Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Break Above Gap

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

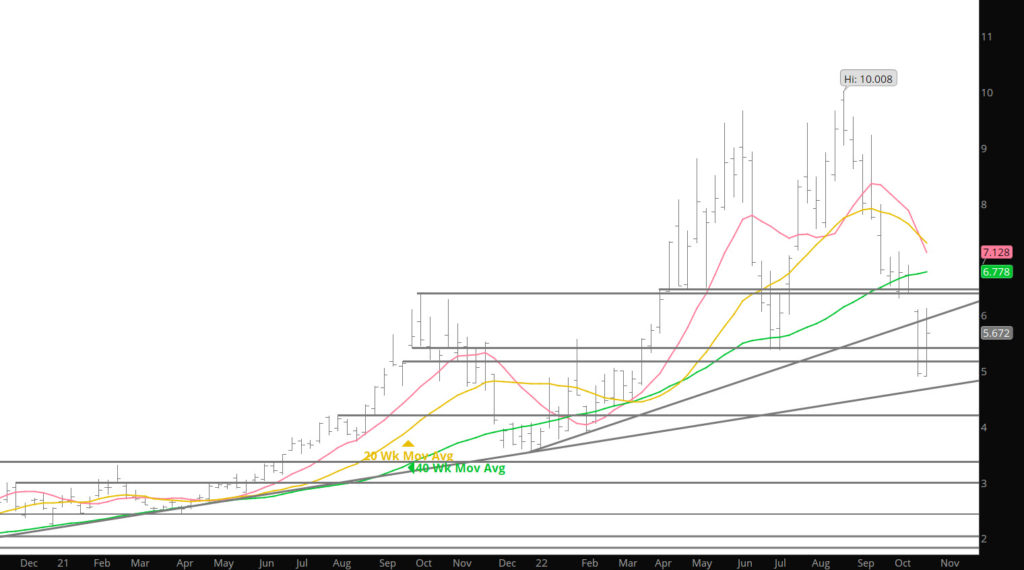

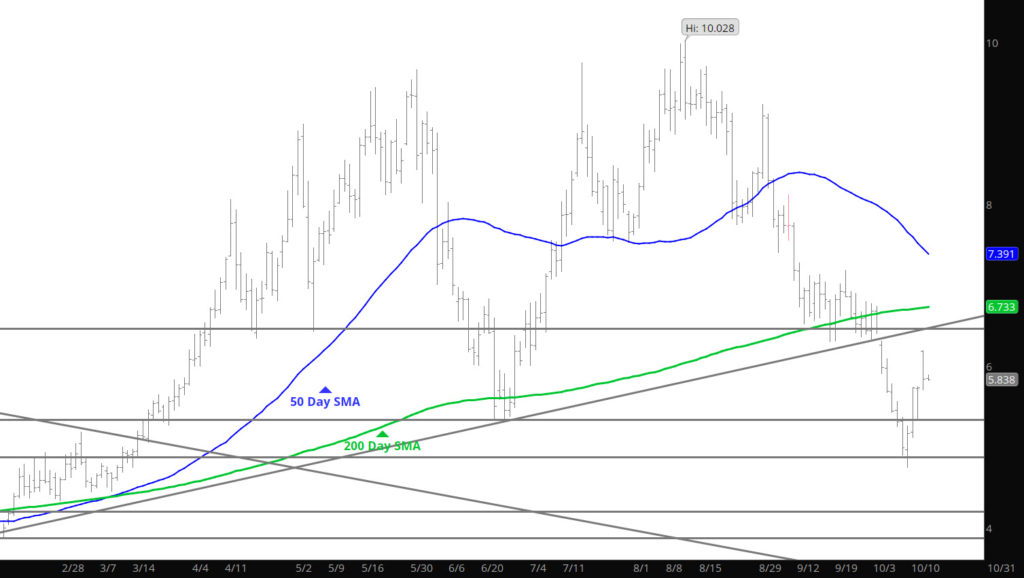

Price Seems to Be Consolidating Either Side of $6.00

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

The Effects of Forecasts

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

What the Market Gives It Takes Back

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Rally Continued Beyond Sunday

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Sunday Strength?

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Dec Takes Over as Prompt Giving Up Some of Differential

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Rather Subtle Expiration – Price Differential Remains

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Could Be Exciting

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.