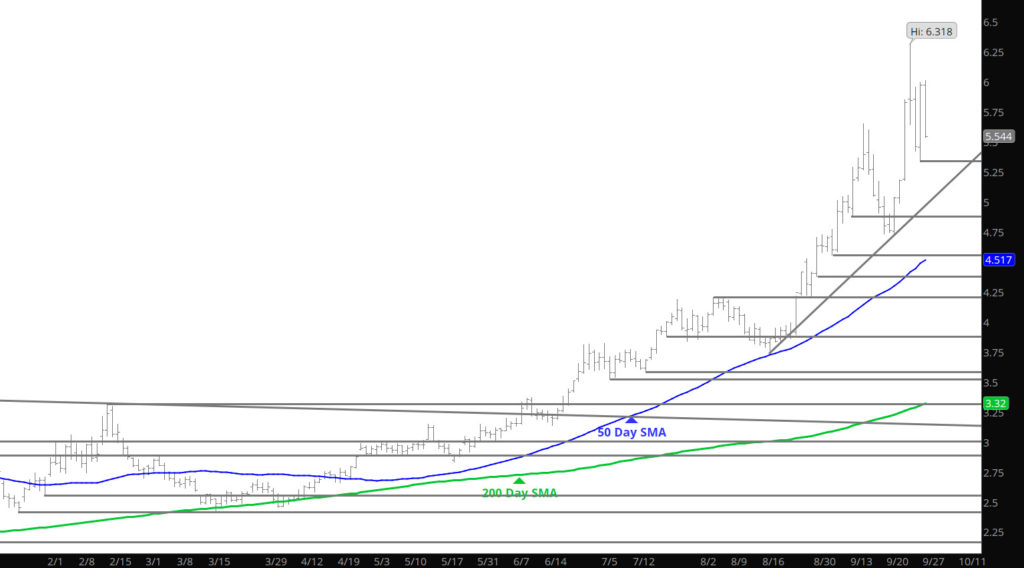

It was good to see prices retrace and test support at last week’s low, just wish they had gotten a little closer but to no avail. The rebound was expected and now prices may head back up to retest some of the resistance areas that proved substantial earlier in the week. Some fundamental folks sent me emails that Russia President Putin said he was going to support supplies to Europe– Novel idea as prices are over $30. That led to declines in the TTF (Europe contract) which led to yesterday’s declines. I apologize — but how you fundamental folks trade and make money when Putin can affect price movement is way over my pay grade. I got ripped, by only a couple of readers, this week for being sarcastic. My o My. Good luck- I will stay focused on the Henry Hub price (from a technical standpoint) and try to make a little more money in this run. BTW — winter is still coming (sarcasm alert).

