Author: Willis Bennett

Expect Volatility to Continue

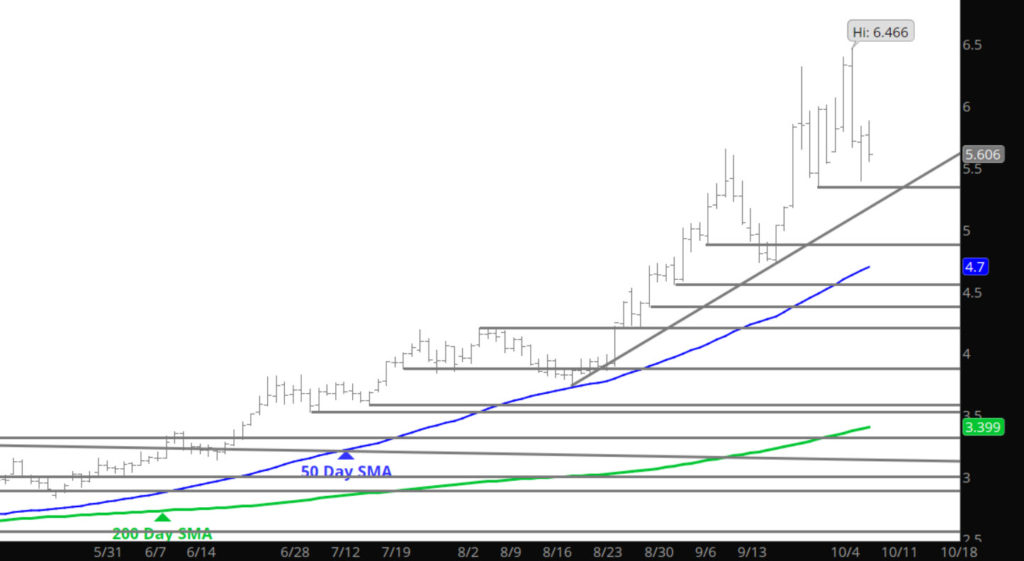

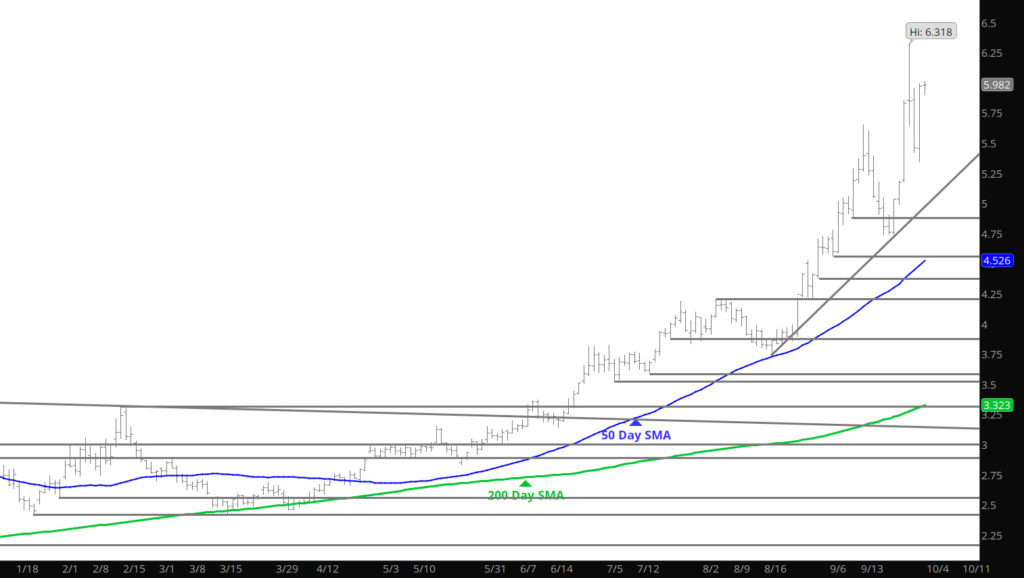

The Nov contract traded through the September high marking the fourth straight year that the Nov contract has done that (see last week’s conversation about Q4 runs and sarcasm), further into the resistance area between the January ’09 and January ’14 highs (6.240 – 6.493) before reversing lower. The reverse sent prompt gas and the coming winter strip closed lower for the first time in seven weeks. However the Q2 ’22 months, summer ’22, as well as the further months strips were higher. Volume and open interest were lower as price failed at a higher high and November closed slightly lower than it had opened when trading resumed on Sunday, suggesting the lack of an appetite for prompt gas above $6.

