Category: Daily Call

Strong Consolidation Pattern

Challenge One Complete

Similar Monday Recipe Until it Wasn’t

It Is a Start

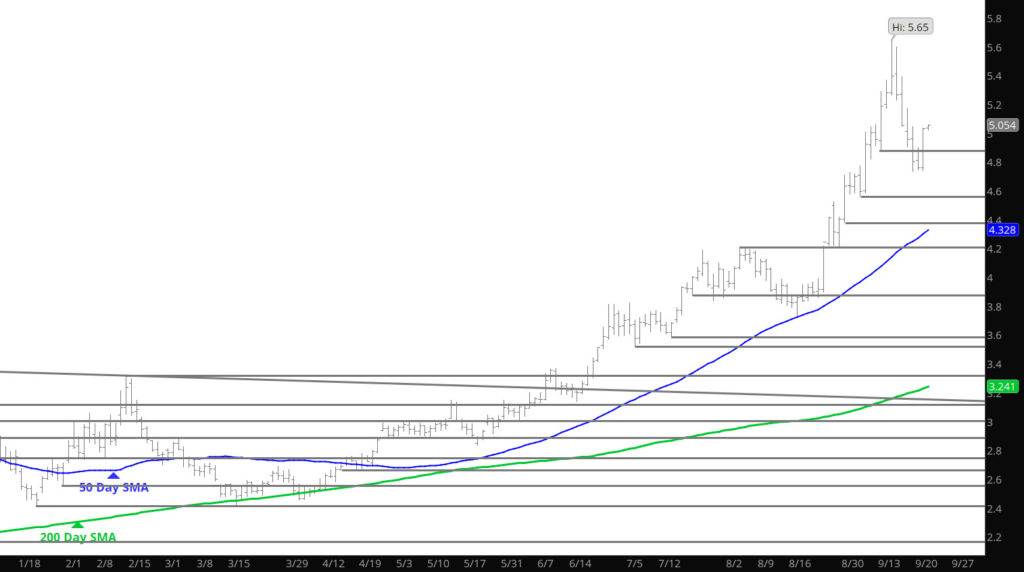

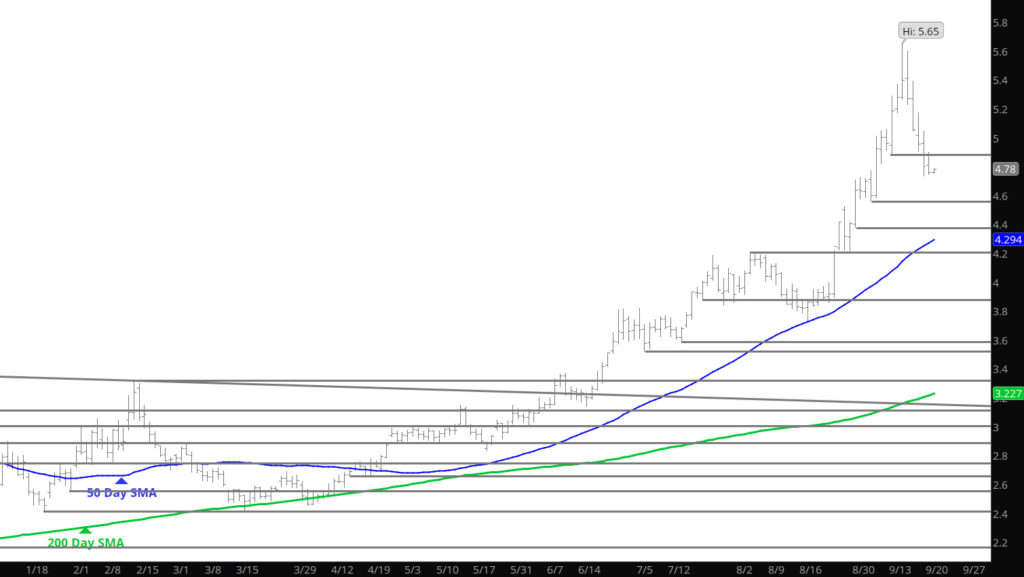

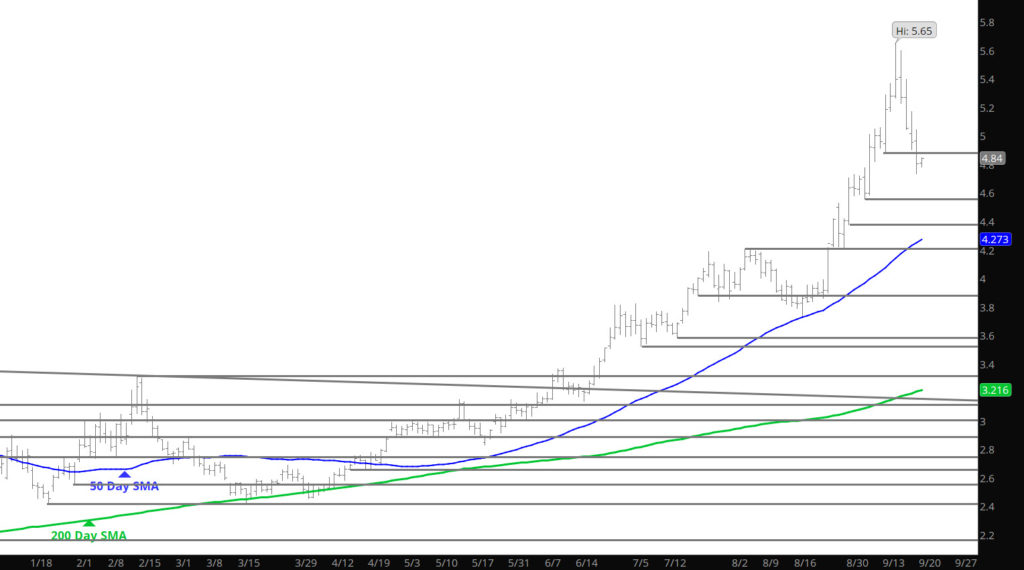

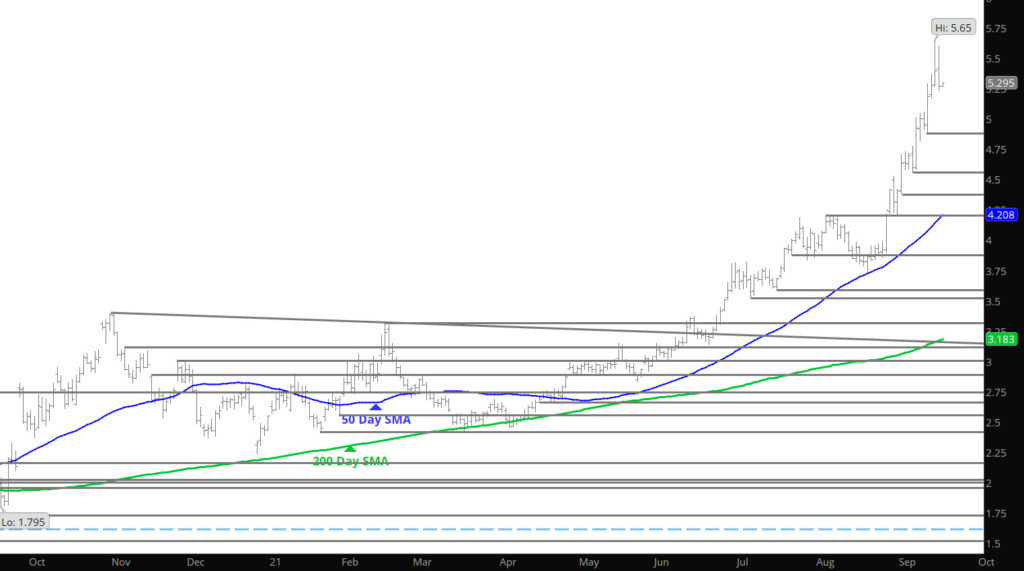

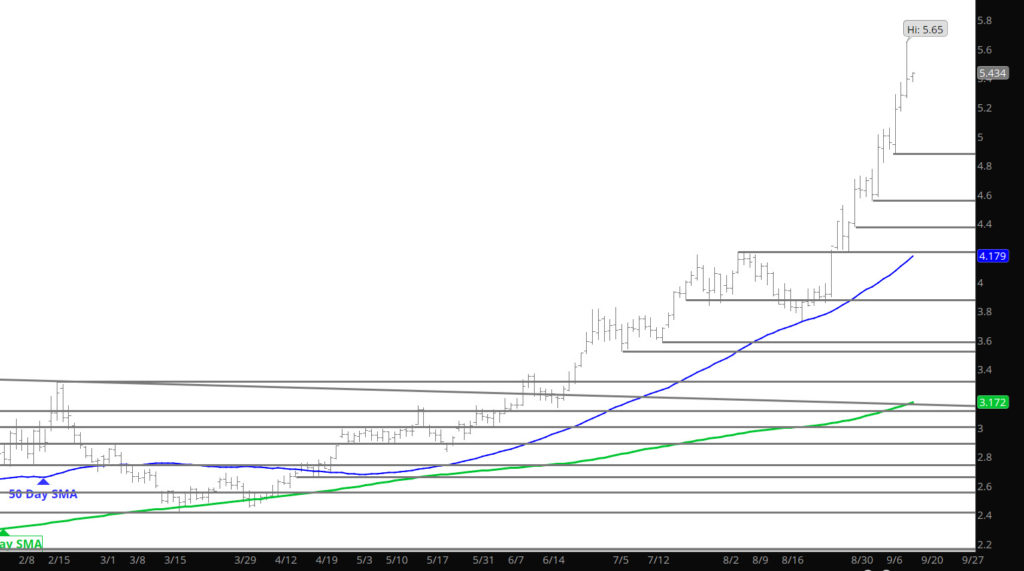