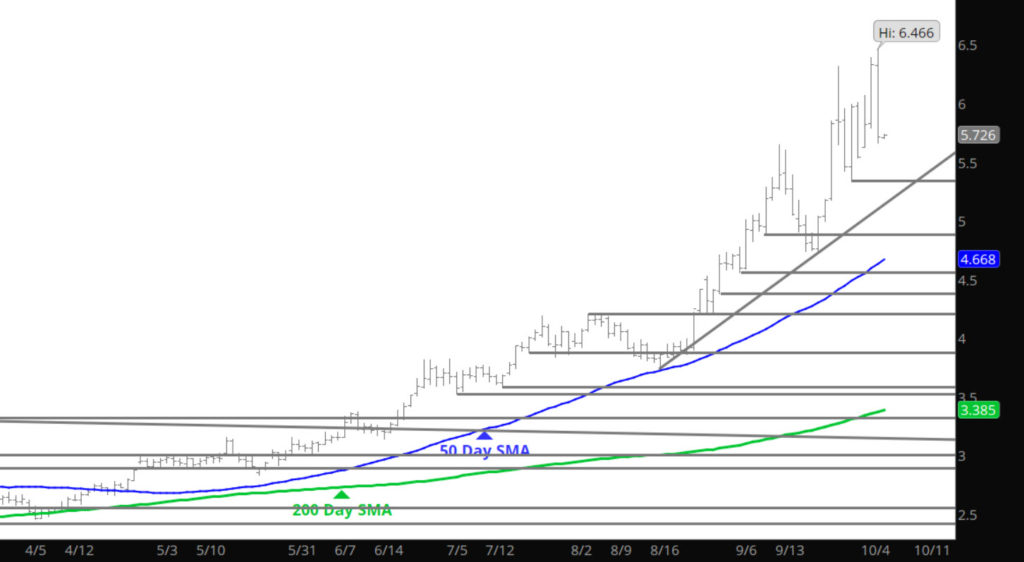

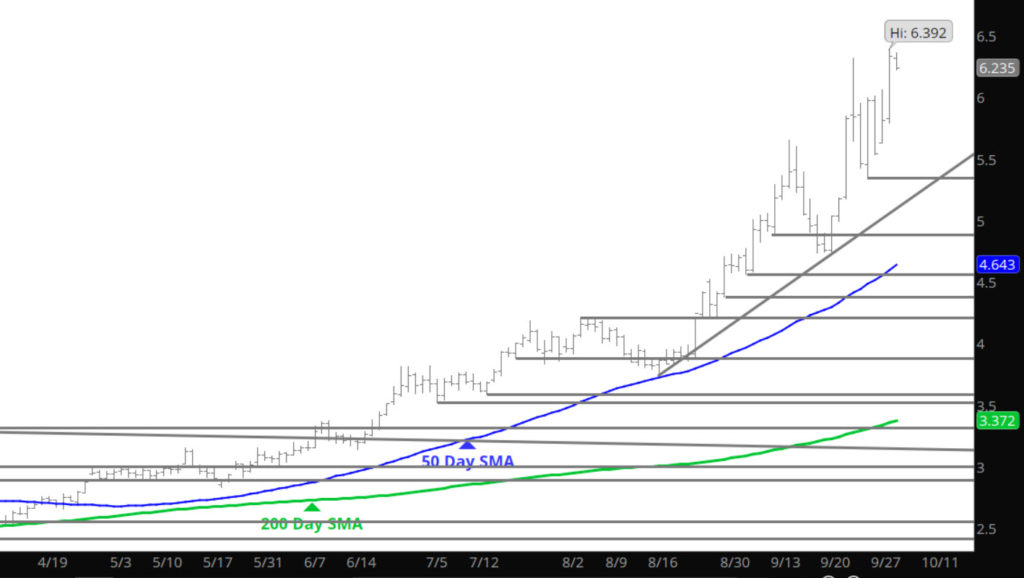

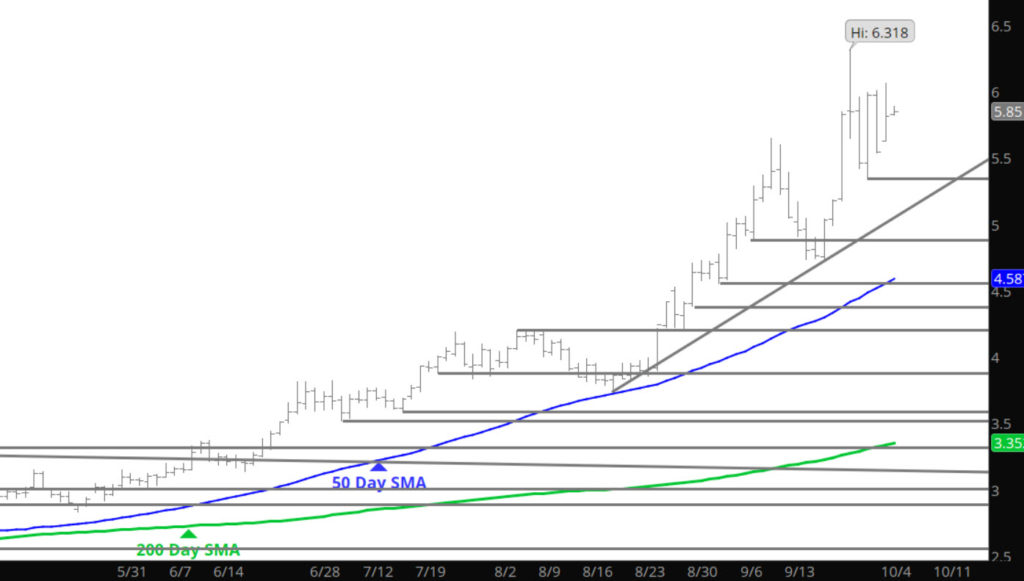

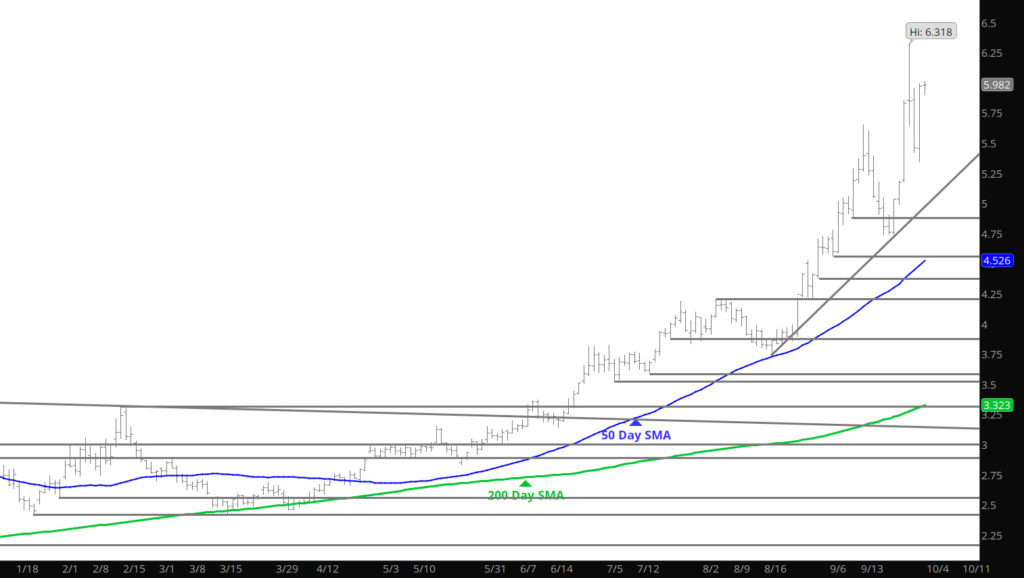

