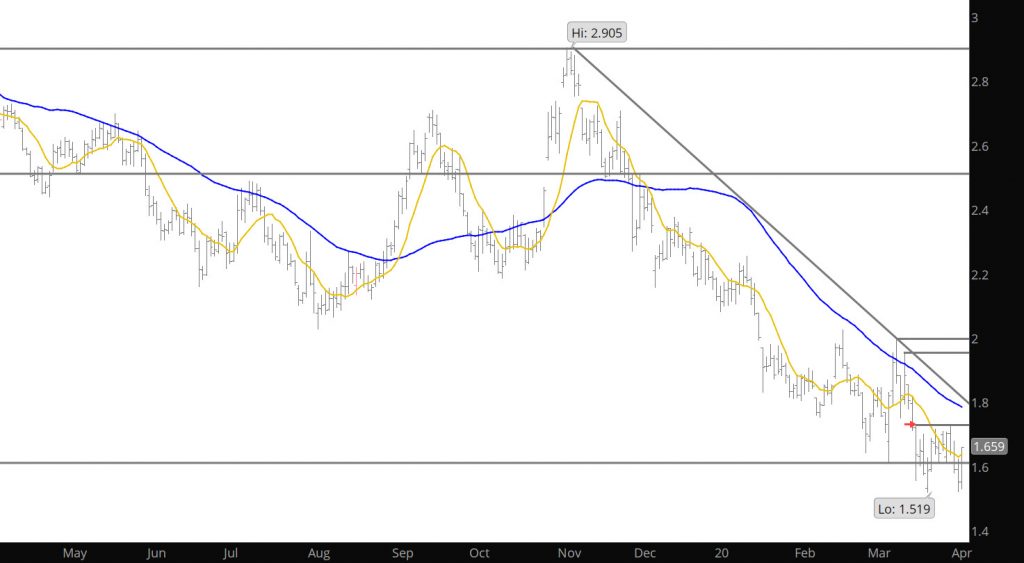

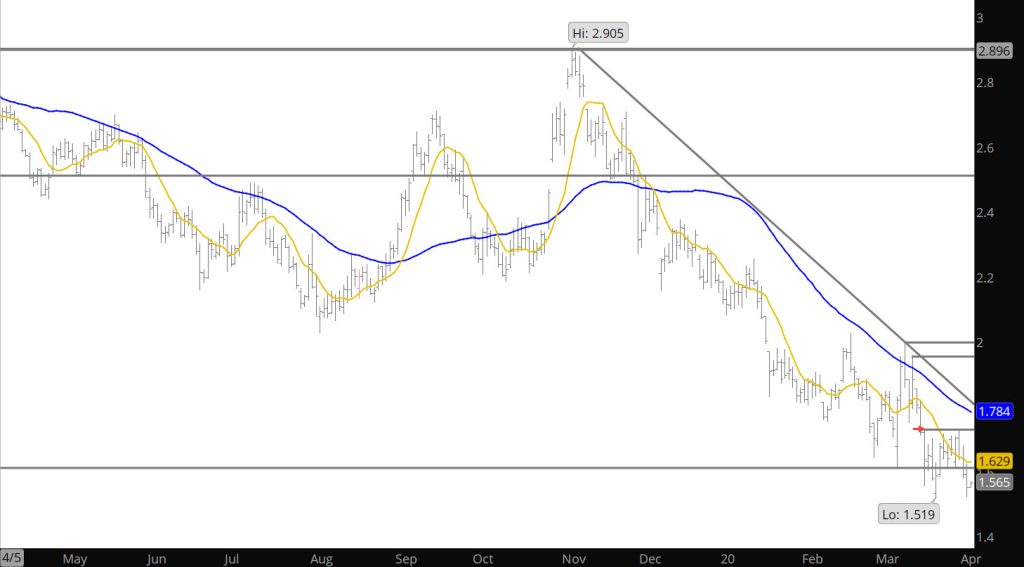

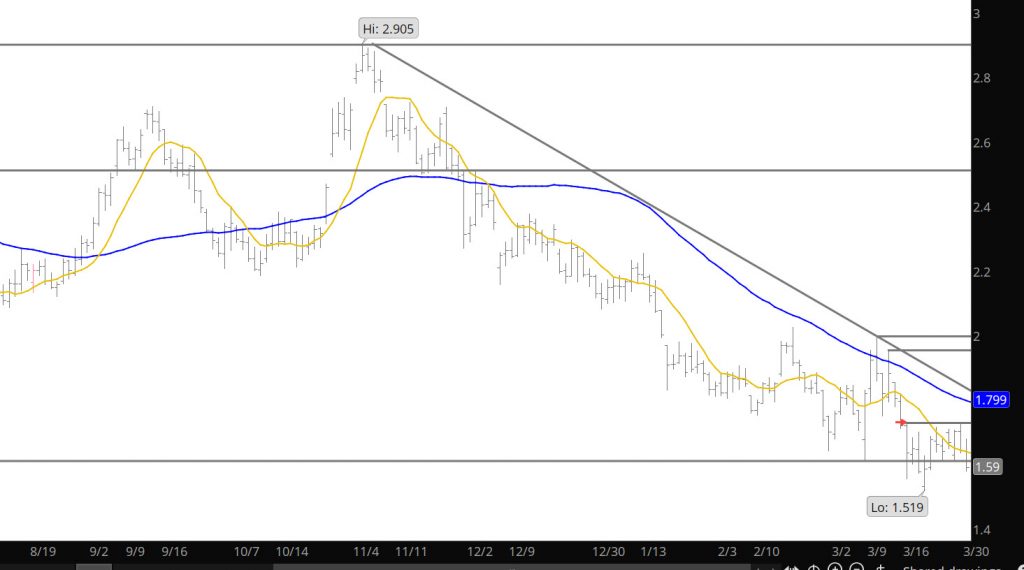

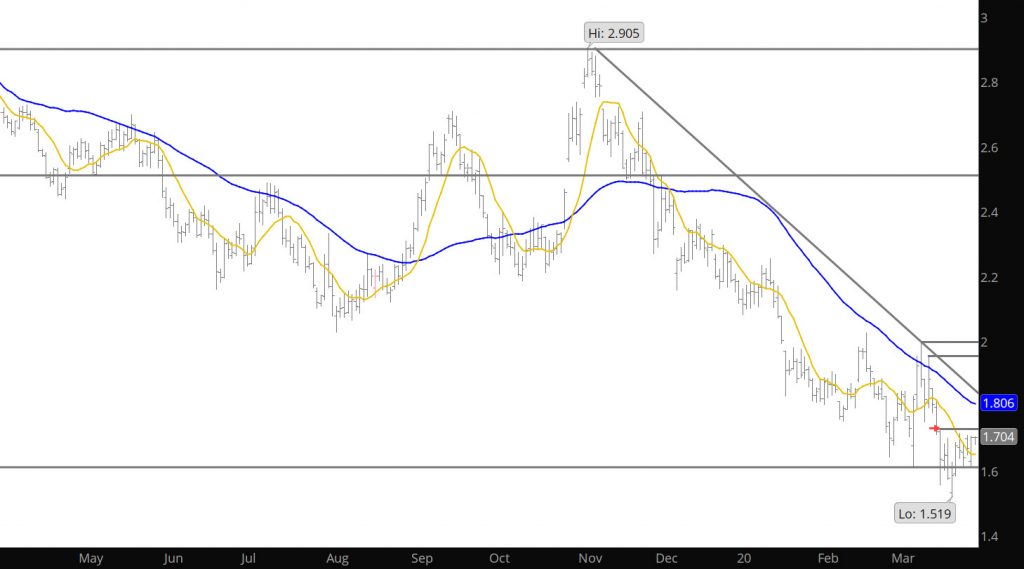

I wanted to expand on the website Weekly published yesterday, as a couple of you contacted me regarding the significant gains in the Winter strip as compared to the prompt May. I would not advise chasing the winter and the chart above shows why. The strip is over bought and currently in the extreme zone for momentum indicators. It will need to back and fill and test the breakout zone around $2.70 so patience is required. It is becoming clear (with today’s extension) that something is garnering serious support for winter and all of 2021 for that matter. Not immersing myself in fundamentals I am limited as to an opinion but I do read that with the destruction of oil prices and production- some of the associated gas may become an issue. As mentioned– I have no clue– but something is clearly driving interests and the prompt May has nothing to do with it. In fact it remains in the middle of the range discussed yesterday.