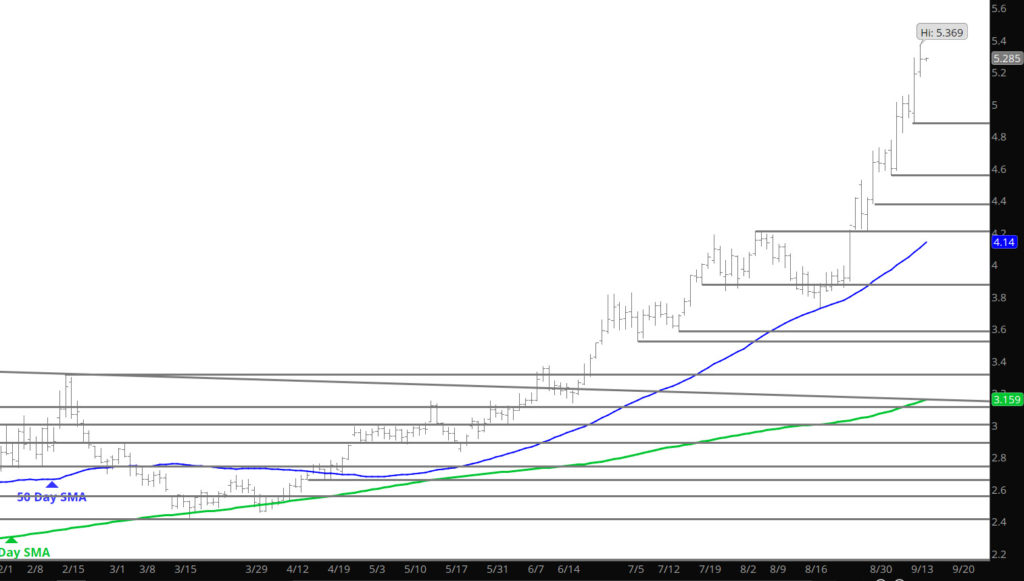

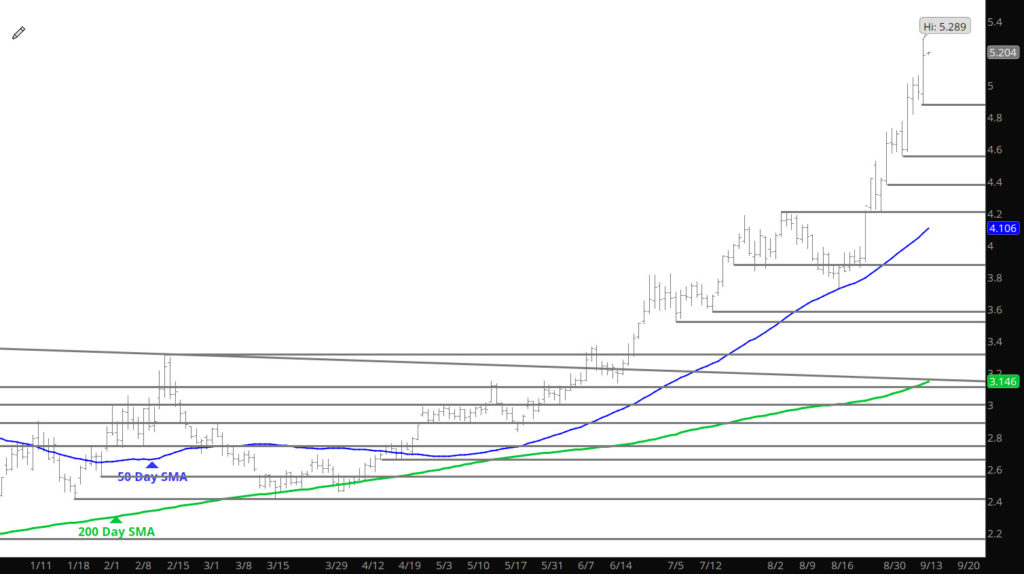

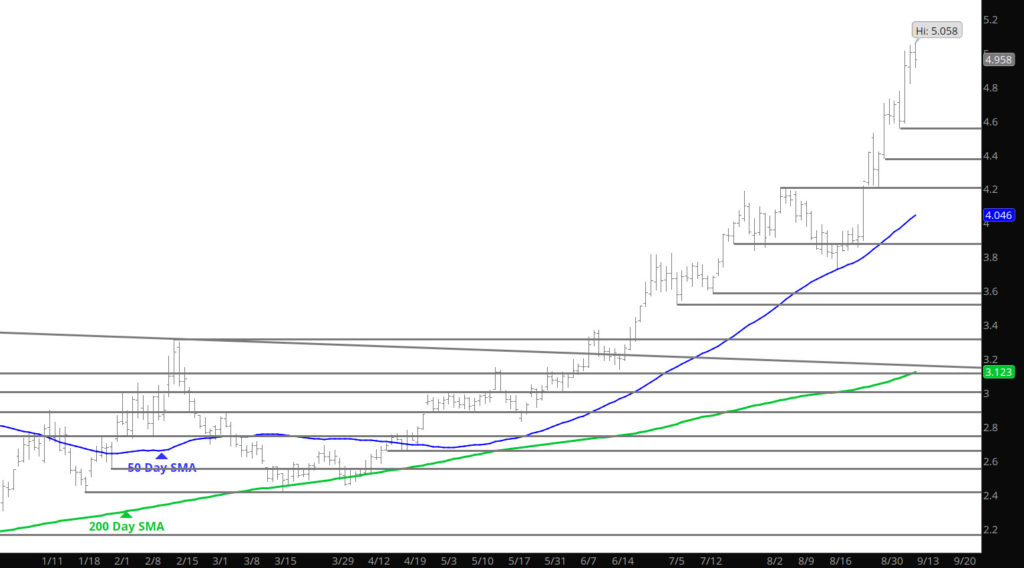

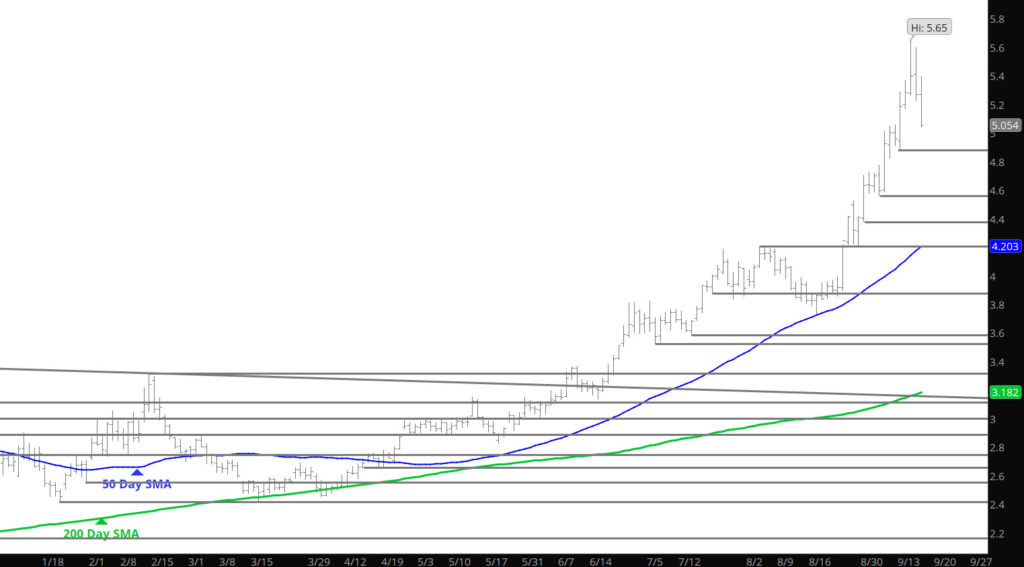

Last week’s three day correction off the high (nearly 3 standard deviations over the 20 week SMA) provided a over a 10% correction. The liquidation of 35,000+ contracts confirmed that the correction was likely fueled by some profit taking. This site has been calling for a correction for weeks, so I guess this is a good example of a broken clock being correct twice a day. Don’t get me wrong– the declines should not be over but from the parabolic formation it was a good initial phase. Go into some of the historical correlations in the Weekly section- and discuss long term implications from a strong September. The trend of the last few months has been strength going into expiration– we will have to wait and witness.

Major Support: $4.879, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92, $3.821, $3.722,

Minor Support: $4.90, $4.728-$4.70, $4.65

Major Resistance: $5.24, $5.486, $5.65, $5.93