Category: Daily Call

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

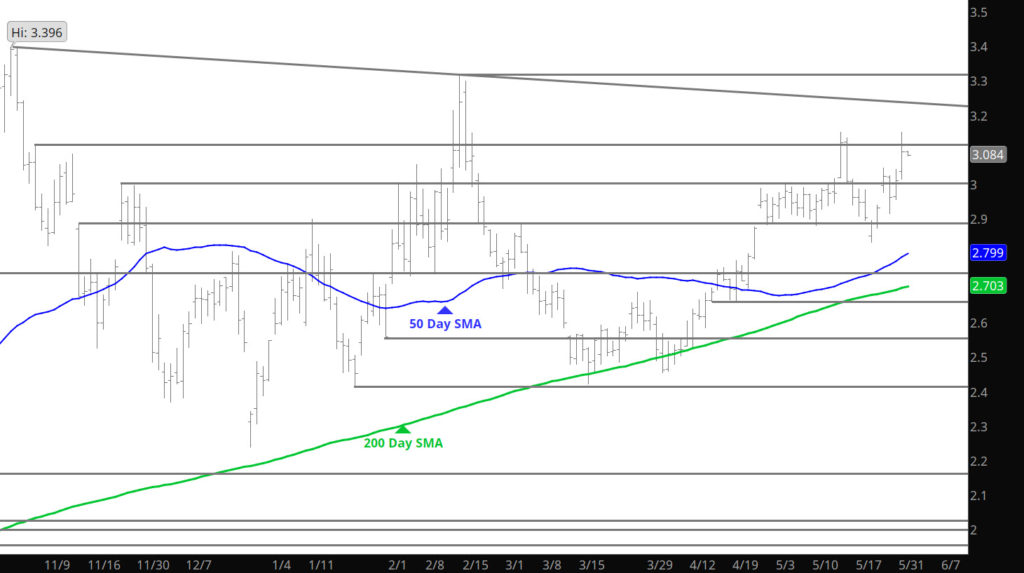

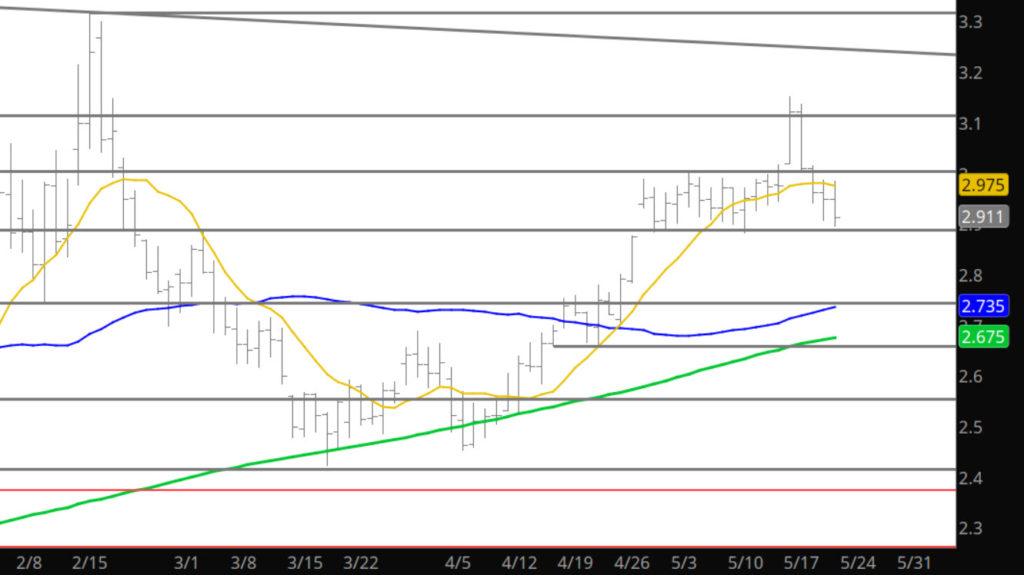

Prices Hold the $3.00 Level

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

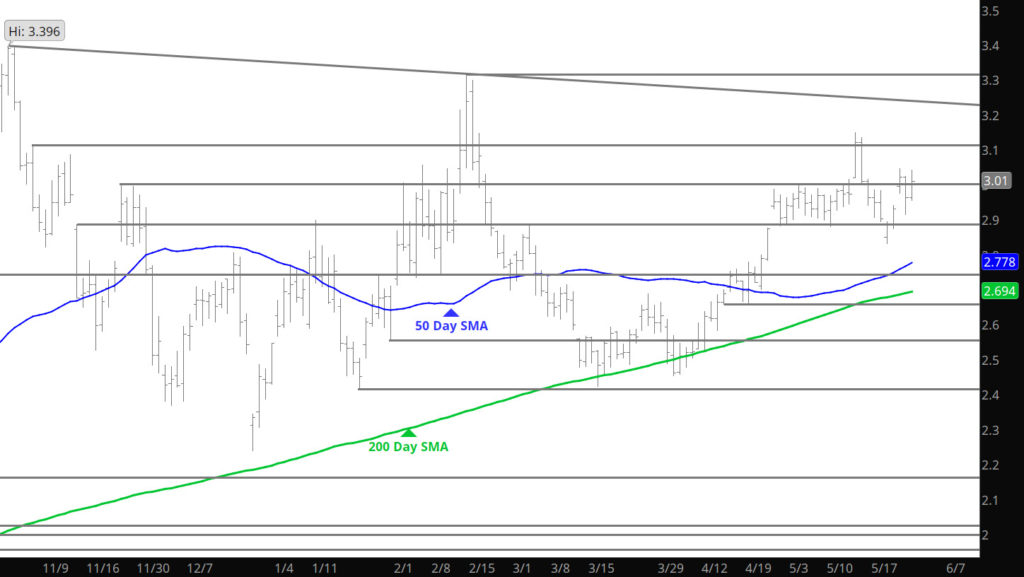

Will Gains Hold

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Price Start Week in a Rally

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

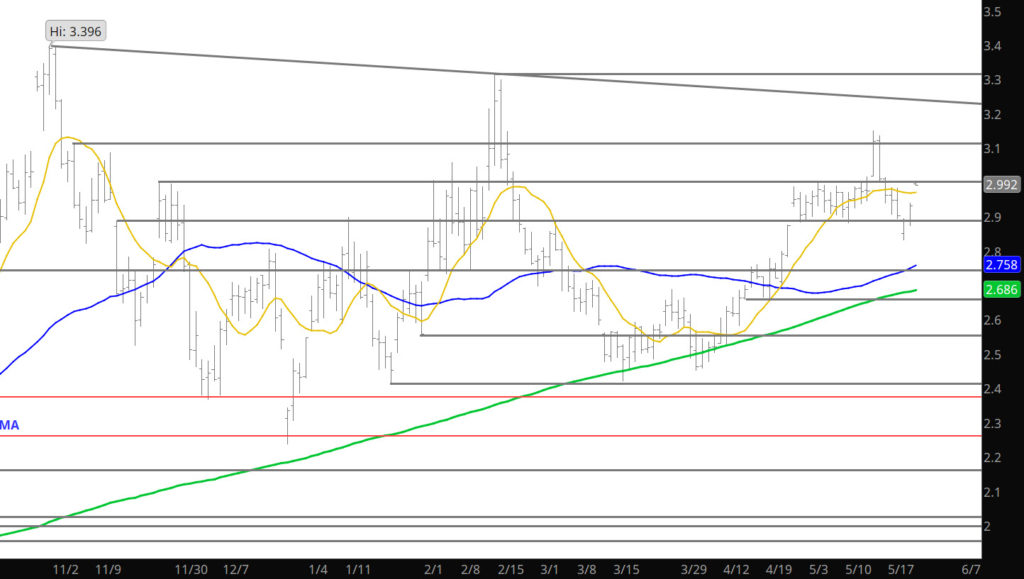

