Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Week’s Rally Fails at Resistance

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Consolidating?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Prices Continue to Grind Higher

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Bulls May Have Found Footing

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Market Finding a Bid?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Post Destructive Expiration – Prices Find Support

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Slight Retracement

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Consolidation of Gains

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

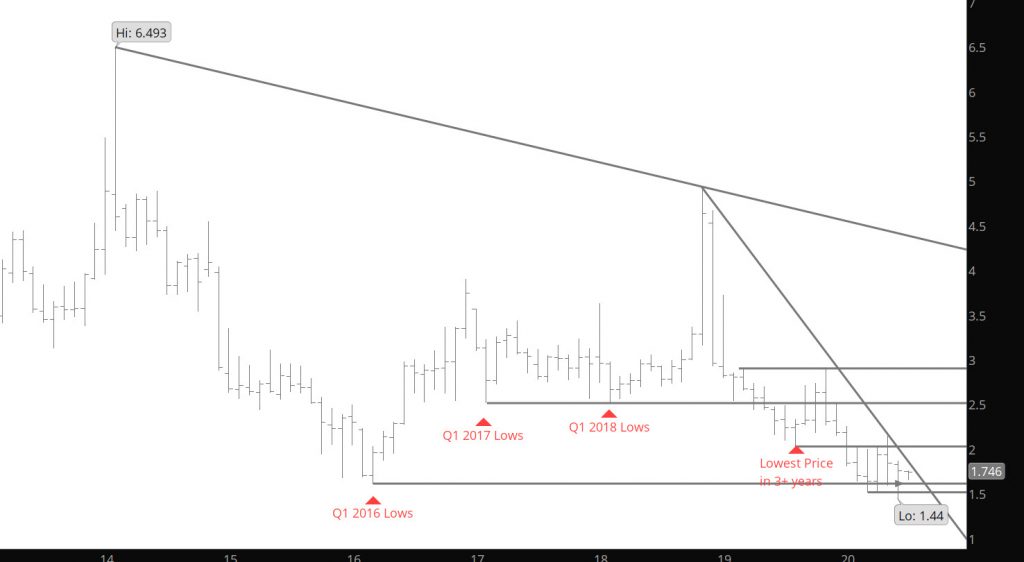

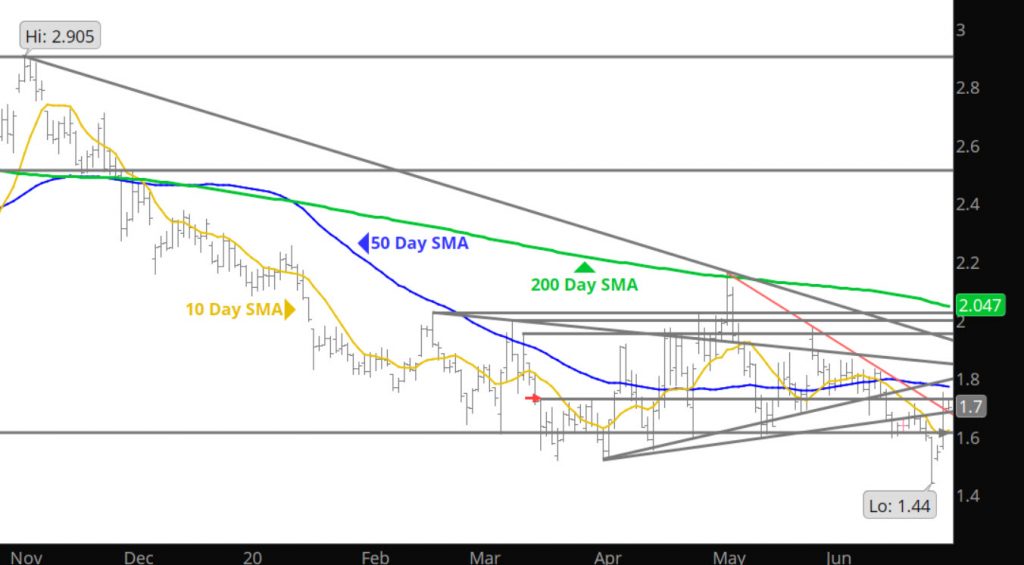

Whoa – Where That Come From

Did not expect that reaction to the close last week. Was thinking more of a retest of the premium afforded the August contract, but clearly the market thought other wise. Now we sit in the middle of the range that has held prices for an extended period of time. Technical indications of an over-sold market have relaxed on the run. Continue to expect short term rallies as the Managed Money long positions increased last week through June 23rd while there was a reduction in short positions.

Major Support: $1.484-$1.44, $1.336

Minor Support: $1.527

Major Resistance: $1.595, $1.611-1.642

Minor Resistance: $1.722, $1.864-$1.896