Daily Call

Gap Starts Trade Week

Lower Low Established

It Was A Lower High?

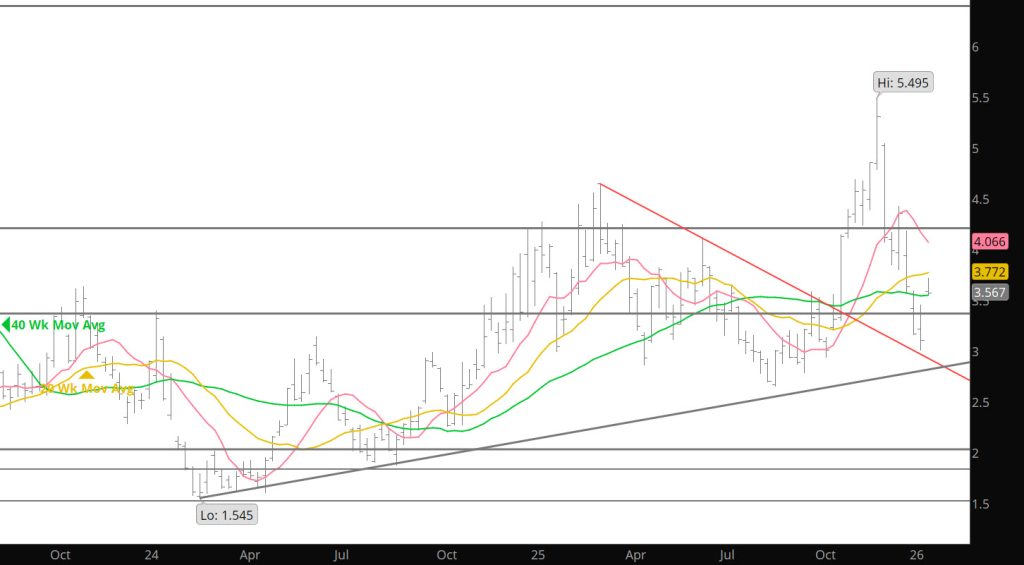

Daily Continuous

There was a lower high with yesterday’s trade, but I would of liked a test of $3.55-$3.60 as a solid lower high before the collapse of the gains sending price to a lower low. Guess the storage release has a bearish bias. Lower targets have not changed from the beginning of the week.

Major Support: $3.16-$3.148, $3.136-$3.024, $2.93

Minor Support/Resistance :

Major Resistance: $3.372, $3.467, $3.554, $3.787-$3.831, $4.063, $4.086

Perhaps Setting a Lower High

Bearish Bias Likely to Continue

Bearish Bias Rocks On

Testing the Support Zone

Negative Bias Returns to Gas

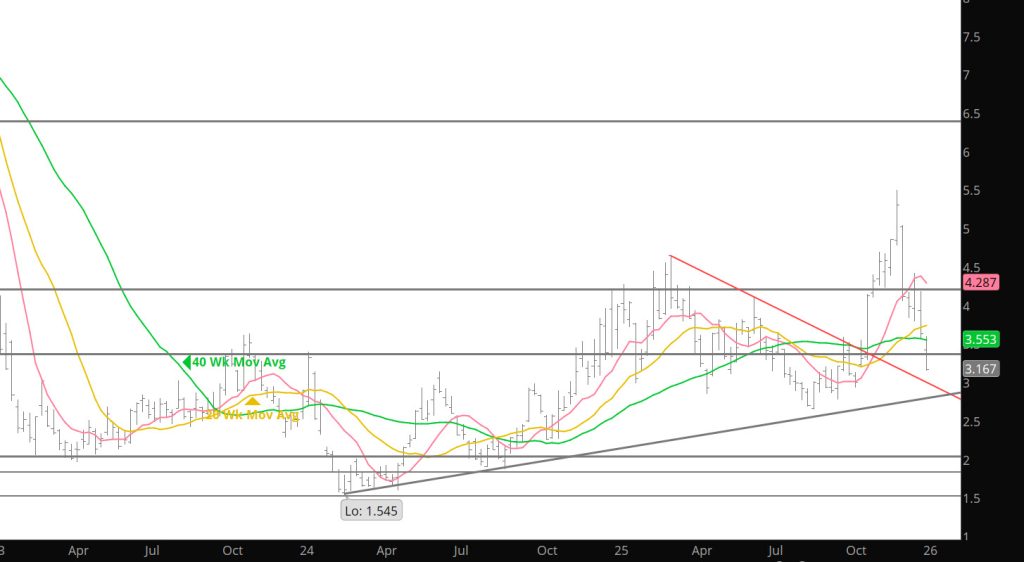

Daily Continuous

Go into the many aspects of why the market flipped to a negative bias in the Weekly section — but all you need to see is that prices are down $.15 and challenging support zones in the early Sunday trade. Not sure how this will track (1: an immediate decline during Jan or 2: or a series of lower highs and lower lows) but the market is clearly setting up for the Q1 lows to be established. My guess is the latter with the low occurring next month.

Major Support: $3.57-$3.546, $3.334,$3.16-$3.148

Minor Support/Resistance : $3.489,$3.467

Major Resistance: $3.787-$3.831, $4.063, $4.086