The elevated level of volatility, the reversals traded this week and previous weeks as prices traded over $6, the near weekly doji (prompt gas closed at 5.556 after opening at 5.628 and traded a new high in between) may be suggesting that Nov contract is vulnerable to a more significant retracement. Like a broken clock, I have been suggesting that the rally is overextended and due for a correction for the last month or so.

Major Support:$5.416, $5.341, $5.17, $4.88, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92, $3.821,

Minor Support: $5.62-$5.633, $4.728-$4.70, $4.66

Major Resistance: $5.876, $6.24-$6.493

Continues to Mature??

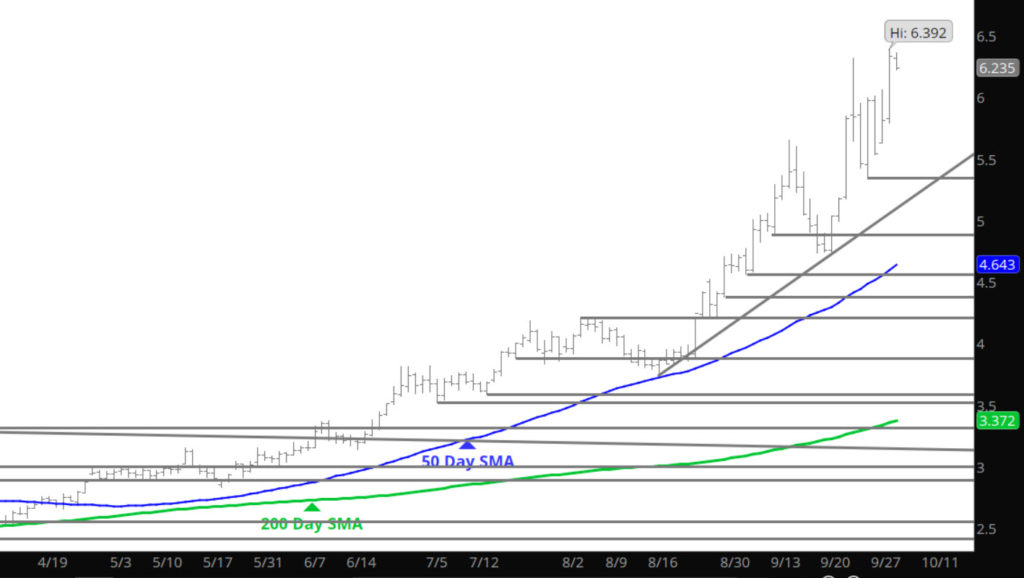

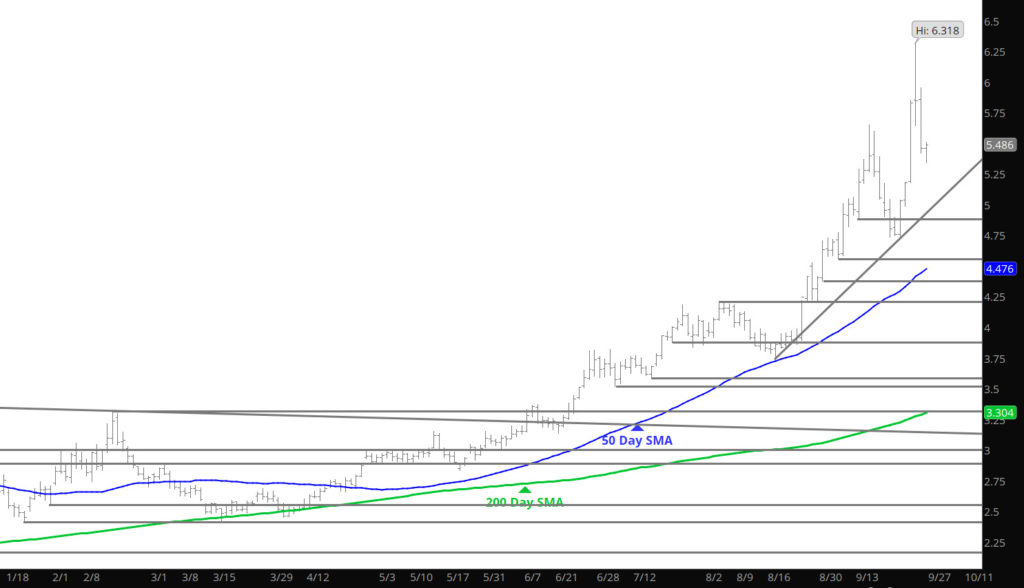

It was good to see prices retrace and test support at last week’s low, just wish they had gotten a little closer but to no avail. The rebound was expected and now prices may head back up to retest some of the resistance areas that proved substantial earlier in the week. Some fundamental folks sent me emails that Russia President Putin said he was going to support supplies to Europe– Novel idea as prices are over $30. That led to declines in the TTF (Europe contract) which led to yesterday’s declines. I apologize — but how you fundamental folks trade and make money when Putin can affect price movement is way over my pay grade. I got ripped, by only a couple of readers, this week for being sarcastic. My o My. Good luck- I will stay focused on the Henry Hub price (from a technical standpoint) and try to make a little more money in this run. BTW — winter is still coming (sarcasm alert).

Major Support:$5.416, $5.341, $5.17, $4.88, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92, $3.821, $3.722,