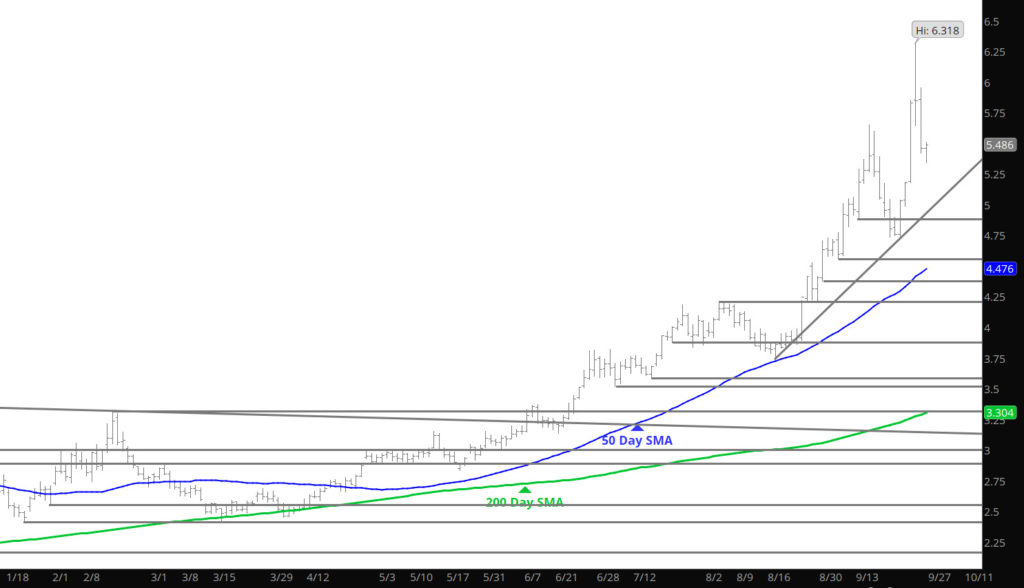

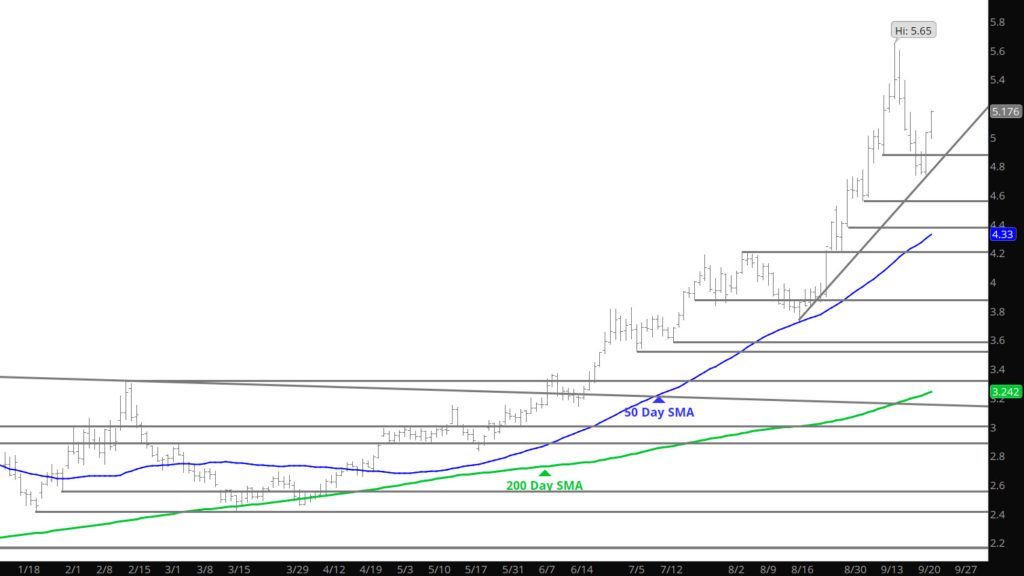

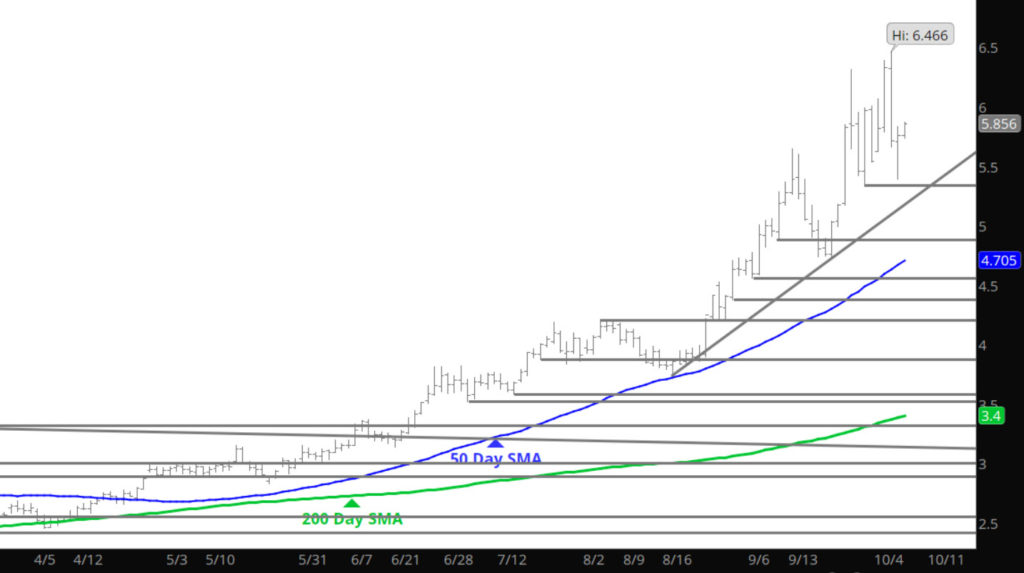

Major Support:$5.416, $5.341, $5.17, $4.88, $4.61, $4.537,$4.375, $4.211, $4.156, $3.92, $3.821, $3.722,

Minor Support: $5.62, $4.728-$4.70, $4.66

Major Resistance: $6.24-$6.493