Resistance on Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Range Trade on Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

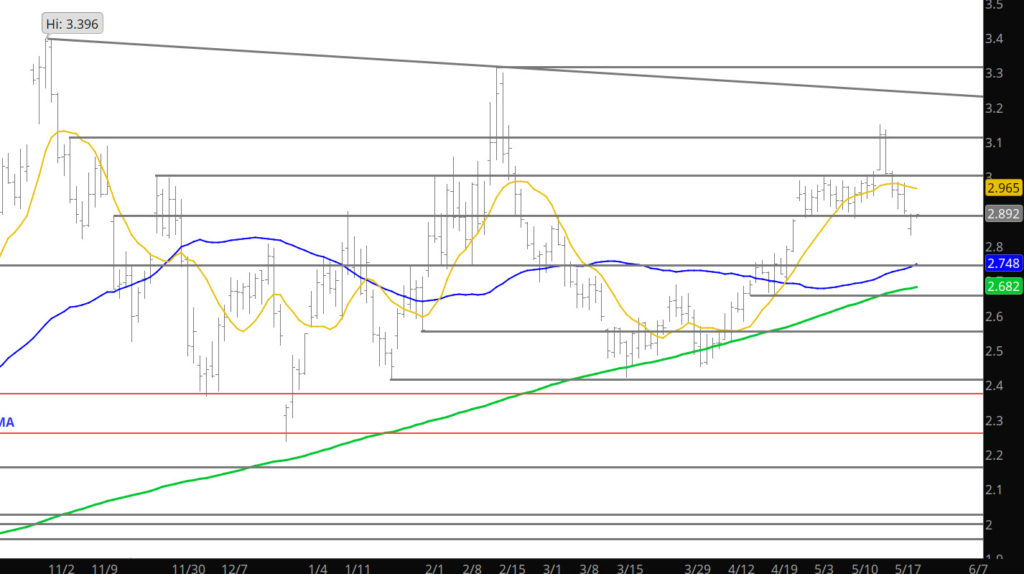

Rebound Off of Sunday Open

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Market Will Define Near Term Support During Expiration

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

No Daily By Email

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.

Guess a “New” Range

To read The Daily Call you must be a subscriber (Current members sign in here. ) Start your subscription today.