Minor Support: $5.62, $4.728-$4.70, $4.66

Major Resistance: $6.24-$6.493

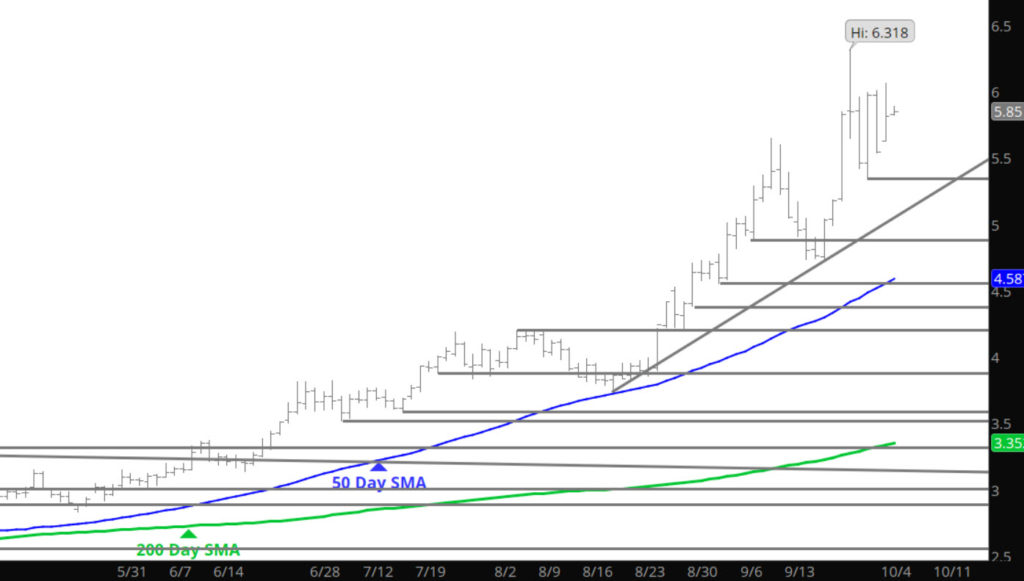

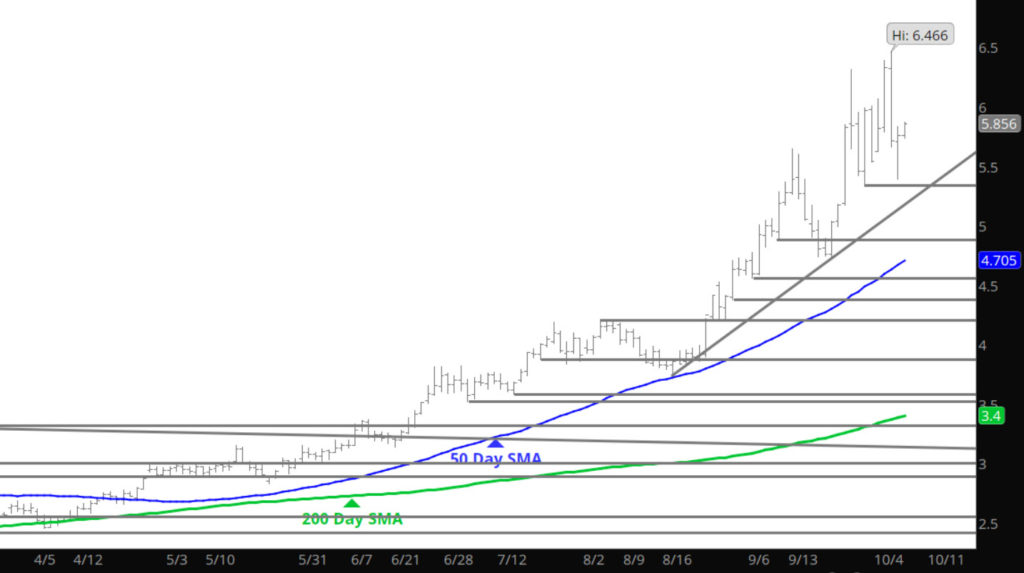

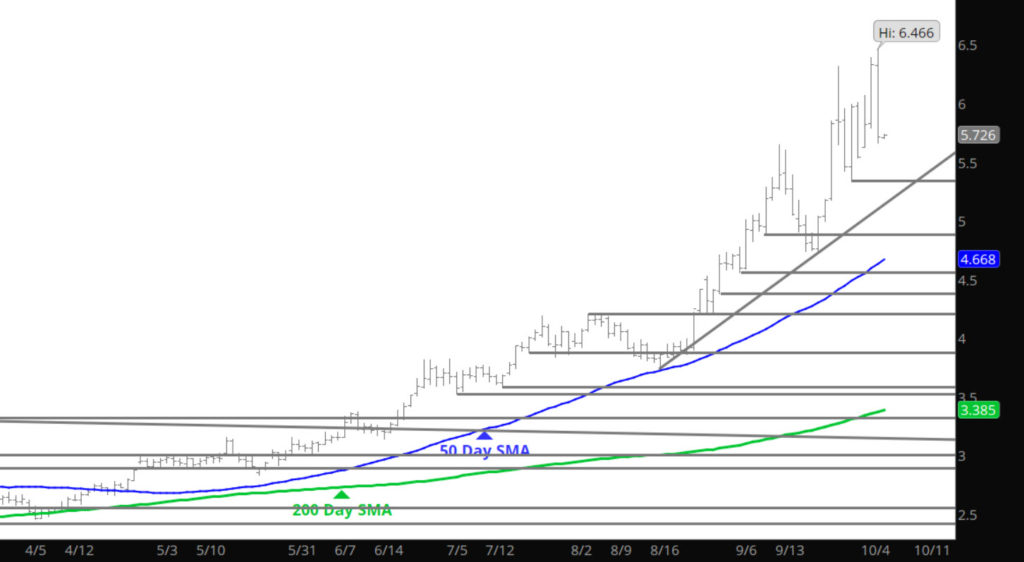

Stunned

The reversal yesterday was stunning (after setting a higher high), but what was more stunning was the response from my Daily yesterday. Most of you know and understand, that the basis of my trade comments is generated from the historical activity that demonstrates the market goes up in the early winter (I call it the Q4 high), goes down as the winter gets defined (I call the Q1 lows), goes up in the early spring (I call it the Q2 high) and finally goes down in late summer early fall (I call it the Q3 lows). I had a “tongue in cheek or sarcastic” comment about the rally, recently, had not even taken into consideration the upcoming winter forecasts. The response from a couple of subscribers was stunning, as I was ridiculed for not understanding that this whole move was based upon the upcoming winter. Oh– Wow your kidding– OK. I guess my sarcasm should not continue in the written form.– Good Luck –ain’t going to happen. Guess the moves in all the previous years (Q4) was by luck and not the expectations of upcoming winters. It is good to know that this year is so different than prior years, with the rally being based on the expectations of the upcoming winter (attn: sarcasm alert). Gee, I haven’t even seen a forecast for storms in November, yet, but I doubt it would effect my trade. BTW — my resistance level held the gains yesterday before the meltdown, so I understand the market looks out of control but it is showing signs (occasionally) of conformity. .

Major Support:$5.416, $5.341, $5.17, $4.88, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92, $3.821, $3.722,

Minor Support: $5.62, $4.728-$4.70, $4.66

Major Resistance: $6.24-$6.493