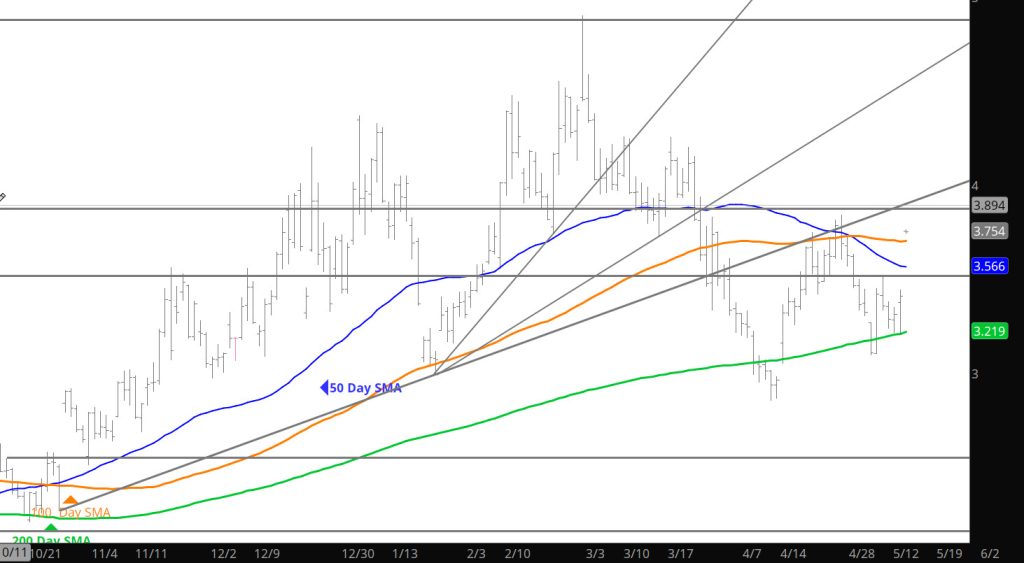

Daily Call

New Prompt — Gap Enclosed

Prices Remain Quiet

Two Week Close at Same Level

Definition of Going Nowhere

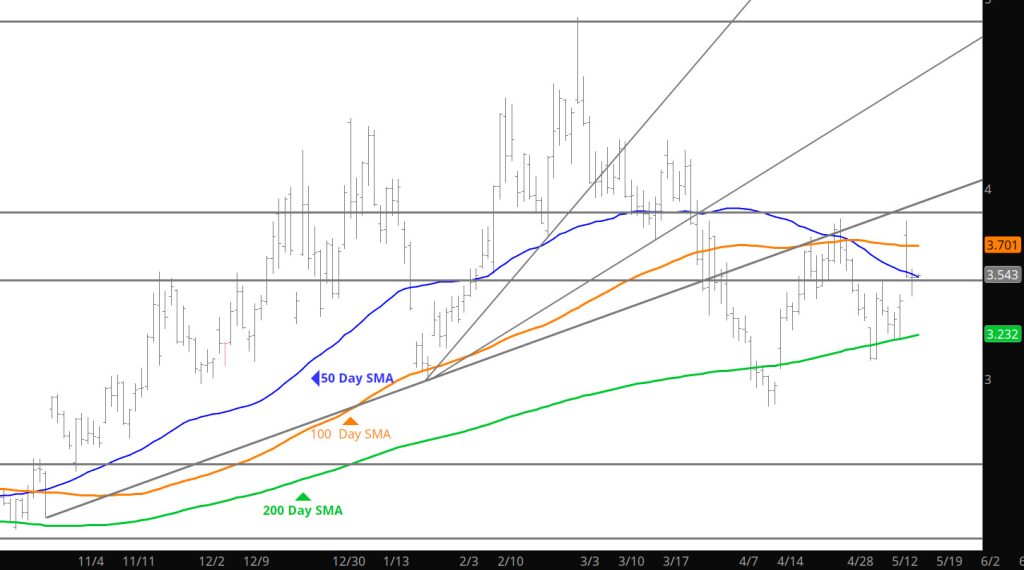

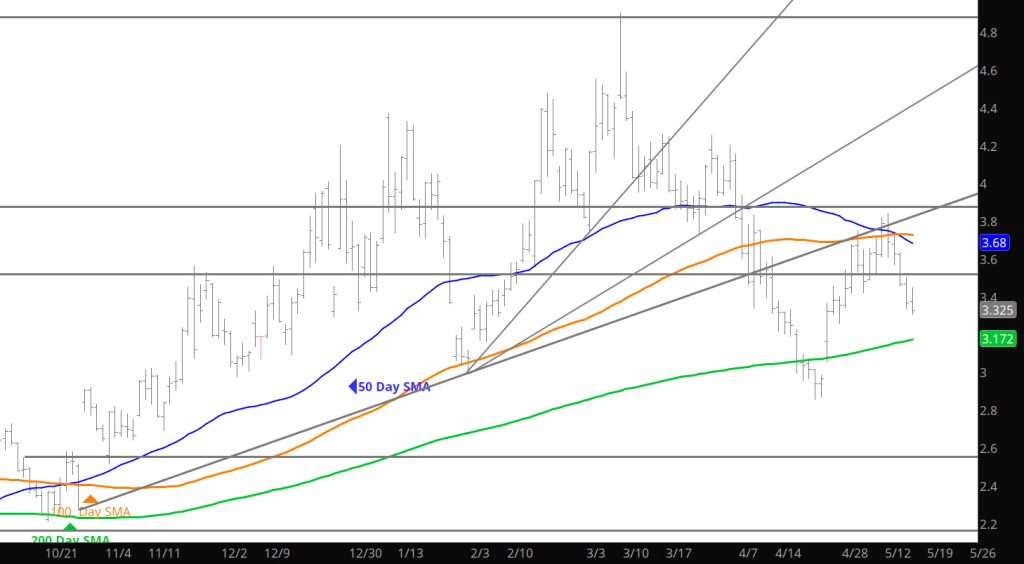

Back to the Range

Daily Continuous

With the storage release I was wondering if the recent strength would be curtailed and that it was. The heading says it all – back into the range that June has created.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.26-$3.305, $3.46, $3.628, $3.86, $4.168, $4.461, $4.501,

