Author: Willis Bennett

Over-Bought But Will It Extend

Slight Extension Higher Followed by Retreat

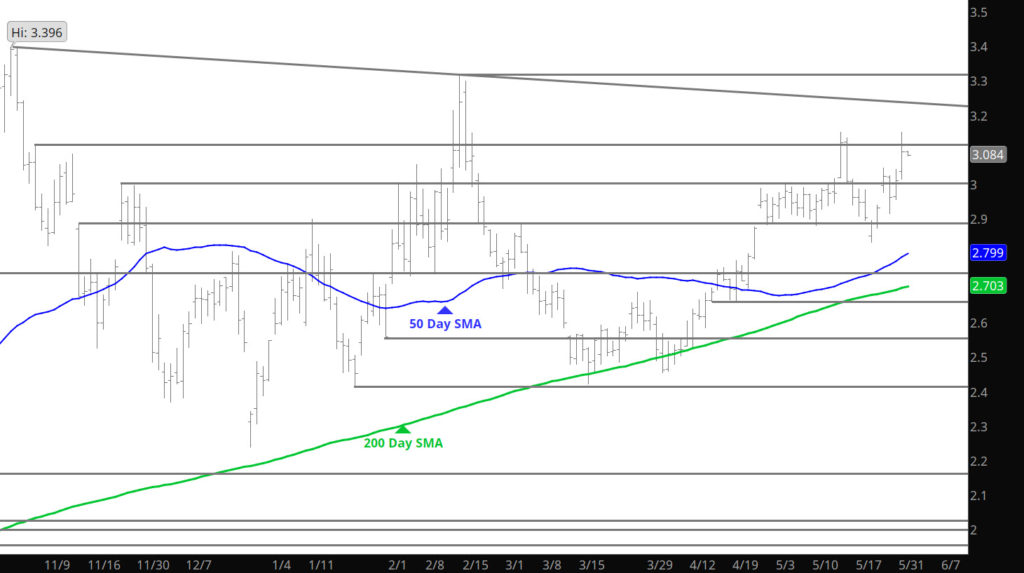

Prices were gaining some momentum and then the storage release brought the house down with prices retreating to yesterday’s close. It remains a bullish trend (discussed since last fall) and mentioned yesterday about the nature of the gains in a bull market. This run is not based on sudden short covering, as open interest has gained this week on the higher volume, clearly supporting the market internals. This week’s extension strongly suggest that dips in natural gas should be buying opportunities.

Major Support: $3.00 $2.914-$2.886, $2.78, $2.71-$2.70, $2.658, $2.52, $2.422-$2.414

Minor Support: $2.876, $2.694, $2.483, $2.162

Major Resistance: $3.12-$3.15, $3.198, $3.251, $3.31, $3.396

Consolidation in the Latest Range

Old Resistance Continues to Hold Support

Prices Firm Above $3.00

A Weekly High Close

Prices finished the week with a new high weekly close for the July contract and did so with higher open interest and supporting volume supporting the gain in price. This activity is presumed bullish, but July faces an array of formidable and well – defined resistance. The highs of week ending 05/24 (the May high), the high of the past week and the May high of July gas (3.204) are nearly or greater than two standard deviations above the 20 – week SMA. Additionally, prompt gas has historically felt the weight of seasonal pressure during the first couple of weeks of June (historically around the holiday), however, this year the weakness was prior to the holiday. This will need to be defined in the coming week.

Major Support: $2.914-$2.886, $2.78, $2.71-$2.70, $2.658, $2.52, $2.422-$2.414

Minor Support: $3.00, $2.876, $2.694, $2.483, $2.162

Major Resistance: $3.12-$3.15, $3.251, $3.31, $3.396