Author: Willis Bennett

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Slow Down in the Gains

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Extension Higher

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Whoa Didn’t Expect That

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

September Fall Back Into the Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Does the Recent Tendency Hold

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Strong Finish To a “Building” Trade

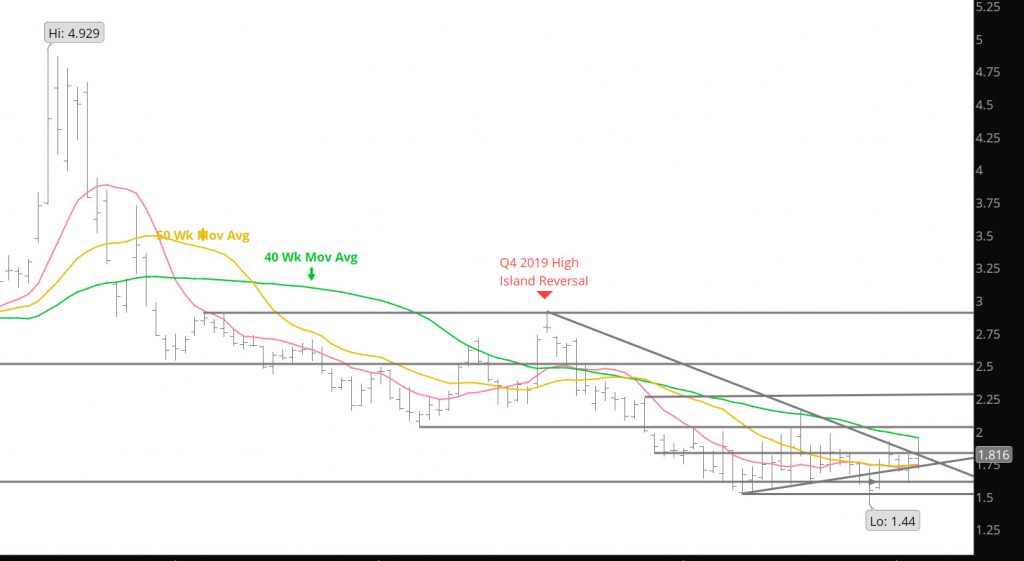

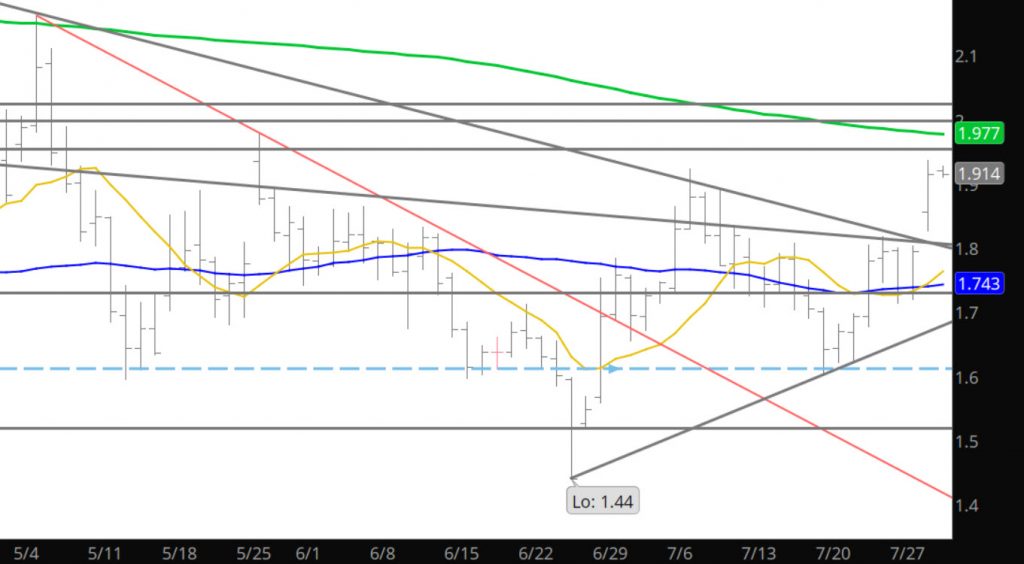

As discussed in the Long Term area of the web site, prices are behaving a little differently recently. I would guess there are fundamental reasons for this, though that confuses me as the market is still long storage etc., but there has been a shift in the trade habits lately. Caution though, as it remains in a range environment and should be traded accordingly. It is now approaching serious resistance and this behavior will indicate potential future expectations.

Major Support: $1.527, $1.484-$1.44, $1.336

Minor Support: 1.893- $1.854, $1.719

Major Resistance: $1.924-$1.956, $1.974-$1.976, $1.989

Minor Resistance:

Weekly Similarities Continue

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Monday Trend Continues

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Shifting a Bias –Perhaps

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.