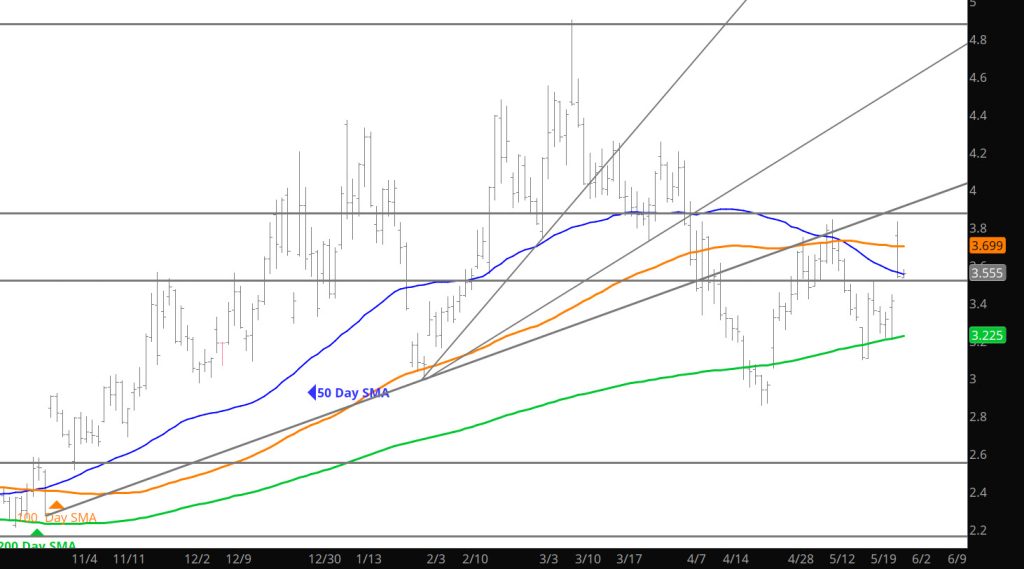

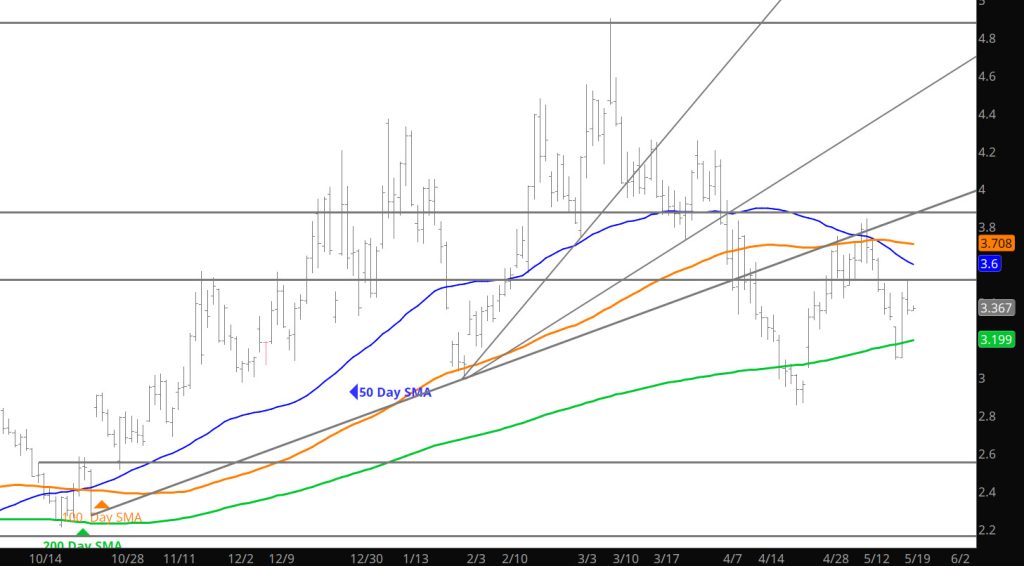

Solid Bounce

Daily Continuous

Prices refused to extend down to the April low of June gas and performed a solid rebound. Not sure this is a rally that should be jumped onto — there is a solid possibility that further gains will be hindered by the storage release coming up. Regardless, the market continues to trade with in the range that June has developed.

Major Support: $3.054-$3.007, $2.97, $2.727, $2.648,

Minor Support :

Major Resistance: $3.26-$3.305, $3.46, $3.628, $3.86, $4.168, $4.461, $4.501,

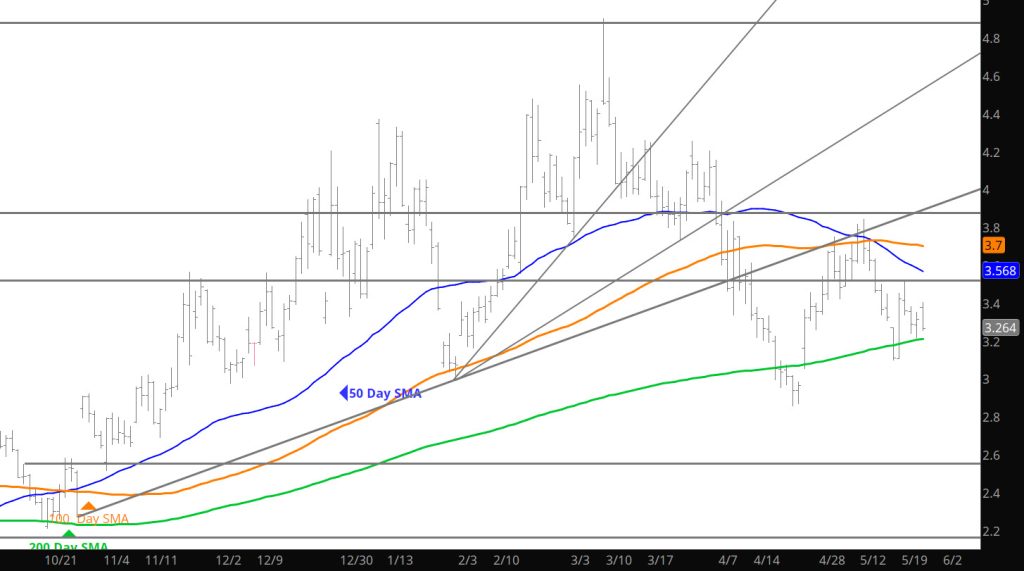

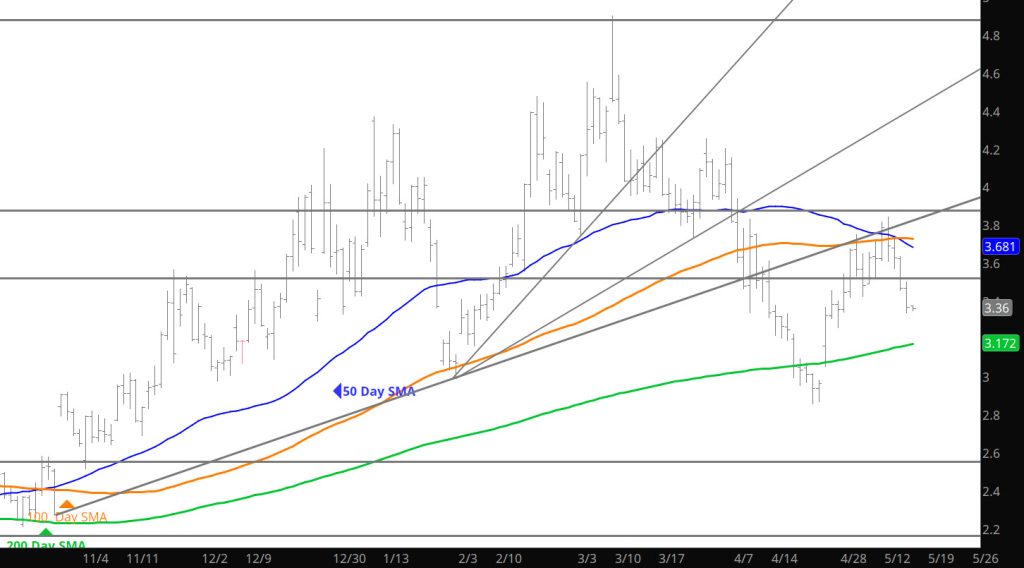

Prompt Approaching Lows

Expect Additional Weakness

Storage Release Confirms Declines

Daily Continuous

The slightly bearish storage data confirmed the near-term bias of declining prices. The Weekly close will be important for the near term price action but remember, we are still in a range for prices — just testing the low end of the range.

Major Support: $3.26, $2.97, $2.727, $2.648,

Minor Support :$3.423

Major Resistance: $3.628, $3.86, $4.168, $4.461, $4.501, $4.551, $4.746-$4.75, $5.03